Fisher (James) & Sons plc Half year post close trading update (1830S)

July 07 2020 - 2:00AM

UK Regulatory

TIDMFSJ

RNS Number : 1830S

Fisher (James) & Sons plc

07 July 2020

7 July 2020

James Fisher and Sons plc (FSJ.L)

Half year post close trading update

James Fisher and Sons plc ("James Fisher" or the "Group"), the

leading marine services provider, issues the following post close

trading update for the half year to 30 June 2020.

Introduction

Our priority throughout the Covid-19 pandemic has been to

protect our employees and their families and to continue to provide

our services and goods to customers, whilst supporting and

maintaining our supply chain. The commitment, support and

engagement of our employees in stepping up to the challenges of

Covid-19 continues to be remarkable and greatly appreciated.

Trading update

As announced in the Group's AGM statement, the effects of

Covid-19 on the Group have been exacerbated by a sharp fall in the

price of oil. The imbalance between supply and demand in the oil

and gas sector has continued to place downward pressure on oil

prices since then and this may persist for some time. Whilst many

of the Group's businesses have proven to be resilient through the

first half, Group revenue in the second quarter was 18% lower than

the comparative period in 2019. For the first half, Group revenue

was 10% lower than the comparative period in 2019.

In Marine Support, the second quarter saw subsea service

projects being deferred, in both renewables and in the oil and gas

sector, together with supply chain challenges due to Covid-19

across all businesses. As a result, Marine Support's financial

performance will be lower in the first half, year-on-year, despite

the ship-to-ship oil transfer business trading strongly during that

period. We have taken the decision to restructure the division,

reduce the cost base and refresh the management structure which

will provide clearer strategic and operational direction going

forward.

Specialist Technical has performed satisfactorily with both the

nuclear and defence segments proving resilient despite some

logistical supply chain issues.

Offshore Oil, which had good momentum entering 2020, has traded

well despite the challenges of Covid-19 and will report improved

profitability compared to the first half of 2019. Notably, our

artificial oil-well lift business continues to perform well and we

have secured a number of marine infrastructure decommissioning

projects in Asia during the first half.

Tankships traded well through the first four months of 2020, but

shipments of clean petroleum products inevitably reduced during May

and June as a consequence of the UK and Irish lockdown.

Covid-19 mitigating actions and financial position

At the start of the Covid-19 pandemic, the Group took immediate

actions to protect our people, optimise cash flow and maximise

liquidity.

This included making use of the Government's furlough scheme,

which the Group will shortly stop utilising, coupled with a 20%

deferral in salary for around 800 employees for the second quarter.

This will be repaid during the second half of the year, except to

all Board members and the Executive Committee who have accepted pay

cuts of 20% for the second quarter. The Group has returned to full

salaries with effect from 1 July.

The Group has a strong balance sheet with net debt estimated at

approximately GBP175m at 30 June 2020, compared to GBP203m at the

year end. In the first half of 2020, the Group increased its

committed lending facilities by GBP50m to GBP300m. Strong cash

management and the deferral of payments for dividends, taxes and

pensions, together with tight control of costs and capital

expenditure, has seen headroom under committed facilities increase

from GBP42m at 31 December 2019 to over GBP100m at 30 June

2020.

Half year results

Due to the uncertainties surrounding our markets at the time of

our AGM on 30 April 2020, the Group withdrew financial guidance for

the year. While the intervening months have continued to present

challenges, the Group has proven resilient and performed well in

the circumstances.

James Fisher is well diversified by geographical sector and by

end markets which provides resilience to profitability and cash

flow, most notably in the current environment. The Group's half

year results are scheduled to be announced on 25 August 2020.

For further information:

Chief Executive

Officer

James Fisher and Eoghan O'Lionaird Group Finance

Sons plc Stuart Kilpatrick Director 020 7614 9508

Richard Mountain

FTI Consulting Susanne Yule 0203 727 1340

--------------------------------------- --------------

Forward-looking statements

This announcement contains statements which are, or may be

deemed to be, "forward-looking statements" which are prospective in

nature. All statements other than statements of historical fact are

forward-looking statements. By their nature, forward-looking

statements are subject to a number of known and unknown risks,

uncertainties and contingencies, and actual results and events

could differ materially from those currently being anticipated as

reflected in such statements. Factors may cause future outcomes to

differ from those foreseen or implied, many of which are beyond

James Fisher's control or influence. Any forward-looking statements

speak only as of the date of this announcement and have not been

audited or otherwise independently verified. Past performance

should not be taken as an indication or guarantee of future results

and no representation or warranty, express or implied, is made

regarding future performance. Except as required by any applicable

law or regulation, James Fisher expressly disclaims any obligation

or undertaking to release publicly any updates or revisions to any

forward looking statements contained in this announcement to

reflect any change in the Group's expectations or any change in

events, conditions or circumstances on which any such statement is

based after the date of this announcement, or to keep current any

other information contained in this announcement. Accordingly,

undue reliance should not be placed on any forward-looking

statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTRFMPTMTBMBJM

(END) Dow Jones Newswires

July 07, 2020 02:00 ET (06:00 GMT)

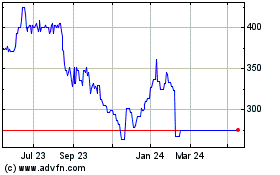

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024