Iran's comeback as a crude-oil exporter appears to have stalled

seven months after Western sanctions over its nuclear program were

lifted, casting fresh uncertainty over the country's willingness to

cooperate with other producers on output.

Iran's production levels have taken on heightened significance

in recent weeks as the Organization of the Petroleum Exporting

Countries gets ready for talks next month on oil output. Iran has

previously refused to consider joining fellow OPEC members in

action to lift crude prices by curbing output until its exports and

production reach presanctions levels.

But the country's ability to reach pre-sanctions levels above 4

million barrels a day are now in question. Iran's crude-oil

production stands at 3.85 million barrels a day in August, the

country's oil minister Bijan Zanganeh said Saturday, little changed

from above 3.8 million barrels a day he cited in June. That is up

from less than 3 million barrels a day from before sanctions were

lifted in January but short of the country's stated goals.

The International Energy Agency says Iran's crude production

actually fell in July, to 3.6 million barrels a day.

Iran's crude-oil exports have also plateaued after nearly

doubling from January to May. Mohsen Ghamsari, the head of oil

marketing at the National Iranian Oil Co, told state media last

week that the country was still short of pre-sanctions exports by

200,000 barrels a day.

Iran has told OPEC that it plans to participate in next month's

talks, national delegates to the cartel say, but the country hasn't

said it would soften its conditions for actually joining in

production limits. Iran and fellow OPEC member Ecuador talked

Wednesday about stabilizing oil prices, Ecuadorean official

said.

Iran's stalled production "will complicate the negotiations,"

John Hall, chairman at UK consultancy Alfa Energy and longtime

observer of OPEC. "It's going to be difficult. The Iranians are not

going back down."

On the other hand, some within OPEC say, Iran hitting a natural

ceiling on its output might be enough to convince a rival like

Saudi Arabia to join an output agreement next month. Saudi Arabia

has pumped its own production up to record levels this summer and

may be more inclined to make a deal next month if Iran seems

weak.

A government oil official at a Persian Gulf nation said the

situation could make it easier for OPEC members to mend fences.

"Iran's production seems to be stuck at a certain level and not

rising like before," the official said.

Iran has faced two significant obstacles in its quest to return

to pre-sanctions production levels: a lack of foreign investment

and its own unwillingness to undercut rivals on pricing.

Lingering American sanctions on Iran over terrorism, human

rights and weapons continue to make it difficult for Iran to do

business with European crude-oil buyers, whom the Islamic Republic

had been counting on to lift its exports. The American sanctions

ban dollar transactions with Iran, requiring European companies

with U.S. business to go to great legal lengths to do deals

there.

"Other exporters took Iran's place during the sanctions," said

Erfan Ghassempour, an adviser to foreign oil companies in Iran.

"Now it will take time for Iran to take back its old friends."

A case in point is Italy, which was Iran's largest oil importer

in the European Union before the bloc embargoed its crude in 2012.

Italy didn't buy any Iranian crude in the first five months of the

year, according to statistics released by industry body Unione

Petrolifera last month.

Sardinia-based refiner Saras SpA was forced to delay its first

Iranian cargo to June "because of the difficulties of establishing

financial and banking lines to operate effectively with Iran," its

general manager Dario Scaffardi told analysts on Aug. 1. An

official at the company said most banks had initially refused to

handle the transactions because they feared they could violate

remaining Washington's sanctions.

Obama administration officials have repeatedly told European

banks they can deal with Tehran.

Despite the banking issues, Iran has refused to discount its oil

against other producers,according to European refiners and Iranian

officials. Saudi Arabia has aggressively cut the price of its oil,

and Iran has matched those cuts -- though they have never gone

deeper to make up for the hassle of obtaining financing to buy its

crude.

"In this context, Iran is just too expensive," an Italian

refinery official said.

An Iranian oil official said Tehran doesn't want to sell its oil

off on the cheap, seeing it as a precious and finite national

resource. Iran also has a more diverse economy than many of its

rivals, with petroleum revenue accounting for about 29% of its

national budget.

Reaching presanctions levels is a key goal of moderate Iranian

President Hassan Rouhani as he tries to woo the opinion over the

merits of the international deal that lifted restrictions on

Tehran's exports in January but also placed curbs on the country's

nuclear program.

That could prove challenging. Apart from competition from

rivals, underinvestment in Iranian oil fields is also capping

exports, said Hamid Hosseini, a board member of Iran's oil

exporters' association.

Homayoun Falakshahi, an oil industry analyst at oil-consultancy

Wood Mackenzie, said that oil production initially ramped up faster

than expected because pressure was very high in wells that had been

shut for years. But Iran will struggle to pump more because the

fields have high depletion rates and now need significant

investment at a time when Iran remain cash-strapped, said Mr.

Falakshahi, who visited key oil-producing facilities in Iran this

spring.

Summer Said contributed to this article.

Write to Benoit Faucon at benoit.faucon@wsj.com

(END) Dow Jones Newswires

August 25, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

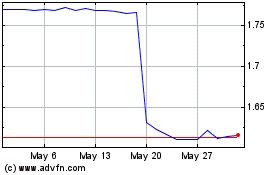

Saras Raffinerie Sarde (BIT:SRS)

Historical Stock Chart

From Nov 2024 to Dec 2024

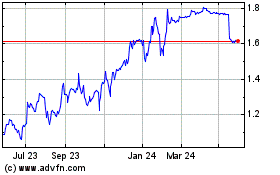

Saras Raffinerie Sarde (BIT:SRS)

Historical Stock Chart

From Dec 2023 to Dec 2024