TIDMNTQ

RNS Number : 3352T

Enteq Upstream PLC

14 November 2019

Enteq Upstream plc

Interim results for the six months ended 30 September 2019

AIM traded Enteq Upstream plc ("Enteq", the "Company" or the

"Group"), the Oil & Gas drilling technology company, today

announces its interim results for the six months ended 30 September

2019.

Key features

-- Significant growth in revenue (58%) and adjusted EBITDA(*)

(143%), ahead of management's prior expectations

-- Adjusted EBITDA(1) margin at 23% (September 2018: 15%)

-- Growth in both North American and International revenues

-- International revenues up to 36% of first half year total (September: 2018: 6%)

-- Technology partnerships creating pull through for Enteq sales

-- Exclusive agreement with Shell for innovative Directional Drilling technology

Financial metrics

6 Months ended 30 September:

2019 2018

US$m US$m

* Revenue 6.5 4.2

* Adjusted EBITDA(1) 1.5 0.6

* Post tax loss for the period 0.5 0.4

* Adjusted loss per share (cents) (2) 0.4 0.4

* Cash balance 10.7 11.8

Outlook

-- North American market requires long term stability of oil

production, but has short term rig count reduction

-- International markets show increase in demand for Enteq equipment

-- New technology agreements, including with Shell, broaden the

markets that can be addressed by Enteq

-- Continuing strong balance sheet enables further investment opportunities

Martin Perry, CEO of Enteq Upstream plc, commented:

"Enteq has delivered progressive growth, both in revenue and

adjusted EBITDA, for the third successive first half reporting

period, with a particularly strong performance from international

sales. Investment continues to be made into both new technology and

strategic opportunities with the recent exclusive technology

agreement with Shell significantly broadening the potential for

Enteq.

"Despite a recent drop in the number of active rigs drilling in

North America, Enteq is optimistic for growth as new technology and

markets are introduced. The board is confident in meeting its full

year expectations."

For further information, please contact:

Enteq Upstream plc +44 (0) 1494 618739

Martin Perry, Chief Executive Officer

David Steel, Finance Director

Investec Bank plc (Nomad and Broker) +44 (0) 20 7597 5970

Chris Treneman, Patrick Robb, David Anderson

(1) Adjusted EBITDA is reported profit before tax adjusted for

interest, depreciation, amortisation, foreign exchange movements,

performance share plan charges and exceptional items.

(2) Adjusted earnings per share is reported profit per share

adjusted for foreign exchange movements, amortisation, performance

share plan charges and exceptional items.

Interim Report

CHAIRMAN & CHIEF EXECUTIVE OFFICER'S REPORT

Market Update

Enteq Upstream supplies Measurement While Drilling (MWD)

equipment to drilling companies in the oil, gas and geothermal

industries. The equipment enables the well-bore to be accurately

positioned and assists in optimising the efficiency of drilling and

production operations.

During the six-month reporting period ended 30 September 2019,

the price of West Texas Intermediate Crude oil ("WTI") averaged

around US$58 per barrel (closing the period at US$53). During the

same period the North American rig count reduced from approximately

1,030 to 850 rigs, but the international market remains strong with

good medium-term prospects.

Enteq's market share has been maintained in North America,

despite reductions in the rig count, through the Group's on-going

rental programme with the number of rental Measurement While

Drilling systems deployed during the period remaining steady at 31

kits (30 September 2018: 24 kits). This business model both secures

long-term market share and maintains Enteq's position as a major

equipment supplier within the MWD system sector.

International sales, being those outside North America,

increased, becoming approximately 40% of total revenue, compared to

approximately 10% in the second half of the financial year ended 31

March 2019 and approximately 6% in the six months period before

that. New customers have been secured in China, Middle East and

Russia, through Enteq's reputation for reliable, technically

advanced, equipment that operates in harsh, high temperature

conditions.

Recently announced technology partnerships and licensing

arrangements, including an agreement with Shell, have enabled Enteq

to broaden its addressable Logging While Drilling and Directional

Drilling (steering) markets. The total Directional Drilling service

market world-wide is estimated to be worth $10bn per annum.

Operations

All the core engineering, manufacturing and distribution

functions continue to operate from the Enteq owned facility in

South Houston, Texas, with some contract engineering being carried

out in the UK.

At the end of September 2019, Enteq employed a total of 35

staff, compared with 33 at end of March 2019. Contract engineering

and support staff are retained as needed for specific projects.

Continued investment in technology

The 'At-Bit' technology, a result of a collaboration with

Houston based firm Well Resolutions Technology, is now

commercialised and has resulted in pull through sales, primarily in

China.

The in-house development of PowerHop, the patented wireless

down-hole connection system, has been successfully demonstrated to

a number of potential customers. It has attracted significant

interest, particularly in International markets for connectivity

with 3(rd) party Logging While Drilling equipment.

The exclusive license signed during the period with Shell to

commercialise their Rotary Steerable System technology represents a

significant medium/ long-term revenue creating opportunity. The

Rotary Steerable drilling market is currently estimated at $1bn.

Enteq has embarked on a two to three-year project to convert the

Shell technology into a fully operational system, requiring a total

investment in the order of US$2m. The final product will offer the

market a unique and differentiated solution for positioning a well

whilst drilling.

Overview of results

The first half year revenue of US$6.5m represents a rise of 58%

over the US$4.2m for the first half of last year, and a 8% rise

over the second half of the year ended 31 March 2019.

The North American market continues to be Enteq's most important

geographical market, representing 64% of first half revenues

(September 2018: 94%). Enteq's sales in the international market

have grown significantly in the last six months, primarily through

extending the Group's customer base in China. The international

market represented 36% of the first half year revenue (September

2018: 6%).

The equipment rental market revenue continues to show good

growth, up from US$1.6m in the first half of last year to US$2.6m

in this reporting period (US$2.1m in the second half of the year

ended 31 March 2019). This growth reflects the on-going investment

in the rental fleet standing at 31 kits as at September 2019 (24

kits as at September 2018). During this reporting period a further

three kits were added to the fleet, at a cost of $0.7m, which

balanced the three kits that came to the end of their rental

contract. The carrying value of these kits were fully depreciated

by the end of their contract and their title passed to the renter

when the final rental payment was made.

The Group's reported gross margin of 55% in the first half of

this year was down on the 62% achieved for the six months to 30

September 2018. This was due to the current half year having a

higher proportion of International sales which, due to their higher

average ticket price, achieve slightly lower margins. In addition,

due to the weakening of the North American market, the first half

year results included a provision against certain projected

slow-moving stock lines.

In the six months to 30 September 2019 the administrative

expenses before amortisation, depreciation and long-term incentive

scheme charges were US$2.1m. This is in line with the equivalent

overhead figures in both the first and second half of the last

financial year.

A combination of all the above results in an adjusted EBITDA

profit in the period of US$1.5m, a strong progression from the

$0.6m for the period ended 30 September 2018. A reconciliation

between the reported loss and the adjusted EBITDA is shown in note

5 to the Financial Statements below.

Cash balance and cashflow

As at 30 September 2019 the Group had a cash balance of

US$10.7m, down US$1.2m over the figure as at 31 March 2019.

The half year cash movement can be analysed as follows:

US$m

Adjusted EBITDA 1.5

Decrease in trade and other receivables -

Decrease in trade and other payables (0.7)

Increase in inventory (0.8)

Operational cashflow -

Increase in the rental fleet (0.7)

R&D expenditure (0.7)

Capex (0.1)

Other items 0.3

----------------------------------------- --------------

Net cash movement (1.2)

Cash balances as at 1 April 2019 11.9

----------------------------------------- --------------

Cash balances as at 30 September 2019 10.7

========================================= ==============

The decrease in trade and other payables resulted from the

timing of net payments to trade creditors, post period end, plus

payments relating to the all staff bonus scheme for the year ended

31 March 2019. The increase in inventory includes US$0.6m of

deliveries of long lead time sensors. The $0.7m spent on the rental

fleet relates to the new kits put into the fleet, as previously

mentioned. The $0.7m spent on R&D relates to the proportion of

the engineering team relating to development of future products

including PowerHop.

Summary and outlook

Enteq has delivered progressive growth, both in revenue and

adjusted EBITDA, for the third successive first half reporting

period, with a particularly strong performance from international

sales. Investment continues to be made into both new technology and

strategic opportunities, with the recent exclusive technology

agreement with Shell significantly broadening the potential for

Enteq.

Despite a recent drop in the number of active rigs drilling in

North America, Enteq is optimistic for growth as new technology and

markets are introduced. The board is confident in meeting its full

year expectations.

Martin Perry Iain Paterson

Chief Executive Chairman

Enteq Upstream plc

14 November 2019

Enteq Upstream plc

Condensed Consolidated Income Statement

Six months Six months Year to

to 30 to 30 31 March

September September 2019

2019 2018

Unaudited Unaudited Audited

Notes US$ 000's US$ 000's US$ 000's

Revenue 6,546 4,152 10,204

Cost of Sales (2,950) (1,581) (3,546)

Gross Profit 3,596 2,571 6,658

Administrative expenses before

amortisation (4,020) (2,943) (6,952)

Amortisation of acquired intangibles 9b (148) (60) (116)

Other exceptional items (2) (2) (7)

Foreign exchange (loss)/gain

on operating activities (25) (28) 6

----------- ----------- ----------

Total Administrative expenses (4,195) (3,033) (7,069)

Operating loss (599) (462) (411)

Finance income 142 111 246

Loss before tax (457) (351) (165)

Tax expense 8 - - 67

Loss for the period 5 (457) (351) (98)

========================================= ====== =========== =========== ==========

Loss attributable to:

Owners of the parent (457) (351) (98)

========================================= ====== =========== =========== ==========

Earnings/loss per share (in

US cents): 7

Basic (0.7) (0.6) (0.2)

Diluted (0.7) (0.6) (0.2)

Adjusted earnings per share

(in US cents): 7

Basic (0.4) (0.4) -

Diluted (0.4) (0.4) -

Condensed Consolidated Statement

of Comprehensive Income

Year

Six months Six months to 31

to 30 September to 30 September March

2019 2018 2019

Unaudited Unaudited Audited

US$ 000's US$ 000's US$ 000's

Loss for the period (457) (351) (98)

Other comprehensive income

for the period:

Items that will not be reclassified

subsequently to profit or loss - - -

Items that will be reclassified

subsequently to profit or loss - - -

Total comprehensive income

for the period (457) (351) (98)

--------------------------------------- ----------------- ----------------- --------------

Total comprehensive income

attributable to:

--------------------------------------- ----------------- ----------------- --------------

Owners of the parent (457) (351) (98)

--------------------------------------- ----------------- ----------------- --------------

Enteq Upstream plc

Condensed Statement of Financial

Position

30 September 30 September

2019 2018 31 March 2019

Unaudited Unaudited Audited

Notes US$ 000's US$ 000's US$ 000's

Assets

Non-current

Goodwill 9a - - -

Intangible assets 9b 2,940 1,657 2,394

Property, plant and

equipment 2,487 2,506 2,446

Rental fleet 2,489 2,963 3,449

Trade and other receivables - 168 334

------------------------------- ------ ----------------- ----------------- --------------

Non-current assets 7,916 7,294 8,623

------------------------------- ------ ----------------- ----------------- --------------

Current

Trade and other receivables 2,347 3,043 2,020

Inventories 5,301 3,989 4,512

Cash and cash equivalents 10,662 11,848 11,930

------------------------------- ------ ----------------- ----------------- --------------

Current assets 18,310 18,880 18,462

------------------------------- ------ ----------------- ----------------- --------------

Total assets 26,226 26,174 27,085

------------------------------- ------ ----------------- ----------------- --------------

Equity and liabilities

Equity

Share capital 10 1,028 1,003 1,005

Share premium 91,579 91,334 91,398

Share based payment

reserve 866 700 750

Retained earnings (69,562) (69,702) (69,105)

------------------------------- ------ --------------

Total equity 23,911 23,335 24,048

------------------------------- ------ ----------------- ----------------- --------------

Liabilities

Current

Trade and other payables 2,315 2,839 3,037

------------------------------- ------ ----------------- ----------------- --------------

Total equity and

liabilities 26,226 26,174 27,085

------------------------------- ------ ----------------- ----------------- --------------

Enteq Upstream plc

Condensed Consolidated Statement of Changes

in Equity

Six months to 30 September 2019

Share

Called

up Profit based

share and loss Share payment Total

capital account premium reserve equity

US$ 000's US$ 000's US$ 000's US$ 000's US$ 000's

Issue of share capital 23 - 181 - 204

Share based payment

charge - - - 116 116

---------- ----------

Transactions with owners 23 - 181 116 320

------------------------------ ---------- ---------- ---------- ---------- ----------

Loss for the period - (457) - - (457)

Total comprehensive

income - (457) - - (457)

------------------------------ ---------- ---------- ---------- ---------- ----------

Movement in period: 23 (457) 181 116 (137)

As at 1 April 2019 (audited) 1,005 (69,105) 91,398 750 24,048

As at 30 September 2019

(unaudited) 1,028 (69,562) 91,579 866 23,911

------------------------------ ---------- ---------- ---------- ---------- ----------

Six months to 30 September 2018

Share

Called

up Profit based

share and loss Share payment Total

capital account premium reserve equity

US$ 000's US$ 000's US$ 000's US$ 000's US$ 000's

Issue of share capital 20 - 303 - 323

Share based payment

charge - - - (210) (210)

---------- ----------

Transactions with owners 20 - 303 (210) 113

------------------------------ ---------- ---------- ---------- ---------- ----------

Loss for the period - (351) - - (351)

Total comprehensive

income - (351) - - (351)

------------------------------ ---------- ---------- ---------- ---------- ----------

Movement in period: 20 (351) 303 (210) (238)

As at 1 April 2018 (audited) 983 (69,351) 91,031 910 23,573

As at 30 September 2018

(unaudited) 1,003 (69,702) 91,334 700 23,335

------------------------------ ---------- ---------- ---------- ---------- ----------

Enteq Upstream plc

Condensed Consolidated Statement of Cash

flows

Six months Six months Year

to to to

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

US$ 000's US$ 000's US$ 000's

Cash flows from operating activities

Loss for the period (457) (351) (98)

Tax charge - - (67)

Net finance income (142) (111) (246)

(Gain)/loss on disposal of fixed

assets - (9) (9)

Share-based payment non-cash charges 116 (206) 186

Impact of foreign exchange movement 25 28 (6)

Depreciation and Amortisation charges 1,934 1,200 2,691

1,476 551 2,451

Tax paid - - -

(Increase)/decrease in inventory (787) (687) (1,210)

Decrease/(increase) in trade and

other receivables 5 (872) (14)

(Decrease)/increase in trade and

other payables (720) (459) (197)

Net cash from operating activities (26) (1,467) 1,030

------------------------------------------ -------------- -------------- ----------

Investing activities

Purchase of tangible fixed assets (127) (203) (213)

Increase in rental fleet assets (743) (1,903) (3,754)

Disposal proceeds of tangible fixed

assets - 9 9

Purchase of intangible fixed assets (693) (495) (1,286)

Interest received 142 111 246

------------------------------------------ -------------- -------------- ----------

Net cash from investing activities (1,421) (2,481) (4,998)

------------------------------------------ -------------- -------------- ----------

Financing activities

Share issue 204 323 391

------------------------------------------ -------------- -------------- ----------

Net cash from financing activities 203 323 391

------------------------------------------ -------------- -------------- ----------

Increase/(decrease) in cash and cash

equivalents (1,243) (3,625) (3,577)

Non-cash movements - foreign exchange (25) (28) 6

Cash and cash equivalents at beginning

of period 11,930 15,501 15,501

Cash and cash equivalents at end

of period 10,662 11,848 11,930

------------------------------------------ -------------- -------------- ----------

ENTEQ UPSTREAM PLC

NOTES TO THE FINANCIAL STATEMENTS

For the six months to 30 September 2019

1. Reporting entity

Enteq Upstream plc ("the Company") is a public limited company

incorporated and domiciled in England and Wales (registration

number 07590845). The Company's registered address is The

Courtyard, High Street, Ascot, Berkshire, SL5 7HP.

The Company's ordinary shares are traded on the AIM market of

The London Stock Exchange.

Both the Company and its subsidiaries (together referred to as

the "Group") are focused on the provision of specialist products

and technologies to the upstream oil and gas services market.

2. General information and basis of preparation

The information for the period ended 30 September 2019 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for the period

ended 31 March 2019 has been delivered to the Registrar of

Companies. The auditors reported on those accounts: their report

was unqualified, did not draw attention to any matters by way of

emphasis and did not contain a statement under section 498(2) or

(3) of the Companies Act 2006.

The annual financial statements of the Group are prepared in

accordance with IFRS as adopted by the European Union. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with International

Accounting Standard 34 'Interim Financial Reporting', as adopted by

the European Union.

The Group's consolidated interim financial statements are

presented in US Dollars (US$), which is also the functional

currency of the parent company. These condensed consolidated

interim financial statements (the interim financial statements)

have been approved for issue by the Board of directors on 13

November 2019.

This half-yearly financial report has not been audited, and has

not been formally reviewed by auditors under the Auditing Practices

Board guidance in ISRE 2410.

3. Accounting policies

The interim financial statements have been prepared on the basis

of the accounting policies and methods of computation applicable

for the period ended 31 March 2019. These accounting policies are

consistent with those applied in the preparation of the accounts

for the period ended 31 March 2019.

4. Estimates

When preparing the interim financial statements, management

undertakes a number of judgements, estimates and assumptions about

recognition and measurement of assets, liabilities, income and

expenses. The actual results may differ from the judgements,

estimates and assumptions made by management, and will seldom equal

the estimated results. The judgements, estimates and assumptions

applied in the interim financial statements, including the key

sources of estimation uncertainty were the same as those applied in

the Group's last annual financial statements for the year ended 31

March 2019.

5. Adjusted earnings and adjusted EBITDA

The following analysis illustrates the performance of the

Group's activities, and reconciles the Group's loss, as shown in

the condensed consolidated interim income statement, to adjusted

earnings. Adjusted earnings are presented to provide a better

indication of overall financial performance and to reflect how the

business is managed and measured on a day-today basis. Adjusted

earnings before interest, taxation, depreciation and amortisation

("adjusted EBITDA") is also presented as it is a key performance

indicator used by management.

Six months Six months

to 30 September to 30 September Year to

2019 2018 31 March

2019

US$ 000's US$ 000's US$ 000's

Unaudited Unaudited Audited

Loss attributable to ordinary

shareholders (457) (351) (98)

Exceptional items 2 2 7

Amortisation of acquired intangible

assets 147 60 116

Foreign exchange movements 25 28 (6)

----------------- ----------------- -----------

Adjusted earnings (283) (261) 19

Depreciation charge 1,787 1,141 2,575

Finance income (142) (111) (246)

PSP charge 114 (163) 173

Tax charge - - (67)

Adjusted EBITDA 1,476 606 2,454

================= ================= ===========

6. Segmental Reporting

For management purposes, the Group is currently organised into a

single business unit, the Drilling Division, which is based,

operationally, solely in the USA.

The principal activities of the Drilling Division are the

design, manufacture and selling of specialised products and

technologies for Directional Drilling and Measurement While

Drilling operations used in the energy exploration and services

sector of the oil and gas industry.

At present, there is only one operating segment and the

information presented to the Board is consistent with the

consolidated income statement and the consolidated statement of

financial position.

The net assets of the Group by geographic location

(post-consolidation adjustments) are as follows:

Net Assets 30 September 30 September

2019 2018 31 March

2019

US$ 000's US$ 000's US$ 000's

Unaudited Unaudited Audited

Europe (UK) 10,689 14,086 10,315

United States 13,222 9,249 13,733

------------- ------------- -----------

Total Net Assets 23,911 23,335 24,048

============= ============= ===========

The net assets in Europe (UK) are represented, primarily, by

cash balances denominated in US$.

7. Earnings Per Share

Basic earnings per share

Basic earnings per share is calculated by dividing the loss

attributable to ordinary shareholders for the six months of

US$457,400 (September 2018: loss of US$350,900) by the weighted

average number of ordinary shares in issue during the period of

65,488,000 (September 2018: 63,705,000).

Adjusted earnings per share

Adjusted earnings per share is calculated by dividing the

adjusted earnings loss for the six months of US$283,400 (September

2018: loss of US$261,200), by the weighted average number of

ordinary shares in issue during the period of 65,488,000 (September

2018: 63,705,000).

The adjusted diluted earnings per share information are

considered to provide a fairer representation of the Group's

trading performance.

A reconciliation between basic earnings and adjusted earnings is

shown in Note 5.

As the Group is loss making, any potential ordinary shares have

the effect of being anti-dilutive. Therefore, the diluted EPS is

the same as the basic EPS. As the share price, as at 30 September

2019, was below the weighted average option price of all the

options issued, the adjusted diluted EPS the same as adjusted

EPS.

8. Income Tax

No tax liability arose on ordinary activities for the six months

under review.

9. Intangible Fixed Assets

a) Goodwill

US$ 000's

Cost:

As at 30 September 2019 and

1 April 2019 19,619

----------

Impairment:

As at 30 September 2019 and

1 April 2019 (19,619)

----------

Net Book Value:

----------

As at 30 September 2019 and -

1 April 2019

----------

9. Intangible Fixed Assets (cont.)

b) Other Intangible Fixed Assets

Developed IPR&D technology Brand Customer Non- compete

technology names relationships agreements Total

US$ 000's US$ 000's US$ US$ 000's US$ 000's US$ 000's

000's

Cost:

As at 1 April

2019 12,823 9,305 1,240 20,586 5,931 49,885

Transfers 153 (153) - - - -

Capitalised in

period - 693 - - - 693

As at 30 September

2019 12,976 9,845 1,240 20,586 5,931 50,578

------------ ----------------- ------- --------------- ------------- ----------

Amortisation:

As at 1 April

2019 12,626 7,108 1,240 20,586 5,931 47,491

Charge for the

period 147 - - - - 147

As at 30 September

2019 12,773 7,108 1,240 20,586 5,931 47,638

------------ ----------------- ------- --------------- ------------- ----------

Net Book Value:

------------ ----------------- ------- --------------- ------------- ----------

As at 1 April

2019 197 2,197 - - - 2,394

============ ================= ======= =============== ============= ==========

As at 30 September

2019 203 2,737 - - - 2,940

============ ================= ======= =============== ============= ==========

The main categories of Intangible Fixed Assets are as

follows:

Developed technology:

This is technology which is currently commercialised and

embedded within the current product offering.

IPR&D technology:

This is technology which is in the final stages of field

testing, has demonstrable commercial value and is expected to be

launched within the next 12 months.

Brand names:

The value associated with the XXT trading name used within the

Group.

Customer relationships:

The value associated with the on-going trading relationships

with the key customers acquired.

Non-compete agreements:

The value associated with the agreements signed by the Vendors

of the acquired businesses not to compete in the markets of the

businesses acquired.

10. Share capital

Share capital as at 30 September 2019 amounted to US$1,028,000

(31 March 2019: US$1,005,000 and 30 September 2018:

US$1,003,000).

11. Going concern

The Directors have carried out a review of the Group's financial

position and cash flow forecasts for the next 12 months by way of a

review of whether the Group satisfies the going concern tests.

These have been based on a comprehensive review of revenue,

expenditure and cash flows, taking into account specific business

risks and the current economic environment. With regards to the

Group's financial position, it had cash and cash equivalents at 30

September 2019 of US$10.7m.

Having taken the above into consideration the Directors have

reached a conclusion that the Group is well placed to manage its

business risks in the current economic environment. Accordingly,

they continue to adopt the going concern basis in preparing the

Interim Condensed Financial Statements.

12. Principal risks and uncertainties

Further detail concerning the principal risks affecting the

business activities of the Group is detailed on pages 10 and 11 of

the Annual Report and Accounts for the year ended 31 March 2019.

Consideration has been given to whether there have been any changes

to the risks and uncertainties previously reported. None have been

identified.

13. Events after the balance sheet date

There have been no material events subsequent to the end of the

interim reporting period ended 30 September 2019.

14. Copies of the interim results

Copies of the interim results can be obtained from the Group's

registered office at The Courtyard, High Street, Ascot, Berkshire,

SL5 7HP and are available from the Group's website at

www.enteq.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FFAFMDFUSEIF

(END) Dow Jones Newswires

November 14, 2019 02:00 ET (07:00 GMT)

Enteq Technologies (AQSE:NTQ.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

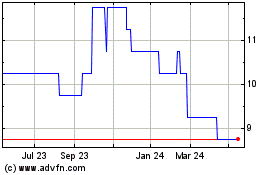

Enteq Technologies (AQSE:NTQ.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024