By Benoit Faucon

LONDON -- The Trump administration says it expects Iran's oil

buyers to begin winding down their purchases Tuesday in response to

sanctions being reimposed by the U.S. Some are seeking

alternatives, but countries including China, India and France, are

considering creative measures to keep importing Iranian crude.

Starting this week U.S. sanctions against Tehran on sectors like

automotive and aircraft are set to return following President

Trump's decision in May to pull out of the nuclear agreement with

Iran.

Oil companies will have until November 4 to adjust to the

returning U.S. ban on buying Iranian oil. "The three-month

wind-down period is starting, " Dario Scaffardi, chief executive of

Italian refiner Saras SpA -- a buyer of Iranian oil -- told

analysts last week. "So, we expect to see the effects sort of

now."

The threat of dwindling oil sales is forcing Tehran and its oil

buyers to react. The U.S. sanctions come as Iran faces a collapsing

currency and protests over living conditions. Petroleum is a main

export, accounting for nearly a fifth of Iran's gross domestic

product.

But overall oil exports declined in July by 300,000 barrels a

day to 2.3 million barrels, according to Paris-based shipping-data

tracker Kpler, as European refiners cut purchases ahead of

returning sanctions. The country's losses could ultimately amount

to 1 million barrels a day, said Richard Nephew, who helped enforce

U.S. sanctions five years ago as deputy coordinator for sanctions

policy at the State Department.

In recent months, U.S. officials have said they expect Iran's

oil exports to either disappear completely or to decline

significantly. The Treasury Department has carried roadshows with

State Department and other government counterparts over the last 90

days explaining what sanctions will snap back when all the

wind-down periods end in November, a U.S. official said.

Italy's Saras already has decided to reduce Iranian oil

purchases before November because of the difficulty of finding

payment channels, according to executives. The company declined to

comment further.

Nations that regularly do business with Iran are in a difficult

position. "We have informed our oil customers that we will only buy

their commodities if they buy our crude," Asadollah Gharekhani,

spokesman for the Iranian parliament's energy commission told

Iranian state-media last month. It is unclear how mandatory such

practice will be. An Iran oil-ministry spokeswoman didn't return a

request for comment.

The European Union, China and India have said they won't enforce

sanctions -- unlike their response to restrictions against Iran oil

in 2012. But they may still bow to the pressure as their oil

companies would risk being blocked from the U.S. financial and oil

markets. Banks and shippers already are stopping trade with Iran

because their businesses are exposed to the U.S. Oil companies in

those nations are considering follow suit because they have assets

in the U.S. or are exposed to the U.S. financial system.

Last month, Iran's vice president Eshaq Jahangiri said the

country would privatize the sale of its crude, a workaround that

could be effective by putting the onus on private businessmen to

sell the commodity. Iran employed the method to market its oil

products and petrochemicals during previous sanctions with the help

of small Chinese and Russia banks and intermediaries, according to

Iranian traders and transaction documents reviewed by The Wall

Street Journal in 2015.

Tehran also has begun to increase reliance on the

privately-owned National Iranian Tanker Co., to replace foreign

tankers in deliveries to India, according to data from shipping

website Fleetmon.com, which gives access to data on tanker

movements.

Most importantly, Iran plans to use a barter system -- which

avoids sanctionable transfers to the nation -- through which oil

payments are deposited into accounts in oil-importing countries and

used by Tehran to buy goods.

Some European Union's nations may consider the process,

according to a European official involved in the contingency

planning. Countries like China, India and, more recently, Russia

have used it successfully to buy Iran's crude.

In a joint statement Monday, the EU, France, the U.K. and

Germany said they are committed to work on the continuation of

Iran's export of oil and gas.

Tehran also has started shipping to small buyers in Latin

America, including a delivery to Chile over this past weekend,

according to a European sanctions official and tracking data.

French, German and British governments are considering the use

of their national banks to activate accounts for the Iranian

central bank, which could receive oil payments, according to

European officials. However, "the United States could still

sanction the oil companies if they pay the central banks for the

oil," said Mr. Nephew, who is now an adjunct professor at Columbia

University's Center on Global Energy Policy.

Among other options, the French government is considering taking

charge of the shipping and storage required to import Iran oil to

replace private companies, the European official said. France could

also buy Iranian oil from countries like China, India or Russia --

possibility refined for the latter -- if they have obtained

exemptions, the official said.

The French finance ministry didn't return a request for

comment.

Meanwhile, Total SA, the main importer of Iranian oil to France,

has cut its purchases from Tehran and largely filled the gap with

Russia's Urals crude grade, according to European traders.

Total didn't reply to a request for comment.

Shipping data from Kpler shows France hasn't imported Iranian

oil since June 18, a loss largely offset by a 63% rise in Russian

oil imports to France over the same period.

The impact of upcoming sanctions has been more mixed in Asia,

where many refiners are state-owned and banks are often exposed to

the U.S. financial system. South Korea didn't purchase oil from

Iran last month for the first time in three years, according to

Kpler. Meanwhile, Indian imports rose by 118,000 barrels a day.

Still, an Indian refinery owned by Reliance Industries Ltd.

began buying crude from faraway countries such as Colombia and the

U.S., a rarity. "They seem to be testing alternatives as they

prepare to reduce Iranian oil imports," said Kpler's economic

analyst Reid I'Anson.

Reliance didn't return a request for comment.

China, generally the largest buyer of Iranian oil, is gearing up

to take more, said a senior U.S. official said. The Asian

powerhouse is engaged in a dispute over trade tariffs with the U.S.

and uses a state-run bank with no American connection, giving it

leverage in fighting the sanctions.

Sarah McFarlane and Ian Talley contributed to this article.

Write to Benoit Faucon at benoit.faucon@wsj.com

(END) Dow Jones Newswires

August 06, 2018 10:04 ET (14:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

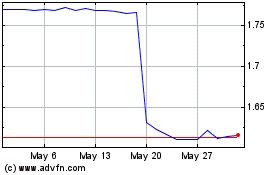

Saras Raffinerie Sarde (BIT:SRS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Saras Raffinerie Sarde (BIT:SRS)

Historical Stock Chart

From Dec 2023 to Dec 2024