2019 Cryptocurrency Weiss Ratings & Outlook

April 03 2019 - 1:38PM

InvestorsHub NewsWire

Bitcoin Global News (BGN)

April 3, 2019 -- ADVFN Crypto NewsWire -- Last week Weiss

released their annual report on cryptocurrencies featuring ratings

and a general outlook. The company engages in many other more

focused cryptocurrency research, but this annual report functions

as the root of discovering the greatest potential growth areas and

what their more concentrated research should look into. Weiss

ratings are looked to for nearly every industry, and the company

took a strong stance on the importance of cryptocurrencies last

year by creating a standalone platform for their research on the

topic. In January of 2018 they launched the Weiss Cryptocurrency

Ratings website which includes weekly reports, and other valuable

investor information

"Despite lower prices since early

2018, our ratings model gives us hard evidence that a critical

segment of the cryptocurrency industry has enjoyed remarkable

growth in user transaction volume, network capacity, and network

security. Equally important is our finding that these improvements

are often powered by an evolution in the underlying technology.

Therefore, for those willing to take the risk, the best time to

invest could be very near." - Weiss Ratings founder, Martin D.

Weiss

Weiss Cryptocurrency

Outlook 2019

They rated a total of 122

cryptocurrencies this year, in contrast to only 74 at the onset of

the annual report, using "a comprehensive, balanced overview of all

factors, based on a complex algorithm — not an average of the

component grades. When making choices, investors should focus

primarily on this overall rating." There are two major categories

where these factors are positioned:

-

Investment Risk/Reward Rating - the

downside investors should be aware of, reflecting price volatility

and magnitude of recent declines vs. profit potential based on

price momentum and recent returns to investors.

-

Technology/Adoption Rating -

software capabilities, such as level of anonymity, sophistication

of monetary policy, governance capabilities, ability or flexibility

to improve code, energy efficiency, scaling solutions,

interoperability with other blockchains, and the real world

performance along with community of developer/enterprise/public

use.

Major Trends

Identified:

-

Several segments of the

cryptocurrency industry have seen remarkable growth in the volume

of user transactions

-

Adoption is now highlighted as a

function of improving technology.

-

Cryptocurrency configurations are

changing with Delegated Proof-of-Stake (DPoS) coins rising, and

Proof-of-Work (PoW) coins losing market share

-

Some cryptocurrencies are moving

beyond traditional style blockchain networks

-

Advanced, userfriendly dApps

(Decentralized Applications) will play a major role in determining

the winners (Decentralized, crypto-based social media, Peer-to-peer

lending, Fair and secure elections)

Top 10 Coin Rating

Examples

-

XRP is best viewed in competition

with SWIFT, the global network for interbank money transfers.

Tech/Adoption Grade: A

-

EOS is viewed in competition with

Ethereum to become the backbone of the new internet (3.0).

Tech/Adoption Grade: A

-

Bitcoin highlights improving

technology with the launch of Lightning Network, viewed as a store

of value for savers and investors. Tech/Adoption Grade:

A

-

Ethereum is the most popular used

smart-contract platform, but faces scaling problems. Tech/Adoption

grade: A-

-

Cardano is also viewed in

competition with Ethereum, but with a stronger focus

on advanced smart contract capabilities, monetary policy

and governance. Tech/Adoption Grade: B+

-

Steem, NEO, Stellar, Zcash, and

BitShares were the other five included in the top 10

By: BGN Editorial Staff

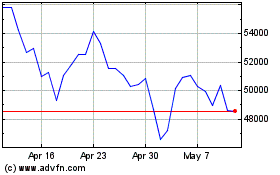

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Jun 2024 to Jul 2024

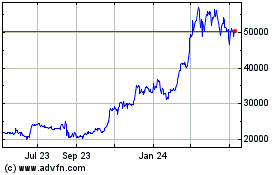

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Bitcoin (Cryptocurrency): 0 recent articles

More Bitcoin News Articles