Aave Might Retrace Further Due To This Formation On Its Chart

February 27 2023 - 1:30PM

NEWSBTC

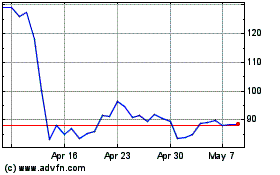

The price of Aave has dropped significantly in the last month after

the altcoin fell below the $90 mark. The altcoin consolidated on

its chart with a 0.2% loss in the past 24 hours. The altcoin has

depreciated by close to 9% in the past week. Related Reading:

Crypto Market Crawls To A Standstill As Investors Remain Neutral

The technical outlook for the coin depicted bearish strength on the

chart. Demand for the coin dipped, and accumulation continued to

fall owing to the altcoin’s decline in value over the past few

weeks. This could mean that before Aave starts to recover, the coin

could take another plunge over the subsequent trading sessions.

Although the coin exceeded the $80 price, it was still in the

woods. Still, Aave needs to start its bullish recovery. Major

altcoins remain wobbly as Bitcoin hovers in the $23,000 price zone,

and a lot depends on how the king coin behaves over the subsequent

trading sessions. Aave Subsequent Analysis: One-Day Chart The

altcoin was trading at $81 at the time of writing. Aave is trading

in a wide range that has stretched between $76 and $92 over the

past few weeks. The middle point of the range is where Aave stands

at the moment. Aave is trading close to its support line of $77.

The next trading sessions remain crucial, as they could decide the

altcoin’s next course of movement. The resistance to the coin stood

at $86. If the altcoin breaches the resistance above, a bullish

recovery will be on the way. The amount of Aave traded in the last

session was red, indicating increased selling pressure. Technical

Analysis The buying pressure has remained low since the beginning

of February as Aave could not manage to turn the price around. The

Relative Strength Index was below the 50-mark, indicating an

increased number of sellers compared to buyers. The daily chart

also paints a bearish signal. The price of Aave fell below the

20-Simple Moving Average line (SMA), which implied that sellers

were driving the price momentum in the market. Additionally, Aave

formed a death cross, with the 200-SMA (green) crossing over the

50-SMA (yellow), which suggests bearishness. The price could fall

over the upcoming trading sessions before it starts to recover.

Following the death cross, Aave also displayed sell signals. The

Moving Average Convergence Divergence indicated the price momentum

and formed red signal bars that were increasing in size. These

histograms were tied to sell signals. Related Reading: BNB Price

Prints Bearish Technical Pattern, Why It Could Revisit $280 The

Bollinger Bands were wide and parallel, denoting the chance of

increased price volatility over the subsequent trading sessions.

Featured Image From UnSplash, Charts From TradingView.com.

Aave Token (COIN:AAVEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aave Token (COIN:AAVEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024