Free Writing Prospectus

VanEck Merk Gold Trust

2021-04-22 Quarterly Webinar

0001546652

Pursuant to 433/164

333-238022

Merk Outlook Webinar Please read important risk disclosure information towards the end of this presentation. • Outlook on markets & economy • U.S. dollar, gold, currency dynamics • Merk Funds

VanEck Merk Gold Trust (“OUNZ”) Disclosure OUNZ must be preceded or accompanied by the prospectus. Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which is available at www.merkgold.com/prospectus . Please read the prospectus carefully before you invest. Investing involves risk, including possible loss of principal. The Trust is not an investment company registered under the investment Company act of 1940 or a commodity pool for the purposes of the Commodity Exchange Act. Shares of the Trust are not subject to the same regulatory requirements as mutual funds. Because shares of the Trust are intended to reflect the price of the gold held in the Trust, the market price of the shares is subject to fluctuations similar to those affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value (“NAV”). Brokerage commissions will reduce returns. Commodities and commodity - index linked securities may be affected by changes in overall market movements and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators and arbitrageurs in the underlying commodities. Trust shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of Trust shares relates directly to the value of the gold held by the Trust (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. The Trust does not generate any income, and as the Trust regularly issues shares to pay for the Sponsor’s ongoing expenses, the amount of gold represented by each Share will decline over time. Investing involves risk, and you could lose money on an investment in the Trust. The request for redemption of shares for gold is subject to a number of risks including but not limited to the potential for the price of gold to decline during the time between the submission of the request and delivery. Delivery may take considerable time depending on your location. For a more complete discussion of the risk factors relative to the trust, carefully read the prospectus. The sponsor of the Trust is Merk Investments LLC (the “Sponsor”). VanEck and Foreside Fund Services, LLC, provide marketing services to the Trust. www.merkinvestments.com 2 © 202 1 M e r k I n v e s t m e n t s ®

U.S. Business Cycle Source: Bloomberg, © Merk Investments LLC www.merkinvestments.com 3 © 202 1 M e r k I n v e s t m e n t s ®

Source: Bloomberg, © Merk Investments LLC www.merkinvestments.com 4 © 202 1 M e r k I n v e s t m e n t s ®

The U.S. dollar is currently modestly overvalued based on relative PPP. Framework: Nominal exchange rates tend to gravitate toward their long - run purchasing power parity (PPP) equilibrium values. The foundation for PPP is the so - called “law of one price,” which suggests that identical goods should trade at the same price across countries when valued in terms of a common currency. Relative PPP extends the law of one price to a broad range of goods and services and takes into account trade impediments. U.S. Dollar Valuation Source: Bloomberg, © Merk Investments LLC www.merkinvestments.com 5 © 202 1 M e r k I n v e s t m e n t s ®

Relative purchasing power parity (PPP): Nominal exchange rates tend to gravitate toward their long - run purchasing power parity (PPP) equilibrium values. The foundation for PPP is the so - called “law of one price,” which suggests that identical goods should trade at the same price across countries when valued in terms of a common currency. Relative PPP extends the law of one price to a broad range of goods and services and takes into account trade impediments. Source: Bloomberg, © Merk Investments LLC www.merkinvestments.com 6 © 202 1 M e r k I n v e s t m e n t s ®

Source: Bloomberg, © Merk Investments LLC CB means central bank www.merkinvestments.com 7 © 202 1 M e r k I n v e s t m e n t s ®

Source: Bloomberg, © Merk Investments LLC www.merkinvestments.com 8 © 202 1 M e r k I n v e s t m e n t s ®

Source: Bloomberg, © Merk Investments LLC Real interest rates are 10 year sovereign bond yields versus the so - called breakeven rate www.merkinvestments.com 9 © 202 1 M e r k I n v e s t m e n t s ® (market based inflation measure based on inflation - linked bond) G4 = U.S., U.K., Germany, and Japan Real rates account for inflation expectations. A negative real rate suggests that inflation will be higher than the nominal interest rate. For example if the nominal rate is 1% and inflation is expected to be 2%, the real rate is - 1%.

Source: Bloomberg, © Merk Investments LLC Real interest rates are 10 year sovereign bond yields versus the so - called breakeven rate www.merkinvestments.com 10 © 202 1 M e r k I n v e s t m e n t s ® (market based inflation measure based on inflation - linked bond) IRD = Interest Rate Differential Real rates adjust nominal interest rates for inflation expectations. A negative real rate suggests that inflation will be higher than the nominal interest rate. For example if the nominal rate is 1% and inflation is expected to be 2%, the real rate is - 1%. R1: 1 st y - axis on right R2: 2 nd y - axis on right

Source: Bloomberg, © Merk Investments LLC PMI = Purchasing Managers Index. The Purchasing Managers' Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting. The Global Manufacturing PMI is an aggregate of a major economy PMIs. R1: 1 st y - axis on right R2: 2 nd y - axis on right www.merkinvestments.com 11 © 202 1 M e r k I n v e s t m e n t s ®

Source: Bloomberg, © Merk Investments LLC Real interest rates is 10 year Treasury yields versus the so - called breakeven rate (market based inflation www.merkinvestments.com 12 © 202 1 M e r k I n v e s t m e n t s ® measure based on inflation - linked bond). US Treasuries are backed by full faith and credit of the US Government. Gold price mentioned in the above chart is in dollars ($). R1: 1 st y - axis on right, inverted R2: 2 nd y - axis on right, logarithmic

O UNZ • Convenient and cost - efficient way to buy and hold gold through an exchange traded product • Option to take delivery of physical gold if and when desired www.merkinvestments.com 13 © 202 1 M e r k I n v e s t m e n t s ®

▪ Basket of Hard Currencies ▪ H e d g e U . S . d o ll a r r i s k ▪ Active management Seeks to profit from rise of Hard Currencies vs. the U.S. dollar Merk Hard Currency Fund (MERKX) www. m e r k f un d s . c o m 14 www.merkinvestments.com 14 © 202 1 M e r k I n v e s t m e n t s ®

MERKX Standardized Performance Through 03 / 31 / 2021 , the Merk Hard Currency Fund Investor Shares (MERKX) had a 1 - year return of 12 . 09 % , a 5 - year return of - 0 . 17 % , a 10 - year return of - 1 . 83 % , and a return of 1 . 25 % since inception on 05 / 10 / 2005 . All performance figures greater than 1 - year are annualized unless otherwise specified . Performance data represents past performance and is no guarantee of future results . Current performance may be lower or higher than the performance data quoted . Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost . Please visit www . merkfunds . com for most recent month end performance . The expense ratio for MERKX is 1 . 36 % for Investor Shares . Merk Hard Currency Fund ® Se e k s t o p r o f i t f r o m a r i s e i n h a r d c ur r e nc i e s r e l a t iv e t o t h e U. S . d o ll a r www.merkinvestments.com 15 © 202 1 M e r k I n v e s t m e n t s ®

- 10.00% - 5.00% 0.00% 5.00% 10.00% 15.00% 20.00% 0.00% 10.00% 20.00% 30.00% 40.00% 50.00% - 10.00% May - 05 May - 06 May - 07 May - 08 May - 09 May - 10 May - 11 May - 12 May - 13 May - 14 May - 15 May - 16 May - 17 May - 18 May - 19 May - 20 M o nthly Return 25.00% C umalati ve Return 60.00% Monthly and Cumulative Return (since inception) Monthly Returns (RHS) Cumulative Returns (LHS) GOLD AUD NZD NOK SEK CHF JPY GBP C A D EUR MER K X InvDXY A n n . Std . Dev iatio n 20 % 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% Risk Comparsion (since inception) CAD 19.9% SEK 17.9% NOK 17.4% AUD 14.4% JPY 9.3% EUR 9.4% 5.4% Currency Allocation (as of 03/31/2021) GBP GOLD NZD 4.3% 1.7% MERKX Performance Risk and Return Annualized Return 1.25% Annualized Volatility 8.52% Sharpe Ratio 0.00 Cumulative Return 21.85% Year - to - Date Return - 2.85% Best Month 7.77% Worst Month - 9.82% Average Month 0.14% Average Monthly Gain 1.95% Average Monthly Loss - 1.88% % of Winning Months 52.36% 95% Monthly VAR - 3.60% www.merkinvestments.com 16 © 202 1 M e r k I n v e s t m e n t s ® AUM: $58.5 million F un d D e t a il s Investor Institutional Ticker MERKX MHCIX Min. Invest. $2,500 $250,000 Exp. Ratio 1.36% 1.11% Fees No Load No Load Performance data represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. All performance figures greater than 1 - year are annualized unless otherwise specified. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Please visit www.merkfunds.com for most recent month end performance. The Fund’s expense ratio is 1.38% for Investor Shares. S ou r c e : M er k I n ves tm e nt s , B l oomb er g . C a lc u l at i on s s i n c e i n c e pt i o n 05 / 10 / 2005 - 03/31/2021

10.00% 8.00% 6.00% 4.00% 2.00% 0.00% - 2.00% - 4.00% GBP NOK SEK EUR JPY NZD AUD CAD USD MERKX SGD CHF XAU - 1.94% - 1.91% - 1.25% - 0.59% - 0.30% - 0.30% - 0.14% - 0.10% 0.62% 1.25% 1.28% 1.53% 9.12% © Merk Investments, LLC Source: Merk Investments , Bloomberg. All calculations are based on daily data. All currencies performance are calculated relative to U.S. Dollar. USD: U.S. Dollar Currency Index (DXY); XAU: Gold Spot as U.S. Dollar per Troy Ounce MERKX Performance since inception Annualized performance – since inception (05/10/05 – 03/31/21) www.merkinvestments.com 17 © 202 1 M e r k I n v e s t m e n t s ® Performance data represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. All performance figures greater than 1 - year are annualized unless otherwise specified. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Please visit www.merkfunds.com for most recent month end performance. The Fund’s expense ratio is 1.36% for Investor Shares. Source: Merk Investments, Bloomberg. Calculations for period 05/10/2005 - 03/31/2021

20.00% 18.00% 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% SGD USD MERKX EUR CAD GBP JPY CHF SEK NOK NZD AUD XAU 5.52% 7.80% 8.52% 9.42% 9.50% 9.78% 10.09% 11.45% 12.27% 12.88% 13.17% 13.19% 18.37% © Merk Investments, LLC Source: Merk Investments, Bloomberg. All calculations are based on daily data. All currencies performance data calculated relative to U.S. Dollar. USD: U.S. Dollar Currency Index (DXY); XAU: Gold Spot as U.S. Dollar per Troy Ounce MERKX Volatility since inception Annualized volatility – since inception (05/10/05 – 03/31/21) www.merkinvestments.com 18 © 202 1 M e r k I n v e s t m e n t s ®

MERKX Correlation Correlation matrix – as of 03/31/2021 Correlation: a statistical measurement that gives the degree of relationship between two variables. In a diversified portfolio, correlation represents the degree of relationship between the price movements of different assets in a portfolio. Fund inception: 05/10/2005. MERKX vs. Since Inception 1 Year YTD Q1 AUD 0.63 0.89 0.93 0.93 CAD 0.62 0.80 0.83 0.83 CHF 0.79 0.56 0.62 0.62 EUR 0.90 0.75 0.84 0.84 GBP 0.67 0.73 0.81 0.81 JPY 0.21 0.37 0.49 0.49 NOK 0.79 0.89 0.90 0.90 NZD 0.61 0.86 0.90 0.90 SEK 0.78 0.87 0.90 0.90 SGD 0.64 0.84 0.83 0.83 USD - 0.90 - 0.84 - 0.88 - 0.88 XAU 0.66 0.45 0.59 0.59 www.merkinvestments.com 19 © 202 1 M e r k I n v e s t m e n t s ® © Merk Investments, LLC Source: Merk Investments, Bloomberg. All calculations are based on daily data as of 03/31/2021. All currencies performance data calculated relative to U.S. Dollar. USD: U.S. Dollar Currency Index (DXY); XAU: Gold Spot as U.S. Dollar per Troy Ounce

Is Your Portfolio Ready? www.merkinvestments.com 20 © 202 1 M e r k I n v e s t m e n t s ®

No t es Indices and terms referred to in this presentation may include the following : U . S . Dollar (DXY) Index and Inverse DXY : DXY is a measure of the value of the United States dollar relative to a static basket of currencies with Euro (EUR) 57 . 6 % weight, Japanese yen (JPY) 13 . 6 % , Pound Sterling (GBP) 11 . 9 % , Canadian dollar (CAD) 9 . 1 % , Swiss franc (CHF) 3 . 6 % and Swedish krona (SEK) 4 . 2 % weight . The DXY is a generally well - known measure of the value of the US dollar versus major foreign currencies, and as such makes a relevant reference point for directional currency strategies . The inverse of the DXY is the value of the currency basket relative to the U . S . dollar, i . e . short dollar and long foreign currencies . Because the Merk Hard Currency Fund is long foreign currencies (and therefore short dollar), using the inverse DXY allows for the logical comparison of performance relative to the Fund . Bloomberg Dollar (BBDXY) Index : an index tracks the performance of a basket of ten leading global currencies versus the U . S . dollar, weighted by the share of international trade and FX liquidity . Deutsche Bank Currency Returns (DBCR) Index : an equal - weighted blend of the most widely used investment strategies among active currency managers . It captures long term systematic returns available in the world currency markets . As a non - directional index, the DBCR provides a useful comparison to absolute return currency strategies like the Merk Absolute Return Currency Fund . JPMorgan 3 - Month Global Cash Index: measures the performance of money market securities denominated in foreign currencies. Citigroup 3 - Month U.S. T - Bill Index: an index that tracks the performance of U.S. Treasury bills with a remaining maturity of three months. S&P 500 Total Return Index (SPXT): a broad - based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. Performance figures assume that all dividends are reinvested. MSCI EAFE (Europe Australasia Far East) Index : a free float - adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada . As international equity investment returns are a combination of equity returns and currency returns, the MSCI EAFE provides a useful comparison to a strategy including U . S . equities and currencies, like the Merk Currency Enhanced US Equity Fund . MSCI EAFE US $ Hedged Net Index : a currency hedged variant of the above, designed to represent the return without the currency exposure if the index . MSCI Emerging Markets (EM) Index : a free float - adjusted market capitalization index that is designed to measure equity market performance of emerging markets . Barclays Capital Aggregate US Bond Index (BONDS) : is a broad - based benchmark that measures the investment grade, U . S . dollar - denominated, fixed - rate taxable bond market, including Treasuries, government - related and corporate securities, MBS (agency fixed - rate and hybrid ARM pass - throughs), ABS, and CMBS . FTSE NAREIT US All REITs Index: spans the commercial real estate space across the US economy. It provides exposure to all investment and property sectors. DJ - UBS Commodity Total Return Index: a diversified benchmark for commodities’ fully collateralized returns. Barclays US TIPS Index: measures the performance of the US Treasury Inflation Protected Securities ("TIPS") market. Alpha: a measure of risk - adjusted return. The excess return of the fund relative to the return of the benchmark is the fund’s alpha. Beta: a measure of systematic risk based on the covariance of the portfolio’s return with the return of the overall market. The market has a beta of 1. Sharpe Ratio: a measure of the excess return per unit of risk in an investment asset or a trading strategy. Correlation: a measure of how two securities or asset classes move in relation to each other. Standard Deviation: a measure of volatility. VAR : VAR refers to value at risk, which gives the worst expected loss given some confidence level over a given time horizon for a given distribution of returns . 95 % Monthly VAR suggests a 95 % probability a monthly loss is no greater than stated assuming a normal distribution of returns . Investors must be aware that this does not capture the worst case scenario and that losses may be greater as the distribution of future returns is unknown . CRY Index : Thomson Reuters/Core Commodity CRB Commodity Index, an arithmetic average of commodity futures prices with monthly rebalancing . Barcap US Corp HY YTW – 10 Year Spread : A measure reflecting risk premia in the market ; specifically, the Barclays Capital US Corporate High Yield to Worst minus the US Generic Government 10 Year Yield . Other indices as defined on the respective pages . Indices are unmanaged ; an investment cannot be made directly in an index . www.merkinvestments.com 21 © 202 1 M e r k I n v e s t m e n t s ®

Notes (continued) Singapore dollar (SGD): official currency of Singapore. Spot Gold (XAU): current market price at which an asset is bought or sold for immediate payment and delivery. It is differentiated from the forward price or the futures price, which are prices at which an asset can be bought or sold for delivery in the future. Russell 2000 Index: a small - cap stock market index of the bottom 2,000 stocks in the Russell 3000 Index . The Russell 2000 is by far the most common benchmark for mutual funds that identify themselves as "small - cap", while the S&P 500 index is used primarily for large capitalization stocks. S&P 500 Index: a capitalization - weighted index of 500 stocks designed to measure performance of the broad U.S. domestic economy through change in the aggregate market value representing all major industries. S&P 500 Financials Index: a capitalization - weighted index of S&P 500 stocks that represent the financial sector as defined by Global Industry Classification Standard (GICS) Level 1 Sector group, calculated by Bloomberg. VIX Short - Term Futures Index: an index that measures the return from a daily rolling long position in the VIX futures contract traded on the Chicago Board Options Exchange. The short - term index is comprised of the first and second contract months. U.S. 10Y Treasury Bonds: represented here by calculating the inverse of Bloomberg’s U.S. Generic Government 10 Year Yield Index (USGG10YR Index) comprised of on - the - run government bill/not/bond indices. Spain 10 Y Treasury Bonds : represented here by calculating the inverse of Bloomberg’s Spanish Generic Government 10 Year Yield Index (GSPG 10 YR Index) comprised of Spanish government bonds that the market considers to be benchmark issue . G 10 : refers to 10 countries/currency areas : Australia (AUD), Canada (CAD), Switzerland (CHF), Eurozone (EUR), United Kingdom (GBP), Japan (JPY), Norway (NOK), New Zealand (NZD), Sweden (SEK), and United States (USD) . US Corp IG Bonds : represented here by Bloomberg US Corporate Bond Index (Investment Grade) for GICS Level I sectors Utilities, Industrials, Consumer Staple, Communications, Health Care and Financials . The Bloomberg USD Corporate Bond Index is a rules - based market - value weighted index engineered to measure the investment grade, fixed - rate, taxable, corporate bond market . It includes USD - denominated securities publicly issued by U . S . and non - U . S . corporate issuers . To be included in the index a security must have a minimum par amount of 250 million . EM USD Bond Aggregate : represented here by Bloomberg Barclays EM USD Aggregate TR Index Unhedged USD . Bloomberg Barclays Emerging Markets Hard Currency Aggregate Index is a flagship hard currency Emerging Markets debt benchmark that includes USD - denominated debt from sovereign, quasi - sovereign, and corporate EM issuers . U . S . Mortgage Backed Securities : represented here by Bloomberg Barclays US MBS Index TR Value Unhedged USD . The Bloomberg Barclays US Mortgage Backed Securities (MBS) Index tracks agency mortgage backed pass - through securities (both fixed - rate and hybrid ARM) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC) . The index is constructed by grouping individual TBA - deliverable MBS pools into aggregates or generics based on program, coupon and vintage . Pan - European IG Bond Aggregate : represented here by Bloomberg Barclays Pan - European Aggregate TR Index Value Unhedged EUR . The Bloomberg Barclays Pan - European Aggregate Index tracks fixed - rate, investment - grade securities issued in the following European currencies : Euro, British pounds, Norwegian krone, Danish krone, Swedish krona, Czech koruna, Hungarian forint, Polish zloty, and Slovakian koruna . Inclusion is based on the currency of the issue, and not the domicile of the issuer . Pan - European HY Bond Aggregate : represented here by Bloomberg Barclays Pan - European High Yield TR Index Value Unhedged EUR . The Bloomberg Barclays Pan - European High Yield Index measures the market of non - investment grade, fixed - rate corporate bonds denominated in the following currencies : euro, pounds sterling, Danish krone, Norwegian krone, Swedish krona, and Swiss franc . Inclusion is based on the currency of issue, and not the domicile of the issuer . G 4 : G 4 or Group of Four refers to the U . S . , U . K . , Germany, and Japan www.merkinvestments.com 22 © 202 1 M e r k I n v e s t m e n t s ®

Mutual Fund Risk Disclosure Information contained herein may discuss Fund performance and holdings . Performance data quoted represents past performance and is no guarantee of future results . Current performance may be lower or higher than the performance data quoted . Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost . For performance current to the most recent month - end, please visit our website at www . merkfunds . com/fund . Since the Fund primarily invests in foreign currencies, changes in currency exchange rates affect the value of what the Fund owns and the price of the Fund’s shares . Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, emerging market risk, and relatively illiquid markets . The Fund is subject to interest rate risk, which is the risk that debt securities in the Fund’s portfolio will decline in value because of increases in market interest rates . If the U . S . dollar fluctuates in value against currencies the Fund is exposed to, your investment may also fluctuate in value . As a non - diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers . For a more complete discussion of these and other Fund risks please refer to the Fund's prospectus . Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses . This and other information is in the prospectus, a copy of which may be obtained by calling 1 - 866 - MERK FUND or visiting the Fund's website . Please read the prospectus carefully before you invest . Foreside Fund Services, LLC, distributor . www.merkinvestments.com 23 © 202 1 M e r k I n v e s t m e n t s ®

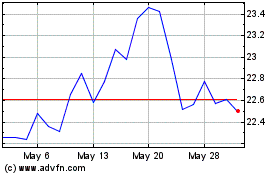

VanEck Merk Gold (AMEX:OUNZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

VanEck Merk Gold (AMEX:OUNZ)

Historical Stock Chart

From Jul 2023 to Jul 2024