FOMO Fuels Bitcoin’s 35% Jump, Options Flow Hints At Bigger Upswing

February 29 2024 - 6:00PM

NEWSBTC

The price of Bitcoin seems on the brink of blasting past its

all-time high (ATH) at the high area of its current levels. The

cryptocurrency has been on a bull run due to the launch of spot

Bitcoin Exchange Traded Funds (ETF), which officially onboarded

institutions to the nascent sector. Related Reading: Shiba Inu

(SHIB) Price Skyrockets By 28%: 4 Key Reasons As of this writing,

Bitcoin (BTC) trades at around $62,900 with a 3% profit in the last

24 hours. In the previous week, the cryptocurrency recorded a

critical 22% profit. It stood as one of the three top gainers in

the top 10 by market cap, only surpassed by Solana (25%) and

Dogecoin (57%) in the same period. Bitcoin-Based Derivatives Hint

At Further Gains Data from the derivatives platform Deribit

indicates a spike in long positions by Options operators. Since

early February, these traders have accumulated important call (buy)

contracts with a strike price above $65,000. At first, as the

report indicates, the increase in bullish positions was thought to

be part of a Bitcoin “Halving” strategy. However, the BTC ETF Flows

seem to be the key component behind the rally. As cryptocurrency

entered the $60,000 area, several operators rushed to accumulate

call contracts, leading to a Fear Of Missing Out (FOMO) rally to

its current levels. The chart below shows that the FOMO buying

began when BTC breached the $57,000 level. The spike in trading

activity during yesterday’s session led to a significant jump in

Implied Volatility (IV). Overleveraged positions further propelled

the metric, Deribit stated: The 62k to 64k surge was so quick, and

with high leverage across the whole system, that when sales hit the

market a cascade sent BTC down to 59k in 15mins, and some Alts

(also massively leveraged) dropped 50% on some exchanges before

promptly bouncing as BTC jumped to 61.5k. As the market continues

to experience sudden moves due to the high IV, there is little

change in the market structure in the derivatives sector. In other

words, Deribit still records a lot of bullish positions for the

coming months, which suggests optimistic conviction by these

players. BTC Price On The Short Timeframe Despite the bull run, the

Bitcoin price could dip as euphoria takes over the market.

According to economist Alex Krüeger, the spike in trading volume

across the derivatives sector indicates the formation of a “local

top.” The analyst believes that retail has returned to the market

driven by FOMO, which often hints at short-term predicaments for

long traders. Krüger predicted further gains into the $70,000 area

via his official X account and then a drop into the $55,000 area.

Related Reading: Dogecoin Rallies 50% To Beat Out Avalanche, BONK

Overtakes PEPE The analyst stated: ATH are inches away. That’s

price discovery territory. Thus very easy for things to get even

crazier. This is just not where one opens new longs. Too easy to

get a quick flush out of nowhere. Ideally we see funding cool down

and price consolidate below ATH then break out. Cover image from

Dall-E, Chart from Tradingview

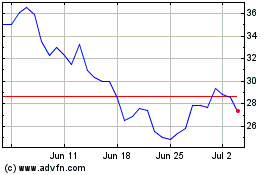

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024