TIDMTMT

RNS Number : 8054N

TMT Investments PLC

01 October 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN (THIS

"ANNOUNCEMENT") IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN,

INTO OR FROM AUSTRALIA, CANADA, JAPAN, NEW ZEALAND, THE REPUBLIC OF

SOUTH AFRICA OR THE UNITED STATES OR ANY OTHER JURISDICTION IN

WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE

UNLAWFUL..

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN TMT INVESTMENTS PLC OR ANY OTHER

ENTITY IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

THIS ANNOUNCEMENT IS A FINANCIAL PROMOTION FOR THE PURPOSES OF

SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 ( "FSMA")

AND HAS BEEN APPROVED BY PRIMARYBID LIMITED WHICH IS AUTHORISED AND

REGULATED BY THE FINANCIAL CONDUCT AUTHORITY (FRN 779021).

For immediate release

1 October 2021

TMT INVESTMENTS PLC

PrimaryBid Offer

TMT Investments Plc (AIM: TMT) ("TMT" or the "Company"), the

venture capital company investing in high-growth, technology

companies across a number of core specialist sectors, is pleased to

announce a conditional subscription via PrimaryBid (the "PrimaryBid

Offer") of new ordinary shares of no par value in the Company

("Ordinary Shares")(the "PrimaryBid Offer Shares") at an issue

price of US$8.50 per share (the "Issue Price") which represents a

discount of 7.6 per cent. to the closing middle market price of an

Ordinary Share on 30 September 2021 (being the latest practicable

date prior to the publication of this Announcement) and a premium

of 13.5 per cent. to the Company's unaudited net asset value per

share of US$7.49 as at 30 June 2021.

Earlier today, the Company also announced a conditional capital

raise to raise US$18.5 million before expenses (the "Capital

Raising") by way of the issue of an aggregate of 2,176,471 new

Ordinary Shares at the Issue Price (the "Capital Raising

Announcement"). The Capital Raising consists of a conditional

placing of 1,577,672 new Ordinary Shares (the "Placing Shares") at

the Issue Price with new and existing institutional investors and

separate conditional direct subscriptions with the Company for an

aggregate of 598,799 new Ordinary Shares (the "Subscription Shares"

and together with the Placing Shares, the "New Ordinary Shares") by

Executive Director Alexander Selegenev and certain members of the

Company's founding management team and their connected parties.

The Capital Raising is conditional upon, inter alia, the New

Ordinary Shares being admitted to trading on the AIM Market of the

London Stock Exchange ("AIM")("Admission").

The PrimaryBid Offer is conditional upon Admission and the

admission of the PrimaryBid Offer Shares being admitted to trading

on AIM becoming effective ("PrimaryBid Admission"). Admission and

PrimaryBid Admission are expected to become effective on or about

8.00 a.m. on 7 October 2021.

The PrimaryBid Offer will therefore not be completed without the

Capital Raising also being completed.

The net proceeds of the PrimaryBid Offer, together with the net

proceeds of the Capital Raising, will be used as described in the

Capital Raising Announcement.

The PrimaryBid Offer

The Company values its retail investor base and is therefore

pleased to provide private and other investors with the opportunity

to participate in the PrimaryBid Offer by applying exclusively

through the PrimaryBid mobile app available on the Apple App Store

and Google Play. PrimaryBid does not charge investors any

commission for this service.

The PrimaryBid Offer, via the PrimaryBid mobile app, will be

open to individual and institutional investors following the

publication of this Announcement. The PrimaryBid Offer is expected

to close at 12 noon on 4 October 2021. The PrimaryBid Offer may be

closed early if it is oversubscribed.

A maximum of approximately US$1.5 million will be raised

pursuant to the PrimaryBid Offer through the issue of a maximum of

176,470 PrimaryBid Offer Shares. While the Issue Price is US$8.50,

valid applications under the PrimaryBid Offer will be processed by

PrimaryBid in Pounds Sterling (GBP) and the final Sterling

equivalent Issue Price will be announced by the Company at the same

time as the results of the PrimaryBid Offer. At the time of this

Announcement the Sterling equivalent of the Issue Price is GBP6.31

based on an exchange rate of US$1.00:GBP0.7422.

The Company reserves the right to scale back any order at its

discretion. The Company and PrimaryBid reserve the right to reject

any application for subscription under the PrimaryBid Offer without

giving any reason for such rejection.

No commission is charged to investors on applications to

participate in the PrimaryBid Offer made through PrimaryBid. It is

vital to note that once an application for PrimaryBid Offer Shares

has been made and accepted via PrimaryBid, an application cannot be

withdrawn.

For further information on PrimaryBid or the procedure for

applications under the PrimaryBid Offer, visit www.PrimaryBid.com

or email PrimaryBid at enquiries@primarybid.com.

The PrimaryBid Offer Shares will be issued free of all liens,

charges and encumbrances and will, when issued and fully paid, rank

pari passu in all respects with the Company's existing issued

Ordinary Shares.

The information contained within this Announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 (as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018). Upon the publication of this Announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

The person responsible for arranging the release of this

announcement on behalf of the Company is Alexander Selegenev, a

director of the Company.

For further information contact :

TMT Investments Plc +44 (0)1534 281 800

Alexander Selegenev (Computershare - Company Secretary)

Executive Director

www.tmtinvestments.com alexander.selegenev@tmtinvestments.com

Strand Hanson Limited (Nominated

Adviser)

James Bellman / James Dance +44 (0)20 7409 3494

PrimaryBid Limited enquiries@primarybid.com

Fahim Chowdhury / James Deal

Kinlan Communications +44 (0)20 7638 3435

David Hothersall davidh@kinlan.net

About TMT Investments Plc

TMT Investments Plc invests in high-growth technology companies

across a number of core specialist sectors and has a significant

number of Silicon Valley investments in its portfolio. Founded in

2010, TMT has a current investment portfolio of over 45 companies

and unaudited net assets of US$218 million as at 30 June 2021. The

Company's objective is to generate an attractive rate of return for

shareholders, predominantly through capital appreciation. The

Company is traded on the AIM market of the London Stock Exchange.

www.tmtinvestments.com .

Further details of the PrimaryBid Offer

The Company highly values its retail investor base which has

supported the Company alongside institutional investors over

several years. Given the longstanding support of retail

shareholders, the Company believes that it is appropriate to

provide retail and other interested investors the opportunity to

participate in the PrimaryBid Offer. The Company is therefore

making the PrimaryBid Offer available exclusively through the

PrimaryBid mobile app.

The PrimaryBid Offer is offered under the exemptions against the

need for a prospectus allowed under the Prospectus Regulation Rules

of the Financial Conduct Authority (the "Prospectus Regulation

Rules"). As such, the Company is not required to publish a

prospectus pursuant to the Prospectus Regulation Rules. The

PrimaryBid Offer is not being made into any Restricted Jurisdiction

(as defined below) or any other jurisdiction where it would be

unlawful to do so.

There is a minimum subscription of GBP250 per investor under the

terms of the PrimaryBid Offer which is open to existing

shareholders and other investors subscribing via the PrimaryBid

mobile app.

For further details please refer to the PrimaryBid website at

www.PrimaryBid.com . The terms and conditions on which the

PrimaryBid Offer is made, including the procedure for application

and payment for PrimaryBid Offer Shares, is available to all

persons who register with PrimaryBid.

Investors should make their own investigations into the merits

of an investment in the Company. Nothing in this Announcement

amounts to a recommendation to invest in the Company or amounts to

investment, taxation or legal advice.

It should be noted that a subscription for PrimaryBid Offer

Shares and investment in the Company carries a number of risks.

Investors should consider the risk factors set out on

PrimaryBid.com before making a decision to subscribe for PrimaryBid

Offer Shares. Investors should take independent advice from a

person experienced in advising on investment in securities such as

the PrimaryBid Offer Shares if they are in any doubt.

Important notices

The distribution of this Announcement and any other

documentation associated with the Capital Raising and the

PrimaryBid Offer into jurisdictions other than the United Kingdom

may be restricted by law. Persons into whose possession these

documents come should inform themselves about and observe any such

restrictions. Any failure to comply with these restrictions may

constitute a violation of the securities laws or regulations of any

such jurisdiction. In particular, such documents should not be

distributed, forwarded to or transmitted, directly or indirectly,

in whole or in part, in, into or from the United States, Australia,

Canada, Japan or the Republic of South Africa or any other

jurisdiction where to do so may constitute a violation of the

securities laws or regulations of any such jurisdiction (each a

"Restricted Jurisdiction" ).

The PrimaryBid Offer Shares have not been and will not be

registered under the US Securities Act 1933 (as amended) (the "US

Securities Act" ) or with any securities regulatory authority of

any state or other jurisdiction of the United States and,

accordingly, may not be offered, sold, resold, taken up,

transferred, delivered or distributed, directly or indirectly,

within the United States except in reliance on an exemption from

the registration requirements of the US Securities Act and in

compliance with any applicable securities laws of any state or

other jurisdiction of the United States.

There will be no public offer of the PrimaryBid Offer Shares in

the United States. The PrimaryBid Offer Shares are being offered

and sold outside the US in reliance on Regulation S under the US

Securities Act. The PrimaryBid Offer Shares have not been approved

or disapproved by the US Securities and Exchange Commission, any

state securities commission in the US or any other US regulatory

authority, nor have any of the foregoing authorities passed upon or

endorsed the merits of the offering of the PrimaryBid Offer Shares

or the accuracy or adequacy of this Announcement. Any

representation to the contrary is a criminal offence in the US.

The PrimaryBid Offer Shares have not been and will not be

registered under the relevant laws of any state, province or

territory of any Restricted Jurisdiction and may not be offered,

sold, resold, taken up, transferred, delivered or distributed,

directly or indirectly, within any Restricted Jurisdiction except

pursuant to an applicable exemption from registration requirements.

There will be no public offer of PrimaryBid Offer Shares in

Australia, Canada, Japan, or the Republic of South Africa.

This Announcement is for information purposes only and does not

constitute or form part of any offer to issue or sell, or the

solicitation of an offer to acquire, purchase or subscribe for, any

securities in any jurisdiction and should not be relied upon in

connection with any decision to subscribe for or acquire any of the

PrimaryBid Offer Shares. In particular, this Announcement does not

constitute or form part of any offer to issue or sell, or the

solicitation of an offer to acquire, purchase or subscribe for, any

securities in the United States.

No statement in this Announcement is intended to be a profit

forecast or profit estimate for any period and no statement in this

Announcement should be interpreted to mean that earnings or

earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings or earnings per share of the Company.

This Announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will", or

"should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

matters that are not historical facts. They appear in a number of

places throughout this Announcement and include statements

regarding the Directors' current intentions, beliefs or

expectations concerning, among other things, the Company's results

of operations, financial condition, liquidity, prospects, growth,

strategies and the Company's markets. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. Actual results and

developments could differ materially from those expressed or

implied by the forward-looking statements. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements in this Announcement are based on

certain factors and assumptions, including the Directors' current

view with respect to future events and are subject to risks

relating to future events and other risks, uncertainties and

assumptions relating to the Company's operations, results of

operations, growth strategy and liquidity. Whilst the Directors

consider these assumptions to be reasonable based upon information

currently available, they may prove to be incorrect. Save as

required by applicable law or by the AIM Rules for Companies, the

Company undertakes no obligation to release publicly the results of

any revisions to any forward-looking statements in this

Announcement that may occur due to any change in the Directors'

expectations or to reflect events or circumstances after the date

of this Announcement.

Neither the content of the Company's website nor any website

accessible by hyperlinks to the Company's website is incorporated

in, or forms part of, this Announcement.

Certain figures contained in this Announcement, including

financial information, have been subject to rounding adjustments.

Accordingly, in certain instances, the sum or percentage change of

the numbers contained in this Announcement may not conform exactly

with the total figure given.

All references to time in this Announcement are to London time,

unless otherwise stated.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUAUVRANURRAA

(END) Dow Jones Newswires

October 01, 2021 11:35 ET (15:35 GMT)

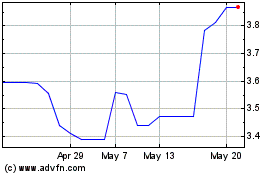

TMT Investments (AQSE:TMT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

TMT Investments (AQSE:TMT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024