TIDMTMT

RNS Number : 0799M

TMT Investments PLC

17 September 2021

17 September 2021

TMT INVESTMENTS PLC

("TMT" or the "Company")

Portfolio Update

TMT Investments Plc (AIM: TMT.L), the venture capital company

investing in high-growth technology companies, is pleased to

announce the following developments in the Company's portfolio

since the publication of the Company's 2021 interim results on 18

August 2021.

Exits and Revaluations

The Company has had the following portfolio exits and

revaluations since the publication of its 2021 interim results on

18 August 2021:

-- TMT sold 11% of its interest in PandaDoc, a proposal

automation and contract management software provider (

www.pandadoc.com ), to a large venture capital fund for a cash

consideration of US$2.0 million. The transaction represents a

revaluation uplift of US$4.2 million (or 30%) in the fair value of

TMT's investment in PandaDoc, compared to the previous announced

amount as of 30 June 2021.

-- TMT signed a definitive conditional agreement to dispose of

its entire holding in Depositphotos, a leading stock photo and

video marketplace ( www.depositphotos.com ), for a total cash

consideration of approximately US$14.3 million (the "Disposal"),

including the hold-back amount of approximately US$1.4 million

payable within approximately 12 months of the completion of the

transaction . Subject to final adjustments, and assuming TMT

receives the entire hold-back amount in full, the Disposal

represents a revaluation uplift of approximately US$3.5 million (or

32.2%) in the fair value of TMT's investment compared to the

previous announced amount as of 30 June 2021. The completion of the

Disposal is subject to various conditions being satisfied, which

include, inter alia, certain competition approvals, with the

parties anticipating completion of, and receipt of the initial

consideration by the Company in connection with, the Disposal

before the end of 2021. Further announcements will be made as

appropriate in this regard.

The above revaluations are expected to result in a combined

increase in the Company's NAV equivalent to approximately US$0.26

per share (before adjustments for the Company's ongoing operating

expenses, accrued bonus, potential future revaluations/impairments,

and similar items). This represents an uplift in the Company's NAV

of approximately 3.5% from the previously stated figure of US$7.49

per share as of 30 June 2021.

New Investments

The Company has also made the following new and further

investments since the publication of its 2021 interim results on 18

August 2021:

-- EUR1,500,000 in EstateGuru, a leading pan-European

marketplace for short-term, property-backed loans (

www.estateguru.co );

-- Additional US$250,000 in Ad Intelligence Inc., trading as

RetargetApp, an online solution aimed at monitoring ad campaigns

and automatically managing daily budgets, audience and bids to

improve the quality of retargeting ( https://retargetapp.com );

-- Additional US$200,000 in Agendapro, Inc., a SaaS-based

scheduling, payment and marketing solution for the beauty and

wellness industry in Latin America ( www.agendapro.com );

-- US$1,800,000 in Prodly, an Applications Operations (AppOps)

software platform that simplifies change management for Salesforce

and helps businesses to automate deployments, regression testing,

governance, and version control for enterprise applications (

https://prodly.co ); and

-- GBP500,000 in SonicJobs App Ltd., an award-winning mobile app

helping blue collar workers find and apply for jobs (

www.sonicjobs.co.uk ).

As of 16 September 2021, TMT had approximately US$11.2 million

of cash and cash equivalents on its balance sheet, and the Company

continues to actively pursue suitable opportunities for further

investment.

Alexander Selegenev, Executive Director of TMT, commented:

" We are delighted to announce further progress in TMT's

portfolio since the publication of TMT's 2021 interim results on 18

August 2021."

"W ith so many investment opportunities available globally, it

is more important than ever to remain focused on investing in

companies that meet TMT' s investment criteria : having outstanding

management teams, a product or service that can be scaled up

globally, fast revenue growth, Series A / Pre-Series A stage, and

viable exit opportunities. We are therefore delighted that

Depositphotos has become TMT's latest full exit, as a company that

met all of those criteria when we first invested in it in 2011,

providing a return of 5 times on TMT' s investment (including

partial exits to date)."

"We are also pleased to announce our partial exit from PandaDoc,

which is testament to the business' excellent progress to date and

underlines the strong secondary buying interest in later-stage

technology companies like PandaDoc from large venture capital

investors ."

"TMT is continuing to make good progress with its investment

programme, investing further into its strong existing portfolio as

and when funding opportunities arise, as well as pursuing new

exciting companies ."

"We look forward to keeping shareholders updated on relevant

developments".

For further information contact:

TMT Investments Plc +44 (0)1534 281 800

Alexander Selegenev (Computershare - Company Secretary)

Executive Director

www.tmtinvestments.com alexander.selegenev@tmtinvestments.com

Strand Hanson Limited

(Nominated Adviser)

James Bellman / James Dance +44 (0)20 7409 3494

Cenkos Securities plc

(Joint Broker)

Ben Jeynes +44 (0)20 7397 8900

Hybridan LLP

(Joint Broker)

Claire Louise Noyce +44 (0)20 3764 2341

Kinlan Communications +44 (0)20 7638 3435

David Hothersall davidh@kinlan.net

About TMT Investments Plc

TMT Investments Plc invests in high-growth technology companies

across a number of core specialist sectors and has a significant

number of Silicon Valley investments in its portfolio. Founded in

2010, TMT has a current investment portfolio of over 45 companies

and net assets of US$218 million as of 30 June 2021. The Company's

objective is to generate an attractive rate of return for

shareholders, predominantly through capital appreciation. The

Company is traded on the AIM market of the London Stock Exchange.

www.tmtinvestments.com .

Twitter

LinkedIn

Facebook

This announcement is released by TMT Investments plc and

contains inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) 596/2014 (MAR), and is disclosed in

accordance with the Company's obligations under Article 17 of

MAR.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUUNVARAAUKAUR

(END) Dow Jones Newswires

September 17, 2021 02:00 ET (06:00 GMT)

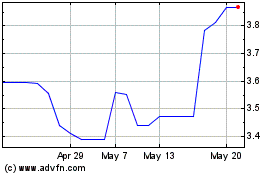

TMT Investments (AQSE:TMT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

TMT Investments (AQSE:TMT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024