Investing in emerging markets comes with risks in a taper-trodden

2014. These markets enjoyed heavy investment when interest rates

were ultra low in the developed world, but things are fated to take

a sharp turn thanks to the beginning of the end of a cheap-dollar

era (read: 3 ETFs Tumble Most on Emerging Market Sell-Off).

The fear of less hot money inflows, tumbling currency, current

account deficit and slowing internal growth are common problems for

most of the nations. As a result, investors have begun to flee the

space to start this year.

While many region-specific ETFs plunged severely in the

year-to-date frame (thanks to their own internal crisis), the slump

in the biggest and broader emerging market ETF –

Vanguard

FTSE Emerging Markets ETF (

VWO) – was

relatively low, and quite shockingly that too was as deep as

6.61%.

Amid such a turbulent situation, a handful of emerging market ETFs

kicked off 2014 on stronger footing and have held up pretty well so

far. First of all, some smaller emerging markets/frontier markets

are giving outstanding performances this year.

These are

Market Vectors’ Egypt

ETF (

EGPT) and

Vietnam

ETF (VNM). EGPT retuned about 28%, which

is the best in the overall emerging market space, while VNM is up

close to 17.7% this year.

Basically, improvement in both the political and the economic

backdrop is propelling this undervalued Egypt ETF. On the other

hand, Vietnam continues to be the main beneficiary of the migration

of low-end manufacturing out of China as the wage level of the

former is half of the latter.

Also, the shift in China’s strategy to enhance domestic consumption

is going to give a big-time boost to Vietnam’s outsourcing industry

(read: How Frontier Market ETFs Surged as EMs Plunged).

However, let’s not consider these frontier markets and look for

some top performing ‘traditional’ emerging markets, and briefly

highlight some reasons behind their surge (read: iShares Plans New

Type of Emerging Market ETFs):

Indonesia

Leaving many investors in utter shock, the Indonesian ETF was off

to a stunning run this year despite inflation, current account and

currency issues. The rupiah has been emerging as Asia's best

performing currency in 2014, as per Reuters.

Inflation and current deficits are also falling. Though the

bank of Indonesia slashed its 2014 growth target from 5.8–6.2% to

5.5–5.9% in the wake of relatively weak consumption and investment,

it still is way higher than the projected growth rate offered by

several developed nations.

Indonesian shares saw the biggest rally in Asia following Vietnam

as net inflows by foreign investors rose to about $907 million, the

maximum in regional markets, as per Bloomberg. Moreover, government

has offered tax incentives for building factories and attracting

foreign investments in ports and airports.

The country’s current-account deficit is expected to fall to 2.5%

this year, from about 3.3% last year, according to Bank of

Indonesia. Also, Indonesia is due for its parliamentary election in

April and presidential election in July.

Thus, the possibility of an influx of campaign spending is more in

the companies having more domestic exposure especially which are

engaged in food, consumer staples and media businesses, as per

Bloomberg.

As a result,

Market Vectors Indonesia Small-Cap ETF

(IDXJ) was the second

best emerging market ETF this year adding about 27.23% while

iShares MSCI Indonesia Investable Market Index Fund

(EIDO) and

Market Vectors Indonesia Index ETF

(IDX) also returned

24.78% and 20.0%, respectively, securing places in the top-five

emerging ETF performers list.

Philippines

The Philippines economy has also shown promise, having expanded at

the fastest clip since the 1950s over the last two years. Than

nation logged GDP growth of 7.2% in 2013 on top of 6.8% in 2012

despite the multi-billion peso wreckage from Super Typhoon Haiyan

(which hit the island nation in early November). Philippine growth

rate came a little short of the Chinese growth rate of 7.7% in

2013.

This year,

iShares MSCI Philippines Investable Market

Index (

EPHE), the only pure-play ETF

focused on the Philippines market, has gained about 8.32%. The

country has reiterated its growth projection of 6.5% to 7.5% for

this year, though some predict that the country may see growth less

than 6.0% this year.

As per Barclays, growth will be helped by reconstruction activity

in Philippines (read: Solid Growth Puts Philippines ETF in Focus).

Also, positive January data on remittances from Filipinos abroad

and the World Bank's optimistic view on the nation this year are

other factors behind the ETF’s nice run.

Thailand

Thailand has been seeing quite a bit of turmoil in recent times

thanks to a prolonged political mayhem which in turn cast a shadow

on its near-term growth outlook. The state planning agency last

month reduced its GDP growth forecast for this year to 3% to 4%

from 4% to 5% range which seems still respectable after so much

political gridlock (read: Where Does the Thailand ETF Go From

Here?).

However, in order to restore some confidence in the nation’s

financial market and boost the politically troubled growth rate,

Thailand slashed its one-day bond repurchase rate by 25 bps to 2%.

Prior to this, the nation went for a rate cut last November as

political unrest crippled the demand for its all-important tourism

sector and the central bank is striving hard to boost other sectors

in the economy, especially consumption and business investment. The

rate has now touched its lowest point since late 2010.

A decent inflation rate (presently at 1.96%) helped the Bank of

Thailand to take such a step. Also, a likely lift in emergency

rule imposed in January 2014 for a timeframe of 60 days gave

the much-needed boost to the Thai stock market. The reduced

interest rate spread cheers among investors. The core Thailand ETF,

iShares MSCI Thailand Investable Market Index Fund

(THD), has advanced

6.74% this year.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

MKT VEC-EGYPT (EGPT): ETF Research Reports

ISHARS-MS INDON (EIDO): ETF Research Reports

ISHARS-MS PHILP (EPHE): ETF Research Reports

MKT VEC-INDONES (IDX): ETF Research Reports

MKT VEC-INDO SC (IDXJ): ETF Research Reports

MKT VEC-VIETNAM (VNM): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

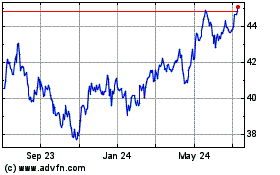

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Dec 2024 to Jan 2025

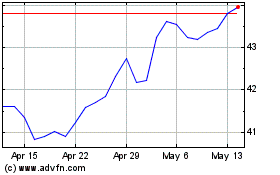

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Jan 2024 to Jan 2025