Updated UK Cryptocurrency Tax Guidelines

December 20 2018 - 1:36PM

ADVFN Crypto NewsWire

Bitcoin Global News (BGN)

December 20, 2018 -- ADVFN Crypto NewsWire -- The tax agency

of the United Kingdom has released a more detailed report on how to

properly report cryptocurrency related taxes for individuals. They

paper acknowledges the gray areas, and the rapidly changing

industry, along with culture that surrounds it. Overall there is

optimism and a clear acceptance for the new financial tool, but

caution is taken and explain to ensure that over time the

integration can happen smoothly.

The Majesty’s Revenue and Customs

(HMRC) is responsible for collecting taxes and overseeing related

activities in the UK. They define cryptocurrencies as: Cryptoassets

(or ‘cryptocurrency’ as they are also known) are cryptographically

secured digital representations of value or contractual rights that

can be:

-

transferred

-

stored

-

traded electronically

They state three broad categories

that most cryptocurrency can fit into, as exchange tokens utility

tokens or security tokens.

-

Exchange tokens are intended to be

used as a method of payment and encompasses ‘cryptocurrencies’ like

bitcoin. They utilise DLT and typically there is no person, group

or asset underpinning these, instead the value exists based on its

use as a means of exchange or investment. Unlike utility or

security tokens, they do not provide any rights or access to goods

or services.

-

Utility tokens provide the holder

with access to particular goods or services on a platform usually

using DLT. A business or group of businesses will normally issue

the tokens and commit to accepting the tokens as payment for the

particular goods or services in question.

-

Security tokens may provide the

holder with particular interests in a business, for example in the

nature of debt due by the business or a share of profits in the

business.

Although any of these can be

transferred as payment for goods in exactly the same way that fiat

currency is, they explicitly do not consider cryptocurrencies money

for the purpose of the tac guidelines. This has strong implications

for business, but these updates are made specifically for guiding

individual cryptocurrency holders.

Where individuals are paid in

cryptocurrency, it is to be recorded as a non-cash payment and

taxed accordingly. The other primary situation where taxes apply

are from mining, airdrops or capital gains. Increases in value of

any token is to be treated like that of shares, securities and

other financial products. However, mining poses some of the biggest

questions for taxes moving forward. Ultimately the process could be

completely undertaken by machines, and the deposits can be

transferred to anonymous wallets, or ones not associated with a

single individual.

By: BGN Editorial Staff

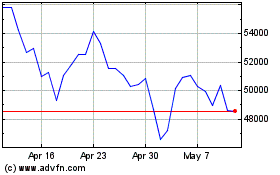

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Jun 2024 to Jul 2024

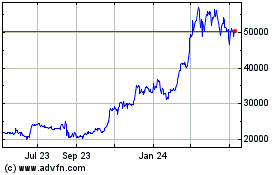

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Bitcoin (Cryptocurrency): 0 recent articles

More Bitcoin News Articles