TIDMMHC

RNS Number : 0385V

MyHealthChecked PLC

03 April 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

MyHealthChecked PLC

("MyHealthChecked" or the "Company")

Preliminary Results

Year Ended 31 December 2022

MyHealthChecked PLC (AIM: MHC), the consumer home-testing

healthcare company, announces its preliminary results for the year

ended 31 December 2022, a successful year with strong revenue

growth and profitability achieved for the second consecutive year,

driven by significant demand from the top high street pharmacy

retailers for COVID Lateral Flow Tests ("LFTs").

MyHealthChecked remains focused on delivering high-quality

wellness testing solutions and guidance to meet the evolving needs

of our customers and help them navigate this new and exciting

space.

Financial highlights

-- Revenue up 36% to GBP22.3m (2021: GBP16.4m)

-- Gross Profit of GBP4.6m (2021: GBP5.1m)

-- Adjusted EBITDA of GBP2.3m (2021: GBP2.7m) - reflecting the change

in product mix away from higher margin PCR testing to the distribution

of LFTs

-- Net cash generated from operating activities of GBP1.6m (2021:

GBP3.0m)

-- Cash balance at year end of GBP7.6m (2021: GBP6.4m) - whilst continuing

to invest across the business for future growth

-- Strong cash position to ensure next growth phases remain self-funded

Commercial and operational highlights

-- Actively developing B2B2C customer relationships in preparation

to launch an expanded portfolio of at-home wellness tests nationwide

in 2023

-- Soft launch of initial DNA at-home wellness portfolio in July

2022

-- Reinvestment of earnings into developing new products for pipeline

of at-home wellness tests and building scalable, digital healthcare-centric

technology

-- Capabilities strengthened by establishing key relationships

with high-quality laboratory and kit-build partners

-- Working towards ISO 27001 and migration of digital Quality Management

System ('QMS') to support key compliance activity including

transition to the requirements of the In Vitro Diagnostics Regulation

("IVDR").

The full Group Annual Report and Financial Statements will be

posted to shareholders today, together wth the notice of the AGM,

and will also be available shortly at

www.investors.myhealthcheckedplc.com .

Penny McCormick, Chief Executive Officer of MyHealthChecked PLC,

said : " MHC has not only established itself as a player in the

wellness industry but has also achieved excellent financial results

in the last two years. Our commitment to innovation, customer

satisfaction, and financial stability and management has set us on

a path to delivering our goal of sustained liquidity. As we enter

an investment phase, we are confident in our ability to execute our

plans and scale our operations to meet the demand of our growing

customer base. With a robust balance sheet and a team of highly

skilled professionals, we are well-positioned to deliver a solid

business in 2023 and beyond. The upcoming launch of new tests and

further development of our digital platform presents a strong

opportunity to create value for our shareholders and solidify our

position as a leading wellness company."

Investor Presentation

Penny McCormick, Chief Executive Officer and Nicholas Edwards,

Chief Financial Officer, will provide a live presentation relating

to the preliminary results via the Investor Meet Company platform

today (Monday 3 April 2023) at 4:30pm BST. The presentation is open

to all existing and potential shareholders.

Investors can sign up to Investor Meet Company for free and

register for the presentation via the link below:

https://www.investormeetcompany.com/myhealthchecked-plc/register-investor

MyHealthChecked PLC www.myhealthcheckedplc.com

P enny McCormick , Chief Executive via Walbrook PR

Officer

Nicholas Edwards, Chief Financial

Officer

SPARK Advisory Partners Limited Tel: +44 (0)20 3368 3550

(NOMAD)

Neil Baldwin

Dowgate Capital Limited (Broker) Tel: +44 (0)20 3903 7715

David Poutney / Nicholas Chambers

Walbrook PR Ltd (Media Tel: +44 (0)20 7933 8780 or myhealthcheckedplc@walbrookpr.com

& IR)

Paul McManus / Alice Woodings Mob: +44 (0)7980 541 893 / +44 (0)7407

804 654

About MyHealthChecked PLC ( www.myhealthcheckedplc.com )

MyHealthChecked PLC, based in Cardiff, is an AIM-quoted

pioneering UK healthcare company focused on a range of at-home

healthcare and wellness tests.

MyHealthChecked is the umbrella brand of a range of at-home

rapid tests, as well as DNA, RNA and blood sample collection kits

which have been created to support customers on their journeys to

wellness. The tests are lateral-flow self-tests, and the sample

collection kits enable the collection of blood, urine, nasal or

mouth swab samples that are analysed in partner laboratories for a

range of biomarkers. The tests will also be made available online

and will be viable for over-the-counter purchase.

The MyHealthChecked portfolio has been identified as part of a

change in mindset as customers become more familiar with the

concept of accessible healthcare in the growing at home testing kit

market with a focus on accessibility at the right price, led by

UK-based experts.

JOINT CHAIRMAN AND CHIEF EXECUTIVE'S REPORT

MyHealthChecked has had a successful year in 2022, with strong

revenue growth and profitability achieved for the second

consecutive year. We surpassed management expectations with our

financial performance, maintaining a reliable track record of

delivery for our valued retail customers and partners.

Despite the unpredictable demand for our services throughout the

challenging COVID period, we were able to deliver and meet the high

demands of our customers in terms of volume. Our revenue increased

by GBP5.9m (36%) to GBP22.3m, and this growth has enabled us to

achieve our ultimate goal of a second year of positive cash flow.

We ended the year with a cash balance of GBP7.6m (2021: GBP6.4m),

providing us with substantial working capital to drive the business

forward in 2023 and beyond.

It's a very exciting time for consumer healthcare and

specifically testing, and in our many years in the consumer

healthcare and testing space, we have never felt so energised

around the potential for consumer self-testing. We are excited

about how this can positively impact the lives of millions as we

embrace preventative methods of care, can make a major difference

to individuals' lives, and ultimately release the pressure on much

strained healthcare services. Never before has there been so much

information and guidance available for us to make informed

decisions on how we reduce our future risks.

As we navigate this dynamic period of behavioural change, MHC

remains focused on delivering high-quality wellness testing

solutions and guidance to meet the evolving needs of our customers

and help them navigate this new and exciting space.

COVID-19 testing

COVID has been a major catalyst for this change in customer

behaviour, and in the past two years we have seen the market

dominated by COVID testing. This familiarisation of both

self-testing and laboratory testing has given customers confidence

and normalised testing outside of a medical setting.

Throughout 2021 and 2022, COVID testing has been a major part of

our business, with over 17 million tests delivered to the market

this past year.

However, as a result in the shift in product mix from higher

margin Polymerase Chain Reaction ("PCR") testing to lateral flow

tests ("LFTs") during the current year, we have seen gross margins

in our COVID portfolio reducing. However, post period we are

launching a new testing portfolio to counter this trend, whilst we

continue to deliver value to our customers.

Retail launches

We are actively developing B2B2C customer relationships and are

preparing to launch an expanded portfolio of at-home wellness tests

nationwide. Since the soft-launch of our initial DNA portfolio in

July of last year we have remained focused on developing our

wellness portfolio and supporting our retail customers in expanding

their own commercial strategies to meet their customers' needs for

at-home testing.

Market reports indicate significant growth potential for the

home testing market, with projections indicating the market will

reach $45.58 billion by 2031 (source : Allied Market Research Nov

2022, At-Home Testing Market Research 2031, Author(s) : Vikita T,

Shubham S , Onkar S).

In order to play a major role in this market, we have

prioritised building strong relationships with our retail partners,

with the goal of reaching as many end users as possible. Beyond our

retail partner launches we plan to expand our core target base,

while keeping a close eye on market trends to ensure an optimal

user journey, and positioning ourselves as cost-effective and

understanding of the current economic climate.

Product portfolio

Amid the challenges of the COVID era, we positioned ourselves as

a leading provider of products and services to meet the demand for

testing - and we succeeded. Our unique multi-platform portfolio of

tests offers users access to a variety of test types, sample

collection options, and levels of analysis, enabling us to meet

diverse customer needs. Whether a customer requires an initial

screener, a lab analysis, or a DNA assessment, our tests provide

reliable results and guidance that empower our customers to make

positive changes to their nutrition and lifestyle.

But we don't stop there in our mission to improve our customers'

health in the longer term. Our tests are not just end-products, but

tools that open up a dialogue with the customer and facilitate the

building of a long-term relationship based on guidance, support,

and monitoring. We don't simply provide test results; through our

evolving digital platform we are providing a supportive

relationship and guidance to ensure our customers achieve their

wellness goals.

As a result of our careful cash control, we have entered another

new financial year in a position of strength. We are reinvesting

our earnings into developing new products for our pipeline of

at-home wellness tests and building scalable, digital

healthcare-centric technology. We remain committed to delivering

innovative solutions that meet the evolving needs of our customers

and the broader healthcare industry.

Developing talent within our team

Our new and dynamic management team has been the driving force

in our past and future success. The team's determined "can-do"

mindset, coupled with a customer-first approach and an agile

streamlined delivery methodology is our greatest asset.

In 2022, we restructured our product development process and

grew our team to ensure efficient delivery of milestone sprints. We

also implemented a constant feedback loop, where our customers and

triallists provided input into each iteration of our products

before launch.

As we move forward, we are further strengthening the MHC team

with new resources in product and digital development operations,

and commercial. We have recently appointed a talented individual in

the newly created role of Operations Director and our primary focus

in 2023 is to grow our commercial team to further expand our B2B2C

customer base and drive greater success.

Operations

Despite making the decision to close down our own laboratory

operations due to the downturn in COVID PCR testing in H1 of 2022,

our lean distribution channel has continued to underpin our success

this past year. Our rapid responses to changing customer and market

needs has seen us bring our distribution centre in-house near to

our Cardiff headquarters, and we continue to strengthen our highly

effective operational set-up.

In 2022, we further strengthened our position as a gold-standard

partner by establishing key relationships with high-quality

laboratory and kit-build partners, as well as digital partners.

These proactive and compliant suppliers have further strengthened

our capabilities and added to our credentials.

Compliance

Our regulatory team is fully committed to meet the new

requirements of the In Vitro Diagnostic Regulation ("IVDR") which

affects our products in the UK. We have a robust network of

experienced regulatory partners to support us through the

transitional provisions of the IVDR and we have commenced a

transition to a digital Quality Management System to support us

during this transition.

We have also submitted an application to the Healthcare

Inspectorate Wales ("HIW") which will enable us to offer

doctor-verified testing, and to provide remote phlebotomy services

in the future, whilst safeguarding our customers in line with our

commitments to best practice under HIW.

Investment in future technology

The cash generated from COVID testing has not only allowed us to

define an investment plan around future growth opportunities, it

has also put us in a position of strength where we can achieve our

current plans for the business without the need for additional

working capital. This is a crucial advantage that will allow us to

move forward with confidence. As we worked to expand our testing

portfolio in 2023, we also committed to investing in our digital

platform, the plan for which is to unlock further growth

potential.

Current Trading

While we anticipate a reduction in the demand for COVID tests as

the general public learns how to respond to living with the virus,

we expect that testing will remain an essential part of our

business into 2023 and beyond. We have seen steady sales in 2023,

and as the year progresses, we will establish a new trendline and

will be ready to respond to spikes in demand.

Regarding our new multi-platform range of tests, 2023 will see

us moving beyond our initial soft launch to deliver a national

rollout. W e are confident that the investments that we make in our

portfolio and service will deliver growing revenues in the future

and a digital infrastructure upon which we can build and grow, and

we are energised by the many opportunities ahead.

Summary

MHC has not only established itself as a player in the wellness

industry but has also achieved excellent financial results in the

last two years. Our commitment to innovation, customer

satisfaction, and financial stability and management has set us on

a path to delivering our goal of sustained liquidity. As we enter

an investment phase, we are confident in our ability to execute our

plans and scale our operations to meet the demand of our growing

customer base. With a robust balance sheet and a team of highly

skilled professionals, we are well-positioned to deliver a solid

business in 2023 and beyond. The upcoming launch of new tests and

further development of our digital platform presents a strong

opportunity to create value for our shareholders and solidify our

position as a leading wellness company.

Adam Reynolds Penny McCormick

Chairman Chief Executive Officer

FINANCIAL REVIEW

Income statement

Revenue for the year increased by 36% to GBP22.3m (2021: 16.4m)

due to the significant demand from the top high street pharmacy

retailers for COVID Lateral Flow Tests ("LTFs"). Gross margins

reduced from 31% to 21% reflecting the change in product mix from

the processing of higher margin COVID PCR testing ("PCR") to the

distribution of LFTs in a highly competitive market. In addition,

capitalised costs amounting to GBP328,000 associated with the

development of COVID user interface on the digital platform, were

fully impaired during the current year through cost of sales.

Sales and marketing costs have increased from GBP699,000 to

GBP798,000 due to the increased investment in marketing activities

associated with the new and planned product launches.

Total administrative expenses were broadly comparable to the

prior year at GBP2,343,000 (2021: GBP2,386,000). Excluding the

impairment of intangible assets, share based payments and the

laboratory closure costs other administrative expenses increased to

GBP2,087,000 (2021: GBP1,860,000) largely due to the significant

investment in the development of the digital platform in readiness

for the launch of the new product offerings in 2023. Research and

development costs expensed to administrative expenses in 2022

amounted to GBP546,000 (2021: GBP175,000). As part of our focus on

tight cost control the decision was also taken to close the

Manchester laboratory at a total cost of approximately GBP226,000

as the facility was no longer operating cost effectively following

the drop in demand for PCR "Fit to Fly" tests. The impairment

charge of GBP50,000 in administration expenses relates to patents

and other costs associated with the MYLO/myLotus products

previously capitalised.

The Group's operating profit amounted to GBP1,506,000 (2021:

GBP2,046,000) and, after the release of the provision for

contingent consideration of GBP1m, the impairment of the associated

goodwill of GBP987,000 and net interest payable of GBP2,000 (2021:

GBP2,000) the Group's profit before and after taxation was

GBP1,517,000 (2021: GBP2,004,000) giving a basic earnings per share

of 0.20p (2021: 0.28p) and fully diluted earnings per share of

0.19p (2021: 0.27p).

Adjusted EBITDA is calculated as follows:

2022 2021

GBP'000 GBP'000

----------------------------------------- -------- --------

Operating profit 1,506 2,046

Depreciation and amortisation 222 157

Impairment of intangible assets 378 414

Share based payments (20) 112

Laboratory closure costs (excluding the 171 -

loss on disposal of equipment)

Adjusted EBITDA 2,257 2,729

----------------------------------------- -------- --------

Financial position

The Group's net assets at 31 December 2022 amounted to

GBP8,850,000 (2021: GBP7,113,000). This comprised total assets of

GBP11,428,000 (2021: GBP11,668,000) and total liabilities of

GBP2,578,000 (2021: GBP4,555,000). The total assets included

property, plant and equipment (including right-of-use assets) of

GBP150,000 (2021: GBP163,000) and intangible assets, being

development costs in respect of the digital platform and website,

know-how, goodwill and patent costs, of GBP1,098,000 (2021:

GBP2,289,000). As noted above an impairment provision was made

against the goodwill arising on the acquisition of Nell Health

Limited which was acquired last year.

Cashflow

The Group's cash balance at the year-end was GBP7,608,000 (2021:

GBP6,387,000). The net inflow from operating activities amounted to

GBP1,606,000 (2021: GBP3,014,000), whilst the cash outflows from

investing activities amounted to GBP338,000 (2021: GBP299,000) and

GBP47,000 (2021: GBP3,206,000 inflow) was spent on financing

activities.

Capital management

The Board's objective is to maintain a balance sheet that is

both efficient and delivers long term shareholder value. The Board

continues to monitor the balance sheet to ensure it has an adequate

capital structure.

Key Performance Indicators ("KPIs")

The Board recognises the importance of both financial and

non-financial KPIs in driving appropriate behaviours and enabling

the monitoring of Group performance.

The key financial KPIs monitored by the Board are revenue, gross

margin and EBITDA which are discussed under the review of the

Income Statement above. In addition, the Board also reviews cash

and working capital balances on a monthly basis.

With regard to non-financial KPIs, the Board monitors its

relationship with key customers and suppliers, the motivation and

retention of employees and progress against the planned development

of the digital platform and new product offerings.

Events after the reporting year

On 17 January 2023 the Court approved the reduction of the share

capital of the Company which involved the cancellation of all the

Deferred Shares, the Share Premium Account and the Capital

Redemption Reserve. The purpose of the Capital Reduction was to

create distributable reserves.

Nicholas Edwards

Chief Financial Officer

FINANCIAL STATEMENTS

The notes to the Financial Statement are an integral part of

these financial statements and will be available in full in the

Group Annual Report and Financial Statements which will be

available on the Company website later today.

www.investors.myhealthcheckedplc.com

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For The Year Ended 31 December 2022

2022 2021

GBP'000 GBP'000

------------------------------------ --------- ---------

Revenue 22,314 16,376

Cost of sales (17,667) (11,245)

-------------------------------------

Gross profit 4,647 5,131

Sales and marketing costs (798) (699)

Other administrative expenses (2,087) (1,860)

Closure of laboratory (226) -

Impairment of intangible assets (50) (414)

Share based payments 20 (112)

------------------------------------- --------- ---------

Administration expenses (2,343) (2,386)

------------------------------------- --------- ---------

Operating profit 1,506 2,046

Finance costs (5) (2)

Finance income 3 -

Contingent consideration no

longer payable on the acquisition

of Nell Health Limited 1,000 -

Impairment of goodwill arising

on acquisition of Nell Health

Limited (987) -

Additional consideration payable

on the

acquisition of The Genome Store

Limited - (40)

------------------------------------- --------- ---------

Profit before income tax 1,517 2,004

Tax charge - -

------------------------------------- --------- ---------

Profit for the year 1,517 2,004

Other comprehensive income - -

------------------------------------- --------- ---------

Total comprehensive profit

for the year 1,517 2,004

------------------------------------- --------- ---------

Attributable to owners of

the parent: 1,517 2,004

Earnings per ordinary share

- basic 0.20p 0.28p

Fully diluted earnings per

ordinary share 0.19p 0.27p

All activities relate to continuing operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As At 31 December 2022

2022 2021

GBP'000 `GBP'000

------------------------------- --------- ---------

Non-current assets

Property, plant and equipment 75 163

Right of use assets 75 -

Intangible assets 1,098 2,289

Total non-current assets 1,248 2,452

-------------------------------- --------- ---------

Current assets

Inventories 1,284 497

Trade and other receivables 1,288 2,332

Cash and cash equivalents 7,608 6,387

-------------------------------- --------- ---------

Total current assets 10,180 9,216

-------------------------------- --------- ---------

Total assets 11,428 11,668

-------------------------------- --------- ---------

Current liabilities

Trade and other payables 2,525 3,315

Lease liabilities 29 -

Deferred consideration - 1,240

Total current liabilities 2,554 4,555

-------------------------------- --------- ---------

Non-current liabilities

Lease liabilities 24 -

-------------------------------- --------- ---------

Total non-current liabilities 24 -

-------------------------------- --------- ---------

Total liabilities 2,578 4,555

-------------------------------- --------- ---------

Net assets 8,850 7,113

-------------------------------- --------- ---------

Share capital 780 756

Deferred shares 6,359 6,359

Share premium account 16,887 16,671

Capital redemption reserve 1,815 1,815

Reverse acquisition reserve (6,044) (6,044)

Retained earnings (10,947) (12,444)

-------------------------------- --------- ---------

Total equity 8,850 7,113

-------------------------------- --------- ---------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share-based Capital Reverse

Share Deferred Share payment redemption acquisition Retained

capital shares Premium reserve reserve reserve earnings Total

GBP '000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- --------- ---------- ---------- ------------ ------------- ------------- ----------- --------

Equity as

at

1 January

2021 518 6,359 12,442 916 1,815 (6,044) (15,476) 530

Profit for

the year - - - - - - 2,004 2,004

---------------- --------- ---------- ---------- ------------ ------------- ------------- ----------- --------

Total

comprehensive

profit - - - - - - 2,004 2,004

Transfer from

share based

payment

reserve - - - (916) - - 916 -

Issue of shares

net of

expenses 194 - 2,979 - - - - 3,173

Conversion

of loan note

and interest 13 92 - - - - 105

Exercise of

options 2 - 18 - - - - 20

Other share

issue 1 16 - - - - 17

Share-based

payments - - - - - - 112 112

Acquisition

of Nell Health

Limited 28 1,124 - - - - 1,152

---------------- --------- ---------- ---------- ------------ ------------- ------------- ----------- --------

Equity as

at

31 December

2021 756 6,359 16,671 - 1,815 (6,044) (12,444) 7,113

Profit for

the year - - - - - - 1,517 1,517

---------------- --------- ---------- ---------- ------------ ------------- ------------- ----------- --------

Total

comprehensive

profit - - - - - - 1,517 1,517

Share-based

payments - - - - - - (20) (20)

The Genome

Store Limited

deferred

consideration 24 - 216 - - - - 240

Equity as

at

31 December

2022 780 6,359 16,887 - 1,815 (6,044) (10,947) 8,850

---------------- --------- ---------- ---------- ------------ ------------- ------------- ----------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

For The Year Ended 31 December 2022

2022 2021

GBP'000 GBP'000

------------------------------------------ -------- --------

Cash flows from operating activities

Profit before taxation 1,517 2,004

Adjustments for:

Deferred consideration (1,000) 40

Decrease in provisions - (26)

Depreciation and amortization 222 157

Impairment of intangible assets 1,365 414

Loss on sale of laboratory assets 55 -

Finance expenses 5 2

Finance income (3) -

Share-based payments (20) 112

Adjusted operating profit before

changes in working capital 2,141 2,703

Changes in working capital

Increase in inventory (787) (494)

Decrease/(Increase) in trade and

other receivables 1,044 (2,124)

(Decrease)/Increase in trade and

other payables (790) 2,931

Cash generated in operations 1,608 3,016

Net interest payable (2) (2)

------------------------------------------ -------- --------

Net cash inflow from operating

activities 1,606 3,014

------------------------------------------ -------- --------

Investing activities

Acquisition of Nell Health Limited - (50)

Purchase of property, plant and

equipment (22) (147)

Purchase of intangible assets (316) (102)

Net cash flows used in investing

activities (338) (299)

------------------------------------------ -------- --------

Financing activities

Issue of ordinary shares (net of

issue expenses) - 3,211

Repayment of lease liability (47) (5)

Net cash flows from financing activities (47) 3,206

------------------------------------------ -------- --------

Net change in cash and cash equivalents 1,221 5,921

Cash and cash equivalents at the

beginning of the year 6,387 466

------------------------------------------ -------- --------

Cash and cash equivalents at the

end of the year 7,608 6,387

------------------------------------------ -------- --------

NOTES TO THE FINANCIAL STATEMENTS

The notes to the Financial Statement are available in full in

the Group Annual Report and Financial Statements which will be

available shortly on the Company website:

www.myhealthcheckedplc.com

Basis of preparation

The financial statements have been prepared in accordance with

UK adopted international accounting standards (IFRS), and with

those parts of the Companies Act 2006 applicable to companies

reporting under IFRS

Earnings per share

2022 2021

Basic and diluted

Profit for the year and earnings used in basic & diluted EPS GBP1,517,000 GBP2,004,000

Weighted average number of shares - basic 774,303,000 710,852,000

Weighted average number of shares - fully diluted 778,223,000 744,056,000

Earnings per share 0.20p 0.28p

Fully diluted earnings per share 0.19p 0.27p

-------------------------------------------------------------- ------------- -------------

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year.

Events after the reporting date

On 17 January 2023 the Court approved the reduction of the share

capital of the Company, involving the cancellation of all the

Deferred Shares, the Share Premium Account and the Capital

Redemption Reserve. The purpose of the Capital Reduction was to

create distributable reserves.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UPUAWCUPWGPG

(END) Dow Jones Newswires

April 03, 2023 02:00 ET (06:00 GMT)

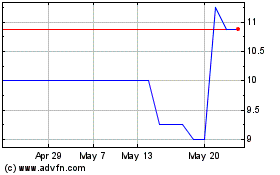

MyHealthChecked (AQSE:MHC.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

MyHealthChecked (AQSE:MHC.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024