Government of Singapore Investment Corp. suffered a loss around

S$59 billion in the fiscal year ended March, making it one of the

worst years for the sovereign wealth fund since it was established

in 1981, people familiar with the situation said Tuesday.

"The equities investments suffered the most, followed by falls

in property valuations. It was one of the worst years ever," the

person told Dow Jones Newswires.

The person said GIC's portfolio now stands at around S$265

billion.

GIC is the world's fourth-largest sovereign fund in terms of

money managed, according to Deutsche Bank, with high-profile

investments in Western financial institutions like Citigroup Inc.

(C) and UBS.AG (UBS).

Earlier in the day, GIC said in its annual report that its

portfolio lost more than 20% of its value in the last fiscal

year.

However, it said, the recent rebound in global stock markets has

helped it recover more than half of the loss.

A second person said GIC's property valuations are also

recovering after suffering huge losses in the past year.

"GIC held on to all its property whose paper value at the end of

the fiscal year looked miserable. Valuations were down in

Australia, Russia, Europe, Japan and China. Now they are coming

back, but are still way off their value in late 2007 and early

2008," he said.

GIC said in the report that it had an annualized 5.7% return in

U.S. dollar terms over the last 20 years from 7.8% a year earlier.

Its nominal return over 20 years in Singapore dollar terms was 4.4%

compared with 5.8% a year earlier.

"Like many large institutional investors, GIC's portfolio had

been impacted in the severe global downturn of 2008," said Tony

Tan, GIC's deputy chairman.

GIC manages the city-state's foreign exchange reserves.

"By end-August 2009, global stock markets have recovered 48%

from the lows of March 2009 even though they are still down 35%

from their peak in October 2007," GIC's group chief investment

officer Ng Kok Song said.

GIC said it has confidence in the long-term prospects of

Citigroup and UBS.

It holds a 9% stake in UBS by way of preferred shares it bought

in late 2007 for CHF11 billion ($11 billion).

Last week, it said it cut its stake in Citigroup to below 5%

from over 9% after it exchanged its convertible preferred stock in

the bank to common stock. It made a profit of US$1.6 billion from

the sale. GIC had invested US$6.88 billion in Citi in January

2008.

"The UBS investment will take longer to recover. While both

banks still face challenges in returning to profitability, we

maintain our confidence in their long-term prospects," Ng said.

Ng said that in the short-term, less funds will be available for

leveraged investments as lending institutions will face more

onerous capital-adequacy requirements and asset securitization

markets remain impaired.

"Regulatory intervention is likely to dampen risk-taking.

Investment vehicles such as hedge funds and private equity funds

will be subject to greater disclosure of their activities," he

said.

The executive also said governments and central banks may face

pressure not to withdraw fiscal and monetary stimulus packages

because of high unemployment levels.

"These changes will present both opportunities and risks that

will require GIC to adapt its investment strategy accordingly," Ng

said.

He said economic growth will be higher in developing countries

rather than developed economies.

GIC said it cut its exposure to equities by more than 10% from

July 2007 to September 2008, but has now increased its exposure in

global stock markets to pre-crisis levels.

The fund invested 38% of its portfolio in equities last year

from 44% a year earlier, while exposure to fixed income such as

bonds was 24% from 26%. About 30% of GIC's portfolio is invested in

real estate, private equity, venture capital and infrastructure

assets, from 23% a year earlier.

The fund increased its exposure to the Americas to 44% of its

portfolio last year from 40%, while in Europe it cut its exposure

to 29% from 35%. Asia accounted for 24% of its portfolio from 23%

earlier.

GIC Real Estate, one of the world's 10 biggest property

investors, has pumped about A$3.8 billion in Australia including

13% and 6% stakes in property managers GPT Group (GPT.AU) and

Mirvac Group (MGR.AU), respectively, worth a combined A$580

million

"At one point last year the losses in these two investments were

more than A$350 million," the second person said.

GIC Real Estate also invested US$233 million in Russia for a 25%

stake in the 114-hectare Yaroslavsky development, northeast of

Moscow. The project involves the development of 50 high-rise

apartments, shops, schools and hospitals.

"More than half of that investment's paper value was gone in

late 2008," the person said.

In all, GIC Real Estate spent US$10 billion on real estate in

western Europe, Japan and Russia in 2007 and 2008.

In early 2009 it also spent US$1.3 billion to buy assets in

China and Japan from Prologis, the U.S. industrial property

developer.

-By Costas Paris and P.R. Venkat, Dow Jones Newswires; +65 64154

151; costas.paris@dowjones.com

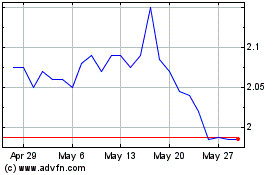

Mirvac (ASX:MGR)

Historical Stock Chart

From May 2024 to Jun 2024

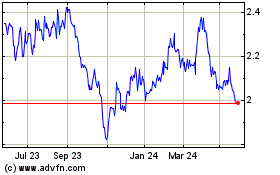

Mirvac (ASX:MGR)

Historical Stock Chart

From Jun 2023 to Jun 2024