TIDMJHD

RNS Number : 1112I

James Halstead PLC

31 March 2020

31 March 2020

JAMES HALSTEAD PLC

INTERIM RESULTS FOR THE HALF-YEARED 31 DECEMBER 2019

Key Figures

James Halstead plc, the AIM listed manufacturer and

international distributor of commercial floor coverings,

reports:

* Revenue at GBP130.4 million (2018: GBP125.8 million)

- up 3.7%

* Operating profit at GBP25.3 million (2018: GBP24.5

million) - up 3.0%

* Pre-tax profit at GBP25.2 million (2018: GBP24.5

million) - up 2.8%

* Basic earnings per ordinary share 9.5p (2018: 9.1p) -

up 4.4%

* 1(st) Interim dividend proposed of 2.125p

* Cash at GBP64.3 million

The Chief Executive, Mr. Mark Halstead, commented:

"In the first half, we have supplied flooring to installations

as diverse as the Folies Bergère in Paris and to the Pooch Perfect

TV set for Network Seven in Australia and, with profits growth and

robust cash balances, it was a satisfying performance.

However, the world has changed since the turn of the year and we

are focused on the security of our businesses and the immediate

challenges of the Coronavirus (COVID- 19). The focus of our

business has moved to our expertise in healthcare as the immediate

need in many of our markets for flooring is in this sector."

Enquiries:

James Halstead 0161 767 2500

Mark Halstead, Chief Executive

Gordon Oliver, Finance Director

Hudson Sandler 020 7796 4133

Nick Lyon

Nick Moore

Panmure Gordon (Nomad and Joint

Broker) 020 7886 2500

Dominic Morley

Arden Partners (Joint Broker)

Richard Johnson 020 7614 5900

CHAIRMAN'S STATEMENT

Trading for the six months ended 31 December 2019

Our turnover of GBP130.4 million (2018: GBP125.8 million) shows

growth of 3.7% and is a record level for the first half. Profit

before tax of GBP25.2 million (2018: GBP24.5 million) is 2.8% ahead

of the comparative period and is another record. Our cash inflows

from operations in the period are GBP28.4 million. The business has

performed well given the fragile state of many markets.

In the UK our sales are 7% ahead of the prior year comparative

and are testament to the efforts of our sales and distribution

teams in servicing the market.

James Halstead France continues to grow, by some 6% in the first

six months. The greater Paris region was affected by strikes but

our investment in additional sales staff across the country is

showing success. One project of note was the new intensive care

facility at the Centre Hospitalier Intercommunal de Poissy.

Objectflor, based in Germany and serving Central Europe,

reported sales growth of some 2.3% though encountered margin

erosion as a result of exchange rates. The Netherlands has had a

difficult few months with the restrictions on construction as a

result of their government's actions to tackle nitrogen emissions.

In October, Objectflor launched "Expona Simplay" carpet tiles which

complement our ranges of loose lay vinyl and are selling very well.

Our new in-house showroom / exhibition centre - "Campus" had 2,500

visitors up until the end of December. The Campus is also a

training facility and in December we introduced a new event, a

trade fair, named "Weilhnacht Campus" where around twenty flooring

related companies shared the costs and presented our flooring

comprehensively with industry leading accessories, adhesives and

design ideas. Projects supplied by Objectflor in the period include

three hospitals - Klinikum Darmstadt, Kilnikum Eisenberg and

Charité Berlin.

In looking at the regions of Polyflor Pacific, sales are

generally positive though mainland China was down by around 8%

which we ascribe to project delays. New Zealand has seen sales

growth of 12% and Australia, mainly affected by the various widely

reported climate issues, reported a 6% decline.

North America has been very positive with over 22% growth in the

six months in comparison to the prior year. Within this, Canada

continues to grow and our team there have supported US growth with

attendance at major exhibitions.

As mentioned at the time of our preliminary results last

October, throughout July and August one of our three main

production lines in Whitefield was idle following the failure of

part of the plant and the consequent damage to the line. Inevitably

this led to unrecovered overhead costs as we were unable to produce

for ten weeks as well as the increased cost of working once the

plant re-started in September and a required running of additional

hours in overtime to rebuild stock levels. This had a knock-on

effect on our ability to fulfil orders particularly in export

markets and, indeed, part of the decline in our Australian sales is

attributable to this break-down. These problems are now behind us

and it is testimony to our robustness that record turnover and

record profits have still been attained.

Earnings per Share and Dividend

Our basic earnings per share at 9.5p are above the comparative

period of 9.1p by 4.4%.

Our cash, which stands at GBP64.3 million, is a key strength and

in these difficult times with the world focused on the global

situation and COVID-19 we are conscious of this asset and the

importance of retaining it. As a Board, we are prudent and cautious

and have looked at our forecasts and discussed at length various

ongoing scenarios regarding the dividend.

We undoubtedly have the cash resource to declare an increased

interim dividend, and based on the position three weeks ago, with a

record first half and a robust balance sheet, with nil net gearing,

this would have been our position. As a Board we are proud of our

long history of increases in dividend. However, as a Board, we feel

given the level of uncertainty in the short-term this would signal

that we are not focused on the current and ongoing situation.

Equally, to forgo a dividend, given the interim payment would have

cost around 14% of the cash resources herein reported, might be

regarded as an overreaction. Our shareholder base includes several

income funds and many private individuals looking for both security

and the income. Approximately half our UK workforce and around 60%

of our former employees (who are now pensioners) are

shareholders.

Accordingly, and in consultation with advisors, we have decided

to declare a first interim dividend of 2.125p per share

representing half of the interim dividend we would otherwise have

declared and to review a payment of a second interim dividend in

August when visibility of the global economy may be clearer. As we

stand, the intention is that this first interim dividend will be

payable on 5 June 2020 to those shareholders on the register at the

close of business on 11 May 2020.

The Board in arriving at this decision has also, recently, paid

an amount broadly equivalent to 50% of this interim dividend into

the Group's defined benefit pension scheme and has contacted the

trustees to confirm that at this time the scheme should not be

liquidating scheme assets to fund benefits and that for the period

to 30 June 2020 the company will underpin any shortfall with

additional funds. In terms of cash this is unlikely to exceed the

level of 25% of this interim dividend and the underpin is capped at

that level.

As a Board we believe this is a measured response and would note

that the first two months trading of the second half have continued

positively in terms of cash flow.

COVID-19 and our current status

The Group as a whole is closely monitoring developments in

respect to the ongoing COVID-19 pandemic. Up until the 20(th) March

we had not experienced any meaningful disruption to our operations

although regionally there were restrictions on travel.

Since that time the UK, and other countries have instigated

various restrictions on travel and the closure of many businesses.

Inevitably office refurbishment, retailer business and leisure will

slow drastically in the coming weeks. None of our markets are

unaffected in terms of the general economic environment. However, a

major part of our business is in healthcare and over 70% of our

turnover is exported and we are receiving a large number of

enquiries from many of our markets.

Our Group has plans in place to mitigate adverse challenges we

face, and resources have been put in place to allow for remote

working for many office-based personnel. More importantly we have

rigorous procedures in our factories to protect our colleagues

including social distancing measures and use of sanitizers. In

addition we stopped all external visitors to site and segregated

delivery drivers from warehouse operatives. We have also insisted

on any employee with symptoms remaining at home, sent home any

worker with underlying conditions, closed vending machines,

conducted all meetings by conference call and limited staff to no

more than two people in any room at the same time.

Government measures to slow the growth of the virus disrupts a

significant part of our business, most noticeably in the UK but, as

noted earlier, around 70% of our sales are exported and other

markets are also affected. It is highly likely that our sales of

luxury vinyl tiles ("LVT") will slow rapidly to the extent that LVT

is installed in the retail and hospitality sectors. Refurbishment

is less affected, and it is clear than contractors are active in

this early phase but are winding-down. Equally, for a period of

time the sheet vinyl part of the business will grow given the

immediate need for expansion of temporary hospitals, assessment

centres, sterile changing areas and isolation wards. Our UK

production lines can fulfil some of this need and are producing

this flooring.

In several markets we have "key supplier" status and are a

preferred supplier to the UK's National Health Service, whilst

there are two other preferred suppliers who are based in France

where all manufacturing is currently closed. Despite being

competitors, we work closely with these two companies on trade

bodies and international standards and have sent our wishes for a

safe outcome. Given the "stay at home" message our employees and

their families have understandable concerns, and the stress and

worry associated with the current situation is an issue for

everyone. Having regard to this, and given the nearness of our

normal Easter shutdown, we will close the Radcliffe factory one

week earlier and extend the break to three weeks.

Our suppliers are in contact and raw material supplies continue,

with 60% of raw materials sourced in Europe and, to date, supply

and delivery are largely unaffected. The 3 week break will give us

more clarity on supply chains as government policy evolves.

I would like to thank those senior members of the various heath

bodies that have written to us with thanks for our ability to

supply rapidly for needed facilities, our local Members of

Parliament for taking time to understand our concerns about the

lack of clarity of going to work, to our workforce whose efforts

are appreciated and to our senior management team who are having to

react to unprecedented events.

Our cash resources are robust and stock levels remain solid

which should help to underpin the coming months and immediate

demand.

Outlook

The second half of the financial year started well with full

production in the UK, with sales and profit in the first three

months of the second half in line with expectations.

Looking at the coming months, it can be envisaged that sales to

retailer refurbishment will slow down, but our core business in

healthcare and institutional refurbishment is more robust. Indeed,

as I have noted, in the preceding section, there are increased

enquiries for flooring for medical facilities in several parts of

the globe and our stocks of sheet resilient flooring allow us to

respond quickly.

The balance of our business will likely continue to shift to

healthcare and given the fast pace of events we cannot be sure how

the market will react to the next few months. In the immediate

two-six weeks the focus in many markets will be on healthcare and,

with the extended Easter factory closure, we will focus on

distribution. Transportation of goods remains relatively normal. In

the UK even large distributors that have closed depots are making

arrangements to continue the supply of commercial flooring to

contractors, but there are localised issues of vehicles being

stopped as part of government monitoring of essential travel.

Overseas international freight rates are rising and the drastic

changes to lock-down in the world means there may be challenges in

delivery.

The immediate few weeks would seem to be busy in terms of demand

but daily changes must be faced. Looking further ahead, our balance

sheet strength, our depth of experience and focus on detail

encourage me to have confidence that we are well placed to

withstand prevailing pressures.

Anthony Wild

Chairman

31 March 2020

Consolidated Income Statement

for the half-year ended 31 December 2019

Half-year Half-year Year

ended ended ended

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Revenue 130,391 125,786 253,038

============ ============ ===========

Operating profit 25,258 24,528 48,374

Finance income 243 171 357

Finance cost (351) (223) (455)

Profit before income tax 25,150 24,476 48,276

Income tax expense (5,389) (5,474) (10,484)

Profit for the period 19,761 19,002 37,792

============ ============ ===========

Earnings per ordinary share of 5p:

-basic 9.5p 9.1p 18.2p

-diluted 9.5p 9.1p 18.2p

All amounts relate to continuing operations.

Details of dividends paid and declared/proposed are given in

note 4.

Consolidated Balance Sheet

as at 31 December 2019

Half-year Half-year Year

ended ended ended

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 37,759 36,870 37,449

Right of use assets 7,103 - -

Intangible assets 3,232 3,232 3,232

Deferred tax assets 3,179 3,267 3,261

---------- ---------- ----------

51,273 43,369 43,942

---------- ---------- ----------

Current assets

Inventories 67,180 63,664 69,921

Trade and other receivables 25,962 26,911 32,816

Derivative financial instruments 1,218 620 372

Cash and cash equivalents 64,332 62,795 68,664

---------- ---------- ----------

158,692 153,990 171,773

---------- ---------- ----------

Total assets 209,965 197,359 215,715

Current liabilities

Trade and other payables 50,643 48,930 58,354

Derivative financial instruments 290 428 684

Current income tax liabilities 740 4,624 3,419

Lease liabilities 2,774 - -

---------- ---------- ----------

54,447 53,982 62,457

---------- ---------- ----------

Non-current liabilities

Retirement benefit obligations 19,354 18,491 19,582

Other payables 400 475 419

Lease liabilities 4,480 - -

Preference shares 200 200 200

---------- ---------- ----------

24,434 19,166 20,201

---------- ---------- ----------

Total liabilities 78,881 73,148 82,658

---------- ---------- ----------

Net assets 131,084 124,211 133,057

========== ========== ==========

Equity

Equity share capital 10,407 10,404 10,407

Equity share capital (B shares) 160 160 160

---------- ---------- ----------

10,567 10,564 10,567

Share premium account 4,044 3,922 4,044

Capital redemption reserve 1,174 1,174 1,174

Currency translation reserve 4,338 5,680 5,265

Hedging reserve 225 (130) (21)

Retained earnings 110,736 103,001 112,028

Total equity attributable to shareholders of the parent 131,084 124,211 133,057

========== ========== ==========

Consolidated Cash Flow Statement

for the half-year ended 31 December 2019

Half-year Half-year Year

ended ended ended

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Profit for the period 19,761 19,002 37,792

Income tax expense 5,389 5,474 10,484

---------- ------------------ ----------

Profit before income tax 25,150 24,476 48,276

Finance cost 351 223 455

Finance income (243) (171) (357)

Operating profit 25,258 24,528 48,374

Depreciation of property, plant & equipment 1,650 1,558 3,105

Depreciation of right of use assets 1,487 - -

(Profit)/loss on sale of plant and equipment (6) 24 16

Decrease in inventories 1,044 7,713 1,449

Decrease/(increase)in trade and other receivables 5,685 5,469 (621)

(Decrease)/increase in trade and other payables (5,657) (598) 9,033

Defined benefit pension scheme service cost 318 287 564

Defined benefit pension scheme employer contributions paid (1,074) (643) (1,780)

Change in fair value of financial instruments (344) 89 281

Share based payments 7 5 11

Cash inflow from operations 28,368 38,432 60,432

Interest received 243 171 357

Interest paid (121) (13) (33)

Taxation paid (7,973) (4,581) (10,487)

Cash inflow from operating activities 20,517 34,009 50,269

---------- ------------------ ----------

Purchase of property, plant and equipment (2,479) (2,038) (4,263)

Proceeds from disposal of property, plant and equipment 32 34 107

---------- ------------------ ----------

Cash outflow from investing activities (2,447) (2,004) (4,156)

---------- ------------------ ----------

Lease payments (1,335) - -

Equity dividends paid (20,813) (20,080) (28,405)

Shares issued - 122 247

---------- ------------------ ----------

Cash outflow from financing activities (22,148) (19,958) (28,158)

---------- ------------------ ----------

Net (decrease)/increase in cash and cash equivalents (4,078) 12,047 17,955

---------- ------------------ ----------

Effect of exchange differences (254) 69 30

Cash and cash equivalents at start of period 68,664 50,679 50,679

Cash and cash equivalents at end of period 64,332 62,795 68,664

========== ================== ==========

Consolidated Statement of Comprehensive Income

for the half-year ended 31 December 2019

Half-year Half-year Year

ended ended ended

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Profit for the period 19,761 19,002 37,792

---------- ---------- ----------

Other comprehensive income net of tax:

Remeasurement of the net defined benefit liability (247) (3,102) (4,546)

Foreign currency translation differences (927) 245 (170)

Fair value movements on hedging instruments 246 (798) (689)

Other comprehensive income for the period net of tax (928) (3,655) (5,405)

Total comprehensive income for the period 18,833 15,347 32,387

========== ========== ==========

Attributable to equity holders of the parent

18,833 15,347 32,387

========== ========== ==========

Notes to the Interim Results

for the half-year ended 31 December 2019

1. Basis of preparation

The interim financial statements are unaudited and do not constitute statutory accounts as

defined within the Companies Act 2006.

The principal accounting policies applied in the preparation of the consolidated interim statements

are those set out in the annual report and accounts for the year ended 30 June 2019, except

for the adoption of IFRS16 Leases as explained in note 5.

The figures for the year ended 30 June 2019 are an abridged statement of the group audited

accounts for that year. The financial statements for the year ended 30 June 2019 were audited

and have been delivered to the Registrar of Companies.

As is permitted by the AIM rules, the directors have not adopted the requirements of IAS34

'Interim Financial Reporting' in preparing the interim financial statements. Accordingly the

interim financial statements are not in full compliance with IFRS.

2. Taxation

Income tax has been provided at the rate of 21.4% (2018: 22.4%).

3. Earnings per share

Half-year Half-year Year

ended ended ended

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Profit for the period 19,761 19,002 37,792

--------------- --------------- --------------

Weighted average number of shares in issue 208,131,108 208,031,705 208,071,633

Dilution effect of outstanding share options 152,678 45,378 70,667

Diluted weighted average number shares 208,283,786 208,077,083 208,142,300

Basic earnings per 5p ordinary share 9.5p 9.1p 18.2p

Diluted earnings per 5p ordinary share 9.5p 9.1p 18.2p

4. Dividends

Half-year Half-year Year

ended ended ended

31.12.19 31.12.18 30.06.19

GBP'000 GBP'000 GBP'000

Equity dividends paid:

Final dividend for the year ended 30 June 2018 - 20,080 20,080

Interim dividend for the year ended 30 June 2019 - - 8,325

Final dividend for the year ended 30 June 2019 20,813 - -

20,813 20,080 28,405

---------- ---------- ----------

Equity dividends declared/proposed at the end of the period

Interim dividend 4,423 8,325 -

Final dividend - - 20,813

Equity dividends per share, paid and declared/proposed are as

follows:

9.65p final dividend for the year ended 30 June 2018, paid on 7 December 2018

4.00p interim dividend for the year ended 30 June 2019, paid on 6 June 2019

10.00p final dividend for the year ended 30 June 2019, paid on 6 December 2019

2.125p 1st interim dividend for the year ended 30 June 2020, payable on 5 June 2020, to those

shareholders on the register at the close of business on 11 May 2020

5. New accounting standard IFRS16 Leases

IFRS16 Leases has replaced IAS17 Leases. The new standard eliminates the distinction between

operating and finance leases. All leases are now accounted for on the balance sheet, except

for low value leases and short term leases of one year or less. The leases are accounted for

by recognising a right of use asset and a lease liability.

On recognition, the right of use asset and lease liability are measured at the present value

of the lease payments discounted over the lease term. The discount rate used is the rate inherent

in the lease if this can be determined, or the incremental borrowing rate.

Subsequent to initial recognition, the right of use assets are depreciated on a straight line

basis over the lease term. The lease liabilities are increased by the interest cost and reduced

by the lease payments made. A depreciation charge and an interest cost are recognised in the

income statement.

IFRS16 has been adopted with effect from 1 July 2019. On adoption the modified retrospective

approach has been applied, such that the right of use assets and lease liabilities are equal

to each other, with no adjustment to opening reserves. There is no restatement of the comparative

periods. The right of use assets and lease liabilities recognised on adoption at 1 July 2019

were GBP8,869,000.

For the half year ended 31 December 2019 the right of use assets depreciation charge was GBP1,487,000

and the lease interest cost was GBP110,000. The adoption of IFRS16 had no significant effect

on the profit before income tax for the half year ended 31 December 2019.

6. Copies of the interim results

Copies of the interim results have been sent to shareholders who requested them. Further copies

can be obtained from the Company's registered office, Beechfield, Hollinhurst Road, Radcliffe,

Manchester, M26 1JN and on the Company's website at www.jameshalstead.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SDWFISESSEDD

(END) Dow Jones Newswires

March 31, 2020 02:00 ET (06:00 GMT)

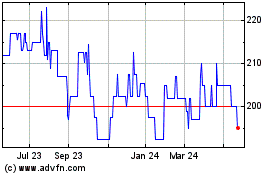

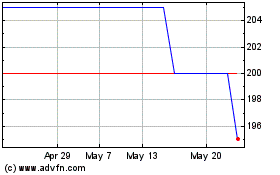

James Halstead (AQSE:JHD.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

James Halstead (AQSE:JHD.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024