TIDMTMT

RNS Number : 9955X

TMT Investments PLC

11 January 2022

11 January 2022

TMT INVESTMENTS PLC

("TMT" or the "Company")

Portfolio Update

TMT Investments Plc (AIM: TMT.L), the venture capital company

investing in high-growth technology companies, is pleased to

announce the following developments in the Company's portfolio

since the publication of the Company's previous portfolio update on

19 October 2021.

Revaluations and Exits

-- TMT's portfolio company Bolt, a leading international

ride-hailing and food delivery company ( www.bolt.eu ), announced

today that it has successfully raised EUR628 million (approx.

US$711 million) in a new equity finance round led by Fidelity,

Sequoia Capital and a number of other leading institutional

investors (the "Bolt Fundraise"). The Bolt Fundraise takes Bolt's

valuation to EUR7.4 billion and represents a substantial valuation

uplift of approximately US$37.2 million (or 56%) in the value of

TMT's investment in Bolt, compared to the previously announced

valuation as of 30 June 2021.

-- Workiz, a leading SaaS provider for the field service

industry ( www.workiz.com ), completed a new equity funding round.

The transaction represented a revaluation uplift of US$3.0 million

(or 298%) in the fair value of TMT's investment, compared to the

previous reported amount as of 31 December 2020.

-- As announced on 1 November 2021, Volumetric Biotechnologies.

Inc. ("Volumetric") was acquired by 3D Systems (NYSE:DDD) (the

"Acquisition"). The Acquisition was structured as a US$45 million

closing payment, with up to US$355 million of further consideration

due on an earnout basis subject to the achievement of certain

milestones linked to the attainment of significant steps in the

demonstration of human applications (the "Contingent

Consideration"), with all such payments comprising approximately

half cash and half equity in 3D Systems. TMT received its part of

the closing cash payment equal to US$0.32 million, plus 11,810

shares of 3D Systems, worth, as of 31 December 2021, approximately

US$0.25 million. The initial part of the transaction (i.e.

excluding any potential future Contingent Consideration)

represented a revaluation uplift of US$0.36 million (or 177%) in

the fair value of TMT's investment, compared to the previous

reported amount as of 31 December 2020.

-- Hinterview, a leading video recruitment software provider (

www.hinterview.com ), completed a new equity funding round. The

transaction represented a revaluation uplift of US$0.2 million (or

35%) in the fair value of TMT's investment, compared to the

previous reported amount as of 31 December 2020.

The above revaluations are expected to result in a combined

increase in the Company's NAV equivalent to approximately US$1.29

per share (before adjustments for the Company's ongoing operating

expenses, accrued bonus, potential future revaluations/impairments,

and similar items).

New Investments

The Company has also made the following new and additional

investments since the publication of the Company's previous

portfolio update on 19 October 2021:

-- US$1,500,000 into Study space, Inc., trading as EdVibe, an

all-in-one language teaching platform ( https://edvibe.com/en

);

-- US$2,000,000 into Bafood Global Limited, a hyper local

ready-to-eat food delivery and cloud kitchen operator in Eastern

Europe ( https://bafood.com.ua /en );

-- US$1,000,000 in Educate Online Inc., an education platform

that allows children aged 4-19 to study in leading international

schools remotely ( www.educate-online.io );

-- US$850,000 in My Device Inc., trading as Whiz, a

device-as-a-service company that provides mobility, sports and

high-tech devices on a subscription basis to corporate and

individual clients ( www.getwhiz.co );

-- US$1,000,000 in Lulu Systems, Inc., trading as Mobilo, an

eco-friendly solution that allows users to digitally share contact

details and turn meetings into leads ( www.mobilocard.com );

-- Additional US$2,000,000 in Muncher Inc., a cloud kitchen and

virtual food brand operator in Latin America ( www.muncher.com.co

);

-- Additional GBP2,000,000 in 3S Money Club Limited, a UK-based

online banking service focusing on international trade (

www.3s.money ); and

-- US$500,000 in Alippe, Inc., trading as 1Fit, a mobile app

with single membership that gives access to multiple gyms and yoga

studios in Kazakhstan and Russia ( www.1fit.app ).

Alexander Selegenev, Executive Director of TMT, commented:

" TMT's portfolio continues to register strong progress and we

are delighted to announce today's update.

Bolt's EUR628 million funding round led by Sequoia Capital and

Fidelity Management and Research Company LLC is its largest to date

and takes its valuation to EUR7.4 billion. The size of the funding

round and calibre of investors is a testament to Bolt's business

model and growth trajectory. TMT is increasingly being recognised

as a trailblazer in identifying promising technology companies at

an earlier stage of their development. Bolt is one of TMT's four

unicorn investments to date, alongside Pandadoc, Wrike (exited in

2019) and Pipedrive (exited in 2020). At the current valuation, the

value of TMT's stake in Bolt is worth approximately US$103 million,

compared to TMT's original investment of US$0.32 million in

2014.

Bolt has grown to become one of the world's leading mobility

companies since TMT first invested in the company in 2014. Today,

Bolt serves 100 million customers in 45 countries and over 400

cities across Europe and Africa, seeking to offer better

alternatives for every use case including ride-hailing, shared cars

and scooters, and food and grocery delivery.

We have been busy investing the proceeds of TMT's October 2021

US$19.3 million fund raise and are pleased to announce six new and

two additional investments today. We continue to make additional

investments into some of our best performing companies when

suitable opportunities arise, in this case an additional US$2

million in Muncher Inc., a cloud kitchen and virtual food brand

operator in Latin America ( www.muncher.com.co ), and an additional

GBP2 million in 3S Money Club Limited, a UK-based online banking

service focusing on international trade ( www.3s.money ).

With over 50 companies in its portfolio and an established

11-year track record as a publicly quoted company, TMT offers a

diversified and liquid route to access some of the fastest and best

growing technology companies globally.

We look forward to keeping shareholders updated on relevant

developments."

For further information contact:

TMT Investments Plc +44 (0)1534 281 800

Alexander Selegenev (Computershare - Company Secretary)

Executive Director

www.tmtinvestments.com alexander.selegenev@tmtinvestments.com

Strand Hanson Limited

(Nominated Adviser)

James Bellman / James Dance +44 (0)20 7409 3494

Cenkos Securities plc

(Joint Broker)

Ben Jeynes +44 (0)20 7397 8900

Hybridan LLP

(Joint Broker)

Claire Louise Noyce +44 (0)20 3764 2341

Kinlan Communications +44 (0)20 7638 3435

David Hothersall davidh@kinlan.net

About TMT Investments Plc

TMT Investments Plc invests in high-growth technology companies

across a number of core specialist sectors and has a significant

number of Silicon Valley investments in its portfolio. Founded in

2010, TMT has a current investment portfolio of over 50 companies

and net assets of US$218 million as of 30 June 2021. The Company's

objective is to generate an attractive rate of return for

shareholders, predominantly through capital appreciation. The

Company is traded on the AIM market of the London Stock Exchange.

www.tmtinvestments.com .

Twitter

LinkedIn

Facebook

This announcement is released by TMT Investments Plc and

contains inside information for the purposes of Article 7 of EU

Regulation 596/2014 (as amended), which forms part of domestic UK

law pursuant to the European Union (Withdrawal) Act 2018, as

amended. Upon publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCURRRRUAUAAUR

(END) Dow Jones Newswires

January 11, 2022 02:00 ET (07:00 GMT)

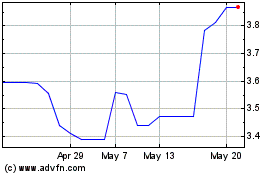

TMT Investments (AQSE:TMT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

TMT Investments (AQSE:TMT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024