S&P/ASX 200 Flat as Australian Dollar Stabilizes, Iron Ore Falls

January 20 2014 - 7:57PM

Dow Jones News

0027 GMT [Dow Jones] Australia's S&P/ASX 200 is flat at

5295.2. An overnight stabilization in the Australian dollar around

US$0.8800 has seen some support for banks--after recent

expectations of offshore selling. The 2% fall in spot iron ore to

fresh six-month lows is weighing down miners. CBA (CBA.AU), ANZ

(ANZ.AU) and NAB (NAB.AU) gain between 0.1% and 0.4% while BHP

(BHP.AU), Rio Tinto (RIO.AU) and Fortescue (FMG.AU) fall between

0.5% and 3.5%. "We remain positive on global cyclicals and some of

the domestic cyclicals," Macquarie Private Wealth division director

Martin Lakos says. "We are reasonably comfortable with China's

December-quarter GDP data and our forecast of 7.5% growth in

China's GDP for 2014. Commodity prices are likely to hold around

current levels." Woodside (WPL.AU) falls 1.1% after both Macquarie

and RBC cut their ratings to Underperform.

(david.rogers@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

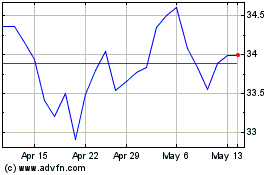

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

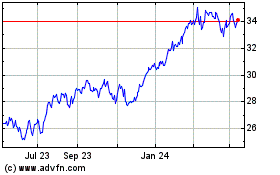

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jul 2023 to Jul 2024