Bitcoin To Bottom Around $70,000? Arthur Hayes Says Correction ‘Very Normal’ In A Bull Market

March 12 2025 - 2:30AM

NEWSBTC

According to crypto entrepreneur Arthur Hayes, Bitcoin (BTC) is

likely to bottom around $70,000, marking a 36% correction from its

latest all-time high (ATH) of $108,786. Hayes stated that such

corrections are “very normal” in a bull market. Bitcoin To Dip

Further? Yesterday, Bitcoin hit a four-month low of $76,606 as both

the global cryptocurrency and stock markets tumbled amid rising

fears of an economic recession. For context, the S&P 500 (SPX)

has dropped nearly 8% over the past month. Related Reading: Bitcoin

Slips Under 200-Day Moving Average – Will The Downtrend Continue?

Latest data from predictions market platform Polymarket assigns a

39% chance of a US recession in 2025. On February 28, the platform

gave a 23% probability of a US recession this year. Despite these

economic concerns, Hayes advises crypto investors to remain

patient. In an X post published yesterday, the former BitMEX CEO

stated that BTC will likely find a bottom around $70,000,

completing a routine 36% correction from its ATH in January. Hayes

further noted that once BTC hits $70,000, traditional financial

markets – including the S&P 500 (SPX) and Nasdaq (NDX) – would

need to experience a sharp decline, accompanied by failures in

major financial institutions. This, in turn, would prompt

central banks like the US Federal Reserve (Fed), the European

Central Bank (ECB), and the Bank of Japan (BOJ) to initiate

quantitative easing (QE), creating an optimal buying opportunity.

He added: Then you load up the truck. Traders will try to buy the

dip, if you are more risk averse wait for the central banks to ease

then deploy more capital. You might not catch the bottom but you

also won’t have to mentally suffer through a long period of

sideways and potential unrealised losses. Historical data suggests

that QE has been highly beneficial for BTC’s price. During the last

QE period, from March 2020 to November 2021 – amid the COVID

pandemic – BTC surged from $6,000 to as high as $69,000, marking an

astonishing 1,050% gain. Similarly, crypto analyst Michael van de

Poppe shared the following chart, noting that BTC likely completed

a double-bottom re-test and experienced a strong bounce after

yesterday’s potential low. He further suggested that if BTC breaks

past $83,500, it could see an even stronger move to the upside.

Data Points Toward BTC Trend Reversal While Hayes predicts that BTC

has yet to bottom, several indicators suggest the flagship

cryptocurrency may soon witness a trend reversal. For instance,

BTC’s Relative Strength Index (RSI) is currently at its lowest

level since August 2024, signaling that a potential recovery may be

imminent. Related Reading: Bitcoin Fills CME Gap Between $78,000

and $80,000 – Is A Reversal Around The Corner? Additionally, the US

dollar index (DXY) recently experienced one of its largest weekly

declines since 2013, raising hopes for a rally in risk-on assets

like Bitcoin. At press time, BTC is trading at $80,008, up 0.1% in

the past 24 hours. Featured image from Unsplash, charts from X and

TradingView.com

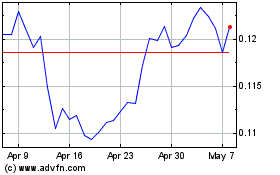

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025