Bitcoin Cash Traders Move Into Profit, But Can The Rally Continue?

August 31 2023 - 7:00PM

NEWSBTC

As the price of Bitcoin and the general crypto market has rallied,

leading to a much-needed increase in price, Bitcoin Cash (BCH)

investors are once again on a profitable path. The majority of

investors are now in the green following its double-digit surge in

the last week. But now the question posed is, will the price of BCH

continue to maintain this surge? Bitcoin Cash Short And Long-Term

Holders Enjoy Profits In a Thursday post, on-chain data tracking

platform Santiment revealed that both short and long-term holders

of Bitcoin Cash are doing quite well right now. The chart shared by

the tracker showed that the average returns for 30-day and 365-day

holders have risen above their average cost price. Related Reading:

Grayscale Victory Sends Bitcoin Open Interest Surging After Hitting

One-Year Lows This means that investors who got into the digital

asset in the last month, as well as those who have been holding for

a year, are the ones doing well right now. It is also the first

time in 10 weeks that this cohort of BCH investors is seeing

profit. Short and long term BCH traders move into profit | Source:

Santiment on X The data from Santiment is also backed up by that

from another on-chain tracker IntoTheBlock. According to the

latter’s data on its website, 59% of all BCH investors are seeing

green compared to 38% sitting in the red and 3% in neutral

territory. Furthermore, IntoTheBlock shows that 96% of holders have

held for more than one year, with 3% holding between 1-12 months,

and 1% holding for less than one month. Combining the data from

both trackers tells us that there are more long-term investors in

profit compared to short-term investors. This fact reinforces the

long-standing belief that buying and holding is usually the best

way to invest in cryptocurrencies. But Can BCH Hold Its Gains? The

fact that so many short and long-term holders are currently in

profit can be attributed to the digital asset’s spike in the last

week. Following the Grayscale ruling that saw the market surge,

BCH’s price rose over 14%, bringing its value to the $220 level

before the retracement. Most of these gains have been sustained so

far, as evidenced by the high percentage of holders in profit.

Related Reading: Is Vitalik Buterin Selling His ETH Stash? Let’s

Take A Look At His Transactions However, Santiment points out in

its report that for Bitcoin Cash to continue to rise, it would be

up to the whales. This is because, during the price spike, there

was an increase in whale activity in relation to the BCH token. So

they likely played a part in the asset’s rise. If the whales

continue to be active and put buying pressure on the coin, then the

price of BCH could continue to appreciate. However, a turn from buy

to sell among these large holders would quickly crash the price,

especially since the market is already feeling the euphoria felt

earlier this week start to recede. Presently, data from

Coinmarketcap shows that Bitcoin Cash is trading at $219, a 14.57%

increase in the last week. BCH price reclaims $220 | Source: BCHUSD

on Tradingview.com Follow Best Owie on Twitter for market insights,

updates, and the occasional funny tweet… Featured image from

WallPaper, chart from TradingView.com

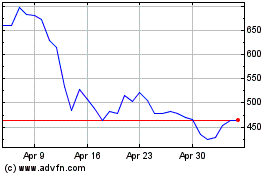

Bitcoin Cash (COIN:BCHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bitcoin Cash (COIN:BCHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024