IMF Still Working On Potential CBDCs

November 26 2018 - 1:04PM

ADVFN Crypto NewsWire

Bitcoin Global News (BGN)

November 26, 2018 -- ADVFN Crypto NewsWire -- Singapore is often a

central spot for cryptocurrency related conventions and to found

related businesses. The government of Singapore has continually

shown a progressive stance on the technology to reap the financial,

cultural and educational benefits. The annual Fintech Festival took

place last week in Singapore where the International Monetary Fund

was represented by Managing Director Christine Lagarde

Still Seeing

Problems

In congruence with the most recent

report on cryptocurrencies released by the IMF, Christine Lagarde

focused on the problems with cryptocurrencies, rather than on the

work being done to overcome the obstacles. Their primary concern is

the potential of a Central Bank issued digital currency (CBDC).

This type of financial instrument would become the closest thing to

a legitimized global currency. Bitcoin and any other public, P2P

cryptocurrencies are already functioning as global currencies, but

without official government recognition.

The primary reason cited that this

could never happen on a major scale is,“for political reasons,” she

said. They see this as a direct liability against a central bank.

However, they do still note that a CBDC seems like the eventual

next step in the evolution of human currency.

“Although the technology [DLT] is

evolving, it currently falls short in scalability, energy

efficiency, and payment finality. DLT could be used over a closed

(“permissioned”) network managed by the central bank. But there are

other types of centralized settlement technology that may prove

more efficient.”

And in an extremely positive light

for cryptocurrencies, the related illicit activies of money

laundering and illegal substance purchases were not covered. But

rather, more focus was placed on another widely considered issue -

volatility of cryptocurrencies where the issue directly affects our

ability to considering them a “currency” in the traditional

sense:

“[Cryptocurrencies] struggle to

fully satisfy the functions of money, in part because of erratic

valuations.” In a footnote, the report said that as for

stablecoins, there are “doubts about the ability to maintain a peg,

short of full backing by fiat currency.” - Christine

Lagarde

By: BGN Editorial Staff

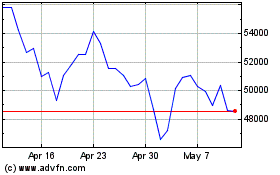

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Jun 2024 to Jul 2024

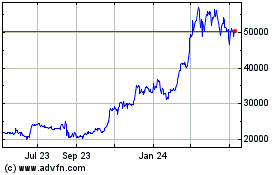

Bitcoin (COIN:BTCGBP)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Bitcoin (Cryptocurrency): 0 recent articles

More Bitcoin News Articles