TIDMBVXP

Bioventix plc

("Bioventix" or "the Company")

Results for the year ended 30 June 2022

Bioventix plc (BVXP), a UK company specialising in the development and

commercial supply of high-affinity monoclonal antibodies for applications in

clinical diagnostics, announces its audited results for the year ended 30 June

2022.

Highlights:

· Revenue up 7% to £11.72 million (2021: £10.93 million)

· Profit before tax up 14% to £9.28 million (2021: £8.12 million)

· Cash at year end of £6.1 million (30 June 2021: £6.5 million)

· Second interim dividend of 74p per share (2021: 62p)

· Special dividend of 26p per share (2021: 38p)

Introduction and Technology

Bioventix creates, manufactures and supplies high affinity sheep monoclonal

antibodies (SMAs) for use in diagnostic applications. Bioventix antibodies are

preferred for use when they confer an improved test performance compared to

other available antibodies.

Most of our antibodies are used on blood-testing machines installed in

hospitals and other laboratories around the world. Bioventix makes antibodies

using our SMA technology for supply to diagnostic companies for subsequent

manufacture into reagent packs used on blood-testing machines. These

blood-testing machines are supplied by large multinational in vitro diagnostics

(IVD) companies such as Roche Diagnostics, Siemens Healthineers, Abbott

Diagnostics & Beckman Coulter. Antibody-based blood tests are used to help

diagnose many different conditions including, amongst others, heart disease,

thyroid function, fertility, infectious disease and cancer.

Over the past 18 years, we have created and supplied approximately 20 different

SMAs that are used by IVD companies around the world. We currently sell a total

of 15-20 grams of purified physical antibody per year, the vast majority of

which is exported. In addition to revenues from physical antibody supplies, the

sale by our customers of diagnostic products (based on our antibodies) to their

downstream end-users attracts a modest percentage royalty payable to Bioventix.

These downstream royalties currently account for approximately 70% of our

annual revenue.

Bioventix adopts one of two commercial approaches when creating new antibodies.

The first is own-risk antibody creation projects which gives Bioventix the

complete freedom to commercialise the antibodies produced. The second is

contract antibody creation projects in partnership with customers who supply

materials, know-how and funding and creates antibodies that can only be

commercialised with the partner company. In both cases, after initiation of a

new project, it takes around a year for our scientists to create a panel of

purified antibodies for evaluation by our customers. The evaluation process at

customers' laboratories generally requires the fabrication of prototype reagent

packs which can be compared to other tests, for example the customer's existing

commercial test or perhaps another "gold standard" method, on the assay machine

platform being considered. The process of subsequent development thereafter by

our customers can take many years before registration or approval from the

relevant authority, for example the US Food and Drug Administration (FDA) or EU

authorities, is obtained and products can be sold to the benefit of the

customers, and of course Bioventix, through the agreed sales royalty. This does

mean that there is a lead time of 4-10 years between our own research work and

the receipt by Bioventix of royalty revenue from product sales. However,

because of the resource required to gain such approvals, after having achieved

approval for an accurate diagnostic test using a Bioventix antibody, there is a

natural incentive for continued antibody use. This results in a barrier to

entry for potential replacement antibodies which would require at least partial

repetition of the approval process arising on a change from one antibody to

another. This barrier to antibody replacement arises from a combination of

factors driven by the clinical criticality of the test and the potential

consequences of making such a change which include the time and cost to

register any changes required to validate the performance of the replacement

antibody.

Another consequence of the lengthy approval process is that the revenue for the

current accounting period is derived from antibodies created many years ago.

Indeed, revenue growth over the next few years from, for example the troponin

antibodies, will come from research work already carried out many years ago. By

the same dynamics, the current research work active at our laboratories now is

more likely to influence sales in the period 2026-2036.

2021/2022 Financial Results

We are pleased to report our results for the financial year ended 30 June 2022.

Revenues for the year increased by 7% to £11.72 million (2020/21: £10.93

million). Profits before tax for the year increased by 14% to £9.28 million

(2020/21; £8.12million). Cash balances at the year-end were lower at £6.1

million (30 June 2021 £6.5 million).

Our most significant revenue stream continues to come from the vitamin D

antibody called vitD3.5H10. This antibody is used by a number of small, medium

and large diagnostic companies around the world for use in vitamin D deficiency

testing. Sales of vitD3.5H10 increased by 13% to £5.4 million which we believe

reflects an improved downstream market for vitamin D testing following a degree

of recovery from coronavirus pandemic effects.

Sales of our other core historic antibodies are featured below with the

respective percentage increase/decrease from 2020/21:

- T3 (tri-iodothyronine): £0.93 million (+25%);

- biotins and biotin blockers: £0.90 million (+67%)

- progesterone: £0.62 million (+14%);

- estradiol: £0.59 million (+34%);

- testosterone: £0.47 million (+7%);

- drug-testing antibodies: £0.38 million (-7%);

As expected, revenues from NT-proBNP terminated in August 2021 and resulted in

a loss of £1.2 million of revenues. This loss has been balanced by the increase

in revenues from the core antibodies together with increased troponin sales.

Total troponin antibody sales from Siemens Healthineers and another separate

technology sub-license almost doubled during the year to £1.23 million (2020/

21: £0.68 million). This significant increase clearly demonstrates a gathering

momentum of product roll-outs for the new high sensitivity troponin assays

supported by SMAs and we believe that these revenues will continue to grow.

Our shipments of physical antibody to China continued to increase. Some sales

are made directly but the majority are made through five appointed

distributors. Regulatory approvals for domestic Chinese customers have

considerable lead times but we are now seeing modest increases in royalty

payments flowing from these customers. The prospects for further growth in

China are good though we recognise that continued antibody technology

development in China and elsewhere does constitute a longer-term threat. In

addition, relative global geopolitical stability will be important for the

continued trade in technology products such as our antibodies.

Our underlying revenues are dominated by foreign currencies such as US Dollars

and Euros. When converting revenues to Sterling, our functional currency, in

the absence of any appropriate hedging mechanisms, they will be influenced by

movements in exchange rates. When Dollar and Euro monies are received, they are

immediately converted into Sterling at the exchange rate applying on the date

of arrival. We have no current plans to institute any hedging mechanisms to

cover future periods and therefore any future changes in exchange rates, up or

down, may impact our reported Sterling revenues accordingly. The majority of

our physical antibody sales are priced in US$. Our royalty revenues from our

multinational customers typically arrive in either US Dollars or Euros

depending on the location of the global finance centre of the customer.

However, the underlying assay sales that support the royalties will comprise a

basket of local currencies, dominated by Dollars, Euros and Asian currencies.

Overall, we estimate that 50-60% of our total sales are directly or indirectly

linked to US Dollars.

In the reporting period, US Dollar royalty revenues received in August relating

to sales by our customers in the period January to June 2022 were converted at

an exchange rate of approximately $1.2 to £1 compared to an exchange rate of

between $1.35-$1.40 to £1 for the same periods in the previous financial year.

This effect was additive to our Sterling revenues for the second half of the

year and contributed to a forex benefit in the year; on a constant currency

basis our turnover for 2021/22 would have been circa £11.3million and the

benefit therefore circa £0.4 million.

During the coronavirus pandemic, activity in the diagnostic pathways that exist

at hospitals and clinics around the world declined. We believe that the

activity within healthcare pathways has recovered more recently in some

territories and our sales have responded accordingly. We hope that this

represents a return to normality but predicting the dynamics of the pandemic

has confounded experts over the last 30 months.

Cash Flows and Dividends

As reported above, the performance of the business during the year generated

cash balances at the year-end of £6.1 million and royalties received during

quarter 3 of 2022 have added to this balance. The Board has determined that is

appropriate to maintain the established dividend policy in the immediate

future. For the current year, the Board is pleased to announce a second interim

dividend of 74 pence per share which, when added to the first interim dividend

of 52 pence per share makes a total of 126 pence per share for the current

year.

Our current view continues to be that maintaining a cash balance of

approximately £5 million is sufficient to facilitate operational and strategic

agility both with respect to possible corporate or technological opportunities

that might arise in the foreseeable future. We have therefore decided to

distribute surplus cash that is in excess of anticipated needs and we are

pleased to announce a special dividend of 26 pence per share.

Accordingly, dividends totaling 100 pence per share will be paid in November

2022. The shares will be marked ex-dividend on 3 November 2022 and the dividend

will be paid on 18 November 2022 to shareholders on the register at close of

business on 4 November 2022.

Research and Future Developments

Over the next few years, the continued commercial development of the new

troponin assays and their roll out by our customers will have the most

significant influence on Bioventix sales.

We have undertaken a range of new research projects over the previous few years

and in the table below we have illustrated our current view of their potential

value and probability of success:

Increasing high Secretoneurin Tau (Alzheimer's,

potential (CardiNor) own-risk)

value Amyloid

(Pre-Diagnostics)

medium Biotin blockers

[1]

Low Industrial Pyrene

biomonitoring biomonitoring

(benzene, THC sandwich [1]

isocyanates)

Low Medium high

Increasing probability of success ->

Table notes:

[1] Projects were successful and modest sales now contribute total sales

Whilst antibodies in the future pipeline are at stages of testing and

development that do not allow us to make any prediction about their potential

value and influence on future revenues there has still been encouraging

progress.

Our partners at CardiNor (Oslo) have continued with their work to try and

identify the possible utility of secretoneurin in heart failure patients and in

particular those patients who might be candidates for implantable cardiac

devices (ICDs). Data from recent patient sample studies does show a link with

heart disease read-outs. The next step for CardiNor will be to define the

potential utility of secretoneurin diagnostics in cardiac health.

Pre-Diagnostics (also in Oslo) and their clinical collaborators have two

amyloid beta assays based on Bioventix antibodies available for research use.

The goal of the project is to identify fragments of amyloid beta in patient

samples that would be helpful in Alzheimer's diagnostics. A new area of

interest is the diagnosis of ARIA, a side-effect related to new anti-amyloid

drugs.

Another biomarker that has shown potential in Alzheimer's diagnostics is the

Tau protein in the form of total Tau and phosphorylated Tau. During the year we

created more anti-Tau antibodies and this work will continue into 2023. Our

academic collaborators at the University of Gothenburg have used our antibodies

to create prototype assays and have generated encouraging data from patient

blood samples. The levels of Tau detected using our antibodies are

approximately 2 times higher in Alzheimer's samples compared to controls, a

ratio of 2 times being similar to other research groups. Our scientific target

ratio is slightly higher at 4-5 times. We are encouraged by this progress and

plan to create more antibodies to support further work with our collaborators

in Gothenburg during 2023. The recent success of the Eisai/Biogen lecanemab

clinical trial is likely to increase the need for early diagnostics and we are

very fortunate to be working with one of the world's leading labs focussed on

Alzheimer's biomarkers and tests.

The biotin "blocker" antibodies and THC sandwich antibodies reviewed in our

previous reports have now progressed at customers and modest sales are now

being generated to add to our total revenues.

Our pyrene lateral flow system for industrial pollution biomonitoring completed

a trial at a UK industrial site during quarter 4 of 2021. This went well and we

plan to conduct additional site studies during 2023. We accept that the

creation, manufacture and supply of final assay products is outside our normal

focus of bulk antibody sales but we believe that through our own efforts we can

substantiate the viability of such products and generate demand, thereby

stimulating the interest of future commercial partners.

The progress of the pyrene project has encouraged us to consider additional

assays for benzene and isocyanates, also in the field of industrial health and

safety. Benzene exposure is of relevance to the petroleum industry and

isocyanates are hazardous chemicals used in the manufacture of polyurethane

paints and plastics. This work will continue into 2023 and 2024.

Future Strategy

We have previously identified diagnostic biomarkers that we believe suit our

antibody technology and have found academic collaborators who have seen merit

in working with Bioventix. This pursuit will continue into the future to

support the internal organic growth of our business.

We will continue to rely on our core SMA antibody creation technology which

consistently helps us to create superior antibodies for our research projects.

We are also incorporating additional newer technologies where such technologies

are helpful to us. We have successfully created "sandwich" assay formats for

pyrene and THC/cannabis using a combination of primary SMA technology and a

secondary synthetic "anti-complex" antibody created using the "antibody

library" technology of a third party. The synergy of the two technologies

provided unique solutions to pyrene and THC/cannabis and we will seek more such

opportunities in the field of small molecule detection.

We are also using new production techniques to improve the yields of our

manufacturing processes. We have had success in transferring some antibody

production from sheep cells to more productive hamster cell systems. E.coli

bacteria have also been used to good effect with certain antibody production

systems. These technologies combine to increase yields and increase effective

production capacity whilst also reducing unit costs.

The Bioventix Team and Facility

The composition of the Bioventix team of 12 full-time equivalents has remained

stable over the year facilitating excellent performance and know how retention.

The past 30 months has been a challenging period for everyone and we are very

grateful to the team at Bioventix for their dedication over this period which

has allowed us to adapt and modify our business to cope with the effects of the

pandemic whilst still maintaining our progress.

Supply chain issues relating to plastics and chemical reagents have persisted

during the year but have been expertly managed by our procurement team.

Turmoil in the energy market has added another risk factor with some energy

commentators predicting power outages during the winter of 2022/23. We plan to

use our diesel generator and reserve fuel supplies to minimise any disruption

caused to the lab by any such power outages.

Environmental, Social and Governance

Our production processes do consume quantities of reagents and plastics. A key

goal for the company is to use our various technologies to reduce the

quantities of materials we consume. The use of bioreactor technology does

result in a significant reduction in plastics consumption and we have converted

one antibody to this production format during the year.

Genetic engineering techniques can also be used to enhance antibody

productivity and we have successfully implemented techniques for one antibody

during the year resulting in a four-fold increase in yield.

The mass immunisation of sheep to make serum-based reagents for clinical assays

has been common-place since the 1970s. SMAs made in vitro can substitute for

this large scale use of animals and our T4 (thyroxine) antibody is reaching the

market thereby resulting in a reduction in animal usage.

Over the last 20 years, our SMAs have been used to improve the diagnostic

processes at hospitals around the world. This has resulted in improved

diagnostic tests for heart disease, thyroid function & fertility. Our goal over

the next few years is to extend this success to dementia diagnostics.

Internally at Bioventix, we value our team and seek ways to help them as they

develop their lives. We have been supportive of recent parents in their desire

to return to work and we now have four parents who work part-time having

returned to the lab after parental leave.

Regarding corporate Governance, we continue to follow the guidelines of the

Quoted Companies Alliance as described in our Governance report above. We are

aware of the need to increase the diversity of our Board whilst maintaining

skills and experience to underpin corporate culture and support business

continuity which both bring benefits for all our stakeholders. Like many

businesses limited candidate availability has compromised our progress in this

regard but our efforts will continue.

Conclusion and Outlook

We are pleased with our financial results for the year which we believe reflect

both the growth in the use of our products and of course some relief from the

global pandemic. In particular the continued roll-out of the high sensitivity

troponin assays and the royalties associated with them have combined to help

replace revenues from NT-proBNP which ceased from August 2021. After stripping

out the impact of these 2 significant changes the growth in our underlying

business over the year is in the range 8-10% which we believe is sustainable

for the immediate future as our sales mix continues to change.

Excellent technical progress has been made with our research projects and we

anticipate that our pipeline of opportunities will create additional

shareholder value in the period 2026 to 2036.

For further information please contact:

Bioventix plc Tel: 01252 728 001

Peter Harrison Chief Executive Officer

finnCap Ltd Tel: 020 7220 0500

Geoff Nash/Simon Hicks Corporate Finance

Alice Lane ECM

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law

by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed

in accordance with the company's obligations under Article 17 of MAR.

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED 30 JUNE 2022

2022 2021

£ £

Turnover 11,719,271 10,930,588

Cost of sales (710,446) (817,448)

Gross profit 11,008,825 10,113,140

Administrative expenses (1,605,446) (1,506,741)

Difference on foreign exchange 92,856 (294,046)

Research and development tax credit 22,160 32,878

Share option charge (244,871) (257,629)

Operating profit 9,273,524 8,087,602

Interest receivable and similar income 4,804 30,628

Interest payable and expenses (303) -

Profit before tax 9,278,025 8,118,230

Tax on profit (1,603,874) (1,386,882)

Profit for the financial year 7,674,151 6,731,348

Other comprehensive income for the year

Total comprehensive income for the year 7,674,151 6,731,348

Earnings per share:

2022 2021

£ 147.32 £ 129.22

Basic

Diluted 145.90 127.94

STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2022

2022 2021

£ £

Tangible assets 694,370 843,720

Investments 610,039 610,039

1,304,409 1,453,759

Current assets

Stocks 461,815 332,459

Debtors: amounts falling due 5,224,717 4,625,967

within one year

Cash at bank and in hand 6,126,650 6,494,985

11,813,182 11,453,411

Creditors: amounts falling due

within one year (1,252,165) (1,008,772)

Net current assets 10,561,017 10,444,639

Total assets less current 11,865,426 11,898,398

liabilities

Provisions for liabilities

Deferred tax (44,276) (78,084)

(44,276) (78,084)

Net assets 11,821,150 11,820,314

Capital and reserves

Called up share capital 260,467 260,467

Share premium account 1,332,471 1,332,471

Capital redemption reserve 1,231 1,231

Profit and loss account 10,226,981 10,226,145

11,821,150 11,820,314

STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30 JUNE 2022

Called up Share Capital Profit and Total

share premium redemption loss account equity

capital account reserve

£ £ £ £ £

At 1 July 2021 260,467 1,332,471 1,231 10,226,145 11,820,314

Comprehensive income for the

year

Profit for the year - - - 7,674,151 7,674,151

Dividends: Equity capital - - - (7,918,186) (7,918,186)

Transfer to/from profit and - - - 244,871 244,871

loss account

Total transactions with owners - - - (7,673,315) (7,673,315)

At 30 June 2022 260,467 1,332,471 1,231 10,226,981 11,821,150

STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30 JUNE 2021

Called up Share Capital Profit and Total

share premium redemption loss account equity

capital account reserve

£ £ £ £ £

At 1 July 2020 260,392 1,312,323 1,231 10,946,981 12,520,927

Comprehensive income for the

year

Profit for the year - - - 6,731,348 6,731,348

Dividends: Equity capital - - - (7,709,813) (7,709,813)

Shares issued during the year 75 20,148 - - 20,223

Share option charge - - - 257,629 257,629

Total transactions with owners 75 20,148 - (7,452,184) (7,431,961)

At 30 June 2021 260,467 1,332,471 1,231 10,226,145 11,820,314

STATEMENT OF CASH FLOWS FOR THE YEARED 30 JUNE 2022

2022 2021

£ £

Cash flows from operating activities

Profit for the financial year 7,674,151 6,731,348

Adjustments for:

Depreciation of tangible assets 143,392 135,103

Loss on disposal of tangible assets 17,714 (500)

Interest paid 303 -

Interest received (4,804) (30,628)

Taxation charge 1,603,874 1,386,882

(Increase) in stocks (129,356) (87,036)

(Increase) in debtors (598,752) (976,596)

Increase in creditors 76,347 59,514

Corporation tax (paid) (1,470,634) (1,138,410)

Share option charge 244,871 257,629

Net cash generated from operating activities 7,557,106 6,337,306

Cash flows from investing activities

Purchase of tangible fixed assets (11,756) (260,327)

Sale of tangible fixed assets - 500

Interest received 4,804 30,628

Net cash from investing activities (6,952) (229,199)

Cash flows from financing activities

Issue of ordinary shares - 20,223

Dividends paid (7,918,186) (7,709,813)

Interest paid (303) -

Net cash used in financing activities (7,918,489) (7,689,590)

Net (decrease) in cash and cash equivalents (368,335) (1,581,483)

Cash and cash equivalents at beginning of year 6,494,985 8,076,468

Cash and cash equivalents at the end of year 6,126,650 6,494,985

Cash and cash equivalents at the end of year comprise:

Cash at bank and in hand 6,126,650 6,494,985

6,126,650 6,494,985

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEARED 30 JUNE 2022

1. Accounting policies

1.1 Basis of preparation of financial statements

The financial statements have been prepared under the historical cost

convention unless otherwise specified within these accounting policies and in

accordance with Financial Reporting Standard 102, the Financial Reporting

Standard applicable in the UK and the Republic of Ireland and the Companies Act

2006.

The preparation of financial statements in compliance with FRS 102 requires the

use of certain critical accounting estimates. It also requires management to

exercise judgment in applying the Company's accounting policies (see note 3).

The following principal accounting policies have been applied:

1.2 Revenue

Turnover is recognised for product supplied or services rendered to the extent

that it is probable that the economic benefits will flow to the Company and the

turnover can be reliably measured. Turnover is measured as the fair value of

the consideration received or receivable, excluding discounts, rebates, value

added tax and other sales taxes. The following criteria determine when turnover

will be recognised:

Direct sales

Direct sales are generally recognised at the date of dispatch unless

contractual terms with customers state that risk and title pass on delivery of

goods, in which case revenue is recognised on delivery.

R&D income

Subcontracted R&D income is recognised based upon the stage of completion at

the year-end.

Licence revenue and royalties

Annual licence revenue is recognised, in full, based upon the date of invoice.

Royalties are accrued over period to which they relate and revenue is

recognised based upon returns and notifications received from customers. In the

event that subsequent adjustments to royalties are identified they are

recognised in the period in which they are identified.

1.3 Foreign currency translation Functional and presentation currency

The Company's functional and presentational currency is GBP.

Transactions and balances

Foreign currency transactions are translated into the functional currency using

the spot exchange rates at the dates of the transactions.

At each period end foreign currency monetary items are translated using the

closing rate. Non- monetary items measured at historical cost are translated

using the exchange rate at the date of the transaction and non-monetary items

measured at fair value are measured using the exchange rate when fair value was

determined.

1.4 Interest income

Interest income is recognised in profit or loss using the effective interest

method.

1.5 Finance costs

Finance costs are charged to profit or loss over the term of the debt using the

effective interest method so that the amount charged is at a constant rate on

the carrying amount. Issue costs are initially recognised as a reduction in the

proceeds of the associated capital instrument.

1.6 Pensions

Defined contribution pension plan

The Company operates a defined contribution plan for its employees. A defined

contribution plan is a pension plan under which the Company pays fixed

contributions into a separate entity. Once the contributions have been paid the

Company has no further payment obligations.

The contributions are recognised as an expense in profit or loss when they fall

due. Amounts not paid are shown in accruals as a liability in the Statement of

financial position. The assets of the plan are held separately from the Company

in independently administered funds.

1.7 Current and deferred taxation

Current and deferred tax are recognised as an expense or income in the

Statement of Comprehensive Income, except when they relate to items credited or

debited directly to equity, in which case the tax is also recognised directly

in equity. The current income tax charge is calculated on the basis of tax

rates and laws that have been enacted or substantively enacted by the reporting

date in the countries where the Company operates and generates income.

Deferred tax balances are recognised in respect of all timing differences that

have originated but not reversed by the reporting date, except that:

· The recognition of deferred tax assets is limited to the extent that it

is probable that they will be recovered against the reversal of deferred tax

liabilities or other future taxable profits; and

· Any deferred tax balances are reversed if and when all conditions for

retaining associated tax allowances have been met.

Deferred tax balances are not recognised in respect of permanent differences

except in respect of business combinations, when deferred tax is recognised on

the differences between the fair values of assets acquired and the future tax

deductions available for them and the differences between the fair values of

liabilities acquired and the amount that will be assessed for tax. Deferred tax

is determined using tax rates and laws that have been enacted or substantively

enacted by the reporting date.

1.8 Research and development

Research and development expenditure is written off in the year in which it is

incurred.

1.9 Tangible fixed assets

Tangible fixed assets under the cost model are stated at historical cost less

accumulated depreciation and any accumulated impairment losses. Historical cost

includes expenditure that is directly attributable to bringing the asset to the

location and condition necessary for it to be capable of operating in the

manner intended by management.

Land is not depreciated. Depreciation on other assets is charged so as to

allocate the cost of assets less their residual value over their estimated

useful live

Freehold property - 2% straight line

Plant and equipment - 25% straight line

Motor Vehicles - 25% straight line

Fixtures & Fittings - 25% straight line

Equipment - 25% straight line

1.10 Valuation of investments

Investments in unlisted Company shares, whose market value can be reliably

determined, are remeasured to market value at each reporting date. Gains and

losses on remeasurement are recognised in the Statement of comprehensive income

for the period. Where market value cannot be reliably determined, such

investments are stated at historic cost less impairment.

1.11 Stocks

Stocks are stated at the lower of cost and net realisable value, being the

estimated selling price less costs to complete and sell. Cost includes all

direct costs and an appropriate proportion of fixed and variable overheads.

At each balance sheet date, stocks are assessed for impairment. If stock is

impaired, the carrying amount is reduced to its selling price less costs to

complete and sell. The impairment loss is recognised immediately in profit or

loss.

1.12 Debtors

Short-term debtors are measured at transaction price, less any impairment.

Loans receivable are measured initially at fair value, net of transaction

costs, and are measured subsequently at amortised cost using the effective

interest method, less any impairment.

1.13 Cash and cash equivalents

Cash is represented by cash in hand and deposits with financial institutions

repayable without penalty on notice of not more than 24 hours. Cash equivalents

are highly liquid investments that mature in no more than twelve months from

the date of acquisition and that are readily convertible to known amounts of

cash with insignificant risk of change in value.

In the Statement of cash flows, cash and cash equivalents are shown net of bank

overdrafts that are repayable on demand and form an integral part of the

Company's cash management.

1.14 Creditors

Short-term creditors are measured at the transaction price. Other financial

liabilities, including bank loans, are measured initially at fair value, net of

transaction costs, and are measured subsequently at amortised cost using the

effective interest method.

1.15 Provisions for liabilities

Provisions are made where an event has taken place that gives the Company a

legal or constructive obligation that probably requires settlement by a

transfer of economic benefit, and a reliable estimate can be made of the amount

of the obligation.

Provisions are charged as an expense to profit or loss in the year that the

Company becomes aware of the obligation, and are measured at the best estimate

at the reporting date of the expenditure required to settle the obligation,

taking into account relevant risks and uncertainties.

When payments are eventually made, they are charged to the provision carried in

the Statement of financial position.

1.16 Financial instruments

The Company only enters into basic financial instrument transactions that

result in the recognition of financial assets and liabilities like trade and

other debtors and creditors, loans from banks and other third parties, loans to

related parties and investments in ordinary shares.

1.17 Dividends

Equity dividends are recognised when they become legally payable. Interim

equity dividends are recognised when paid. Final equity dividends are

recognised when approved by the shareholders at an annual general meeting.

1.18 Employee benefits-share-based compensation

The company operates an equity-settled, share-based compensation plan. The fair

value of the employee services received in exchange for the grant of the

options is recognised as an expense over the vesting period. The total amount

to be expensed over the vesting period is determined by reference to the fair

value of the options granted. At each balance sheet date, the company will

revise its estimates of the number of options are expected to be exercisable.

It will recognise the impact of the revision of original estimates, if any, in

the profit and loss account, with a corresponding adjustment to equity. The

proceeds received net of any directly attributable transaction costs are

credited to share capital (nominal value) and share premium when the options

are exercised.

2. Judgments in applying accounting policies and key sources of

estimation uncertainty

In the application of the company's accounting policies, management is required

to make judgments, estimates and assumptions. These estimates and underlying

assumptions and are reviewed on an ongoing basis.

Carrying value of Unlisted Investments

The Company holds two unlisted investments in companies carrying out research

in identifying biomarkers for diagnosing health conditions. The Directors have

reviewed the progress of this research over the last year. In common with much

scientific research there is uncertainty, both in relation to the science and

to the commercial outcome, and no information to be able to reliably calculate

a fair value for these investments. The carrying value of these investments

will continue to be historic cost.

3. Turnover

An analysis of turnover by class of business is as follows:

2022 2021

£ £

Product revenue and R&D income 3,592,556 3,620,416

Royalty and licence fee income 8,126,715 7,310,172

11,719,271 10,930,588

2022 2021

£ £

United Kingdom 787,046 824,518

European Union 1,327,360 1,246,024

Rest of the world 9,604,865 8,860,046

11,719,271 10,930,588

4. Operating profit

The operating profit is stated after charging: 2022 2021

£ £

Depreciation of tangible fixed assets 143,392 135,104

Fees payable to the Company's auditor and its associates for the

audit of the Company's annual financial statements 25,000 12,500

Exchange differences (92,856) 294,046

Research and development costs 975,317 1,201,236

5. Taxation

2022 2021

£ £

Corporation tax

Current tax on profits for the year 1,637,682 1,359,036

Total current tax 1,637,682 1,359,036

Deferred tax

Origination and reversal of timing differences (33,808) 27,846

Total deferred tax (33,808) 27,846

1,603,874 1,386,882

Taxation on profit on ordinary activities

Factors affecting tax charge for the year

The tax assessed for the year is higher than (2021 - lower than) the standard

rate of corporation tax in the UK of 19% (2021 - 19%). The differences are

explained below:

2022 2021

£ £

Profit on ordinary activities before tax 9,278,025 8,118,230

Profit on ordinary activities multiplied by standard 1,762,825 1,542,464

rate of corporation tax in the UK of 19% (2021 - 19%)

Effects of:

Expenses not deductible for tax purposes, other than 83 42

goodwill amortisation and impairment

Capital allowances for year in excess of depreciation 27,048 (6,398)

Research and development tax credit (198,799) (226,022)

Share based payments 46,525 48,950

Other differences leading to an increase in the tax (33,808) 27,846

charge

Total tax charge for the year 1,603,874 1,386,882

Factors that may affect future tax charges

The rate of corporation tax in the UK is set to be increased from the current

rate of 19% to 25% with effect from 1 April 2023. This change will increase the

tax charge in future years such that, had the change been in place in the

current year, it would have increased by £517,163 from £1,603,874 to £

2,121,037.

6. Dividends

2022 2021

£ £

Dividends paid 7,918,186 7,709,813

7,918,186 7,709,813

7. Share capital

2022 2021

£ £

Allotted, called up and fully paid

5,209,333 (2021 - 5,209,333) Ordinary shares of £0.05 260,467 260,467

each

The holders of ordinary shares are entitled to receive dividends as declared

and are entitled to one vote per share at meetings of the Company. All ordinary

shares rank equally with regard to the Company's residual assets.

8. Share based payments

During the year the company operated 2 share option schemes; an Approved EMI

Share Option Scheme and an Unapproved Share Option Scheme to incentivise

employees.

The company has applied the requirements of FRS 102 Section 26 Share-based

Payment to all the options granted under both schemes. The terms for granting

share options under both schemes are the same and provide for an option price

equal to the market value of the Company's shares on the date of the grant and

for the Approved EMI Share Option Scheme this price is subsequently agreed with

HMRC Shares and Assets Valuation Division.

The contractual life of an option under both schemes is 10 years from the date

of grant. Options granted become exercisable on the third anniversary of the

date of grant. Exercise of an option is normally subject to continued

employment, but there are also considerations for good leavers. All share based

remuneration is settled in equity shares.

Weighted Weighted

average average

exercise exercise

price price

(pence) Number (pence) Number

2022 2022 2021 2021

Outstanding at the beginning of the 2942.00 52,204 2,942.00 57,103

year

Granted during the year - - -

Forfeited during the year 3855.00 (1,706) 3855.00 (3,401)

Exercised during the year - - 1350.00 (1,498)

Outstanding at the end of the year 2896.00 50,498 2928.00 52,204

2022 2021

Option pricing model used Issue price

Exercise price (pence)

Black Scholes

£13.50-

£38.55

£13.50-

£38.55

Black Scholes

£13.50-

£38.55

£13.50-

£38.55

Option

life

10

years

10 years

Expected

volatility

25.15%

25.15%

Fair value at measurement date

£4.66 -

£26.91

£4.66 -

£26.91

Risk-free interest

rate

0.18%

0.18%

The expected volatility is based upon the historical volatility over the period

since the Company's shares were listed on AIM.

The expense recognised for share-based payments during the year ended 30 June

2022 was £244,871 (2021 : £257,629).

The number of staff and officers holding share options at 30 June 2022 was 13

(2021: 14). The share options have been issued to underpin staff service

conditions.

9. Publication of Non-Statutory Accounts

The financial information set out in this preliminary announcement does not

constitute the Group's financial statements for the year ended 30 June 2022.

The financial statements for the year ended 30 June 2021 have been delivered to

the Registrar of Companies. The financial statements for the year ended 30 June

2022 will be delivered to the Registrar of Companies following the Company's

Annual General Meeting. The auditors' report on both accounts was unqualified,

did not include references to any matters to which the auditors drew attention

by way of emphasis without qualifying their report and did not contain

statements under sections 498(2) or (3) of the Companies Act 2006. The audited

financial statements of Bioventix plc for the period ended 30 June 2022 are

expected to be posted to shareholders shortly, will be available to the public

at the Company's registered office, 7 Romans Business Park, East Street,

Farnham, Surrey, GU9 7SX and available to view on the Company's website at

www.bioventix.com once posted.

END

(END) Dow Jones Newswires

October 24, 2022 02:02 ET (06:02 GMT)

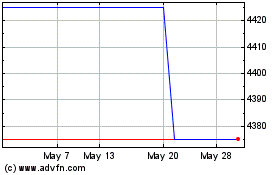

Bioventix (AQSE:BVXP.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bioventix (AQSE:BVXP.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024