TIDMGLR

RNS Number : 3395L

Galileo Resources PLC

30 December 2022

30 December 2022

Galileo Resources PLC

("Galileo" or "the Company" or "the Group")

Unaudited interim results for the six months ended 30 September

2022

Galileo (AIM: GLR) , the exploration and development mining

company, announces its unaudited interim results for the six-month

period ended 30 September 2022. A copy of the interim results is

available on the Company's website, www.galileoresources.com .

Operational Highlights

ZAMBIA

Luansobe Copper Project

The Company holds a 75% interest in the Luansobe project and is

undertaking an advanced exploration programme with a view to

completing a Project Feasibility Study within 18 months of 20

February 2022.

The Luansobe area is situated some 15km to the northwest of

Mufulira Mine in the Zambian Copperbelt which produced well over

9Mt of copper metal during its operation. It forms part of the

north-western limb of the northwest - southeast trending Mufulira

syncline and is essentially a strike continuation of Mufulira, with

copper mineralisation hosted in the same stratigraphic horizons. At

the Luansobe prospect mineralisation occurs in at least two

horizons, dipping at 20-30 degrees to the northeast, over a strike

length of about 3km and to a vertical depth of at least 1,250m.

Period Under Review

Re-logging of historic drill core dating from the 1950s and

1960s was completed, with core from five vertical holes being split

for assaying of possible copper-bearing zones not previously

recognised or considered of interest by earlier operators. This

work identified mineralised lenses of moderate copper grade, with

some higher-grade intervals in an upper zone at Luansobe - selected

assay results received included:

-- 16m @ 1.20% Cu from 58m in hole L0071

-- 14m @ 0.99% Cu from 70m in hole L0069

The newly discovered mineralisation was considered by the

Company to have the potential to add incremental value to a

possible open pit mining operation.

A contract was signed in August 2022 for a programme of core

drilling designed to infill gaps in historic drilling and twin

selected holes, with a particular focus on shallow levels of the

Luansobe deposit. The new data will be utilised to complete a

mineral resource estimate reported in accordance with JORC (2012)

which will be used as the basis for potential open pit mine

planning.

Post Period Under Review

On 03 November 2022 the Company confirmed completion of the

drill programme, comprising 28 vertical diamond drill holes

totalling 3,563.5m, thus marking an important step towards the

definition of a new Mineral Resource Estimate for the Project.

Assay results for the first 15 of 28 holes drilled were received.

These identified wide zones of moderate grade, near-surface copper

mineralisation, potentially offsetting open pit pre-stripping

costs, which could be expected to impact positively on project

economics.

Selected assay intervals for the first fifteen holes,

included:

-- 23.73m @ 2.63% Cu from 85.27m in hole LUDD013

-- 2.56m @ 2.78% Cu from 45.44m in hole LUDD005

-- 16.39m @ 0.95% Cu from 54.0m in hole LUDD009

-- 7.0m @ 0.66% Cu from 21.0m in hole LUDD006

External independent consultant, Addison Mining Services of the

UK, will complete a JORC (2012) Mineral Resource Estimate as soon

as the balance of geological data and supporting assays have been

received. The Mineral Resource Estimate will provide the

information required to progress towards a potential open pit mine

plan.

Shinganda Project

Galileo has an Option and Joint Venture project covering the

Shinganda Copper-Gold project, Zambia where the Company has the

right to earn an initial 51% interest.

The project area covers part of a major 10km structural trend

with two previously developed small-scale open pit copper-gold

mines. Very limited historic drilling on the property is reported

to have intersected 1.07% Cu over a true width of 28.3m at shallow

depth within supergene copper oxides. Drilling on the structure

within the Shinganda property further to the west by Vale S.A.

recorded a 2m interval @ 3.93% Cu, 1.72g/t Au.

Period Under Review

The Company engaged a contractor to undertake a detailed ground

magnetic survey at Shinganda, covering 383-line kilometres in

total. Results were received and are being used to help guide

further exploration.

On 20 July 2022 Galileo reported that it had completed a

reconnaissance mapping and sampling exercise over the most

prospective western sector of the exploration licence. Much of the

area is covered by a layer of overburden and duricrust,

nevertheless nine target areas with mineralisation or alteration of

interest were identified during mapping. Almost all were artisanal

pit working exposures with visible copper oxide mineralisation.

Altogether 27 rock grab samples were collected for copper and gold

assay from the exposed rocks. Assay results returned strongly

anomalous values for copper and gold from many of these,

including:

-- 1.42% Cu, 3.14g/t Au from the Shinganda outcrop

-- 1.79% Cu, 10.19g/t Au from Target No.1

-- 3.77% Cu, 1.24g/t Au from Target No.7

The outcome of the prospecting, showing the presence of copper

and gold mineralisation over an area of at least 12km x 6km on the

Shinganda licence, points to the potential for several shallow

copper-gold deposits on the property or for a potentially larger

target.

The Company engaged a contractor to undertake an initial

drilling programme to test the Shinganda pit workings in the

vicinity of the historic intersection of 1.07% Cu over a true width

of 28.3m at shallow depth within supergene copper oxides - previous

drill holes at Shinganda were not assayed for gold.

Results were reported for the first six angled holes totalling

963.9m drilled at the Shinganda outcrop target, with copper assays

being received for the first four of these. Gold assay results were

awaited. Shallow intervals of semi-massive hematite mineralisation

with strongly disseminated copper were noted particularly in holes

SHDD002 and SHDD005.

Assay results included:

-- 50.3m @ 1.53% Cu from 21m downhole depth in SHDD002, with a

sub-interval of 7m @ 4.36% Cu, including 2.0m @ 11.31% Cu

-- 43.7m @ 1.01% Cu from 7.3m downhole depth in SHDD004, including 10.0m @ 1.61% Cu

Further drilling is planned.

Kashitu

Period under review

A new small-scale exploration licence was issued on 23 February

2022 covering the core of the Kashitu project area. The licence

will run for four years from the issue date.

The Company has continued to plan for a drilling programme at

the Kashitu zinc project. Site visits were previously undertaken to

establish the suitability of several potential drill sites, with

the initial focus on testing of a high-grade willemite zinc

silicate vein zone which has been partially mined previously in a

small open pit.

ZIMBABWE

Galileo announced an agreement entered into on 04 March 2022

which assigned to Galileo an option granted under an agreement

dated 21 January 2022 between BC Ventures and Cordoba Investments

Limited to acquire a 51% interest in BC Ventures. BC Ventures is

the owner of a highly prospective lithium project in western

Zimbabwe (the Kamativi Lithium Project) and two gold licences (the

Bulawayo Gold Project) close to Bulawayo through its wholly owned

Zimbabwe subsidiary Sinamatella Investments (Private) Limited.

Under the terms of the agreement the Company committed to spend

US$1.5 million on exploration expenditure by 21 January 2024.

On 10 August 2022, the Company further announced an agreement to

acquire a further 29% shareholding in the Sinamatella projects and

an extension on the commitment to spend US$ 1.5 million on

exploration expenditure by 6 months to 21 July 2024. Post the

financial period under review the Company announced that all

conditions had been met in relation to the agreement to acquire a

29% shareholding in BC Ventures Limited (the "Share Acquisition")

accordingly, the Company issued 50,000,000 Galileo ordinary shares

at a price of 1.2 pence per share being the consideration shares

due in relation to the Share Acquisition. As a result, Galileo now

has an interest of 29% in BC Ventures alongside an option to

acquire a further 51% interest through the Company spending

$1.5million on exploration and evaluation of the Projects by 21

July 2024.

Zimbabwe is recognised as one of the most potentially

prospective countries in Africa for pegmatite-hosted lithium. Among

other explorers, Prospect Resources Ltd (ASX: PSC) estimates that

its Arcadia open pit lithium deposit, hosted within a stacked

series of pegmatite dykes, contains JORC- compliant proven and

probable ore reserves of 37.4Mt, grading at 1.22% Li2O. China's

Zhejiang Huayou Cobalt recently announced that it had agreed a deal

to purchase 100% of the Arcadia hard-rock lithium project for

US$422m. Zimbabwe has also long been a significant gold producer,

primarily from Greenstone Belt quartz 'reef' deposits that are host

to many small to mid-size quartz reef gold mines and deposits.

Period Under Review

Kamativi Lithium Project

The Kamativi Lithium Project comprises EPO 1782, covering

520km2, and lies on the Kamativi Belt directly adjacent to, and

along strike from the historic Kamativi tin- tantalum mine which

operated from 1936 to 1994. The Kamativi Mine produced 37,000

tonnes of tin and 3,000 tonnes of tantalum ore from pegmatites, and

in 2018 Chimata Gold Corp (Zimbabwe Lithium Company) announced a

new JORC (2012) compliant Indicated Mineral Resource of 26Mt @

0.58% Li2O within the Kamativi mine tailings, confirming that the

mine contained significant quantities of lithium.

The Sinamatella licence area encloses extensions and splays of

the Kamativi Tin Mine host unit, including mapped pegmatites, and

it has been reported that there are old tin-fluorite workings

within the Sinamatella property. The licence area also contains a

large extent of the pre-Cambrian Malaputese Formation which is

considered to be strongly prospective for VMS hosted copper,

surrounding the old Gwaii River Copper Mine and including numerous

other copper prospects and occurrences.

Little exploration has been carried out on the licence area in

the past 25+ years, however there is very good historical data

available to advance exploration for lithium prospects.

Environmental studies were completed on the permit area and the

necessary permissions were granted by the Zimbabwe authorities to

facilitate commencement of exploration on the property.

Reconnaissance mapping/sampling site visits were undertaken, and

detailed exploration work commenced on the property, comprising

geological mapping, rock grab sampling and soil sampling aimed at

identifying potentially lithium-bearing pegmatite host rocks.

Bulawayo Gold-Nickel-Copper Project

The Bulawayo Project comprises EPO 1783 and EPO 1784, covering a

large 1,300km2 licence area near Bulawayo with extensive Greenstone

Belt rock formations in Zimbabwe. No systematic exploration has

been carried out in the area for more than 25 years due to the

previously unfavourable investment climate in Zimbabwe. Prospective

areas with thin sand/alluvial/Karoo basalt cover have never been

explored and preliminary grab sampling on the property reported

assays ranging from 3.9-16g/t Au, confirming the prospectivity of

the ground.

The aim is to explore for resources to support the development

of a large scale mine. The licences adjoin and enclose a number of

small-scale gold mines on pre-existing mining permits which

provides the opportunity to integrate the production from these

operations which have a total historic production reported as more

than 1Moz Au.

The Company contracted Xcalibur Airborne Geophysics (Pty) Ltd,

to carry out a fixed-wing airborne magnetic and radiometric survey

over the Bulawayo licence area, with the programme being completed

in June 2022. The survey comprised 12,184 line km of flying at 100m

line spacing covering extensive Greenstone Belt rock formations.

The aim of the survey was to map critical structures and belts

linking the many known small-scale gold mines and deposits to help

identify targets for the potential development of a medium to large

scale mine.

The survey successfully mapped magnetic greenstone lithologies

that have remained unexplored, hidden beneath relatively shallow

alluvial and Karoo sandstone cover. The new geophysical data was

then integrated with existing gold deposit and soil geochemical

datasets. Modelling of the integrated dataset identified multiple

gold targets associated with these prospective lithologies and

geological structures known to provide the setting for both

historic gold producers and operating mines within the Bulawayo

licences.

In addition to gold targets, three nickel targets were also

identified together with several further sites of interest. These

included a 1.5km long soil geochemical anomaly up to 1,700ppm Ni

with a coincident magnetic signature in the Fingo area, as well as

several other buried or previously unidentified gabbro and

ultra-mafic intrusives that represent potential hosts for

nickel-copper mineralisation

Post Period Under Review

Kamativi

On 08 December 2022 the Company provided an update on a

reconnaissance mapping and sampling programme which identified four

target zones with potential for pegmatite-hosted lithium, tin and

tantalum. Work included collection of 1,661 samples, comprising

rock chips, stream sediments and soil samples which were dispatched

to an assay laboratory for a range of elements, including lithium,

tin and tantalum. Possible spodumene and petalite lithium

mineralisation was visually identified in rock chip samples from

one site, however this will require laboratory confirmation.

Bulawayo

In November 2022 Galileo reported in relation to the Bulawayo

Project that the following work was under way or planned on the

initial targets selected for follow-up, as a precursor to proposed

drilling in early 2023.

Bembeshi Gold:

At the Bembeshi gold target, evidence was found of both historic

and current gold mining along a 7km-long outcropping greenstone

trend. Exploration encountered visible sulphides and associated

alteration in multiple shear-hosted quartz veins and stockworks

over zones up to 30m wide. High-grade gold is currently being mined

by artisans and small-scale miners at reported average grades of 5

to 7g/t Au. A wide-spaced soil survey had commenced over a 6km-long

greenstone gold target hosting former producing mines to confirm

the continuity of gold mineralisation.

Bembeshi Nickel:

The new Bembeshi nickel target was outlined, located east of the

Fingo prospect, representing an entirely new potential nickel

target. The target was based on available evidence for a large

buried mafic - ultramafic body with potential to host nickel. Soil

and rock sampling by the Company returned encouraging Ni results

from preliminary handheld XRF analysis.

At the Fingo nickel target, infill and extension soil lines were

planned on the prospect.

Queens West:

Ground geophysical surveys (resistivity and magnetic) were

undertaken to test possible gold-bearing structures identified

under surface cover extending away from current and historic gold

mining activity in the Queens mine area, supported by historic

anomalous gold in soil ranging from 0.5 to 1.0g/t Au. Discovery of

multiple quartz veins/stockworks at surface containing sulphide

mineralisation, and active artisanal mining were considered to

provide clear evidence of the presence of gold along these

structural extensions. Supplementary IP-Resistivity ground

geophysics was planned to generate drill-ready gold targets

Galileo also reported that it had commissioned an external

geological contractor to build a small-scale mining database for

legally held small mining claims within the larger Bulawayo Licence

to assist with exploration in the medium-term.

BOTSWANA

Kalahari Copperbelt

Period under review

Following completion of the first phase drilling programme on

PL40, PL39 and PL253 an overview report of the programme was

prepared incorporating recommendations for follow-up drilling on

the Galileo retained licences.

Significant encouragement in relation to the Kalahari Copperbelt

is derived from the recent commencement of mining operations by

Sandfire Resources Limited on its' Motheo Copper Mine and

especially drilling reports by ASX listed Cobre Limited from its'

newly discovered Ngami copper-silver project along 10km of strike

which lies just about 20km from Galileo's PL253.

NEVADA

Ferber gold-copper project

Period Under Review

An earlier Galileo project review identified several drill

targets at Ferber to test both skarn-type gold-copper occurrences

and Carlin-type gold occurrences on the 100% held property. Due to

strong demand for drill machines in Nevada, it proved difficult to

find a contractor to undertake diamond core drilling at Ferber in

2022. However, the Company has proceeded with an application for

environmental permit for the planned programme and has engaged

Rangefront Mining Services, based in Elko Nevada, to assist in

seeking quotes from drilling contractors for Reverse Circulation

(RC) drilling with the aim of completing the planned programme

during Q3 2023.

SOUTH AFRICA

Glenover Phosphate Project (" Glenover")

Period Under Review

The Company received confirmation that all conditions for

Afrimat Limited ("Afrimat") to acquire the Vermiculite Mining Right

from Glenover had been met and that Glenover had elected for the

Vermiculite Mining Right Consideration to be paid in cash, of which

of ZAR11.6 million (approx. GBP0.6 million) was received by the

Company.

Post Period Under Review

The Company announced that Afrimat had given notice to Glenover

of its intention to conditionally acquire 100% of the shares in

Glenover from the current shareholders of Glenover for

consideration of ZAR300 million (approximately GBP14.3 million)

with the to receive ZAR107 million (approximately GBP5.1

million).

The Sale Shares Consideration will be settled through a

combination of cash and Afrimat shares;

-- 50% of the Sale Shares Consideration shall, at the election

of Afrimat, be split between Afrimat shares based on the Afrimat

30-day VWAP at which the Afrimat shares traded on the JSE Limited

on the relevant Effective Date and cash (Afrimat has to make this

election on the relevant Effective Date); and

-- 50% of the Sale Shares Consideration shall, at the election

of the Sellers (which includes the Company), be split between

Afrimat shares 30-day VWAP at which the Afrimat shares traded on

the JSE Limited on the relevant Effective Date and cash (the

Sellers have to make this election on the relevant Effective

Date).

The remaining suspensive conditions of the Glenover Acquisition

include approval from the South African Department of Mineral

Resources and Energy ("DMRE") in terms of Section 11 of the South

African Mineral and Petroleum Resource Development Act No. 28 of

2000 and South African Competition Commission approval for the

Acquisition. The Company anticipates that the above suspensive

conditions will be met by 31 July 2023.

In the event that either or both the suspensive conditions are

not fulfilled by 31 July 2023, interest will be payable at the

prime lending rate of the South African Reserve Bank (basic rate of

interest that commercial banks charge their customers) less 2% on

the remaining purchase consideration of ZAR300 million (GBP14.3

million) from 1 August 2023 until the suspensive conditions are

fulfilled or waived, as applicable, prior to the longstop date of

30 April 2024.

The Company has a very prospective portfolio of projects all of

which will be pursued during 2023. The progress of certain projects

beyond the first half of 2023 will depend on receipt of the funds

from the Glenover sale proceeds as referred to above. Should the

receipt of funds be delayed, then certain low priority projects may

be deferred until receipt of the funds or alternative funding is

secured.

Financial Highlights

The Group reported earnings of GBP1,209,344 (2021: loss of

GBP552,493) after taxation. This included a fair value adjustment

on non-current asset held for sale of GBP 2,392,670 in relation to

the Group's interest in Glenover as more fully described in the

announcement of 9 December 2021 . Earnings reported is 0.11 pence

(2021: loss of 0.06 pence) per share. Earnings per share is based

on a weighted average number of ordinary shares of 1,115,819,649

(2021: 919,808,258).

For further information, please contact:

Colin Bird, Chairman and Tel +44 (0) 20 7581 4477

CEO

Edward Slowey, Executive Tel +353 (1) 601 4466

Director

www.galileoresources.com

Beaumont Cornish Limited

Nominated Advisor

Roland Cornish/James Biddle Tel +44 (0)20 7628 3396

Novum Securities Limited

- Broker Tel +44 (0)20 7382 8416

Colin Rowbury/ Jon Belliss

Statement of Responsibility for the six months ended 30

September 2022

The directors are responsible for preparing the consolidated

interim financial statements for the six months ended 30 September

2022 and they acknowledge, to the best of their knowledge and

belief, that:

-- the consolidated interim financial statements for the six

months ended 30 September 2022 have been prepared in accordance

with UK adopted IAS 34 - Interim Financial Reporting;

-- based on the information and explanations given by

management, the system of internal control provides reasonable

assurance that the financial records may be relied on for the

preparation of the consolidated interim financial statements.

However, any system of internal financial control can provide only

reasonable, and not absolute, assurance against material

misstatement or loss;

-- the going concern basis has been adopted in preparing the

consolidated interim financial statements and the directors of

Galileo have no reason to believe that the Group will not be a

going concern in the foreseeable future, based on forecasts and

available cash resources;

-- these consolidated interim financial statements support the viability of the Company; and

-- having reviewed the Group's financial position at the balance

sheet date and for the period ending on the anniversary of the date

of approval of these financial statements they are satisfied that

the Group has, or has access to, adequate resources to continue in

operational existence for the foreseeable future.

C Bird

Chairman and Chief Executive Officer

30 December 2022

CONSOLIDATED STATEMENTS

OF FINANCIAL POSITION

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBPs GBPs GBPs

ASSETS

Intangible assets 6 4,382,659 2,854,706 3,875,570

Investment in joint ventures - 1,990,053 2,936,125

Non-current assets held for

sale 7 5,138,367 1,574,160 -

Loans to joint ventures,

associates and subsidiaries 284,792 364,644 792,259

Other financial assets 2,318,549 1,440,148 1,994,617

---------------- --------------- --------------

Non-current assets 6,986,000 6,649,551 9,598,571

---------------- --------------- --------------

Trade and other receivables 387,734 49,796 119,855

Cash and cash equivalents 3,309,842 3,523,794 4,648,995

Other financial assets - 6,930 -

--------------- --------------

Current assets 8,835,943 5,154,680 4,768,850

---------------- --------------- --------------

Total Assets 15,821,943 11,804,231 14,367,421

---------------- --------------- --------------

EQUITY AND LIABILITIES

Share capital 32,146,730 31,636,356 31,996,730

Reserves 1,352,184 887,304 1,223,801

Accumulated loss (18,142,010) (21,687,406) (19,351,353)

---------------- --------------- --------------

15,356,904 10,836,254 13,869,178

Non-controlling interest 117,754 - 117,754

---------------- --------------- --------------

Equity 15,474,658 10,836,254 13,986,932

---------------- --------------- --------------

Liabilities

Other financial liabilities 6 6 6

Deferred taxation - 425,813 -

---------------- ---------------

Non-current liabilities 6 425,819 6

---------------- --------------- --------------

Trade and other payables 141,628 542,158 106,233

Taxation payable 205,651 - 274,250

---------------- --------------- --------------

347,279 542,158 380,483

---------------- --------------- --------------

Total liabilities 347,285 967,977 380,489

---------------- --------------- --------------

Total Equity and liabilities 15,821,943 11,804,231 14,367,421

---------------- --------------- --------------

Joel Silberstein

30 December 2022

Company number: 05679987

CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBPs GBPs GBPs

Revenue - - -

Operating expenses (629,417) (556,524) (753,321)

---------------- --------------- --------------

Operating loss (629,417) (556,524) (753,321)

Investment revenue 218,012 - 332,904

Fair value adjustments 2,392,670 - 141,205

Profit/(loss) on sale of

investments - - (1,266,967)

Provision for impairment - - (495,842)

Share of (loss)/profit from

equity accounted investments (771,921) 4,031 3,433,034

---------------- --------------- --------------

Profit/(loss) for the period

before taxation 1,209,344 (552,4933) 1,391,013

Taxation - - 151,563

---------------- --------------- --------------

Profit for the period after

taxation 1,209,344 (552,493) 1,542,576

---------------- --------------- --------------

Other comprehensive loss:

Exchange differences on translating

foreign operations 91,182 41,091 483,319

---------------- --------------- --------------

Total comprehensive income/(loss) 1,300,526 (511,402) 2,025,895

---------------- --------------- --------------

Total comprehensive loss

attributable to:

Owners of the parent 1,300,526 (511,402) 2,025,895

Weighted average number of

shares in issue 1,115,819,649 919,808,258 1,038,799,984

Basic earnings/(loss) per

share - pence 0.11 (0.06) 0.15

STATEMENTS OF CHANGES IN EQUITY as at 30 September 2022

Share Share Total Foreign Convertible Shares Share based Total Accumulated Total NCI Total

Capital capital currency instruments to be issued payment reserves loss equity equity

premium translation reserve reserve attributable

reserve to equity

holders

of the

company

---------- ------------

Figures in Pound Sterling

reserve

---------------------------------------------------------------------------------------------------- ------------------- ----------------- ----------------------------- ----------------- ------------ --- ----- -------------- ------------

Balance at 1 April 2021 6,522,609 23,182,635 29,705,244 (776,495) 1,047,821 - 566,374 837,700 (21,134,916) 9,408,029 - 9,408,029

Loss for the year - - - - - - - - 1,542,576 1,542,576 - 1,542,576

Other comprehensive income - - - 483,319 - - - 483,319 - 483,319 - 483,319

------------------- -------------------- ------------------------------------- ----------------- -------------------- --------------------------- ------------ ---------------- -------------- ------------ -------------- -------------

Total comprehensive income

for the year - - - 483,319 - - - 483,319 1,542,576 2,025,895 - 2,025,895

Warrants lapsed (91,194) (91,194) 91,194 - -

Options lapsed (149,793 (149,793) 149,793 - -

Warrants issued - (27,560) (27,560) - - - 27,560 27,560 - - - -

Warrants exercised - 33,791 33,791 - - - (33,791) (33,791) - - - -

- -

Issue of shares 184,559 2,100,696 2,285,255 -- - - - - - - - -

Shares to be issued - - - - - 150,000 - 150,000 - 150,000 - 150,000

Change in share in associate - - - - - - - - - - 117,754 117,754

------------------- -------------------- ------------------------------------- ----------------- -------------------- --------------------------- ------------ ---------------- -------------- ------------ -------------- -------------

Total contributions by

and distributions to owners

of company recognised

directly in equity 184,559 2,106,927 2,291,486 - - - (247,218) (97,218) 240,987 2,435,255 117,754 2,553,009

Balance at 1 April 2022 6,707,168 25,289,562 31,996,730 (293,176) 1,047,821 150,000 319,156 1,223,801 (19,351,353) 13,869,178 117,754 13,986,932

------------------- -------------------- ------------------------------------- ----------------- -------------------- --------------------------- ------------ ---------------- -------------- ------------ -------------- -------------

Loss for the 6 months - - - - - - - - 1,209,344 1,209,344 - 1,209,344

Other comprehensive income - - - 91,182 - 91,182 - 91,182 - 91,182

------------------- -------------------- ------------------------------------- ----------------- -------------------- --------------------------- ------------ ---------------- -------------- ------------ -------------- -------------

Total comprehensive income

for the 6 months - - - 91,182 - - - 91,182 1,209,344 1,300,526 - 1,300,526

------------------- -------------------- ------------------------------------- ----------------- -------------------- --------------------------- ------------ ---------------- -------------- ------------ -------------- -------------

Options issued - - - - - - 187,201 187,201 - 187,201 - 187,201

Warrants exercised - - - - - - - - - - - -

Issue of shares 13,742 136,258 150,000 - - (150,000) - (150,000) - - - -

Total contributions by

and distributions to owners

of company recognised

directly in equity 13,742 136,258 150,000 - - (150,000) 187,201 37,201 - 187,201 - 187,201

Balance at 30 September

2022 6,720,910 25,425,820 32,146,730 (201,994) 1,047,821 - 506,357 1,352,184 (18,142,010) 15,356,904 117,754 15,474,658

------------------- -------------------- ------------------------------------- ----------------- -------------------- --------------------------- ------------ ---------------- -------------- ------------ -------------- -------------

CONSOLIDATED STATEMENTS OF Six months Six months Year

CASH FLOW ended ended ended

30 September 30 September 31 March

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBPs GBPs GBPs

Cash used in operations (595,592) (175,946) (901,220)

Interest income 2,884 - 238,827

Net cash from operating activities (592,708) (175,946) (662,393)

-------------- -------------- ------------

Additions to intangible assets (154,106) (700,753) (1,559,823)

Distributions from Joint Ventures

(incl subs, JVs & Assoc) - - 2,417,977

Proceeds on sale of non-current

assets held for sale - 1,095,385 1,132,394

Loans repaid/(advanced) 509,567 (18,960) -

Purchase of financial assets (1,101,906) - (132,644)

Net cash flows from investing

activities (746,445) 375,672 1,857,904

-------------- -------------- ------------

Net Proceeds on share issue - 1,931,113 2,060,529

Net cash flows from financing

activities - 1,931,113 2,060,529

Total cash movement for the

period (1,339,153) 2,130,839 3,256,040

Cash at the beginning of the

period 4,648,995 1,392,955 1,392,955

-------------- -------------- ------------

Total cash at end of the period 3,309,842 3,523,794 4,648,995

-------------- -------------- ------------

Notes to the Financial Statements

1. Status of interim report

The Group unaudited condensed interim results for the six months

ended 30 September 2022 have been prepared using the accounting

policies applied by the Company in its 31 March 2022

annual report, which are in accordance with UK adopted

international Accounting Standard, the AIM rules of the London

Stock Exchange and the Companies Act 2006 (UK). This condensed

consolidated interim financial report does not include all notes of

the type normally included in an annual financial report.

Accordingly, this report is to be read in conjunction with the

annual report for the year ended 31 March 2022 and any public

announcements by Galileo Resources Plc. All monetary information is

presented in the presentation currency of the Company being Great

British Pound. The Group's principal accounting policies and

assumptions have been applied consistently over the current and

prior comparative financial period. The financial information for

the year ended 31 March 2022 contained in this interim report does

not constitute statutory accounts as defined by section 435 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor's

report on those accounts was unqualified and did not contain a

statement under section 498(2)-(3) of the Companies Act 2006.

2. Basis of preparation

The consolidated financial statements incorporate the financial

statements of the Company and all entities for the six months ended

30 September 2022, including special purpose entities, which are

controlled by the Company. Control exists when the Company has the

power to govern the financial and operating policies of an entity

to obtain benefits from its activities. The results of subsidiaries

are included in the consolidated annual financial statements from

the effective date of acquisition to the effective date of

disposal. Adjustments are made when necessary to the annual

financial statements of subsidiaries to bring their accounting

policies in line with those of the Group.

All intra-group transactions, balances, income and expenses are

eliminated in full on consolidation. Non-controlling interests in

the net assets of consolidated subsidiaries are identified and

recognised separately from the Group's interest therein and are

recognised within equity. Losses of subsidiaries attributable to

non-controlling interests are allocated to the non-controlling

interest even if this results in a debit balance being recognised

for non-controlling interest. Transactions which result in changes

in ownership levels, where the Group has control of the subsidiary

both before and after the transaction, are regarded as equity

transactions and are recognised directly in the statement of

changes in equity. The difference between the fair value of

consideration paid or received and the movement in non-controlling

interest for such transactions is recognised in equity attributable

to the owners of the parent.

3. Segmental analysis

Business unit

The Company's investments in subsidiaries and associates, that

were operational at year-end, operate in four geographical

locations being South Africa, Botswana, Zambia, Zimbabwe and USA,

and are organised into one business unit, namely Mineral Assets,

from which the Group's expenses are incurred and future revenues

are expected to be earned. This being the exploration for and

extraction of its mineral assets through direct and indirect

holdings. The reporting on these investments to the board focuses

on the use of funds towards the respective projects and the

forecasted profit earnings potential of the projects.

The Company's investment in Zambia and Zimbabwe did not

contribute to the operating profit or losses and is excluded from

the segmental analysis.

Geographical segments

An analysis of the profit/(loss) on ordinary activities before

taxation is given below:

Six months Six months Year

ended 30 ended 30

September September ended

2022 2021 31 March

(Unaudited) (Unaudited) 2022

(Audited)

GBPs GBPs GBPs

Profit/(loss) on ordinary

activities before taxation:

Rare earths, aggregates

and iron ore and manganese

- South Africa 2,191,462 4,031 3,433,034

Gold - USA (4,214) (2,288) 8,170

Copper - Botswana (22,664) - 117,599

Corporate costs - United

Kingdom (955,240) (443,598) (2,167,790)

1,209,344 (552,493) 1,391,013

-------------- ------------- ------------

4. Financial review

The Group reported earnings of GBP1,209,344 (2021: loss of

GBP552,493) after taxation. Earnings reported is 0.11 pence (2021:

loss of 0.06 pence) per share. Earnings per share is based on a

weighted average number of ordinary shares of 1,115,819,649 (2021:

919,808,258).

5. Share Capital

During the period under review the Company issued new ordinary

shares as follows:

Number of

Date ordinary shares

================ ================

Opening balance 1 096 946 844

Acquisition 13 741 609

================ ================

Closing balance 1 110 688 453

================ ================

Post the period under review the Company issued new ordinary

shares as follows:

Number of

Date ordinary shares

================ ================

Opening balance 1 110 688 453

Acquisition 50 000 000

================ ================

Closing balance 1 160 688 453

================ ================

Warrants

The Company had the following warrants outstanding at the period

end:

Issue date Number of warrants Issue Expiry date

price

(pence)

15-Sep-20 10 000 000 2.00 2022/10/15

--------------------------- ------------- ------------

01-Jun-21 3 341 666 2.25 2023/06/01

--------------------------- ------------- ------------

01-Jun-21 66 833 332 2.25 2023/06/01

--------------------------- ------------- ------------

80 174 998

--------------------------- ------------- ------------

The Company had the following warrants outstanding at the date

of this report:

Issue date Number of warrants Issue Expiry date

price

(pence)

01-Jun-21 3 341 666 2.25 2023/06/01

--------------------------- ------------- ------------

01-Jun-21 66 833 332 2.25 2023/06/01

--------------------------- ------------- ------------

70 174 998

--------------------------- ------------- ------------

Share Options 30 September 30 September 31 March

2022 2021 2022

Outstanding at the beginning

of the year 58,700,000 68,400,000 68,400,000

Options lapsed - - (9,700,000)

58,700,000 68,400,000 58,700,000

--------------- --------------- ------------

During the period under review, on 28 July 2022 the Company

granted 13,500,000 new options to employees and management at a

strike price of 1.35 pence. The options vest immediately and expire

on 25 July 2025. The fair value of options issued prior to the

period end was determined by using the Black-Scholes Valuation

Model.

6. Intangible assets

Reconciliation of Intangible assets:

Group as at 30 September 2022

Asset Opening Additions Foreign Closing

currency balance exchange balance

movements

Exploration

and evaluation

asset - Botswana BWP 1,467,320 32,692 12,976 1,512,988

----------- ------------- ----------- ------------- ----------

Exploration

and evaluation

asset - U.S.A. US$ 1,893,024 121,414 340,007 2,354,445

----------- ------------- ----------- ------------- ----------

Exploration

and evaluation

asset - Zambia ZMW 515,226 - - 515,226

----------- ------------- ----------- ------------- ----------

Total intangible

assets 3,875,570 154,106 352,983 4,382,659

------------- ----------- ------------- ----------

Group as at 30 September 2021

Asset Opening Disposal Additions Foreign Closing

currency balance as part exchange balance

of assets movements

held for

sale

Exploration

and evaluation

asset - Botswana BWP 2,796,950 (2,378,626) 605,575 391 1,024,290

------------ -------------- ------------ ----------- ---------------- ------------

Exploration

and evaluation

asset - U.S.A. US$ 1,696,493 - 95,178 38,744 1,830,415

------------ -------------- ------------ ----------- ---------------- ------------

Total intangible

assets 4,493,443 (2,378,626) 700,753 39,135 2,854,705

-------------- ------------ ----------- ---------------- ------------

Group as at 31 March 2022

Asset Opening Additions Foreign Total

currency exchange

movements

Exploration

and evaluation

asset - Botswana BWP 418,324 1,047,628 1,367 1,467,320

----------- ---------- ---------- ------------------ ----------

Exploration

and evaluation

asset - U.S.A. US$ 1,696,493 114,723 81,807 1,893,024

----------- ---------- ---------- ------------------ ----------

Exploration

and evaluation

asset - Zambia ZMW - 515,226 - 515,226

----------- ---------- ---------- ------------------ ----------

2,114,817 1,667,577 83,174 3,875,570

------------------------------- ---------- ---------- ------------------ ----------

Botswana

The Company currently holds copper licenses in the highly

prospective Kalahari Copper Belt ("KCB"), The KCB is approximately

800km long by up to 250km wide, is a northeast-trending Meso- to

Neoproterozoic belt that occurs discontinuously from western

Namibia and stretches into northern Botswana along the northwestern

edge of the Paleoproterozoic Kalahari Craton. The belt contains

copper-silver mineralisation, which is generally stratabound and

hosted in metasedimentary rocks of the D'Kar Formation near the

contact with the underlying Ngwako Pan Formation. The hanging

wall-footwall redox contact is a distinctive target horizon that

consistently hosts copper-silver mineralization in fold-hinge

settings. The geological setting is similar to that of the major

Central African Copper Belt and Kupferschiefer in Poland.

7. Non-current assets held for sale

Group as at 30 September 2022

Glenover Phosphate (Pty) Ltd

The Company currently holds a 30.70% direct investment in

Glenover and also has an indirect investment of 4.99% in Glenover

through its shareholding in Galagen Proprietary Limited, a special

purpose vehicle incorporated to hold the BEE shareholding in the

Glenover project, resulting in a total interest in Glenover of

35.69%.

As announced on 9 December 2021, Glenover entered into a

conditional sale of shares agreement with JSE Limited listed

Afrimat Limited (JSE: AFT) ("Afrimat") Glenover also between

Afrimat, Glenover and the shareholders of Glenover including

Galileo Resources SA (Pty) Ltd the Company's wholly owned South

African subsidiary under which Afrimat has the option to acquire

the sale of shares in and shareholders loans made to Glenover for

ZAR300 million (approximately GBP14 .3 million).

On 26 October 2022 , The Company announced that Afrimat had

given notice to Glenover of its intention to conditionally acquire

100% of the shares in Glenover from the current shareholders of

Glenover for consideration of ZAR300 million (approximately GBP14.3

million) with the to receive ZAR107 million (approximately GBP5.1

million).

The Sale Shares Consideration will be settled through a

combination of cash and Afrimat shares;

-- 50% of the Sale Shares Consideration shall, at the election

of Afrimat, be split between Afrimat shares based on the Afrimat

30-day VWAP at which the Afrimat shares traded on the JSE Limited

on the relevant Effective Date and cash (Afrimat has to make this

election on the relevant Effective Date); and

-- 50% of the Sale Shares Consideration shall, at the election

of the Sellers (which includes the Company), be split between

Afrimat shares 30-day VWAP at which the Afrimat shares traded on

the JSE Limited on the relevant Effective Date and cash (the

Sellers have to make this election on the relevant Effective

Date).

The remaining suspensive conditions of the Glenover Acquisition

include approval from the South African Department of Mineral

Resources and Energy ("DMRE") in terms of section 11 of the South

African Mineral and Petroleum Resource Development Act No. 28 of

2000 and South African Competition Commission approval for the

Acquisition.

In the event that either or both the suspensive conditions are

not fulfilled by 31 July 2023, interest of the South African

Reserve Bank at prime rate less 2% will be payable on the remaining

purchase consideration of ZAR300 million from 1 August 2023 until

the suspensive conditions are fulfilled or waived, as applicable,

prior to the longstop date of 30 April 2024.

8. Going concern

The Company has sufficient financial resources to enable it to

continue in operational existence for the foreseeable future and

meet its liabilities as they fall due.

The directors have further reviewed the financial position of

the Company at the date of this report and Company's cash flow

forecast which includes the receipt of GBP5.1 million from the

proceeds of the sale of shares in Glenover which the Company

anticipates will be received by the 31 July 2023. The Company has a

very prospective portfolio of projects all of which will be pursued

during 2023. The progress of certain projects beyond the first half

of 2023 will depend on receipt of the funds from the Glenover sale

proceeds as referred to above. Should the receipt of funds be

delayed, then certain low priority projects may be deferred until

receipt of the funds or alternative funding is secured.

Accordingly, the directors consider it appropriate to continue

to adopt the going-concern basis in preparing these financial

statements. This basis presumes that funds will be available to

finance future operations and that the realisation of assets and

settlement of liabilities and commitments will occur in the

ordinary course of business.

9. Post balance sheet events

9.1 Acquisition of a further 29% shareholding in BC Ventures Limited

On 20 October 2022, the Company announced that all conditions

had been met in relation to the agreement to acquire a 29%

shareholding in BC Ventures Limited (the "Share Acquisition");

accordingly, the Company issued 50,000,000 Galileo ordinary shares

at a price of 1.2 pence per share being the consideration shares

due in relation to the Share Acquisition (the "Consideration

Shares").

As a result, Galileo hold an interest of 29% in BC Venturers

alongside an option to acquire a further 51% interest through the

Company spending $1.5million on exploration and evaluation of the

Projects by 21 January 2024.

The Consideration Shares are subject to the following lockup and

orderly market arrangements and cannot be sold during the lockup

periods.

9.2 Update on Afrimat Option to sell shares in Glenover

The Company announced 26 October 2022 that Afrimat Limited

("Afrimat") had given notice to Glenover of its intention to

conditionally acquire 100% of the shares in Glenover from the

current shareholders of Glenover for consideration of ZAR300

million (approximately GBP14.3 million) with the to receive ZAR107

million (approximately GBP5.1 million).

The Sale Shares Consideration will be settled in a combination

of cash and Afrimat shares;

-- 50% of the Sale Shares Consideration shall, at the election

of Afrimat, be split between Afrimat shares based on the Afrimat

30-day VWAP at which the Afrimat shares traded on the JSE Limited

on the relevant Effective Date and cash (Afrimat has to make this

election on the relevant Effective Date); and

-- 50% of the Sale Shares Consideration shall, at the election

of the Sellers (which includes the Company), be split between

Afrimat shares 30-day VWAP at which the Afrimat shares traded on

the JSE Limited on the relevant Effective Date and cash (the

Sellers have to make this election on the relevant Effective

Date).

The remaining suspensive conditions of the Glenover Acquisition

include approval from the South African Department of Mineral

Resources and Energy ("DMRE") in terms of section 11 of the South

African Mineral and Petroleum Resource Development Act No. 28 of

2000 and South African Competition Commission approval for the

Acquisition.

In the event that either or both the suspensive conditions are

not fulfilled by 31 July 2023, interest of the South African

Reserve Bank at prime rate less 2% will be payable on the remaining

purchase consideration of ZAR300 million from 1 August 2023 until

the suspensive conditions are fulfilled or waived, as applicable,

prior to the longstop date of 30 April 2024.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKKBPCBDKOBN

(END) Dow Jones Newswires

December 30, 2022 05:00 ET (10:00 GMT)

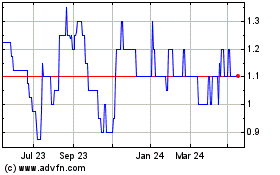

Galileo Resources (AQSE:GLR.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

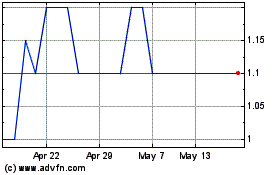

Galileo Resources (AQSE:GLR.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024