Filed Pursuant to Rule 424(b)(5)

Registration No. 333-255743

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 11, 2021)

Timber Pharmaceuticals, Inc.

21,325,000 Shares of Common Stock

Pre-funded Warrants to Purchase

up to 2,112,500 Shares of Common Stock

Warrants to Purchase up

to 23,437,500 Shares of Common Stock

We are offering up to

21,325,000 shares of our common stock and warrants to purchase one shares of common stock. Each share of our common stock is

being sold with one warrant to purchase one share of our common stock, at the combined offering price of $0.64 per share of common

stock and accompanying warrant to purchase one share of common stock, representing an offering price of $0.63 per share of common stock and $0.01 per accompanying

warrant. The warrants are exercisable from and after the date of their issuance and expire on the fifth anniversary of such date, at

an exercise price of $0.70 per share of common stock. The shares of common stock and warrants will be issued separately.

We are also offering 2,112,500

pre-funded warrants, or the Pre-funded Warrants (and the shares of common stock issuable from time to time upon exercise of the Pre-funded

Warrants), to those purchasers whose purchase of shares of common stock in this offering would result in the purchaser, together with

its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding

shares of common stock following the consummation of this offering in lieu of the shares of common stock that would result in such excess

ownership. Each Pre-funded Warrant will be exercisable for one share of common stock at an exercise price of $0.001 per shares of common

stock. The public offering price is $0.639 per Pre-funded Warrant and accompanying warrant, which is equal to the public offering price

per share and accompanying warrant less $0.001. Each Pre-funded Warrant will be exercisable upon issuance and will expire when exercised

in full. There is no established public trading market for the Pre-funded Warrants, and we do not expect a market to develop. We do not

intend to apply for listing of the Pre-funded Warrants on any securities exchange or nationally recognized trading system. Without an

active trading market, the liquidity of the Pre-funded Warrants will be extremely limited.

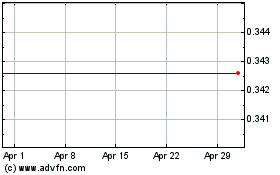

Our common stock is listed

on The NYSE American, LLC (the “NYSE American”) under the symbol “TMBR”. On November 2, 2021, the last reported

sales price of our common stock on the NYSE American was $0.80 per share. Our common stock has recently experienced extreme volatility

in price and trading volume. For example, on March 4, 2021 and March 11, 2021, the closing price of our common stock on the NYSE American

was $1.66 and $3.55, respectively, and daily trading volume on these days was approximately 3.5 million and 143.7 million shares, respectively.

During this period, there were no recent changes in our financial condition or results of operations that were consistent with the change

in our stock price. Investors that purchase shares of our common stock may lose a significant portion of their investments if the price

of our common stock declines. Please see the section of this prospectus supplement titled “Risk Factors.” You are urged to

obtain current market quotations of our common stock. We have no preferred stock, warrants, subscription rights or units listed on any

market.

The offering is being underwritten

on a firm commitment basis. The underwriters may offer the shares of common stock and Pre-funded Warrants from time to time to purchasers

directly or through agents, or through brokers in brokerage transactions on the NYSE American, or to dealers in negotiated transactions

or in a combination of such methods of sale, or otherwise, at fixed price or prices, which may be changed, or at market prices prevailing

at the time of sale, at prices related to such prevailing market prices.

Investing in our common

stock involves risks. Before buying any shares, you should read the discussion of material risks of investing in our common stock in “Risk

Factors” beginning on page S-8 of this prospectus supplement, on page 4 of the accompanying prospectus and in the documents incorporated

by reference in this prospectus supplement.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per Share and

Warrant

|

|

|

Per Pre-Funded

Warrant and

Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

0.64

|

|

|

$

|

0.639

|

|

|

$

|

14,997,887.50

|

|

|

Underwriting discounts and commissions(1)

|

|

$

|

0.0384

|

|

|

$

|

0.0384

|

|

|

$

|

900,000.00

|

|

|

Proceeds, before expenses and fees, to us

|

|

$

|

0.6016

|

|

|

$

|

0.6006

|

|

|

$

|

14,097.887.50

|

|

|

|

(1)

|

In addition, we have agreed to pay a management fee to the underwriters equal to 1.0% of the aggregate

gross proceeds in the offering and to reimburse certain expenses of the underwriters in connection with this offering. See “Underwriting”

for additional disclosure regarding underwriting compensation.

|

We have granted the underwriters an option for

a period of up to 30 days from the date of this prospectus supplement to purchase up to 3,515,625 additional shares of our common stock

at the public offering price per share, and/or warrants to purchase up to 3,515,625 shares of our common stock at the public offering

price per warrant, less the underwriting discounts and commissions. If the underwriters exercise the option in full, the total underwriting

discounts and commissions payable by us will be $1,035,000 and the total proceeds to us, before expenses, will be $16,212,887.50.

Delivery of the shares of our common stock, Pre-funded

Warrants and warrants being offered pursuant to this prospectus supplement and the accompanying prospectus is expected to be made on or

about November 5, 2021, subject to satisfaction of customary closing conditions.

H.C. Wainwright & Co.

The date of this prospectus supplement is November

2, 2021.

TABLE OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

On

May 4, 2021, we filed with the Securities and Exchange Commission, or SEC, a registration statement on Form S-3 (File No. 333-255743)

utilizing a “shelf” registration process relating to the securities described in this prospectus supplement, which registration

statement was declared effective on May 11, 2021. Under this shelf registration process, we may offer and sell, either individually or

in combination, in one or more offerings, any of the securities described in the accompanying prospectus, for total gross proceeds of

up to $100,000,000.

This prospectus supplement

describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the

documents incorporated by reference herein and into the accompanying prospectus. The second part, the accompanying prospectus, provides

more general information. If the information in this prospectus supplement or any relevant free writing prospectus we may authorize for

use in connection with this offering is inconsistent with the accompanying prospectus or any document incorporated by reference therein

filed prior to the date of this prospectus supplement or such free writing prospectus, you should rely on the information in this prospectus

supplement or such free writing prospectus.

We and the underwriters have

not authorized anyone to provide you with any information or to make any representations other than those included or incorporated by

reference in this prospectus supplement and the accompanying prospectus and any relevant free writing prospectus we may authorize for

use in connection with this offering. If you receive any information not authorized by us, we and the underwriters take no responsibility

for, and can provide no assurance as to the reliability of, such information. We are not making an offer to sell the securities offered

hereby in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or incorporated

by reference in this prospectus supplement or the accompanying prospectus or any relevant free writing prospectus we may authorize for

use in connection with this offering is accurate as of any date other than its respective date, regardless of its time of delivery or

any sale of the securities covered hereby. Our business, financial condition, results of operations and prospects may have changed since

that date.

It is important for you to

read and consider all of the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus

and any relevant free writing prospectus we may authorize for use in connection with this offering in making your investment decision.

This prospectus supplement contains summaries of certain provisions contained in some of the documents described herein, but reference

is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents.

We include cross-references in this prospectus supplement and the accompanying prospectus to captions in these materials where you can

find additional related discussions. The table of contents in this prospectus supplement provides the pages on which these captions are

located. You should read both this prospectus supplement and the accompanying prospectus, together with the additional information described

in the sections entitled “Where You Can Find Additional Information” on page S-18 and “Incorporation of Documents by

Reference” on page S-19 of this prospectus supplement, before investing in our common stock.

We are offering to sell, and

seeking offers to buy, the securities offered hereby only in jurisdictions where offers and sales are permitted. The distribution of this

prospectus supplement, the accompanying prospectus and any relevant free writing prospectus we may authorize for use in connection with

this offering and the offering of the securities offered hereby in certain jurisdictions may be restricted by law. Persons outside the

United States who come into possession of this prospectus supplement, the accompanying prospectus and any relevant free writing prospectus

we may authorize for use in connection with this offering must inform themselves about, and observe any restrictions relating to, the

offering of the securities offered hereby and the distribution of this prospectus supplement, the accompanying prospectus and any relevant

free writing prospectus we may authorize for use in connection with this offering outside the United States. This prospectus supplement,

the accompanying prospectus and any relevant free writing prospectus we may authorize for use in connection with this offering do not

constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by

this prospectus supplement, the accompanying prospectus and any relevant free writing prospectus we may authorize for use in connection

with this offering by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Timber Pharmaceuticals, Inc.

and its consolidated subsidiaries are referred to herein as “Timber,” “the Company,” “we,” “us”

and “our,” unless the context indicates otherwise.

This prospectus supplement

and the accompanying prospectus contain, or incorporate by reference, trademarks, tradenames, service marks and service names of Timber

Pharmaceuticals, Inc. and its subsidiaries.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement,

including the documents that we incorporate by reference, contains forward-looking statements as that term is defined in the federal securities

laws. The events described in forward-looking statements contained in this prospectus supplement, including the documents that we incorporate

by reference, may not occur. Generally, these statements relate to our business plans or strategies, projected or anticipated benefits

or other consequences of our plans or strategies, financing plans, projected or anticipated benefits from acquisitions that we may make,

or projections involving anticipated revenues, earnings or other aspects of our operating results or financial position, and the outcome

of any contingencies. Any such forward-looking statements are based on current expectations, estimates and projections of management.

We intend for these forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements. Words such

as “may,” “expect,” “believe,” “anticipate,” “project,” “plan,”

“intend,” “estimate,” and “continue,” and their opposites and similar expressions are intended to

identify forward-looking statements. We caution you that these statements are not guarantees of future performance or events and are subject

to a number of uncertainties, risks and other influences, many of which are beyond our control that may influence the accuracy of the

statements and the projections upon which the statements are based. Factors that may affect our results include, but are not limited to,

the risks and uncertainties discussed in the “Risk Factors” section on page S-8 of this prospectus supplement and on

page 4 of the accompanying prospectus, in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 or in other

reports we file with the Securities and Exchange Commission.

Any one or more of these uncertainties,

risks and other influences could materially affect our results of operations and whether forward-looking statements made by us ultimately

prove to be accurate. Our actual results, performance and achievements could differ materially from those expressed or implied in these

forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether from new information,

future events or otherwise.

You should rely only on the

information in this prospectus supplement and accompanying base prospectus. We have not authorized any other person to provide you with

different information. If anyone provides you with different or inconsistent information, you should not rely upon it.

PROSPECTUS

SUPPLEMENT SUMMARY

The following summary highlights

some information from this prospectus supplement. It is not complete and does not contain all of the information that you should consider

before making an investment decision. You should read this entire prospectus, including the “Risk Factors” section on page S-8

and the accompanying prospectus on page 4, the consolidated financial statements and related notes and the other more detailed information

appearing elsewhere or incorporated by reference into this prospectus supplement.

The Company

We are a clinical-stage biopharmaceutical

company focused on the development and commercialization of treatments for orphan dermatologic diseases. Our investigational therapies

have proven mechanisms-of-action backed by decades of clinical experience and well-established CMC (chemistry, manufacturing and control)

and safety profiles. We are initially focused on developing non-systemic treatments for rare dermatologic diseases including congenital

ichthyosis, facial angiofibromas (“FAs”) in tuberous sclerosis complex (“TSC”), and other sclerotic skin diseases.

Our lead programs are TMB-001, TMB-002 and TMB-003.

TMB-001

TMB-001, a patented topical

formulation of isotretinoin was recently evaluated in a Phase 2b clinical trial for the treatment of moderate to severe subtypes

of congenital ichthyosis (“CI”), a group of rare genetic keratinization disorders that lead to dry, thickened, and scaling

skin. A prior Phase 1/2 study involving 19 patients with CI demonstrated safety and a signal of preliminary efficacy of TMB-001, as well

as minimal systemic absorption. In 2018, the FDA awarded us the first tranche of a $1.5 million grant in the amount of $500,000 to support

clinical trials evaluating TMB-001 through its Orphan Products Grant program. In March 2020 and March 2021, the FDA awarded

us the second and third tranches of the grant, respectively, each in the amount of $500,000.

On

July 1, 2020, we announced that all 11 sites across the United States and Australia in the Phase 2b CONTROL study evaluating TMB-001

in patients with moderate to severe CI were enrolling patients. As of December 31, 2020, all sites participating in a Phase 2b clinical

trial evaluating TMB-001 were opened and enrolling patients. On May 31, 2021, we completed patient enrollment in the Phase 2b clinical

trial with 34 patients randomized. On October 7, 2021, we announced top line data from the TMB-001 Phase 2b trial. The data demonstrated

a reduction in targeted and overall severity of CI in patients treated with topical IPEG™ TMB-001 (topical isotretinoin).

|

|

·

|

In

the per protocol population (the “PP population”), 100 percent (nominal p = 0.04 ) and 40 percent (nominal p=

ns ) of patients treated with TMB-001 0.05% and 0.1%, respectively, achieved VIIS-50 compared to 40 percent in the vehicle group.

|

|

|

·

|

In

the ITT population, 64 percent (nominal p =0.17 ) and 40 percent (nominal p =ns ) of patients treated with TMB-001

0.05% and 0.1%, respectively, achieved VIIS-50 compared to 33 percent in the vehicle group.

|

|

|

·

|

In

the PP population, 100 percent (nominal p =0.002 ) and 60 percent (nominal p =ns ) of patients treated with TMB-001

0.05% and 0.1%, respectively, achieved a ≥2 point improvement in the IGA at week 12 compared to 10 percent in the vehicle group.

|

|

|

·

|

In

the ITT population, 55 percent (nominal p =0.02 ) and 40 percent (nominal p =ns ) of patients treated with TMB-001

0.05% and 0.1%, respectively, achieved a ≥2 point improvement in the IGA at week 12 compared to 8 percent in the vehicle group.

|

|

|

·

|

TMB-001

was generally well tolerated with a similar incidence of adverse events (AEs) across treatment groups. The most frequent AEs were local

adverse effects common for such topical treatments. There were no treatment-related serious adverse events (SAE).

|

On

December 15, 2020, we announced that we had received a notice of allowance from the U.S. Patent and Trademark Office (USPTO) for a Company

patent application covering TMB-001 (U.S. Patent Application No.: 15/772,456) and the application subsequently issued on February 10,

2021 as US 10,933,018.

On

April 28, 2021, we announced that the Japanese Patent Office had decided to grant a patent (No. 2018542677) for TMB-001.

On

May 18, 2021, we received notice that the Australian Patent Office had decided to grant a patent (No. 2016346203) for TMB-001.

TMB-002

TMB-002, a proprietary topical

formulation of rapamycin, is currently being evaluated in a Phase 2b clinical trial for the treatment of FAs in TSC, a multisystem genetic

disorder resulting in the growth of hamartomas in multiple organs. TSC results from dysregulation in the mTOR pathway, and as a topical

mTOR inhibitor, TMB-002 may address FAs in TSC without the systemic absorption of an oral agent.

As of April 30, 2021, all

sites participating in a Phase 2b clinical trial evaluating TMB-002 were opened and are currently enrolling patients. Site activation

and patient enrollment and data collection have been impacted by the COVID-19 pandemic in the larger and longer TMB-002 study, especially

at our contracted test sites in Eastern Europe. Currently, we can confirm that recruitment has been finalized on the TMB-002 Phase 2b

trial with a total of 114 consented (108 randomized) patients. We expect to review top line results from this trial in the third quarter

of 2022.

On March 17, 2021, we announced

that AFT Pharmaceuticals Limited (“AFT”), one of our development partners, entered into a license and supply agreement with

Desitin Arzneimittel GmbH (“Desitin”) for Pascomer® (TMB-002 topical rapamycin) for the treatment of FAs associated with

TSC in Europe. Pursuant to the AFT Licensing and Development Agreement, we are entitled to receive a significant percentage of the economics

(royalties and milestones) in any licensing transaction that AFT executes outside of North America, Australia, New Zealand, and Southeast

Asia. The current transaction with Desitin is included in the scope of this provision and as such in the third quarter of 2021 the Company

has received €250,000 related to an upfront milestone payment paid to AFT by Desitin during the quarter ended September 30, 2021

and has recorded approximately $0.3 million in our financial statements.

TMB-003

The product in its earliest

stage in our pipeline is TMB-003, a proprietary formulation of Sitaxsentan, a new chemical entity in the U.S., which is a selective endothelin-A

receptor antagonist. It is currently in preclinical development as a locally applied formulation for the treatment of fibrotic and sclerotic

skin disorders, such as scleroderma, a rare connective tissue disorder characterized by abnormal thickening of the skin.

On January 12, 2021, we announced

that the FDA has granted orphan drug designation for TMB-003, our locally delivered formulation of Sitaxsentan, for the treatment of systemic

sclerosis. We are planning to pursue additional orphan drug designations in other indications.

BPX-01 and BPX-04

Pursuant

to the Merger Agreement (as defined below), BPX-01 (Topical Minocycline, 2%) and BPX-04 (Topical Minocycline, 1%) were added to our portfolio.

BPX-01 and BPX-04 are assets currently in development for acne vulgaris and papulopustular rosacea, respectively. On July 22, 2020, we

announced that we had received notice from the European Patent Office that it intends to grant a patent for the Company’s topical

composition of pharmaceutical tetracycline (including minocycline) for dermatological use (European Patent Application No. 16714168.8)

and the application subsequently issued on December 16, 2020 as EP 3273940. Patents covering the BPX-01 and BPX-04 assets have previously

been granted in the United States, Japan, South Africa, and Australia. We are currently evaluating our strategic options regarding these

assets.

On

September 15, 2020, we announced that we had received a notice of allowance from the USPTO for a Company patent application covering BPX-01

and BPX-04 (U.S. Patent Application No.: 16/514,459) and the application subsequently issued on January 5, 2021 as US 10,881,672.

The Merger, Reverse Stock Split and Name Change

On

May 18, 2020, we completed our business combination with Timber Sub, in accordance with the terms of the Agreement and Plan of Merger

and Reorganization, dated as of January 28, 2020, as amended, by and among Timber, Timber Sub and BITI Merger Sub Inc., a wholly-owned

subsidiary of Timber (“Merger Sub”) (the “Merger Agreement”), pursuant to which Merger Sub merged with and into

Timber Sub, with Timber Sub surviving as a wholly owned subsidiary of Timber (the “Merger”).

In

connection with, and immediately prior to the completion of, the Merger, we effected a reverse stock split of our common stock, at a ratio

of 1-for-12 (the “Reverse Stock Split”). Under the terms of the Merger Agreement, after taking into account the Reverse Stock

Split, we issued shares of common stock to Timber Sub’s unitholders at an exchange rate of 629.57 shares of common stock for each

Timber Sub common unit outstanding immediately prior to the Merger. In connection with the Merger, we changed our name from “BioPharmX

Corporation” to “Timber Pharmaceuticals, Inc.,” and the business conducted by the Company became the business conducted

by Timber Sub.

Private Placement of Common Stock and Warrants

On

May 18, 2020, Timber and Timber Sub completed a private placement transaction (the “Pre-Merger Financing”) with the Investors

pursuant to the Securities Purchase Agreement for an aggregate purchase price of approximately $25.0 million (comprised of (i) approximately

$5 million credit with respect to the senior secured notes issued in connection with the bridge loan that certain of the Investors made

to Timber Sub at the time of the execution of the Merger Agreement and (ii) approximately $20 million in cash from the Investors).

Pursuant

to the Pre-Merger Financing, (i) Timber Sub issued and sold to the Investors common units of Timber Sub which converted pursuant

to the exchange ratio in the Merger into an aggregate of approximately 4,137,509 shares (the “Converted Shares”) of common

stock; and (ii) the Company agreed to issue to each Investor, on the tenth trading day following the consummation of the Merger,

(A) Series A Warrants representing the right to acquire shares of common stock equal to 75% of the sum of (a) the number

of Converted Shares issued to the Investor, without giving effect to any limitation on delivery contained in the Securities Purchase Agreement,

and (b) the number of shares of common stock underlying the Series B Warrants issued to the Investor (the “Series B

Warrants”) and (B) the Series B Warrants. On June 2, 2020, pursuant to the terms of the Securities Purchase Agreement,

the Company issued the Series A Warrants and the Series B Warrants.

In

addition, pursuant to the terms of the Securities Purchase Agreement, dated as of January 28, 2020 between Timber Sub and several

of the Investors, the Company issued to such purchasers, on May 22, 2020, warrants to purchase 413,751 shares of our common stock

(the “Bridge Warrants”) which have an exercise price of $2.2362 per share, subject to full ratchet anti-dilution and adjustment

if shares are sold for a price less than the exercise price of the warrants.

Pursuant

to the Waiver Agreements we entered into with the Selling Stockholders on November 19, 2020, (A) the exercise price of the Series A

Warrants was definitively set at $1.16 per share, (B) the number of shares underlying all of the Series A Warrants was definitively

set at 20,178,214 and (C) the number of shares underlying all of the Series B Warrants was definitively set at 22,766,776. As

of March 4, 2021, all Series B Warrants had been exercised in full.

Recent Developments

Preliminary Operating

Results for the Three and Nine Months Ended September 30, 2021 and Estimated Financial Condition Information as of September 30, 2021

Preliminary unaudited

operating results for the quarter ended September 30, 2021 and certain preliminary financial condition information as of September 30,

2021 are as follows:

|

|

·

|

Net

operating loss for the three and nine months ended September 30, 2021 is expected to be approximately $3.0 million and $7.8

million, respectively.

|

|

|

·

|

The

Company ended the third quarter with approximately $3.4 million in cash and common shares outstanding of 36,659,685 at September

30, 2021.

|

The

above information is preliminary financial information for the third quarter of 2021 and subject to completion. The unaudited, estimated

results for the third quarter of 2021 are preliminary and were prepared by our management, based upon our estimates, a number of assumptions

and currently available information, and are subject to revision based upon, among other things, quarter-end closing procedures and/or

adjustments, the completion of our interim consolidated financial statements and other operational procedures. This preliminary financial

information is the responsibility of management and has been prepared in good faith on a consistent basis with prior periods. However,

we have not completed our financial closing procedures for the quarter ended September 30, 2021, and our actual results could be materially

different from this preliminary financial information, which preliminary information should not be regarded as a representation by us,

our management, or the underwriters as to our actual results for quarter ended September 30, 2021. In addition, KPMG LLP, our independent

registered public accounting firm, has not audited, reviewed, compiled, or performed any procedures with respect to this preliminary financial

information and does not express an opinion or any other form of assurance with respect to this preliminary financial information. During

the course of the preparation of our financial statements and related notes as of and for the quarter ended September 30, 2021, we may

identify items that would require us to make material adjustments to this preliminary financial information. As a result, prospective

investors should exercise caution in relying on this information and should not draw any inferences from this information. This preliminary

financial information should not be viewed as a substitute for full financial statements prepared in accordance with United States generally

accepted accounting principles and reviewed by our auditors. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking

Statements.”

Our

financial statements and related notes as of and for the quarter ended September 30, 2021 may not be filed with the SEC until after this

offering is completed. We currently expect to file our Quarterly Report on Form 10-Q including our financial statements for the quarter

ended September 30, 2021 on or about November 15, 2021.

Corporate Information

Our principal offices are

located at 110 Allen Road, Suite 401, Basking Ridge, NJ, and our telephone number is (908) 636-7160. Our website address is www.timberpharma.com.

Our website and the information contained on, or that can be accessed through, our website shall not be deemed to be incorporated by reference

in, and are not considered part of, this prospectus supplement. You should not rely on any such information in making your decision whether

to purchase our common stock.

THE

OFFERING

|

Securities offered by us

|

|

21,325,000 shares of common stock, warrants to purchase an aggregate of 23,437,500 shares of common stock and Pre-funded Warrants to purchase an aggregate of 2,112,500 shares of common stock.

|

|

|

|

|

|

Warrants offered

|

|

Warrants to purchase up to

23,437,500 shares of common stock, which will be exercisable during the period commencing on the date of their issuance and ending

five years from such date at an exercise price of $0.70 per share of common stock. This prospectus also relates to the offering of

the shares of common stock issuable upon exercise of the warrants. There is no established public trading market for the warrants,

and we do not expect a market to develop. In addition, we do not intend to apply for listing of the warrants on any national

securities exchange or other nationally recognized trading system

|

|

|

|

|

|

Description of Pre-funded Warrants

|

|

If the issuance of shares of common stock to a purchaser in this offering would result in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock following the consummation of this offering, then such purchaser may purchase, if they so choose, in lieu of the shares of common stock that would result in such excess ownership, a Pre-funded Warrant to purchase shares of common stock for a purchase price per share of common stock subject to such Pre-funded Warrant equal to the per share public offering price for the shares of common stock in this offering less $0.001. Each Pre-funded Warrant will have an exercise price of $0.001 per share of common stock, will be exercisable upon issuance and will expire when exercised in full. This prospectus supplement also relates to the offering of shares of common stock issuable upon exercise of these Pre-funded Warrants.

|

|

|

|

|

|

Option to purchase additional shares and/or warrants

|

|

We have granted the underwriter a 30-day option to purchase up to 3,515,625 additional shares of

common stock and/or warrants to purchase up to 3,515,625 shares of our common stock at the public offering price per share of common

stock or warrant, respectively, less underwriting discounts and commissions.

|

|

|

|

|

|

Common stock to be outstanding immediately after this offering

|

|

60,097,185 shares

of common stock (or 63,612,810 shares if the underwriters exercise in full their option to purchase additional shares), assuming

the exercise in full of Pre-funded Warrants issued in this offering.

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering for general corporate purposes, including, but not limited to, ongoing research and pre-clinical studies, clinical trials, the development of new biological and pharmaceutical technologies, investing in or acquiring companies that are synergistic with or complementary to our technologies, and licensing activities related to our current and future product candidates, including a payment of $4.0 million due to Patagonia Pharmaceuticals LLC (“Patagonia”) on the initiation of a Phase 3 pivotal trial for TMB-001, and working capital. See “Use of Proceeds” on page S-10.

|

|

|

|

|

Risk factors

|

|

This investment involves a high degree of risk. You should read the description of risks set forth under “Risk Factors” beginning on page S-8 of this prospectus supplement or otherwise incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to purchase our securities.

|

|

|

|

|

NYSE American symbol

|

|

Our common stock is listed on the NYSE American under the symbol “TMBR”. There is no established trading market for the Pre-funded Warrants, and we do not expect a trading market to develop. We do not intend to list the Pre-funded Warrants on any securities exchange or nationally recognized trading system. Without a trading market, the liquidity of the Pre-funded Warrants will be extremely limited.

|

The number of shares of our common stock to be

outstanding immediately after this offering is based on 36,659,685 shares outstanding as of November 1, 2021, and excludes, as

of that date, the following:

|

|

●

|

2,657,640 shares of common stock issuable upon the exercise of outstanding vested and unvested stock options under our 2020 Omnibus Equity Incentive Plan at a weighted-average exercise price of $1.10 per share, 15,781 shares of common stock underlying legacy BioPharmX stock options at a weighted-average exercise price of $75.27 per share, and 367,670 shares of common stock issuable upon the exercise of outstanding value appreciation rights (“VARs”);

|

|

|

|

|

|

|

●

|

17,329,621 shares of common stock issuable upon the exercise of outstanding warrants, having a weighted-average exercise price of $2.25 per share, including (i) 16,701,824 Series A Warrants with an exercise price of $1.16, (ii) 213,992 BioPharmX legacy warrants with a weighted-average exercise price of $87.21, and (iii) 413,751 Bridge Warrants with an exercise price of $2.2362 that are subject to potential anti-dilution adjustment as a result of this offering;

|

|

|

|

|

|

|

●

|

100,753 shares of common stock issuable upon the conversion of outstanding Series A Preferred Stock;

|

|

|

|

|

|

|

●

|

183,360 shares of treasury stock; and

|

|

|

|

|

|

|

●

|

the shares of common stock

issuable upon exercise of the warrants issued in this offering.

|

RISK

FACTORS

Before deciding whether to

invest in our common stock, you should carefully consider the risk factors set forth below and incorporated by reference in this prospectus

supplement from our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and any subsequent updates described

in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as the risks, uncertainties and additional information

set forth in our SEC reports on Forms 10-K, 10-Q and 8-K and in the other documents incorporated by reference in this prospectus supplement.

For a description of these reports and documents, and information about where you can find them, see “Where You Can Find Additional

Information” and “Incorporation of Certain Information By Reference”. Additional risks not presently known or that we

presently consider to be immaterial could subsequently materially and adversely affect our financial condition, results of operations,

business and prospects.

Risks Related to this Offering and our Common

Stock

We have broad discretion

in the use of the net proceeds from this offering and our existing cash and may not use them effectively.

Our management will have broad

discretion in the application of the net proceeds from this offering, including for any of the purposes described in the section entitled

“Use of Proceeds,” as well as our existing cash and cash equivalents, and you will be relying on the judgment of our management

regarding such application. You will not have the opportunity, as part of your investment decision, to assess whether the net proceeds

are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this

offering, their ultimate use may vary substantially from their currently intended use. Our management might not apply the net proceeds

or our existing cash in ways that ultimately increase the value of your investment. If we do not invest or apply the net proceeds from

this offering or our existing cash and cash equivalents in ways that enhance stockholder value, we may fail to achieve expected business

and financial results, which could cause our stock price to decline. Pending their use, we may invest the net proceeds from this offering

in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders.

You will experience

immediate dilution in the book value per share of the securities you purchase in this offering.

Because

the price per share of our common stock being offered is substantially higher than the net tangible book value per share of

our common stock after giving effect to this offering, you will suffer substantial dilution in the as adjusted net tangible

book value of the common stock you purchase in this offering. If you purchase shares of common stock in this offering, you will suffer

immediate and substantial dilution of $0.33 per share in the as adjusted net tangible book value of the common stock you

purchase. Any exercise of outstanding stock options, warrants or other equity awards will result in further dilution. See “Dilution”

for a more detailed discussion of the dilution you will incur if you purchase our securities in this offering.

The issuance or

sale of shares in the future to raise money or for strategic purposes could reduce the market price of our common stock.

In the future, we may issue

securities to raise cash for operations, to pay down then existing indebtedness, as consideration for the acquisition of assets, as consideration

for receipt of goods or services, and to pay for the development of our product candidates. We have and in the future may issue securities

convertible into our common stock. Any of these events may dilute stockholders’ ownership interests in our company and have an adverse

impact on the price of our common stock.

In addition, sales of a substantial

amount of our common stock in the public market, or the perception that these sales may occur, could reduce the market price of our common

stock. This could also impair our ability to raise additional capital through the sale of our securities.

Any actual or

anticipated sales of shares by our stockholders may cause the trading price of our common stock to decline. The sale of a

substantial number of shares of our common stock by our stockholders, or anticipation of such sales, could make it more difficult

for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect

sales.

Issuance of our

common stock upon exercise of convertible securities may depress the price of our common stock.

As of November 1, 2021, we

had 36,659,685 shares of common stock issued and outstanding, warrants to purchase 17,329,567 shares of common stock at a weighted-average

exercise price of $2.25, including (i) 16,701,824 Series A Warrants with an exercise price of $1.16, and (ii) 413,751 Bridge Warrants

with an exercise price of $2.2362 that are subject to potential anti-dilution as a result of this offering, (iii) 213,992 BioPharmX legacy

warrants with a weighted-average exercise price of $87.21, and (iv) outstanding stock options to purchase 2,657,640 shares of common stock

under our 2020 Omnibus Equity Incentive Plan at a weighted-average exercise price of $1.10 per share, 15,781 shares of common stock issuable

upon the exercise of outstanding and vested legacy BioPharmX stock options at a weighted-average exercise price of $75.27 and outstanding

VARs convertible into an aggregate of 367,670 shares of common stock. All warrants, and stock options are convertible, or exercisable

into, one share of common stock. The issuance of shares of our common stock upon the exercise of outstanding convertible securities could

result in substantial dilution to our stockholders, which may have a negative effect on the price of our common stock.

There is no public market for the Pre-funded Warrants

being offered by us in this offering.

There is no established public

trading market for the Pre-funded Warrants being offered in this offering, and we do not expect a market to develop. In addition,

we do not intend to apply to list the Pre-Funded warrants on any national securities exchange or other nationally recognized

trading system, including the NYSE American. Without an active market, the liquidity of the Pre-funded Warrants will be limited.

Holders of the Pre-funded Warrants

offered hereby will have no rights as common stockholders with respect to the common stock underlying the Pre-funded Warrants

until such holders exercise their Pre-funded Warrants and acquire our common stock, except as otherwise provided in the Pre-funded Warrants.

Until holders of the Pre-funded Warrants

acquire our common stock upon exercise thereof, such holders will have no rights with respect to the common stock underlying such Pre-funded Warrants,

except to the extent that holders of such Pre-Funded warrants will have certain rights to participate in distributions or dividends

paid on our common stock as set forth in the Pre-funded Warrants. Upon exercise of the Pre-funded Warrants, the holders

will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise

date.

There is no public

market for the warrants to purchase common stock being offered in this offering.

There is no established public

trading market for the warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend

to apply for listing of the warrants on any securities exchange. Without an active market, the liquidity of the warrants will be limited.

Holders

of our warrants will have no rights as a common stockholder until such holders exercise their warrants and acquire

our common stock, except as provided in the warrants.

Until holders of warrants

acquire shares of our common stock upon exercise of the warrants, holders of warrants will have no rights with respect to the shares of

our common stock underlying such warrants, except as provided in the warrants. Upon exercise of the warrants, the holders thereof will be entitled to exercise the rights

of a common stockholder only as to matters for which the record date occurs after the exercise date.

USE

OF PROCEEDS

We estimate that the net

proceeds from the offering will be approximately $13.5 million (or approximately $15.6 million if the underwriters exercise in full

their option to purchase up to 3,515,625 additional shares of common stock and/or warrants to purchase 3,515,625 additional shares

of common stock), after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net

proceeds from the offering for general corporate purposes, which includes, without limitation, ongoing research and pre-clinical

studies, clinical trials, the development of new biological and pharmaceutical technologies, investing in or acquiring companies

that are synergistic with or complementary to our technologies, licensing activities related to our current and future product

candidates (including a payment of $4.0 million due to Patagonia on the initiation of a Phase 3 pivotal trial for TMB-001), the development of emerging technologies, investing in or acquiring companies that are developing emerging

technologies, licensing activities, or the acquisition of other businesses and working capital. The amounts and timing of these

expenditures will depend on numerous factors, including the development of our current business initiatives. We have no specific

acquisition contemplated at this time. As of the date of this prospectus supplement, we cannot specify with certainty all of the

particular uses for the net proceeds from this offering. The amounts and timing of our actual expenditures will depend on numerous

factors, including factors described under “Risk Factors” in this prospectus supplement, the accompanying base

prospectus and the documents incorporated by reference herein and therein.

DILUTION

If you invest in our securities

in this offering, your interest will be diluted immediately to the extent of the difference between the public offering price paid by

the purchasers of the shares of common stock and warrants sold in this offering and the as-adjusted net tangible book value per shares

of common stock after this offering.

The net tangible book value

of our common stock as of June 30, 2021 was approximately $4.8 million, or approximately $0.13 per shares of common stock.

Net tangible book value per share represents the amount of our total tangible assets less total liabilities divided by the total number

of our shares of common stock outstanding as of June 30, 2021.

After giving effect to

the sale by us in this offering of 21,325,000 shares of common stock, 2,112,500 Pre-Funded Warrants and 23,437,500 warrants at

a price per share and related warrant of $0.64 after deducting estimated underwriting discounts and commissions and estimated

offering expenses payable by us, and assuming the exercise in full of Pre-funded Warrants issued in this offering, our as

adjusted net tangible book value as of June 30, 2021 would have been approximately

$18.3 million, or approximately

$0.31 per share of common stock. This represents an

immediate increase in net tangible book value of approximately

$0.18 per share of common stock to our existing

security holders and an immediate dilution in as adjusted net tangible book value of approximately

$0.33 per share of common stock to purchasers of

common stock in this offering, as illustrated by the following table:

|

Public offering price per share of common stock and related warrant

|

|

|

|

|

|

$

|

0.64

|

|

|

Consolidated net tangible book value per share as of June 30, 2021

|

|

$

|

0.13

|

|

|

|

|

|

|

Increase in consolidated net tangible book value per share of common stock attributable to the offering

|

|

$

|

0.18

|

|

|

|

|

|

|

As adjusted consolidated net tangible book value per share of common stock as of June 30, 2021

|

|

$

|

0.31

|

|

|

|

|

|

|

Dilution per share of common stock to new investors participating in this offering

|

|

|

|

|

|

$

|

0.33

|

|

If the underwriters exercise

their option to purchase up to 3,515,625 additional shares of common stock and/or warrants to purchase 3,515,625 additional shares in

full, the as adjusted net tangible book value will increase to $0.32

per share, representing an immediate increase in net tangible book value of $0.19

per share of our common stock to existing stockholders and an immediate dilution of $0.32 per share to purchasers of our common stock

in this offering.

The figures above are based

on 36,659,685 shares outstanding as of June 30, 2021, and excludes as of such date:

|

|

●

|

184,456 shares of common stock issuable upon the exercise of outstanding vested and unvested stock options under our 2020 Omnibus Equity Incentive Plan at a weighted-average exercise price of $2.87 per share (excluding aggregate of 2,473,184 shares of common stock issuable upon the exercise of outstanding options with a weighted-average exercise price of $0.96 granted in the third quarter of 2021), 15,781 shares of common stock issuable upon the exercise of outstanding and vested legacy BioPharmX stock options at a weighted-average exercise price of $75.27, and 367,670 shares of common stock issuable upon the exercise of outstanding vested and unvested VARs;

|

|

|

|

|

|

|

●

|

17,335,503 shares of common stock issuable upon the exercise of outstanding warrants, having a weighted-average exercise price of $2.25 per share, including (i) 16,701,824 Series A Warrants with an exercise price of $1.16, (ii) 214,046 BioPharmX legacy warrants with a weighted-average exercise price of $87.25, and (iii) 413,751 Bridge Warrants with an exercise price of $2.2362 that are subject to potential anti-dilution adjustment as a result of this offering;

|

|

|

|

|

|

|

●

|

100,753 shares of common stock issuable upon the conversion of outstanding Series A Preferred Stock;

|

|

|

|

|

|

|

●

|

183,360 shares of treasury stock; and

|

|

|

|

|

|

|

●

|

the shares of common stock issuable upon exercise of the warrants issued in this offering.

|

To the extent that outstanding

exercisable options or warrants are exercised, including the warrants issued in this offering, you may experience further dilution. In addition, we

may need to raise additional capital and to the extent that we raise additional capital by issuing equity or convertible debt securities

your ownership will be further diluted.

DESCRIPTION OF SECURITIES OFFERED

We are offering 21,325,000 shares

of our common stock and warrants to purchase up to 23,437,500 shares of common stock. We are also offering 2,112,500 Pre-funded Warrants

to those purchasers whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates

and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares

of common stock following the consummation of this offering in lieu of the shares of common stocks that would result in such excess ownership.

Each Pre-funded Warrant will be exercisable for one share of common stock. No warrant for fractional shares of common stock will be issued,

rather warrants will be issued only for whole shares of common stock. We are also registering the shares of common stock issuable from

time to time upon exercise of the Pre-funded Warrants and warrants offered hereby.

Common Stock

The descriptions of our common

stock included in the accompanying prospectus on page 7 under the heading “Description of Capital Stock” are incorporated

herein by reference.

Warrants

The

following is a summary of all material terms and provisions of the warrants that are being offered hereby, the form of which will

be filed as an exhibit to a Current Report on Form 8 K in connection with this offering and incorporated by reference into the registration

statement of which this prospectus supplement forms a part. Prospective investors should carefully review the terms and provisions of

the form of warrant for a complete description of the terms and conditions of the warrants.

Duration and Exercise Price

Each warrant offered hereby

will have an exercise price equal to $0.70. The warrants will be immediately exercisable and may be exercised until the fifth anniversary

of the issuance date. The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment

in the event of stock dividends, stock splits, reorganizations or similar events affecting our common stock and the exercise price. The

warrants will be issued separately from the common stock or pre-funded warrants, respectively, and may be transferred separately immediately

thereafter. Warrants will be issued in certificated form only.

Exercisability

The warrants will be

exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment

in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed

below). A holder (together with its affiliates) may not exercise any portion of such holder’s warrants to the extent that

the holder would own more than 4.99% of the outstanding common stock immediately after exercise, except that upon at least 61 days’

prior notice from the holder to us, the holder may increase the amount of ownership of outstanding stock after exercising the holder’s

warrants up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as

such percentage ownership is determined in accordance with the terms of the warrants.

Cashless Exercise

If, at the time a holder exercises

its warrants, a registration statement registering the issuance or resale of the shares of common stock underlying the warrants

under the Securities Act is not then effective or available for the issuance of such shares, then in lieu of making the cash payment otherwise

contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon

such exercise (either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the

warrant. The warrants will be automatically exercised on a cashless basis on the expiration date.

Fundamental Transactions

In the event of any fundamental

transaction, as described in the warrants and generally including any merger with or into another entity, sale of all or substantially

all of our assets, tender offer or exchange offer, or reclassification of our common stock, then upon any subsequent exercise of a warrant,

the holder will have the right to receive as alternative consideration, for each share of our common stock that would have been issuable

upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of common stock of the successor

or acquiring corporation or of our company, if it is the surviving corporation, and any additional consideration receivable upon or as

a result of such transaction by a holder of the number of shares of our common stock for which the warrant is exercisable immediately

prior to such event. Notwithstanding the foregoing, in the event of a fundamental transaction, the holders of the warrants have the right

to require us or a successor entity to redeem the warrants for cash in the amount of the Black-Scholes Value (as defined in each warrant)

of the unexercised portion of the warrants concurrently with or within 30 days following the consummation of a fundamental transaction.

However, in the event of a fundamental transaction which is not in our control, including a fundamental transaction not approved by our

board of directors, the holders of the warrants will only be entitled to receive from us or our successor entity, as of the date of consummation

of such fundamental transaction the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the

unexercised portion of the warrant that is being offered and paid to the holders of our common stock in connection with the fundamental

transaction, whether that consideration is in the form of cash, stock or any combination of cash and stock, or whether the holders of

our common stock are given the choice to receive alternative forms of consideration in connection with the fundamental transaction.

Transferability

Subject to applicable laws,

a warrant may be transferred at the option of the holder upon surrender of the warrant to us together with the appropriate

instruments of transfer.

Fractional Shares

No fractional shares of common

stock will be issued upon the exercise of the warrants. Rather, the number of shares of common stock to be issued will, at our

election, either be rounded up to the nearest whole number or we will pay a cash adjustment in respect of such final fraction in an amount

equal to such fraction multiplied by the exercise price.

Trading Market

There is no established trading

market for the warrants, and we do not expect an active trading market to develop. We do not intend to apply to list the

warrants on any securities exchange or other trading market. Without a trading market, the liquidity of the warrants will be extremely

limited.

Right as a Stockholder

Except as otherwise provided

in the warrants or by virtue of the holder’s ownership of shares of our common stock, such holder of warrants does

not have the rights or privileges of a holder of our common stock, including any voting rights, until such holder exercises such holder’s

warrants.

Waivers and Amendments

No term of the warrants

may be amended or waived without the written consent of the majority of the holders of the warrants purchased in this offering.

Pre-funded Warrants

The following summary of certain

terms and provisions of the Pre-funded Warrants that are being offered hereby is not complete and is subject to, and qualified

in its entirety by, the provisions of the Pre-funded Warrant, the form of which will be filed with the SEC as an exhibit to

a Current Report on Form 8-K in connection with this offering and incorporated by reference into the registration statement

of which this prospectus supplement forms a part. Prospective investors should carefully review the terms and provisions of the form of Pre-funded Warrant

for a complete description of the terms and conditions of the Pre-funded Warrants.

Duration and Exercise Price

Each Pre-funded Warrant

offered hereby will have an initial exercise price per share of common stock equal to $0.001. The Pre-funded Warrants will be

immediately exercisable and will expire when exercised in full. The exercise price and number of shares of common stock issuable upon

exercise is subject to appropriate adjustment in the event of share dividends, share splits, reorganizations or similar events affecting

our shares of common stock and the exercise price. Subject to the rules and regulations of the applicable trading market, we may at any

time during the term of the Pre-funded Warrant, subject to the prior written consent of the holders, reduce the then current

exercise price to any amount and for any period of time deemed appropriate by our board of directors.

Exercisability

The Pre-funded Warrants

will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied

by payment in full for the number of shares of common stock purchased upon such exercise (except in the case of a cashless exercise as

discussed below). A holder (together with its affiliates) may not exercise any portion of the Pre-funded Warrant to the extent

that the holder would own more than 4.99% of the outstanding shares of common stock immediately after exercise, except that upon at least

61 days’ prior notice from the holder to us, the holder may increase the amount of beneficial ownership of outstanding shares

after exercising the holder’s Pre-funded Warrants up to 9.99% of the number of our shares of common stock outstanding

immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-funded Warrants.

Purchasers of Pre-funded Warrants in this offering may also elect prior to the issuance of the Pre-funded Warrants

to have the initial exercise limitation set at 9.99% of our outstanding shares of common stock.

Cashless Exercise

In lieu of making the cash

payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead

to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a formula

set forth in the Pre-funded Warrants.

Fractional Shares

No fractional shares of common

stock will be issued upon the exercise of the Pre-funded Warrants. Rather, at the Company’s election, the number of shares

of common stock to be issued will be rounded up to the nearest whole number or the Company will pay a cash adjustment in an amount equal

to such fraction multiplied by the exercise price.

Transferability

Subject to applicable laws,

a Pre-funded Warrant may be transferred at the option of the holder upon surrender of the Pre-funded Warrant to us

together with the appropriate instruments of transfer.

Trading Market

There is no trading market

available for the Pre-funded Warrants on any securities exchange or nationally recognized trading system, and we do not expect

a trading market to develop. We do not intend to list the Pre-funded Warrants on any securities exchange or nationally recognized

trading market. Without a trading market, the liquidity of the Pre-funded Warrants will be extremely limited. The shares of

common stock issuable upon exercise of the Pre-funded Warrants are currently traded on the NYSE American.

Right as a Shareholder

Except as otherwise provided

in the Pre-funded Warrants or by virtue of such holder’s ownership of shares of common stock, the holders of the Pre-funded Warrants

do not have the rights or privileges of holders of our shares of common stock, including any voting rights, until they exercise their Pre-funded Warrants.

The Pre-funded Warrants will provide that holders have the right to participate in distributions or dividends paid on our shares

of common stock.

Fundamental Transaction

In the event of a fundamental

transaction, as described in the Pre-funded Warrants and generally including any reorganization, recapitalization or reclassification

of our shares of common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation

or merger with or into another person, the acquisition of more than 50% of our outstanding shares of common stock, or any person or group

becoming the beneficial owner of 50% of the voting power represented by our outstanding shares of common stock, the holders of the Pre-funded Warrants

will be entitled to receive upon exercise of the Pre-funded Warrants the kind and amount of securities, cash or other property

that the holders would have received had they exercised the Pre-funded Warrants immediately prior to such fundamental transaction

on a net exercise basis.

UNDERWRITING

Pursuant to the underwriting

agreement with H.C. Wainwright & Co., LLC (the “Representative”), as Representative of the several underwriters in this

offering, we have agreed to issue and sell, and each of the underwriters have agreed to purchase, the number of shares of common stock, warrants

and Pre-funded Warrants listed opposite its name below, less the underwriting discounts and commissions, on the closing date, subject

to the terms and conditions contained in the underwriting agreement. The underwriting agreement provides that the obligations of the underwriters

are subject to certain customary conditions precedent, representations and warranties contained therein.

|

Underwriter

|

|

Number of

Shares

|

|

|

Number of

Warrants

|

|

|

Number of

Pre-funded

Warrants

|

|

|

H.C. Wainwright & Co., LLC

|

|

|

21,325,000

|

|

|

|

23,437,500

|

|

|

|

2,112,500

|

|

|

Total

|

|

|

21,325,000

|

|

|

|

23,437,500

|

|

|

|

2,112,500

|

|

Pursuant to the

underwriting agreement, the underwriters have agreed to purchase all of the shares and warrants sold under the underwriting

agreement if any of these shares and warrants are purchased, other than those shares and warrants covered by the underwriters’

option to purchase additional shares of common stock described below. The underwriters have advised us that they do not intend to

confirm sales to any account over which they exercise discretionary authority.

Discount, Commissions and Expenses

The underwriters may

offer the shares of common stock and warrants from time to time to purchasers directly or through agents, or through brokers in

brokerage transactions on the NYSE American, or to dealers in negotiated transactions or in a combination of such methods of sale,

or otherwise, at a fixed price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices

related to such prevailing market prices or at negotiated prices, subject to receipt and acceptance by them and subject to their

right to reject any order in whole or in part. The difference between the price at which the underwriters purchase shares and

warrants from us and the price at which the underwriters resell such shares may be deemed underwriting compensation. If the

underwriters effect such transactions by selling shares of common stock and warrants to or through dealers, such dealers may receive

compensation in the form of discounts, concessions or commissions from the underwriters and/or purchasers of shares of common stock

and warrants for whom they may act as agents or to whom they may sell as principal.

While the underwriters

intend to offer the shares of common stock at the price set forth on the cover of this prospectus supplement, the underwriters may

offer the shares of common stock from time to time to purchasers directly or through agents, or through brokers in brokerage

transactions on NYSE American, or to dealers in negotiated transactions or in a combination of such other methods of sale, or

otherwise, at a fixed price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices related

to such prevailing market price or at negotiated prices. Any shares and warrants sold by the underwriters to securities dealers will

be sold at the public offering price less a selling concession not in excess of $0.0288 per share and related warrant.

We have granted to the Representative

an option, exercisable for 30 days from the date of this prospectus supplement, to purchase up to 3,515,625 additional shares of common

stock and/or warrants to purchase up to 3,515,625 shares of our common stock at the public offering price per share of common stock or

warrant, respectively, less underwriting discounts and commissions.

The following table shows

the public offering price, underwriting discounts and commissions and proceeds, before expenses, to us.

|

|

|

Per Share and

Related

Warrant

|

|

|

Per Pre-funded

Warrant and

Related Warrant

|

|

Total Without

Option

|

|

|

Total With

Option

|

|

|

Public offering price

|

|

$

|

0.64

|

|

|

$

|

0.639

|

|

$

|

14,997,887.50

|

|

|

$

|

17,247,887.50

|

|

|

Underwriting discounts and commissions

|

|

$

|

0.0384

|

|

|

$

|

0.0384

|

|

$

|

900,000.00

|

|

|

$

|

1,035,000.00

|

|

|

Proceeds, before expenses and fees, to us

|

|

$

|

0.6016

|

|

|

$

|

0.6006

|

|

$

|

14,097,887.50

|

|

|

$

|

16,212,887.50

|

|

We have agreed to pay

the legal fees and expenses of the underwriters, in the sum of up to $100,000 in connection with this offering, $50,000 for

non-accountable expenses and clearing fees of $15,950. We have also agreed to pay the underwriters a management fee equal to 1.0% of

the aggregate gross proceeds in this offering. We estimate that the total expenses of the offering, excluding the underwriting

discounts and commissions, will be approximately $410,000 and are payable by us.

Right of First Refusal

We have granted the Representative

a six-month right of first refusal to act as sole book-running manager, sole underwriter, or sole placement agent if we or any of our

subsidiaries raise funds by means of a public offering or a private placement or any other capital-raising financing of equity or equity-linked

securities using an underwriter or placement agent. If the Representative or an affiliate of the Representative accept any such engagement,

the agreement governing such engagement will contain, among other things, provisions for customary fees and terms for transactions of

similar size and nature, including indemnification, which are appropriate to such a transaction.

Tail

If an offering is not consummated

by November 15, 2021, we shall pay the Representative the cash compensation provided above on the gross proceeds provided to us by investors

that were brought over-the-wall or introduced to the Company by the Representative during our engagement of the Representative in a public

or private offering or other financing or capital-raising transaction within six months following the termination of our engagement of

the Representative.

Indemnification

We have agreed to indemnify

the underwriters against certain liabilities, including civil liabilities under the Securities Act, or to contribute to payments that

the underwriters may be required to make in respect of those liabilities.

Lock-Up Agreements

We have agreed to not sell

any shares of our common stock, or any securities convertible into or exercisable or exchangeable into shares of common stock, subject to

certain exceptions, for a period of 90 days after the closing of this offering unless we obtain prior written consent of the underwriters.

This consent may be given at any time without public notice, and the underwriters may consent in their sole discretion. The exceptions

to the restriction include, among other things, the issuance of any shares of our capital stock or securities convertible into shares

of our capital stock that are issued (i) pursuant to a stock or option plan, (ii) pursuant to the exercise or exchange of or conversion

of any securities exercisable or exchangeable for or convertible into shares of common stock issued and outstanding on the date of this

prospectus supplement, (iii) as consideration in an acquisition, merger or similar strategic transaction approved by a majority of the

disinterested directors, provided that such securities are issued as “restricted securities” as defined in Rule 144 and carry

no registration rights that require or permit the filing of any registration statement in connection therewith within 90 days following

the closing of this offering, and provided that any such issuance shall only be to a person providing us business synergies and additional

benefits in addition to the investment of funds, but shall not include a transaction in which we are issuing securities primarily for

the purpose of raising capital or to an entity whose primary business is investing in securities.

In addition, each of our directors

and executive officers has entered into a lock-up agreement with the Representative. Under the lock-up agreements, subject to certain

limited circumstances, our directors and officers may not, directly or indirectly, sell, offer to sell, contract to sell, or grant any

option for the sale (including any short sale), grant any security interest in, pledge, hypothecate, hedge, establish an open “put

equivalent position” (within the meaning of Rule 16a-1(h) under the Exchange Act), or otherwise dispose of, or enter into any transaction

which is designed to or could be expected to result in the disposition of, any shares of our common stock or securities convertible into

or exchangeable for shares of our common stock, or publicly announce any intention to do any of the foregoing, unless such directors and

executive officers obtain prior written consent of the Representative for a period of 90 days from the date of this prospectus supplement.

This consent may be given at any time without public notice, and the Representative may consent in its sole discretion.

Price Stabilization, Short Positions and Penalty

Bids

In connection with this offering,

the underwriters may engage in stabilizing transactions, syndicate covering transactions and penalty bids in connection with our common

stock.

Stabilizing transactions permit

bids to purchase shares of common stock so long as the stabilizing bids do not exceed a specified maximum.

Syndicate covering transactions

involve purchases of common stock in the open market after the distribution has been completed in order to cover syndicate short positions.