MARKET COMMENT: S&P/ASX 200 May Rise After Breaking Resistance

February 14 2013 - 6:28PM

Dow Jones News

2257 GMT [Dow Jones] Australia's S&P/ASX 200 may rise

further Friday after breaking major technical resistance from the

April 2010 peak at 5025.1 yesterday. On a technical basis, the

psychological 5000 level could now support the market for a test of

the next resistance level at 5177. ANZ (ANZ.AU) shares may weaken

after its 1Q trading update revealed downward pressure on deposit

margins, and weaker income growth than NAB (NAB.AU) and CBA

(CBA.AU). Investors could switch to CBA (CBA.AU) and Telstra

(TLS.AU) before they go ex-dividend on Monday. BHP (BHP.AU) ADR's

fell 0.5% to A$38.72, but BHP broke resistance at A$38.25

yesterday. Rio Tinto (RIO.AU) is poised to break equivalent

resistance at A$72.30. On the offshore front, European GDP data

disappointed the market, with Eurozone 4Q GDP down the most in

nearly 4 years. Wall Street appeared to look through the European

GDP data, helped by lower than expected jobless claims, and

Berkshire Hathaway's US$23 billion purchase of Heinz. S&P/ASX

200 last 5036.9. (david.rogers1@wsj.com)

-Write to the Sydney newsroom at djnews.sydney@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

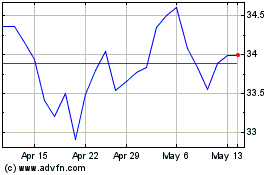

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

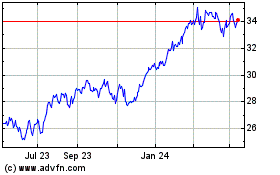

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jul 2023 to Jul 2024