false

0000724742

0000724742

2023-11-28

2023-11-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): December 4, 2023 (November 28, 2023)

Trinity Place Holdings Inc.

(Exact Name of Registrant as Specified

in Charter)

| Delaware |

|

001-08546 |

|

22-2465228 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

340 Madison Avenue, New York, New York 10173

(Address of Principal Executive Offices) (Zip Code)

(212) 235-2190

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Securities registered or to be registered

pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading

Symbol |

|

Name of each exchange on which

registered |

| Common Stock $0.01 Par Value Per Share |

|

TPHS |

|

NYSE American |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, on

September 6, 2023, Trinity Place Holdings Inc. (the “Company”) and its

subsidiary borrower (the “Mortgage Borrower”) under the Master Loan Agreement, dated as of October 22, 2021 (the “Mortgage

Loan Agreement”), by and between the Mortgage Borrower and Macquarie PF Inc., as lender and administrative agent (the “Mortgage

Lender”), entered into a forbearance agreement effective as of September 1, 2023 (the “Forbearance Agreement”),

pursuant to which, among other things, the Mortgage Lender agreed to forbear from exercising its rights and remedies during the Forbearance

Period, as defined below, with respect to any failure by the Mortgage Borrower to make payments under the Mortgage Loan Agreement, including,

without limitation, interest payments due on September 1, 2023 and principal and interest payments due at maturity, and achieve any Milestone

Construction Hurdles or to satisfy the Quarterly Sales Hurdle (each as defined in the Mortgage Loan Agreement) or make the related prepayment

as and when required, until the earliest of November 15, 2023 and the occurrence of certain other specified events (the “Forbearance

Period”). The Forbearance Period terminated in accordance with the terms of the Forbearance Agreement. On November 28, 2023,

the Company, Mortgage Borrower and Mortgage Lender entered into an agreement pursuant to which, among other things, the Mortgage Lender

agreed to reinstate the Forbearance Period effective as of November 15, 2023 and extend the Forbearance Period to December 20, 2023, as

such date may be further extended by the Mortgage Lender in its sole discretion by written notice to the Mortgage Borrower. In connection

with certain of the Proposed Transactions, as defined below, the parties also agreed to non-binding terms which contemplate certain amendments

to the Mortgage Loan Agreement, including among others, an extension of the maturity date by two years, subject to an extension by an

additional one year period if certain conditions are satisfied.

On

December 1, 2023, the Company entered into an eighth amendment (the “CCF Amendment”) to the Credit Agreement, dated

as of December 19, 2019 (as amended, supplemented or otherwise modified from time to time prior to the date hereof, the “CCF”),

by and between the Company, as borrower, certain subsidiaries of the Company as guarantors, and TPHS Lender LLC, as initial lender (the

“CCF Lender”) and as administrative agent which provided among other things for the provision of incremental term loan

advances under the CCF in the amount of $750,000, with the first $375,000 being provided upon execution of the CCF Amendment and the second

$375,000 to be provided upon and subject to board approval of definitive agreements in respect of certain proposed transactions with the

CCF Lender and/or its affiliates, on the terms set forth in a non-binding term sheet (the “Proposed Transactions”)

and the filing of preliminary materials with the Securities and Exchange Commission (“SEC”) for the solicitation of the vote

or consent of the Company’s stockholders, if required. The CCF Amendment also amends the Company’s forbearance agreement

with the CCF Lender with respect to certain additional defaults in respect of which the CCF Lender is forbearing. The terms of such forbearance

agreement are otherwise unchanged.

The

Company continues to explore strategic and financing alternatives. There can be no assurance that any such transactions, including

the Proposed Transactions, will be entered into or consummated before the Forbearance Period expires, and that the Mortgage Lender will

not exercise its rights and remedies, including seeking to foreclose on the 77 Greenwich property and assets securing the loan, among

other remedies, or before the forbearance periods under the previously disclosed forbearance agreements with the CCF Lender and lender

under the Company’s mezzanine loan expire, and that the lenders thereunder will not exercise their respective rights and remedies.

Any definitive agreements if entered into would be subject to conditions to closing, including stockholder approval if applicable, and

there is no assurance that such transactions would be consummated on terms or a timeframe acceptable to the Company or at all. Even

if a strategic transaction and/or other transaction(s) are entered into, the benefits to stockholders, if any, of such transactions are

uncertain. There can also be no assurance that the Company will be able to obtain additional forbearance

from the Mortgage Lender or the other lenders or complete a restructuring or refinancing and/or obtain an acceptable waiver or amendment

under all or any of the facilities on terms acceptable to the Company, or at all, or that the Company’s cash position will extend

through the date on which forbearance terminates.

Item 2.03 Creation

of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of the Registrant.

The

information included in Item 1.01 of this Current Report on Form 8-K with respect to the CCF Amendment is incorporated by reference into

this Item 2.03.

Item 3.01 Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

November 29, 2023, the Company received a deficiency letter (the “Deficiency Letter”) from the NYSE American LLC (the

“NYSE American”) indicating that the Company is not in compliance with the NYSE American continued listing standards

set forth in Sections 1003(a)(i) and (ii) of the NYSE American Company Guide (the “Guide”). Section 1003(a)(i) of the Guide

requires a listed company’s stockholders’ equity be at least $2.0 million if it has reported losses from continuing operations

and/or net losses in two of its three most recent fiscal years. Section 1003(a)(ii) of the Guide requires a listed company’s stockholders’

equity be at least $4.0 million if it has reported losses from continuing operations and/or net losses in three of its four most recent

fiscal years. The Deficiency Letter noted that the Company reported a stockholders’ deficit of $(1.2) million as of September 30,

2023, and losses from continuing operations and/or net losses in three of its four most recent fiscal years ended December 31, 2022.

In

order to maintain the Company’s listing on the NYSE American, the NYSE American has requested that the Company submit a plan of

compliance (the “Plan”) by December 29, 2023 advising of actions it has taken or will take to regain compliance with

Section 1003(a)(i) and (ii) of the Guide by May 29, 2025.

The

Company’s management has begun its analysis regarding submission of the Plan to the NYSE American by the December 29, 2023 deadline.

If the NYSE American accepts the Company’s Plan, the Company will have an eighteen (18) month

cure period to comply with the Plan and be able to continue its listing during such period and will be subject to continued periodic

review by the NYSE American staff. If the Plan is not submitted, or not accepted, or is accepted but the Company does not make progress

consistent with the Plan during the Plan period, the Company will be subject to delisting procedures as set forth in the Guide.

The

Company intends to consider available options to regain compliance with the stockholders’ equity requirement. No decisions have

been made at this time, although certain transactions under consideration by the parties may position the Company to submit a Plan and,

if consummated, meet the listing standards. There can be no assurance that the Company will be able to achieve compliance with

the NYSE American’s continued listing standards within the required time frames.

The

Deficiency Letter has no immediate impact on the listing of the Company’s shares of common stock (the “Common Stock”),

which will continue to be listed and traded on the NYSE American during this period, subject to the Company’s compliance with the

other listing requirements of the NYSE American. The Common Stock will continue to trade under the symbol “TPHS”, but will

have an added designation of “.BC” to indicate the status of the Common Stock as “below compliance”. The Deficiency

Letter does not affect the Company’s ongoing business operations or its reporting requirements with the SEC.

If

the Common Stock ultimately were to be delisted for any reason, it could negatively impact the Company and its stockholders by (i) reducing

the liquidity and market price of the Company’s Common Stock; (ii) reducing the number of investors willing to hold or acquire the

Common Stock, which in turn could potentially negatively impact the Company’s ability to raise equity financing; and (iii) limiting

the Company’s ability to use a registration statement to offer and sell freely tradable securities, thereby preventing the Company

from accessing the public capital markets; and/or (iv) impairing the Company’s ability to provide equity incentives to its employees.

Item 7.01 Regulation

FD Disclosure.

On

December 4, 2023, in accordance with the NYSE American’s procedures, the Company issued a press release discussing the matters disclosed

in Item 3.01 above. A copy of the press release is included herewith as Exhibit 99.1, which is incorporated by reference into this Item

7.01.

The

information under this Item 7.01, including Exhibit 99.1 hereto, is being furnished herewith and shall not be deemed

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated

by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by

specific reference in such filing. Furthermore, the furnishing of information under Item 7.01 of this Current Report on Form 8-K is

not intended to constitute a determination by the Company that the information contained herein, including the exhibit hereto, is

material or that the dissemination of such information is required by Regulation FD.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits

This Current Report on

Form 8-K includes forward-looking statements within the meaning of Section 21E of the Exchange Act and the Private Securities Litigation

Reform Act of 1995. These forward-looking statements are based on current expectations and projections about future events and are not

guarantees of future performance or results and involve risks and uncertainties that cannot be predicted or quantified, and, consequently,

the actual performance of the Company may differ materially from those expressed or implied by such forward-looking statements. Such risks

and uncertainties include the risks and uncertainties, as well as the other factors, described in more detail in the Company’s most

recent Annual Report on Form 10-K and its subsequent filings with the SEC. The forward-looking statements contained herein speak only

as of the date hereof, and the Company assumes no obligation to update any forward-looking statements, whether as a result of new information,

subsequent events or otherwise, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TRINITY PLACE HOLDINGS INC. |

| |

|

| Date: December 4, 2023 |

/s/ Steven Kahn |

| |

Steven Kahn |

| |

Chief Financial Officer |

Exhibit 99.1

Trinity Place Holdings Inc. Discloses Communication

from NYSE American

New York, New York, December 4, 2023 — Trinity

Place Holdings Inc. (NYSE American: TPHS) (the “Company”) announced today that on November 29, 2023 it received a letter (the

“Notice”) from the NYSE American LLC (“NYSE American”) advising the Company is not in compliance with the NYSE

American continued listing standards set forth in Sections 1003(a)(i) and (ii) of the NYSE American Company Guide given the reported stockholders’

deficit as of September 30, 2023, and losses from continuing operations and/or net losses in three of its four most recent fiscal years

ended December 31, 2022.

The Notice has no immediate impact on the listing

of the Company’s shares of common stock, par value $0.01 per share (the “Common Stock”), which will continue to be listed

and traded on the NYSE American during the period mentioned below, subject to the Company’s compliance with the other listing requirements

of the NYSE American. The Common Stock will continue to trade under the symbol “TPHS”, but will have an added designation

of “.BC” to indicate the status of the Common Stock as “below compliance”. The Notice does not affect the Company’s

ongoing business operations or its reporting requirements with the Securities and Exchange Commission (“SEC”).

The Company is required to submit a plan of compliance

by December 29, 2023 addressing how the Company intends to regain compliance with Section 1003(a)(i) and (ii) of the NYSE American Company

Guide by May 29, 2025.

Section 1003(a)(i) of the NYSE American Company

Guide requires a listed company’s stockholders’ equity be at least $2.0 million if it has reported losses from continuing

operations and/or net losses in two of its three most recent fiscal years. Section 1003(a)(ii) of the NYSE American Company Guide requires

a listed company’s stockholders’ equity be at least $4.0 million if it has reported losses from continuing operations and/or

net losses in three of its four most recent fiscal years.

The Company intends to consider available options

to regain compliance with the stockholders’ equity requirement. No decisions have been made at this time, although certain transactions

under consideration by the parties may position the Company to submit a plan of compliance and, if consummated, meet the listing standards.

There can be no assurance that the Company will be able to achieve compliance with the NYSE American’s continued listing standards

within the required time frames.

Additional details regarding the Notice from the

NYSE American were included in, and the description above is qualified in its entirety by, the Company’s Current Report on Form

8-K filed with the SEC on December 4, 2023, which is available on the Company’s website under “Investor Relations –

SEC Filings” at www.tphs.com.

About Trinity Place Holdings

Trinity Place Holdings

Inc. is a real estate holding, investment, development and asset management company. The Company’s largest asset is a property located

at 77 Greenwich Street in Lower Manhattan, which is substantially complete as a mixed-use project consisting of a 90-unit residential

condominium tower, retail space and a New York City elementary school. The Company also owns a 105-unit, 12-story multi-family property

located at 237 11th Street in Brooklyn, New York, as well as a property occupied by a retail tenant in Paramus, New Jersey.

In addition to its real estate portfolio, the Company also controls a variety of intellectual property assets focused on the consumer

sector, a legacy of its predecessor, Syms Corp., including FilenesBasement.com, its rights to the Stanley Blacker® brand, as well

as the intellectual property associated with the Running of the Brides® event and An Educated Consumer is Our Best Customer® slogan.

In addition, the Company also had approximately $305.4 million of federal net operating loss carryforwards at September 30, 2023,

as well as various state and local NOLs, which can be used to reduce its future taxable income and capital gains.

Forward Looking Statements

This press release includes forward-looking

statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are based on current expectations and projections about future

events and are not guarantees of future performance or results and involve risks and uncertainties that cannot be predicted or

quantified, and, consequently, the actual performance of the Company may differ materially from those expressed or implied by such

forward-looking statements. Such risks and uncertainties include the risks and uncertainties, as well as the other factors,

described in more detail in the Company’s most recent Annual Report on Form 10-K and its subsequent filings with the SEC. The

forward-looking statements contained herein speak only as of the date hereof, and the Company assumes no obligation to update any

forward-looking statements, whether as a result of new information, subsequent events or otherwise, except as required by law.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

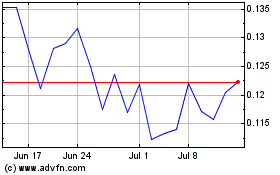

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Oct 2024 to Nov 2024

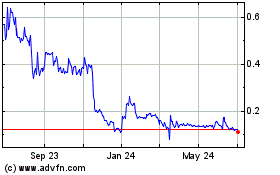

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Nov 2023 to Nov 2024