Morgan Stanley to Seek Court Backing for Vote on Dexus's IOF Bid

March 22 2016 - 9:20PM

Dow Jones News

By Rebecca Thurlow

SYDNEY--Morgan Stanley (MS) is heading to court in Australia

seeking a declaration of its right to vote on Dexus Property

Group's (DXS.AU) 2.6 billion Australian dollar (US$1.9 billion) bid

for Investa Office Fund (IOF.AU) as demand for commercial property

in the country heats up.

The move by the U.S. investment bank comes after Dexus,

Australia's biggest office landlord, made an application to

Australia's Takeovers Panel asking Morgan Stanley be prevented from

voting on the cash-and-shares bid when shareholders meet to decide

on the offer next month, claiming it has a conflict of interest

because of its relationship with the fund's manager.

In a filing to the Australian Securities Exchange on Wednesday,

Investa Office Fund said it was notified by Morgan Stanley's real

estate investing arm, which controls a 8.9% stake in the Investa,

that it intends to file proceedings in the Supreme Court of New

South Wales against the responsible entity of the fund.

Investa said it understands Morgan Stanley intends to apply for

a declaration from the court that it is entitled to participate in

the April 8 vote.

The court's decision could make or break Dexus's takeover plan,

which requires 75% of the vote to succeed and would entrench

Dexus's dominance of the listed office trust sector in Australia

after it snapped up rival Commonwealth Property Office Fund in 2014

following a takeover fight with GPT Group.

The offer of 0.424 Dexus shares and A$0.8229 cash for every IOF

share already has the approval of the IOF board, but is being

opposed by Investa Commercial Property Fund Group, which took over

IOF's management from Morgan Stanley as part of a move by the U.S.

investment bank to divest its Australian commercial property

business Investa Property Group. In an unusual misalignment between

the advice of a real estate trust's manager and that of its board,

ICPF is urging shareholders to reject the Dexus offer and instead

buy half the management platform.

Dexus wants Morgan Stanley to abstain from voting, saying it

would be unacceptable for the U.S. investment bank to vote because

it is associated with ICPF. The second tranche of the A$90 million

payment from ICPF for the management rights is conditional on IOF

being still managed under the platform.

The Takeovers Panel said Tuesday it had received the application

from Dexus but no decision had yet been made as to whether to

conduct proceedings.

-Write to Rebecca Thurlow at rebecca.thurlow@wsj.com

(END) Dow Jones Newswires

March 22, 2016 21:05 ET (01:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

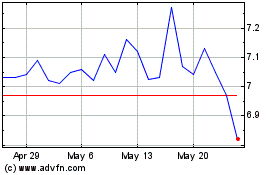

Dexus (ASX:DXS)

Historical Stock Chart

From Jan 2025 to Feb 2025

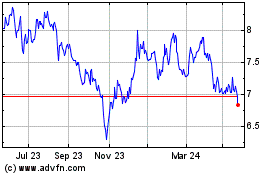

Dexus (ASX:DXS)

Historical Stock Chart

From Feb 2024 to Feb 2025