TIDMENT

RNS Number : 6006C

Entain PLC

13 June 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, CANADA, AUSTRALIA, JAPAN, SOUTH AFRICA OR ANY OTHER STATE

OR JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

13 June 2023

Entain plc

Entain CEE acquisition of STS, the #1 sports-betting operator in

Poland

Further expansion across Central and Eastern Europe

Entain plc (LSE: ENT), the global sports-betting, gaming and

interactive entertainment group ("Entain" or the "Group"), today

announces that Entain Holdings (CEE) Ltd. ("Entain CEE"), is

launching a tender offer (the "Offer") to acquire 100% of STS

Holding S.A. ("STS") for a total consideration of approximately

GBP750m (the "Acquisition"). (1)

STS is the leading sports-betting operator in Poland and is

listed on the Warsaw Stock Exchange (WSE:STH). The Offer will be

priced at PLN 24.80 per share, valuing the equity value of STS at

approximately GBP750m, and the enterprise value at approximately

GBP690m.(2)

Entain CEE is Entain's venture in Central and Eastern Europe

("CEE") together with its partner EMMA Capital ("EMMA"). Entain and

EMMA will fund the Offer in proportion to their current

shareholding in Entain CEE (75% / 25% respectively). Entain will

fund its proportion of the consideration via an equity placing and

a separate retail offer through the PrimaryBid platform, the

details of which have been announced separately .

STS's CEO Mateusz Juroszek and his father Zbigniew Juroszek, who

through their respective family foundations ("Juroszek Foundations"

or "Foundations") collectively hold approximately 70% of STS's

share capital, have entered into a binding agreement to irrevocably

accept the Offer. Following completion, the Juroszek Foundations

will re-invest a proportion of their proceeds into Entain CEE in

return for a 10% economic stake in Entain CEE. (3)

The net cash consideration of the Acquisition payable by Entain

will be approximately GBP 450m.

Compelling Strategic Rationale

-- An exciting opportunity to acquire an attractive asset in a

high-growth regulated market within CEE: CEE offers an exciting

opportunity in new high-growth and regulated markets in line with

the Group's strategy, as outlined at the launch of Entain CEE with

the acquisition of SuperSport in August 2022 . Poland is the CEE

region's largest economy, with the Polish gaming market having

c.$1.6bn of gross gaming revenue in 2022 and average gambling spend

per adult increasing at a CAGR of 24% in the last three years. This

market continues to grow considerably with a forecast near term

CAGR of 12% (2022-2025). (4)

-- Acquiring the #1 sports-betting operator in Poland : STS is

the market leader in Poland, and has a highly successful and proven

omnichannel offering led by a substantial online business (82% of

NGR), with strong active user growth. In the three years to the end

of 2022, its active users grew at a 19% CAGR to reach 783k active

users at the end of 2022. STS also has a significant and

complementary retail footprint of c.400 stores, making it the

largest retail operator in the Polish market. STS has a robust and

high-growth financial profile, generating FY22 NGR of PLN 663m (

GBP 121 m, +17% YoY) and Adjusted EBITDA of PLN 273m ( GBP 50

m).(5)

-- Adding another leading business to Entain CEE, which is

expected to provide attractive synergies from our CEE platform:

Through the transaction, GBP10m+ run-rate synergies are expected to

be generated, including through the proposed combination of two

outstanding operational and technology platforms in the CEE

region.

-- Acquisition expected to be earnings accretive in the first

full year of ownership: STS has consistently delivered strong top

line financial performance (+24% NGR CAGR since 2020) and adjusted

EBITDA growth (+34% CAGR). Combined with the expected GBP10m+

run-rate synergies, it is estimated that the Acquisition will be

earnings accretive in its first full year of ownership.(6)

-- Mateusz Juroszek will remain as CEO of STS and join the board

of Entain CEE: Mateusz has been CEO of STS since 2012 and has been

critical in driving STS's growth over the last decade. Given

Mateusz's extensive knowledge of the business and the Polish gaming

market, Entain is delighted that he will continue as STS CEO and

that he will also join the board of Entain CEE, helping to drive

further regional growth and deliver on Entain CEE's strategy.

-- Incremental potential upside if Polish online casino market

fully liberalises: The online casino market is currently not fully

liberalised in Poland. As a licensed and regulated operator, STS

would likely be well-positioned to benefit from the opportunity to

enter the online casino market should this market fully liberalise

in the future.

Consideration and Offer Highlights

-- Entain CEE is launching the Offer to acquire 100% of STS, at

a purchase price of PLN 24.80 per share

-- This Offer represents a 35% premium to 6-month volume

weighted average price of PLN 18.33 as at 12 June 2023(78)

-- This Offer represents a 28% premium to the 3-month volume

weighted average price of PLN 19.38 as at 12 June 2023(78)

-- This Offer represents a 20% premium to the spot price of PLN

20.75 as at 12 June 2023(7)

-- Based on analyst consensus for the year to 31 December 2024,

STS is expected to generate EBITDA of PLN 333m, implying an

enterprise multiple of 11x(9)

o After the synergies that being part of Entain CEE can bring,

we expect this multiple to reduce to below 10x

-- Radim Haluza, CEO of Entain CEE, will continue to drive and

oversee the continued success of both STS and SuperSport

-- Following the Juroszek Foundation's investment in Entain CEE,

Entain CEE's economic rights will be approximately 67.5% owned by

Entain plc, 22.5% owned by EMMA Capital, and 10% owned by the

Juroszek Foundations

o Up to half of the 10% stake owned by the Juroszek Foundations

is subject to clawback by Entain CEE should STS not achieve certain

financial hurdles in 2023

o There are options over the shares held by the Foundations and

EMMA, giving Entain a path to 100% ownership, exercisable by Entain

4 years from closing and exercisable by the other shareholders from

November 2025

-- The tender offer document is expected to be published in

mid-July, with the acceptance period expected to commence shortly

afterwards

o The acceptance threshold of the Offer is set at 50%

o The Juroszek Foundations have made irrevocable undertakings to

tender their c.70% shareholding into the Offer, and therefore this

threshold will be met

o The Acquisition is also conditional upon antitrust approval,

and is expected to complete in Q3 2023

-- The Offer price of PLN 24.80 per share is made on the basis

that no dividends are to be paid or declared by STS to its

shareholders, including the recently proposed dividend of PLN 0.55

per share for the financial year 2022 and any advance on dividends

for financial year 2023 (which accordingly shall not be paid in

addition to the Offer price)

Financing

-- Entain's cash component of the consideration will be funded

through a non-pre-emptive equity placing of new ordinary shares

conducted through an accelerated bookbuild launched today, and via

a separate offer to retail investors via the PrimaryBid

platform.

-- This is expected to raise gross proceeds of approximately

GBP600m (representing c. 7.9% of Entain's issued share capital) to

primarily finance the Acquisition (GBP450m), as well as to fund

further near term acquisitions. The terms of the placing and retail

offer were announced separately today.

-- As a result of the Acquisition, equity placing, and retail

offer, Entain's FY23 Net Debt / EBITDA will be reduced by

approximately 0.3 x.

Morgan Stanley is acting as lead financial adviser to Entain as

part of the transaction with BofA Securities acting as financial

adviser and Santander Corporate and Investment Banking acting as

financial adviser and sole provider of the financing guarantee.

Clifford Chance LLP and Freshfields Bruckhaus Deringer LLP are

acting as legal advisers and Ernst & Young LLP providing tax

and structuring advice.

Oakvale Capital LLP and White & Case LLP are acting as sole

financial and legal advisers to STS and the Juroszek Foundations as

part of the transaction.

Jette Nygaard-Anderson, Entain's CEO, commented :

"We are delighted to be acquiring the leading sports-betting

operator in Poland, which is a hugely exciting and fast-growing

market. STS is an exceptional business with a great brand, a

compelling omnichannel offering, and an outstanding CEO and

management team. The transaction is perfectly aligned with our

Entain CEE strategy and our wider M&A strategy of acquiring

high quality businesses with leading positions in attractive,

growing and regulated markets.

E xpansion across Central and Eastern Europe remains a core

component of our growth plans, and STS will be an integral part of

our platform in that region."

Mateusz Juroszek, STS's CEO, commented:

"I am very excited to be joining the board of Entain CEE, and

see significant growth opportunities in the Polish market for STS

under Entain's ownership. Entain is a world class operator and has

already made a significant investment in this region through

SuperSport in Croatia. We could not have found a better partner to

help us take STS into the next phase of its growth, and it is clear

that Entain shares our ambition and vision for its future. I look

forward to continuing to lead and grow STS, and to working in close

collaboration with the Entain CEE team."

Th e Acquisition constitutes a Class 2 transaction for the

purposes of the UK Listing Rules. For the purposes of LR 10.4.1 R

(Notification of Class 2 transactions), the gross assets and

profits of STS were GBP85m and GBP42m, based on the Q1 2023 balance

sheet (as of 31 March 2023) and the full year 2022 audited accounts

respectively.

Notes

(1) Based on a PLNGBP exchange rate of 5.21, which is the

assumed exchange rate where relevant throughout this announcement.

Historical financials translated at appropriate historical FX rates

for that period or date.

(2) Enterprise value includes an adjustment for net cash

position on balance sheet. GBP10m+ of synergies are expected from

the transaction.

(3) The Juroszek Foundations will reinvest a proportion of the

sale proceeds for a 10% economic stake, assuming 100% acceptance of

the Offer. Depending on the level of acceptances to the tender

offer, the Foundations' economic interest in Entain CEE may be

initially higher (up to 11.5%) with a corresponding pro rata impact

on the Entain and EMMA holdings. However, this will be diluted back

to 10% in due course (and by mid-January 2025 in any event). This

reinvestment will be made by reference to the valuation of Entain

CEE that is in-line with the previously communicated value of

Entain CEE at the time of the SuperSport transaction.

(4) Market data per H2GC. Total Addressable Market (TAM) is

based on gross win across land based and interactive, excluding

lotteries.

(5) NGR presented as per STS accounting. FY22 financials

translated at average FY22 PLNGBP rate.

(6) Excluding the use and raise of the GBP150m additional

proceeds.

(7) As per Bloomberg.

(8) Arithmetic average of the average daily prices weighted by

the volume of trade in the stated period preceding the tender offer

notification in Poland on 13 June

(9) Consensus as per Refinitiv Eikon.

Presentation

A presentation for analysts and investors will be held today, 13

June, at 5:15PM. Participants may join via webcast or by conference

dial in:

Webcast link:

https://kvgo.com/IJLO/ENTAIN_Private_and_Confidential

To participate in the Q&A, please also connect via the

conference call dial in details:

UK +44 (0) 330 551 0200

US +1 786 697 3501

Access Code: Quote Entain when prompted by operator

Contact details

Entain plc

Investor Relations - Entain plc investors@Entaingroup.com

David Lloyd-Seed, Chief IR & Communications Officer

Davina Hobbs, Head of Investor Relations

Aimee Remey, VP US Investor Relations

Callum Sims, IR Manager

Media - Entain plc media@Entaingroup.com

Lisa Attenborough, Head of Corporate Communications

Jay Dossetter, Head of Corporate PR

Jodie Hitch, PR Manager

Morgan Stanley (Lead Financial Adviser and Joint Corporate

Broker)

Laurence Hopkins

Pawel Dela

Tom Perry

Tel: +44 (0) 20 7425 8000

BofA Securities (Financial Adviser and Joint Corporate

Broker)

Ed Peel

James Robertson

Tel: +44 (0) 20 7628 1000

Media - Powerscourt

Rory Godson / Rob Greening / Sam Austrums

Tel: +44 (0) 20 7250 1446

Entain@powerscourt-group.com

Contact for Polish Investors - Trigon Dom Maklerski S.A. (Polish

Tender Offer Intermediary)

Jan Rekowski

Tel: +48 22 330 11 11 / +48 604 574 337

LEI: 213800GNI3K45LQR8L28

About Entain plc

Entain plc (LSE: ENT) is a FTSE100 company and is one of the

world's largest sports betting and gaming groups, operating both

online and in the retail sector. The Group owns a comprehensive

portfolio of established brands; Sports brands include BetCity,

bwin, Coral, Crystalbet, Eurobet, Ladbrokes, Neds, Sportingbet,

Sports Interaction and SuperSport; Gaming brands include Foxy

Bingo, Gala, GiocoDigitale, Ninja Casino, Optibet, Partypoker and

PartyCasino. The Group owns proprietary technology across all its

core product verticals and in addition to its B2C operations

provides services to a number of third-party customers on a B2B

basis.

The Group has a 50/50 joint venture, BetMGM, a leader in sports

betting and iGaming in the US. Entain provides the technology and

capabilities which power BetMGM as well as exclusive games and

products, specially developed at its in-house gaming studios. The

Group is tax resident in the UK and is the only global operator to

exclusively operate in domestically regulated or regulating markets

operating in over 40 territories.

Entain is a leader in ESG, a member of FTSE4Good, the DJSI and

is AA rated by MSCI. The Group has set a science-based target,

committing to be carbon net zero by 2035 and through the Entain

Foundation supports a variety of initiatives, focusing on safer

gambling, grassroots sport, diversity in technology and

community

projects. For more information see the Group's website : www.entaingroup.com

About STS

STS is the leading omnichannel player in the high-growth and

regulated Polish market. The company has a diverse product

portfolio with a focus on high-growth categories including:

sportsbetting, betgames, virtual sports and e-sport (STS was the

first bookmaker in Poland to introduce this). As at the end of

2022, STS has c.2m registered players and 783k active users. STS

has a robust financial growth profile achieving +24% net gaming

revenue CAGR and +34% adjusted EBITDA CAGR since 2020. STS is led

by CEO Mateusz Juroszek who has significant experience in the

Polish gaming and broader CEE market.

Important notices

The person responsible for arranging for the release of this

announcement on behalf of Entain is Simon Zinger (General

Counsel).

This Announcement is for information only and does not itself

constitute or form part of an offer to sell or issue or the

solicitation of an offer to buy or subscribe for securities

referred to herein in any jurisdiction including, without

limitation, the United States, any other Restricted Territory (as

defined below) or in any jurisdiction where such offer or

solicitation is unlawful. No public offering of securities will be

made in connection with any securities referred herein in the

United Kingdom, the United States, any other Restricted Territory

or elsewhere.

This Announcement is restricted and is not for publication,

release, distribution or forwarding, in whole or in part, directly

or indirectly, in or into the United States of America (including

its territories and possessions, any state of the United States and

the District of Columbia (collectively, the "United States"),

Australia, Canada, the Republic of South Africa, Japan (each a

"Restricted Territory") or any other jurisdiction in which such

release, publication, distribution or forwarding would be unlawful.

No public offering of the securities referred to herein is being

made in any such jurisdiction or elsewhere. This information has

not been approved by the London Stock Exchange, nor is it intended

to be so approved.

The securities referred to herein have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "Securities Act"), or with any securities regulatory

authority of any state or other jurisdiction of the United States,

and may not be offered, sold or transferred directly or indirectly

in or into the United States, except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements

of the Securities Act and in compliance with the securities laws of

any state or any other jurisdiction of the United States. No public

offering of any securities referred to herein is being made in the

United States.

Persons distributing this Announcement must satisfy themselves

that it is lawful to do so. This Announcement is for information

purposes only and shall not constitute an offer to sell or issue or

the solicitation of an offer to buy, subscribe for or otherwise

acquire securities in any jurisdiction. Any failure to comply with

this restriction may constitute a violation of the securities laws

of such jurisdictions.

No offering document or prospectus will be made available in any

jurisdiction in connection with the matters contained or referred

to in this Announcement and no such offering document or prospectus

is required (in accordance with the EU Prospectus Regulation or UK

Prospectus Regulation) to be published.

Certain statements in this announcement are forward-looking

statements, including with respect to Entain's expectations,

intentions and projections regarding its future performance,

strategic initiatives, anticipated events or trends and other

matters that are not historical facts and which are, by their

nature, inherently predictive, speculative and involve risks and

uncertainty because they relate to events and depend on

circumstances that may or may not occur in the future. All

statements that address expectations or projections about the

future, including statements about operating performance, strategic

initiatives, objectives, market position, industry trends, general

economic conditions, expected expenditures, expected cost savings

and financial results are forward--looking statements. Any

statements contained in this announcement that are not statements

of historical fact are, or may be deemed to be, forward--looking

statements. These forward-looking statements, which may use words

such as "aim", "anticipate", "believe", "could", "intend",

"estimate", "expect", "may", "plan", "project" or words or terms of

similar meaning or the negative thereof, are not guarantees of

future performance and are subject to known and unknown risks and

uncertainties. There are a number of factors including, but not

limited to, commercial, operational, economic and financial

factors, that could cause actual results, financial condition,

performance or achievements to differ materially from those

expressed or implied by these forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond

Entain's ability to control or estimate precisely, such as changes

in taxation or fiscal policy, future

market conditions, currency fluctuations, the behaviour of other

market participants, the actions of governments or governmental

regulators, or other risk factors, such as changes in the

political, social and regulatory framework in which Entain operates

or in economic or technological trends or conditions, including

inflation, recession and consumer confidence, on a global, regional

or national basis. Given those risks and uncertainties, readers are

cautioned not to place undue reliance on forward-looking

statements. Forward-looking statements speak only as of the date of

this announcement. Entain and its affiliates, and any of its or

their respective directors, officers, partners, employees, advisers

or agents (collectively, "Representatives") expressly disclaim any

obligation or undertaking to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise unless required to do so by applicable

law or regulation.

In particular, no statement in this announcement is intended to

be a profit forecast or profit estimate and no statement of a

financial metric (including estimates of EBITDA, profit before tax,

free cash flow or net debt) should be interpreted to mean that any

financial metric for the current or future financial years would

necessarily match or exceed the historical published position of

Entain and its subsidiaries. Certain statements in this

announcement may contain estimates. The estimates set out in this

announcement have been prepared based on numerous assumptions and

forecasts, some of which are outside of Entain's influence and/or

control, and is therefore inherently uncertain and there can be no

guarantee or assurance that it will be correct. The estimates have

not been audited, reviewed, verified or subject to any procedures

by Entain's auditors. Undue reliance should not be placed on them

and there can be no guarantee or assurance that they will be

correct.

This announcement is being issued by and is the sole

responsibility of Entain. No representation or warranty, express or

implied, is or will be made as to, or in relation to, and no

responsibility or liability is or will be accepted by or on behalf

of Entain (apart from the responsibilities or liabilities that may

be imposed by the Financial Services and Markets Act 2000, as

amended or the regulatory regime established thereunder) or by its

affiliates or any of its Representatives as to, or in relation to,

the accuracy, adequacy, fairness or completeness of this

announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers or any other statement made or purported to be made by or

on behalf of Entain or any of its affiliates or any of its

Representatives in connection with Entain and any responsibility

and liability whether arising in tort, contract or otherwise

therefore is expressly disclaimed.

Morgan Stanley & Co. International plc ("Morgan Stanley"),

which is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential

Regulation Authority in the United Kingdom, is acting exclusively

as financial adviser to Entain and no one else in connection with

the Acquisition. In connection with such matters, Morgan Stanley,

its affiliates and their respective directors, officers, employees

and agents will not regard any other person as their client, nor

will they be responsible to anyone other than Entain for providing

the protections afforded to clients of Morgan Stanley nor for

providing advice in connection with the Acquisition, the contents

of this announcement or any matter referred to herein.

Merrill Lynch International ("BofA Securities"), which is

authorised by the Prudential Regulation Authority and regulated by

the Financial Conduct Authority and the Prudential Regulation

Authority in the UK, is acting as corporate broker and financial

adviser exclusively for Entain and for no one else in connection

with the matters referred to in this announcement and will not be

responsible to anyone other than Entain for providing the

protections afforded to its clients or for providing advice in

relation to the matters referred to in this announcement. Neither

BofA Securities, nor any of its affiliates, owes or accepts any

duty, liability or responsibility whatsoever (whether direct or

indirect, whether in contract, in tort, under statute or otherwise)

to any person who is not a client of BofA Securities in connection

with this announcement, any statement contained herein or

otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEASKDFSEDEFA

(END) Dow Jones Newswires

June 13, 2023 12:02 ET (16:02 GMT)

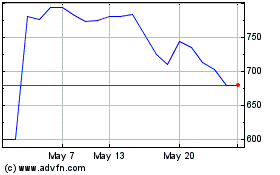

Entain (AQSE:ENT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Entain (AQSE:ENT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024