false

2023

FY

0001065078

0001065078

2023-01-01

2023-12-31

0001065078

2023-06-30

0001065078

2024-03-01

0001065078

2023-10-01

2023-12-31

0001065078

2023-12-31

0001065078

2022-12-31

0001065078

2022-01-01

2022-12-31

0001065078

us-gaap:CommonStockMember

2021-12-31

0001065078

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001065078

us-gaap:RetainedEarningsMember

2021-12-31

0001065078

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001065078

nssi:TotalStockholdersEquityMember

2021-12-31

0001065078

us-gaap:CommonStockMember

2022-12-31

0001065078

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001065078

us-gaap:RetainedEarningsMember

2022-12-31

0001065078

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001065078

nssi:TotalStockholdersEquityMember

2022-12-31

0001065078

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001065078

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001065078

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001065078

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001065078

nssi:TotalStockholdersEquityMember

2022-01-01

2022-12-31

0001065078

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001065078

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001065078

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001065078

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0001065078

nssi:TotalStockholdersEquityMember

2023-01-01

2023-12-31

0001065078

us-gaap:CommonStockMember

2023-12-31

0001065078

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001065078

us-gaap:RetainedEarningsMember

2023-12-31

0001065078

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001065078

nssi:TotalStockholdersEquityMember

2023-12-31

0001065078

2021-12-31

0001065078

nssi:ILiADBiotechnologiesLLCMember

2023-12-31

0001065078

nssi:LitigationSettlementsMember

2023-01-01

2023-12-31

0001065078

nssi:LitigationSettlementsMember

2022-01-01

2022-12-31

0001065078

srt:MinimumMember

2023-12-31

0001065078

srt:MaximumMember

2023-12-31

0001065078

srt:MinimumMember

2023-01-01

2023-12-31

0001065078

srt:MaximumMember

2023-01-01

2023-12-31

0001065078

nssi:StockIncentivePlan2022Member

2023-12-31

0001065078

nssi:StockIncentivePlan2013Member

2023-12-31

0001065078

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-12-31

0001065078

us-gaap:RestrictedStockUnitsRSUMember

2022-01-01

2022-12-31

0001065078

us-gaap:RestrictedStockUnitsRSUMember

2023-12-31

0001065078

us-gaap:RestrictedStockUnitsRSUMember

2022-12-31

0001065078

nssi:CostBasisMember

2023-12-31

0001065078

nssi:GrossUnrealizedGainsMember

2023-12-31

0001065078

nssi:GrossUnrealizedLossesMember

2023-12-31

0001065078

nssi:FairValueMember

2023-12-31

0001065078

nssi:CostBasisMember

2022-12-31

0001065078

nssi:GrossUnrealizedGainsMember

2022-12-31

0001065078

nssi:GrossUnrealizedLossesMember

2022-12-31

0001065078

nssi:FairValueMember

2022-12-31

0001065078

nssi:ILiADBiotechnologiesLLCMember

2022-12-31

0001065078

nssi:IliadMember

nssi:ClassCUnitsMember

2023-12-31

0001065078

nssi:IliadMember

2023-01-01

2023-12-31

0001065078

nssi:ILiADBiotechnologiesLLCMember

2022-08-24

0001065078

nssi:IliadMember

2022-01-01

2022-12-31

0001065078

nssi:IliadMember

2023-12-31

0001065078

2022-10-01

2023-09-30

0001065078

2021-10-01

2022-09-30

0001065078

2022-03-01

2022-03-25

0001065078

2013-05-01

2023-12-31

0001065078

2022-05-01

0001065078

srt:ChiefExecutiveOfficerMember

nssi:NewEmploymentAgreementMember

2022-03-02

2022-03-22

0001065078

srt:ChiefExecutiveOfficerMember

2023-01-01

2023-12-31

0001065078

srt:ChiefExecutiveOfficerMember

2022-01-01

2022-12-31

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

2022-03-02

2022-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2022-03-02

2022-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2023-03-02

2023-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2024-03-02

2024-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

2022-03-02

2022-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

2022-03-02

2022-03-22

0001065078

us-gaap:RestrictedStockUnitsRSUMember

srt:ChiefExecutiveOfficerMember

nssi:ShareBasedCompensationAwardTrancheFourMember

2022-03-02

2022-03-22

0001065078

srt:VicePresidentMember

2023-01-01

2023-12-31

0001065078

srt:VicePresidentMember

2022-01-01

2022-12-31

0001065078

srt:ChiefFinancialOfficerMember

2022-01-01

2022-12-31

0001065078

nssi:GoogleMember

2017-05-08

2017-05-09

0001065078

nssi:FacebookMember

2017-05-08

2017-05-09

0001065078

nssi:NetgearMember

2017-05-08

2017-05-09

0001065078

nssi:AristaNetworksMember

2017-05-08

2017-05-09

0001065078

nssi:FourPartiesMember

2023-01-01

2023-12-31

0001065078

nssi:BoardOfDirectorsMember

2023-06-14

0001065078

2011-08-01

2023-12-31

0001065078

nssi:BoardOfDirectorsMember

2023-03-01

2023-03-03

0001065078

nssi:BoardOfDirectorsMember

2021-09-01

2021-09-08

0001065078

us-gaap:SubsequentEventMember

nssi:BoardOfDirectorsMember

2024-02-01

2024-02-23

0001065078

us-gaap:SubsequentEventMember

us-gaap:RestrictedStockUnitsRSUMember

2024-02-01

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

nssi:Integer

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ___________.

Commission File Number: 1-15288

NETWORK-1 TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

|

11-3027591 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(I.R.S.

Employer

Identification

Number) |

| |

|

|

65 Locust Avenue, Third Floor

New Canaan, Connecticut 06840

|

| (Address

of Principal Executive Offices) |

Registrant's telephone number, including area code:

(203) 920-1055

Securities registered pursuant to Section 12(b) of the

Act:

| Title

of each class |

Trading

symbol |

Name

of each exchange on which registered |

| Common

Stock $.01 par value |

NTIP |

NYSE

American |

| |

|

|

Securities registered under Section 12(g) of the Act:

Common Stock, $.01 par value

(Title of Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act

of 1934. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller Reporting Company ☒ |

| Emerging growth

company ☐ |

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in this filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D.1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

☒

The

aggregate market value of the voting and non-voting common stock held by non-affiliates computed by reference to the price at which the

common stock was last sold as of June 30, 2023 was approximately $38,052,926 based on the closing price as reported on NYSE American

Exchange. Shares of voting stock held by each officer and director and by each person, who as of June 30, 2023, the last business

day of the Registrant’s most recently completed second quarter, may be deemed to have beneficially owned more than 10% of the voting

stock have been excluded. This determination of affiliate status is not necessarily a conclusive determination of affiliate status for

any other purpose.

The

number of shares outstanding of Registrant's common stock as of March 1, 2024 was 23,510,019.

NETWORK-1

TECHNOLOGIES, INC.

2023

FORM 10-K

TABLE

OF CONTENTS

Page

No.

PART

I

PART

I

Forward-looking

statements:

THIS

ANNUAL REPORT ON FORM 10-K CONTAINS STATEMENTS ABOUT FUTURE EVENTS AND EXPECTATIONS WHICH ARE “FORWARD-LOOKING

STATEMENTS”. ANY STATEMENT IN THIS 10-K THAT IS NOT A STATEMENT OF HISTORICAL FACT MAY BE DEEMED TO BE A FORWARD-LOOKING

STATEMENT WITHIN THE MEANING OF SECTION 27A OF THE SECURITIES EXCHANGE ACT OF 1933, AS AMENDED, OR SECTION 21E OF THE SECURITIES

EXCHANGE ACT OF 1934, AS AMENDED. FORWARD-LOOKING STATEMENTS PROVIDE CURRENT EXPECTATIONS OF FUTURE EVENTS BASED

ON CERTAIN ASSUMPTIONS AND INCLUDE ANY STATEMENT THAT DOES NOT DIRECTLY RELATE TO ANY HISTORICAL OR CURRENT FACT. STATEMENTS

CONTAINING SUCH WORDS AS “MAY,” “WILL,” “EXPECT,” “BELIEVE,”

“ANTICIPATE,” “INTEND,” “COULD,” “ESTIMATE,” “CONTINUE” OR

“PLAN” AND SIMILAR EXPRESSIONS OR VARIATIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE

STATEMENTS ARE BASED ON THE BELIEFS AND ASSUMPTIONS OF OUR MANAGEMENT BASED ON INFORMATION CURRENTLY AVAILABLE TO MANAGEMENT. SUCH

FORWARD-LOOKING STATEMENTS ARE SUBJECT TO CURRENT RISKS, UNCERTAINTIES AND ASSUMPTIONS RELATED TO VARIOUS FACTORS SET FORTH IN

THIS REPORT AND IN OTHER FILINGS MADE BY US WITH THE SECURITIES AND EXCHANGE COMMISSION. BASED UPON CHANGING CONDITIONS, SHOULD ANY

ONE OR MORE OF THESE RISKS OR UNCERTAINTIES MATERIALIZE, INCLUDING THOSE DISCUSSED AS “RISK FACTORS” IN ITEM 1A AND

ELSEWHERE IN THIS REPORT, OR SHOULD ANY OF OUR UNDERLYING ASSUMPTIONS PROVE INCORRECT, ACTUAL RESULTS MAY VARY MATERIALLY FROM THOSE

DESCRIBED IN THIS REPORT. WE UNDERTAKE NO OBLIGATION TO UPDATE, AND WE DO NOT HAVE A POLICY OF UPDATING OR REVISING THESE

FORWARD-LOOKING STATEMENTS. READERS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF

THE DATE THE STATEMENT WAS MADE. UNLESS THE CONTEXT OTHERWISE REQUIRES, THE TERMS

“NETWORK-1”,“COMPANY”,“WE,” “OUR,” “US” MEAN NETWORK-1 TECHNOLOGIES,

INC. AND ITS WHOLLY-OWNED SUBSIDIARIES, MIRROR WORLDS TECHNOLOGIES, LLC AND HFT SOLUTIONS, LLC.

ITEM

1. BUSINESS

Overview

Our

principal business is the development, licensing and protection of our intellectual property assets. We presently own one hundred (100)

U.S. patents, fifty-four (54) of such patents have expired, and fifteen (15) foreign patents relating to (i) our Cox patent portfolio

(the “Cox Patent Portfolio”) relating to enabling technology for identifying media content on the Internet and taking further

actions to be performed after such identification;(ii) our M2M/IoT patent portfolio (the “M2M/IoT Patent Portfolio”) relating

to,

among

other things, enabling technology for authenticating and using eSIM (embedded Subscriber Identification Module) technology in IoT, Machine-to-Machine,

and other mobile devices, including smartphones, tablets and computers, as well as automobiles; (iii) our HFT patent portfolio (the “HFT

Patent Portfolio”) covering certain advanced technologies relating to high frequency trading, which inventions specifically address

technological problems associated with speed and latency and provide critical latency gains in trading systems where the difference between

success and failure may be measured in nanoseconds; (iv) our Mirror Worlds patent portfolio (the “Mirror Worlds Patent Portfolio”)

relating to foundational technologies that enable unified search and indexing, displaying and archiving of documents in a computer system;

and (v) our remote power patent (the “Remote Power Patent”) covering the delivery of Power over Ethernet (PoE) cables for

the purpose of remotely powering network devices, such as wireless access ports, IP phones and network based cameras. In addition,

we review opportunities to acquire or license additional intellectual property as well as other strategic alternatives.

We

have invested $7,000,000 in ILiAD Biotechnologies, LLC (“ILiAD”), a clinical stage biotechnology company with an exclusive

license to seventy (70) patents. On December 31, 2023, we owned approximately 6.7% of the outstanding units of ILiAD on a non-fully diluted

basis and 5.4% of the outstanding units on a fully diluted basis (after giving effect to the exercise of all outstanding options and

warrants).

Our

current strategy includes continuing our efforts to monetize our intellectual property. In addition, we continue to seek to

acquire additional intellectual property assets to develop, commercialize, license or otherwise monetize. Our strategy includes working

with inventors and patent owners to assist in the development and monetization of their patented technologies. Our patent acquisition

and development strategy is to focus on acquiring high quality patents which management believes have the potential to generate significant

licensing opportunities as we have achieved with respect to our Remote Power Patent and our Mirror Worlds Patent Portfolio. In addition,

we may also enter into strategic relationships with third parties to develop, commercialize, license or otherwise monetize their intellectual

property.

We

have been dependent upon our Remote Power Patent for a significant portion of our revenue. Our Remote Power Patent has generated revenue

in excess of $188,000,000 from May 2007 through December 31, 2023. We no longer receive revenue for our Remote Power Patent for any period

subsequent to March 7, 2020 (the expiration date of the patent). During the year ended December 31, 2023, our Remote Power Patent generated

all of our revenue of $2,601,000 as a result of litigation settlements relating to periods prior to March 7, 2020 (see “Legal Proceedings

at pages 20 - 21. Our future revenue is largely dependent on our ability to monetize our other patent assets.

We

have pending litigation involving our assertion of infringement claims concerning certain patents within our Cox Patent Portfolio

and our Remote Power Patent. In addition, we have a pending appeal to the U.S. Court of Appeals for the Federal Circuit of the

District Court judgment of non-infringement dismissing our case against Meta Platforms, Inc. (formerly Facebook, Inc.) involving

certain patents within our Mirror Worlds Patent Portfolio (see “Legal Proceedings” at pages 19 - 21 of this Annual

Report).

At

December 31, 2023, we had cash and cash equivalents and marketable securities of $45,467,000 and working capital of $44,850,000. Based

on our current cash position, we believe that we will have sufficient cash to fund our operations for the foreseeable future.

Overview

of Our Patents

We

currently own one hundred (100) U.S. patents and fifteen(15) foreign patents relating to patents within our Cox Patent Portfolio, M2M/IoT

Patent Portfolio, HFT Patent Portfolio, Mirror World Patent Portfolio and our Remote Power Patent. With respect to our one hundred (100)

U.S. patents, fifty-four (54) of such patents have expired. However, we can assert expired patents against third parties but only for

past damages up to the expiration date. We currently have pending litigation involving expired patents including our Remote Power Patent,

and certain patents within Our Cox and Mirror Worlds Patent Portfolios (see “Legal Proceedings” at pages 19 - 21 hereof).

Cox

Patent Portfolio

Our

Cox Patent Portfolio, acquired from Dr. Ingemar Cox in February 2013, currently consists of thirty-nine (39) U.S. patents relating to

enabling technology for identifying media content on the Internet, such as audio and video, and taking further actions to be performed

based on such identification. All of the patents within our Cox patent portfolio have expired. We have pending litigation against Google

Inc. and YouTube, LLC involving assertion of certain patents within our Cox Patent Portfolio (see “Legal Proceedings” at

pages 19 - 20 hereof). The patents within our Cox Patent Portfolio are based on a patent application filed in 2000. Since the acquisition

of the Cox Patent Portfolio in February 2013, we have been issued thirty-four (34) additional patents relating to this portfolio. The

claims in these thirty-four (34) additional patents are generally directed towards systems of content identification and performing actions

following therefrom.

We

are obligated to pay Dr. Cox 12.5% of the net proceeds generated by us from licensing, sale or enforcement of the Cox Patent Portfolio.

Dr. Cox provides consulting services to us with respect to the Cox Patent Portfolio and assists our efforts to develop the patent portfolio.

Dr.

Cox is currently a Professor at the University of Copenhagen and University College London where he is head of its Information and Decision

Systems Group. Dr. Cox was formerly a member of the Technical Staff at AT&T Bell Labs and a Fellow at NEC Research Institute. He

is a Fellow of the ACM, IEEE, the IET (formerly IEE), and the British Computer Society and is a member of the UK Computing Research Committee.

In 2019, Dr. Cox was the recipient of the Tony Kent Strix Award in recognition of his contribution to the field of information retrieval.

He was founding co-editor in chief of the IEE Proc. on Information Security and was an associate editor of the IEEE

Trans. on Information Forensics and Security. He is co-author of a book entitled “Digital Watermarking” and its second edition

“Digital Watermarking and Steganography”. He is an inventor or co-inventor of over seventy (70) U.S. patents.

M2M/IoT

Patent Portfolio

Our

M2M/IoT Patent Portfolio, acquired in December 2017 from M2M and IoT Technologies, LLC (“M2M”), relates to, among other things,

enabling technology for authenticating and using eSIM (embedded Subscriber Identification Module) technology in IoT, Machine-to-Machine

and other mobile devices including smartphones, tablets and computers, as well as automobiles. The M2M/IoT Patent Portfolio currently

consists of thirty-seven (37) issued U.S. patents, nine (9) pending U.S. patent applications, fourteen (14) registered foreign patents

and one (1) additional pending non-U.S. patent applications. Since we acquired the M2M/IoT Patent Portfolio in December 2017, we have

been issued twenty-three (23) additional U.S. patents with respect to the portfolio. We anticipate further issuances of additional claims

for this portfolio. The expiration dates of the thirty-seven (37) issued U.S. patents currently within our M2M/IoT Patent Portfolio range

from September 2033 to May 2034.

We

have an obligation to pay M2M 14% of the first $100 million of net proceeds (after deduction of expenses) and 5% of net proceeds greater

than $100 million from Monetization Activities (as defined) related to our M2M/IoT Patent Portfolio. In addition, M2M will be entitled

to receive from us $250,000 of additional consideration upon the occurrence of certain future events related to the patent portfolio.

John

Nix, the Managing Member of M2M, provides consulting services to us with respect to our M2M/IoT Patent Portfolio. Mr. Nix is an entrepreneur

and inventor, and founder and Chief Executive Officer of Vobal Technologies, LLC. In 2016, Mr. Nix was recognized as “Creator of

the Year” by the Intellectual Property Law Association of Chicago for his intellectual property related to eSIM technology.

HFT

Patent Portfolio

On

March 25, 2022, we acquired the HFT Patent Portfolio. This portfolio covers certain advanced technologies relating to high frequency

trading, which inventions specifically address technological problems associated with speed and latency and provide critical latency

gains in trading systems where the difference between success and failure may be measured in nanoseconds. The HFT Patent Portfolio

currently includes nine issued U.S. patents and two pending U.S. patents.

In

addition to the purchase price that we paid at closing, we have an obligation to pay the seller an additional cash payment of $500,000

and $375,000 of our common stock contingent upon achieving certain milestones with respect to the HFT Patent Portfolio. We also have

an obligation to pay the seller 15% of the first $50 million of net proceeds (after deduction of expenses) generated from the patent

portfolio and 17.5% of net proceeds greater than $50 million.

Mirror

Worlds Patent Portfolio

Our

Mirror Worlds Patent Portfolio, acquired in May 2013, consists of ten (10) U.S. patents and covers foundational technologies that enable

unified search and indexing, displaying and archiving of documents in a computer system. All of our patents within our Mirror Worlds

Patent Portfolio have expired. The Mirror Worlds Patent Portfolio includes U.S. Patent No. 6,006,227 (the “227 Patent”),

U.S. Patent No. 7,865,538 and U.S. Patent No. 8,255,439 which are currently being asserted in our litigation against Meta Platforms,

Inc. (formerly Facebook, Inc.) (see “Legal Proceedings” at page 20 hereof). Our 227 Patent was previously asserted in litigations

against Apple Inc. and Microsoft Corporation which were settled resulting in aggregate payments to us of $29,650,000.

The

inventions relating to document stream operating systems covered by our Mirror Worlds Patent Portfolio resulted from the work done by

Yale University computer scientist, Professor David Gelernter, and his then graduate student, Dr. Eric Freeman, in the mid-1990s. Certain

aspects of the technologies developed by David Gelernter were commercialized in their company's product offering called “Scopeware.”

Technologies embodied in Scopeware are now common in various computer and web-based operating systems.

As

part of our acquisition of the Mirror Worlds Patent Portfolio in 2013, we also entered into an agreement with Recognition Interface,

LLC (“Recognition”), an entity that financed the commercialization of the Mirror Worlds patent portfolio prior to its sale

to Mirror Worlds, LLC and also retained an interest in the licensing proceeds of the Mirror Worlds patent portfolio. Pursuant to the

terms of the agreement with us, we are obligated to pay Recognition an interest in the net proceeds realized from our monetization of

the Mirror Worlds Patent Portfolio as follows: (i) 10% of the first $125 million of net proceeds; (ii) 15% of the next $125 million of

net proceeds; and (iii) 20% of any portion of the net proceeds in excess of $250 million. Since entering into the agreement with Recognition

in May 2013, we have paid Recognition an aggregate of $3,127,000 with respect to such net proceeds interest in our Mirror Worlds Patent

Portfolio (no such payments were made during the years 2023 and 2022).

Remote

Power Patent

Our

Remote Power Patent (U.S. Patent No. 6,218,930) covers the delivery of power over Ethernet cables for the purpose of remotely powering

network devices such as wireless access ports, IP phones and network based cameras. Our Remote Power Patent expired on March 7, 2020.

Notwithstanding the expiration of the Remote Power Patent in March 2020, in October and November 2022, we asserted the patent in nine

separate actions against ten defendants for damages prior to March 7, 2020 and have reached settlement agreements with eight of the defendants

(see “Legal Proceedings” at pages 20 - 21 hereof).

On

June 13, 2003, the Institute of Electrical Engineers (IEEE), a non-profit, technical professional association, approved the 802.3af Power

over Ethernet standard (the “Standard”), which covers technologies deployed in delivering power over Ethernet networks. The

Standard provides for the Power Sourcing Equipment (PSE) to bedeployed in switches or as standalone

midspan hubs to provide power to remote devices such as wireless access points, IP phones and network-based cameras. The technology is

commonly referred to as Power over Ethernet (“PoE”). In 2009, the IEEE Standards Association approved 802.3at, a new PoE

standard which, among other things, increased the available power for delivery over Ethernet networks. We believe that our Remote Power

Patent covers several of the key technologies covered by both the 802.3af and 802.3at standards.

Network-1

Strategy

Our

strategy is to capitalize on our intellectual property assets by entering into licensing arrangements with third parties that utilize

our intellectual property's proprietary technologies as well as any additional proprietary technologies covered by patents which may

be acquired by us in the future. Our current patent acquisition and development strategy is to focus on acquiring high quality patents

which management believes have the potential to generate significant licensing opportunities as has been the case with our Remote Power

Patent and Mirror Worlds Patent Portfolio. Our Remote Power Patent has generated licensing revenue in excess of $188,000,000 from May

2007 through December 31, 2023. Since the acquisition of our Mirror Worlds Patent Portfolio in May 2013, we have received licensing and

other revenue of $47,150,000 through December 31, 2023. In addition, we may enter into third party strategic relationships with inventors

and patent owners to assist in the development and monetization of their patent technologies. Based on our cash position, we review opportunities

to acquire additional intellectual property as well as evaluate other strategic alternatives.

In

connection with our activities relating to the protection of our intellectual property assets, or the intellectual property assets of

third parties with whom we may have strategic relationships in the future, it may be necessary to assert patent infringement claims against

third parties whom we believe are infringing our patents or those of our strategic partners. We are currently involved in several litigations

to protect our patents including certain patents within our Cox Patent Portfolio, Mirror Worlds Patent Portfolio and Remote Power Patent

(see “Legal Proceedings” at pages 19 - 21 hereof). We have previously successfully asserted litigation with respect to our

Remote Power Patent and our Mirror Worlds Patent Portfolio and have also been successful in defending proceedings at the USPTO challenging

the validity of our Remote Power Patent and certain patents within our Cox Patent Portfolio.

Revenue

Concentration

Revenue

from our Remote Power Patent as a result of litigation settlements constituted 100% of our revenue for the year ended December 31, 2023,

of which four defendants constituted 90% of our revenue for such year.

We

anticipate that our future revenue will continue to be derived from a few parties.

Competition

With

respect to our ability to acquire additional intellectual property assets or enter into strategic relationships with third parties to

monetize their intellectual property assets, we face considerable competition from other companies, many of which have significantly

greater financial and other resources than we have. The patent licensing and enforcement industry has grown and there has been a material

increase in the number of companies seeking to acquire intellectual property assets from third parties or to provide financing to third

parties seeking to monetize their intellectual property. Entities including, among others, Acacia Research Corporation (NASDAQ:ACTG),

Intellectual Ventures, WI-LAN Inc., VirnetX Holdings Corporation (NYSE MKT:VHC) and RPX Corporation, seek to acquire intellectual

property or partner with third parties to license or enforce intellectual property rights. In addition, we also compete with strategic

corporate buyers with respect to the acquisition of intellectual property assets. It is expected that others will enter this market as

well. Many of these competitors have significantly greater financial and human resources than us.

We

may also compete with litigation funding firms such as Burford Capital Limited, Validity Finance, LLC, Fortress Investment Group, LLC,

Parabellum Capital LLC and Bentham Capital LLC, venture capital firms and hedge funds for intellectual property acquisitions and licensing

opportunities. Many of these competitors also have greater financial resources and human resources than us.

Regulatory

Environment

If

new legislation, regulations or rules are implemented either by Congress, the USPTO or the courts that impact the patent application

process, the patent enforcement process or the rights of patent holders, these changes could negatively affect our business,

financial condition and results of operations. Certain legislation, regulations, and rulings by the courts and actions by the USPTO

have materially increased the risk and cost of enforcement of patents. U.S. patent laws were amended by the Leahy-Smith America

Invents Act, referred to as the “America Invents Act”, which became effective on March 16, 2013. The America Invents Act

included a number of significant changes to U.S. patent law. In general, it addressed issues surrounding the enforceability of

patents and the increase in patent litigation by, among other things, establishing new procedures for patent litigation and new

administrative post-grant review procedures to challenge the patentability of issued patents outside of litigation, including Inter

Partes Review (IPR) and Covered Business Method Review (CBM) proceedings which provide third parties a timely and cost

effective alternative to district court litigation to challenge the validity of an issued patent. The America Invents Act and its

implementation increased the uncertainties and costs

surrounding the enforcement of patent rights has made it more difficult to successfully enforce our patents.

In

addition, future changes in patent law could adversely impact our business. Such changes may not be advantageous to us and may make it

more difficult to obtain adequate patent protection to enforce our patents. Increased focus on the growing number of patent lawsuits,

particularly by non-practicing entities (NPEs), may result in legislative changes which increase the risk and costs of asserting patent

litigation.

Investment

in ILiAD Biotechnologies

During

the period December 2018 to date, we made aggregate investments of $7,000,000 in ILiAD, a privately held clinical stage biotechnology

company dedicated to the prevention and treatment of human disease caused by Bordetella pertussis. ILiAD is currently focused

on validating its proprietary intranasal vaccine, BPZE1, for the prevention of pertussis (whooping cough). Pertussis is a life-threatening

disease caused by the highly contagious respiratory bacterium Bordetella pertussis. ILiAD has the exclusive license to seventy

(70) issued patents and has forty-nine (49) pending patent applications. On December 31, 2023, we owned approximately 6.7% of the outstanding

units of ILiAD on a non-fully diluted basis and 5.4% of the outstanding units on a fully diluted basis (after giving effect to the exercise

of all outstanding options, and warrants). In connection with our investment, Corey Horowitz, our Chairman and Chief Executive Officer,

became a member of ILiAD’s Board of Managers and receives the same compensation for service on the Board as the other non-management

Board members.

BPZE1

was developed in the laboratory of Camille Locht, PhD, at the Institut Pasteur de Lille (IPL) and French National Institute of Health

and Medical research. BPZE1 is a live-attenuated intranasal vaccine designed to overcome deficiencies of current pertussis vaccines,

including poor durability of protection and failure to prevent nasopharyngeal Bordetella pertussis infections that lead to escape

mutants and transmission to vulnerable infants.

On

August 24, 2022, ILiAD consummated a private financing of $42,800,000 of its Class D units, of which a multi-national pharmaceutical

company invested $30,000,000. As a result of the financing, we recognized a gain in 2022 of $3,883,000 on our equity investment and a

gain of $271,000 with respect to the conversion of our convertible note in the principal amount of $1,000,000 plus interest into equity

of ILiAD.

Corporate

Information

We

were incorporated under the laws of the State of Delaware in July 1990. Our principal executive offices are located at 65 Locust Avenue,

Third Floor, New Canaan, Connecticut 06840 and our telephone number is (203) 920-1055.

Available

Information

We

file or furnish various reports, such as registration statements, quarterly and current reports, proxy statements and other materials

with the SEC. Our website address is www.network-1.com. You may obtain, free of charge on our Internet website, copies

of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, Section 16 filings

and amendments to those reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably

practicable after we electronically file such material with, or furnish it to, the SEC. The information we post on our website is intended

for reference purposes only; none of the information posted on our website is part of this Annual Report or incorporated by reference

herein.

In

addition to the materials that are posted on our website, you may read and copy any materials we file with the SEC at the SEC's Public

Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by

calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and other information statements,

and other information regarding issuers, including us, that file electronically with the SEC. The address of the SEC’s Internet

site is http://www.sec.gov.

Employees

and Consultants

We

currently have two full-time employees and two consultants providing monthly services to us.

ITEM 1A. RISK FACTORS

Our

operations and financial results are subject to various material risks and uncertainties, including those described below, which could

adversely affect our business, financial condition, results of operations, cash flow, and the trading price of our common stock. You

should carefully consider the material risks and uncertainties described below in addition to the other information set forth in this

Annual Report on Form 10-K, including, but not limited to, the section titled “Management’s Discussion and Analysis of Financial

Condition and Results of Operations.” The material risks described below are not the only risks we face. Additional risks that

we do not know of or that we currently believe are immaterial may also impair our business operations. If any of the following risks

actually occur, our business, financial condition, results of operations and cash flow could be materially adversely affected, and the

trading price of our common stock could decline significantly.

Risks

Related to Our Business

Our

revenue is uncertain as it is dependent upon litigation outcomes involving our patents which we cannot predict.

Our

revenue is dependent upon our litigation outcomes. We currently have pending litigation involving our Cox Patent Portfolio and Mirror

Worlds Patent Portfolio as well as our Remote Power Patent (see “Legal Proceedings” at pages 19 - 21 hereof). Patent litigation

is inherently risky and uncertain and we cannot assure you that any of our current or future litigation will result in a favorable outcome

for us. Accordingly, our revenue is uncertain.

If

we are unable to protect our patents, our business would be negatively impacted.

We

believe our patents are valid, enforceable and valuable. Despite this belief, third parties typically defend assertion of our patents

by asserting defenses, among others, of non-infringement and invalidity. In addition, in the future certain of our patents may be subject

to USPTO post-grant inter partes review proceedings (IPRs) which could result in all or a part of our patents being invalidated

or the claims being limited. Unfavorable outcomes in our litigation or IPRs may reduce our ability to enforce our patents or have other

adverse consequences. If we are unable to protect our patents or otherwise realize value for them, our business would be negatively impacted.

The

outcome of our substantial investment in ILiAD is uncertain.

To

date we have invested $7,000,000 in ILiAD, a privately held clinical stage biotechnology company, with focus on validating its proprietary

intranasal vaccine (BPZE1) for the prevention of pertussis (whopping cough). Notwithstanding the aforementioned, ILiAD still faces material

risks going forward. Accordingly, our investment in ILiAD remains subject to substantial risks.

We

have been dependent upon our Remote Power Patent for a significant portion of our revenue and we may not be able to generate future revenue

from our other patents.

Our

Remote Power Patent has generated revenue for us in excess of $188,000,000 from May 2007 through December 31, 2023. Revenue from our

Remote Power Patent constituted 100% of our revenue ($2,601,000) for 2023. We had no revenue in 2022 and revenue from our Remote Power

Patent constituted 100% of our revenue for 2021 ($36,029,000), 2020 ($4,403,000) and 2019 ($3,037,000). As a result of the expiration

of our Remote Power Patent on March 7, 2020, we no longer receive revenue from such patent for any period subsequent to the expiration

date. Our failure to successfully monetize our other patents would have a negative impact on our business, financial condition and operating

results.

We

may not achieve successful outcomes of our pending or future litigation which would have a negative impact on our business.

We

are currently enforcing certain patents within our Cox Patent Portfolio against Google and YouTube, who are challenging these patents

and we are also asserting our Remote Power Patent against Ubiquity Inc. and Honeywell International Inc. We have appealed to the Federal

Circuit the District Court decision granting Facebook (Meta Platforms, Inc.), summary judgment of non-infringement and dismissing

our case involving certain patents within our Mirror Worlds Patent Portfolio (see “Legal Proceedings” at pages 19 - 20 hereof).

In addition, our M2M/IoT Patent Portfolio and HFT Patent Portfolio are not currently being asserted. We may not have success in enforcing

or defending our patents, which would have a negative impact on our business.

We

may not be able to capitalize in the future on our strategy to acquire high quality patents with significant licensing opportunities

or enter into strategic relationships with third parties to license or otherwise monetize their intellectual property.

Based

upon the success we achieved from licensing our Remote Power Patent (twenty-eight (28) license agreements and in excess of $188,000,000

of revenue through December 31, 2023), the revenue we generated from our Mirror Worlds Patent Portfolio ($47,150,000) and establishing

a patent portfolio currently consisting of one hundred (100) U.S. patents and fifteen (15) foreign patents as well as our cash position,

we believe we have the expertise and sufficient capital to compete in the patent monetization market and to enter strategic relationships

with third parties to develop, commercialize, license or otherwise monetize their patents. Our strategy is to focus on acquiring high

quality patent assets which management believes have the potential for significant licensing opportunities. However, we may not be able

to acquire such additional high quality patents or, if acquired, we may not achieve material revenue or profit from such patents. Acquisitions

of patent assets are competitive, time consuming, complex and costly to consummate. High quality patents with significant licensing

opportunities are difficult to find and are often very competitive to acquire. In addition, such acquisitions present material

risks. Even if we acquire such additional patent assets, we may not be able to achieve significant licensing revenue or even generate

sufficient revenue related to such patent assets to offset the acquisition costs and the legal fees and expenses which may be incurred

to enforce, license or otherwise monetize such patents. In addition, we may not be able to enter into strategic relationships with third

parties to license or otherwise monetize their intellectual property and, even if we consummate such strategic relationships, we may

not achieve material revenue or profit from such relationships.

The

patent monetization cycle is long, costly and unpredictable.

There

is generally a significant time lag between acquiring a patent portfolio and recognizing revenue from those patent assets. During this

time lag, significant costs are likely to be incurred which may have a negative impact on our results of operations, cash flow and financial

position. Furthermore, the outcome of our efforts to monetize our patents is uncertain and we may not be successful.

Our

quarterly and annual operating and financial results, including our revenue, are difficult to predict and are likely to fluctuate significantly

in future periods.

Our

quarterly and annual operating and financial results are difficult to predict and may fluctuate significantly from period to period.

In 2023, we had revenue of $2,601,000 and incurred a net loss of $1,457,000. In 2022, we had no revenue and incurred a net loss of $2,326,000.

We had revenue of $36,029,000 and net income of $14,281,000 for 2021, as compared to revenue of $4,403,000 and a net loss of $1,709,000

for 2020. Accordingly, our revenue, net income and results of operations may widely fluctuate as a result of a variety of factors that

are outside our control including the timing and our ability to achieve successful outcomes from current and future patent litigation,

our ability and timing in consummating future license agreements for our intellectual property assets, the timing and extent of payments

received by us from licensees, whether we will achieve a successful outcome of our investment in ILiAD, and the timing and our ability

to achieve revenue from future strategic relationships.

In

the future we could be classified as a Personal Holding Company resulting in a 20% tax on our PHC Income that we do not distribute to

our shareholders.

The

personal holding company (“PHC”) rules under the Internal Revenue Code impose a 20% tax on a PHC’s undistributed personal

holding company income (“UPHCI”), which means, in general, taxable income subject to certain adjustments and reduced by certain

distributions to shareholders. For a corporation to be classified as a PHC, it must satisfy two tests: (1) that more than 50% in value

of its outstanding shares must be owned directly or indirectly by five or fewer individuals at any time during the second half of the

year (after applying constructive ownership rules to attribute stock owned by entities to their beneficial owners and among certain family

members and other related parties) (the “Ownership Test”) and (2) at least 60% of its adjusted ordinary gross income for

a taxable year consists of dividends, interest, royalties, annuities and rents (the “Income Test”). During the second

half of 2023, based on available information concerning our shareholder ownership, we did not satisfy the Ownership Test. In addition,

we did not satisfy the Income Test for 2023. Thus, we were not a PHC for 2023. However, we may be determined to be a PHC in the future. If

we were determined to be a PHC in 2024 or any future year, we would be subject to an additional 20% tax on our UPHCI. In such event,

we may issue a special cash dividend to our shareholders in an amount equal to the UPHCI rather than incur the 20% tax.

We

are dependent upon our CEO and Chairman.

Our

success is largely dependent upon the personal efforts of Corey M. Horowitz, our Chairman, Chief Executive Officer and Chairman of our

Board of Directors. On March 22, 2022, we entered into a new four year employment agreement with Mr. Horowitz pursuant to which

he continues to serve as our Chairman and Chief Executive Officer. The loss of the services of Mr. Horowitz would have a material adverse

effect on our business

and prospects. We do not maintain key-man life insurance on the life of Mr. Horowitz.

Cash

dividends may not be continued to be paid.

Our

dividend policy consists of semi-annual cash dividends of $0.05 per share ($0.10 per share annually) which have been paid in March and

September of each year. We have paid such semi-annual dividends since our dividend policy was enacted in December 2016. At this

time, we anticipate continuing to pay dividends consistent with our policy. However, our dividend policy undergoes a periodic review

by our Board of Directors and is subject to change at any time depending upon our earnings, financial requirements and other factors

existing at the time. We may not be in a position to continue to pay dividends in the future.

Legislation,

regulations, court rulings and actions by the USPTO have materially increased the risk and cost of enforcement of patents and may continue

to do so in the future.

Legislation,

regulations, court rulings and actions by the USPTO have materially increased the risk and cost of enforcing patents. U.S. patent laws

were amended by the Leahy-Smith America Invents Act, referred to as the America Invents Act, which became effective on March 16, 2013.

The America Invents Act included a number of significant changes to U.S. patent law. In general, it addressed issues surrounding the

enforceability of patents and the increase in patent litigation by, among other things, established new procedures for patent litigation

and new administrative post-grant review procedures to challenge the patentability of issued patents outside of litigation, including

Inter Partes Review (IPR) proceedings, which provide third parties a timely, cost effective alternative to district court litigation

to challenge the validity of an issued patent. In addition, the America Invents Act changed the way that parties may be joined in patent

infringement actions, and increased the likelihood that such actions will need to be brought against individual parties allegedly infringing

by their respective individual actions or activities. The America Invents Act and its implementation also increased the uncertainties

and costs surrounding the enforcement of patent rights, which have made it more difficult to successfully prosecute our patents.

The

increasing development of artificial intelligence could materially impact our business.

Our

patents are central to our business strategy of licensing our intellectual property rights or enforcing such rights against those that

we believe are infringing. However, rapid advancements in the field of artificial intelligence (AI) and machine learning (ML) have the

potential to disrupt our current business model in various ways. AI technologies are increasingly capable of developing solutions that

either design around existing patents or create alternative technologies that may not infringe on our intellectual property. As AI evolves,

it may accelerate the pace at which our patents become obsolete or irrelevant, reducing our ability to monetize our patent portfolio

effectively. Furthermore, the proliferation of AI may lead to the emergence of new market participants with innovative

solutions that challenge our patents' validity or enforceability. Such challenges could result in lengthy legal battles or the invalidation

of our patents, thereby impacting our potential future revenue.

AI

driven legal analytics tools can also empower potential infringers with sophisticated insights into the strengths and weaknesses of

our patent claims, potentially reducing our leverage in litigation and licensing negotiations. The integration of AI technologies

into the products and services of the companies we may assert claims against could also complicate infringement analyses and legal

arguments, potentially affecting the outcomes of our enforcement actions. Investors are advised that our financial results could be

adversely affected if we are unable to adapt to the rapid changes brought about by AI and ML technologies, and our ability to

enforce our patent rights is consequently diminished.

Changes

in patent law could adversely impact our business.

Patent

laws may continue to change and may alter the protections afforded to owners of patent rights. Such changes may not be advantageous to

us and may make it more difficult to obtain adequate patent protection to enforce our patents. Increased focus on the growing number

of patent lawsuits, particularly by non-practicing entities (NPEs), may result in further legislative changes which increase the risk

and costs of asserting patent litigation.

Our

pending patent infringement litigations are time consuming and costly.

We

have pending litigations involving our Cox Patent Portfolio, Mirror Worlds Patent Portfolio (pending appeal to the Federal Circuit of

dismissal of our Facebook (Meta Platforms, Inc.) litigation) and Remote Power Patent (see “Legal Proceedings” at pages 19

- 21 of this Annual Report). While we have contingent legal fee arrangements, or a contingency plus a fixed cash amount arrangement,

with our patent litigation counsel in each litigation, we are responsible for all or a portion of the expenses which are anticipated

to be material. In addition, the time and effort required of our management to effectively pursue these litigations is likely to be significant

and it may adversely affect other business opportunities.

We

face intense competition to acquire intellectual property and enter into strategic relationships.

With

respect to our ability to acquire additional intellectual property or enter into strategic relationships with third parties to monetize

their intellectual property, we face considerable competition from other companies, many of which have significantly greater financial

and other resources than we have. We face a number of competitors in the patent licensing and enforcement business seeking to acquire

intellectual property rights from third parties. Many of these competitors have significantly more financial and human resources than

us.

We

may also compete with strategic corporate buyers, litigation funding firms, venture capital firms and hedge funds for intellectual property

acquisitions and licensing opportunities. Many of these competitors have greater financial resources and human resources than us.

Our

markets are subject to rapid technological change and our technologies face potential technology obsolescence.

The

markets covered by our intellectual property are characterized by rapid technological changes, changing customer requirements, frequent

new product introductions and enhancements, and evolving industry standards. The introduction of products embodying new technologies

and the emergence of new industry standards may render our technologies obsolete or less marketable.

In

addition, other companies may develop competing technologies that offer better or less expensive alternatives to the technologies covered

by our intellectual property. Moreover, technological advances or entirely different approaches developed by other companies or adopted

by various standards groups could render our patents obsolete, less marketable or unenforceable.

The

burdens of being a public company may adversely affect us including our ability to pursue litigation.

As

a public company, our management must devote substantial time, attention and financial resources to comply with U.S. securities laws.

This may have a material adverse effect on management's ability to effectively and efficiently pursue its business. In addition, our

disclosure obligations under U.S. securities laws require us to disclose information publicly that will be available to litigation opponents.

We may, from time to time, be required to disclose information that may have a material adverse effect on our litigation strategies.

This information may enable our litigation opponents to develop effective litigation strategies that are contrary to our interests.

General

Risk Factors

Investors

may have limited influence on stockholder decisions because ownership of our common stock is concentrated.

As

of February 15 , 2024, our executive officers and directors beneficially owned 32% of our outstanding common stock. As a result,

these stockholders may be able to exercise substantial control over all matters requiring stockholder approval, including the election

of directors and approval of significant corporate transactions, such as a merger or other sale of our company or its assets. This concentration

of ownership will limit other stockholders' ability to influence corporate matters and may have the effect of delaying or preventing

a third party from acquiring control over us.

Our

common stock may be delisted from the NYSE American exchange if we fail to comply with continued listing standards.

Our

common stock is currently traded on the NYSE American exchange under the symbol “NTIP”. If we fail to meet any of the continued

listing standards of the NYSE American exchange, our common stock could be delisted. Such delisting could adversely affect the price

and trading (including liquidity) of our common stock.

There

are inherent uncertainties involved in estimates, judgments and assumptions used in the preparation of financial statements in accordance

with U.S. GAAP. Any changes in estimates, judgments and assumptions could have a material adverse effect on our business, financial condition,

and operating results.

The

preparation of financial statements in accordance with accounting principles generally accepted in the United States involves making

estimates, judgments and assumptions that affect reported amounts of assets (including intangible assets), liabilities and related reserves,

revenues, expenses, and income. Estimates, judgments, and assumptions are inherently subject to change in the future, and any such changes

could result in corresponding changes to the amounts of assets, liabilities, expenses, and income. Any such changes could have a material

adverse effect on our business, financial condition, and operating results.

Provisions

in our corporate charter, by-laws and in Delaware law could make it more difficult for a third party to acquire us, discourage a takeover

and adversely affect existing stockholders.

Our

certificate of incorporation authorizes the Board of Directors to issue up to 10,000,000 shares of preferred stock. The preferred

stock may be issued in one or more series, the terms of which may be determined at the time of issuance by our Board of Directors, without

further action by stockholders, and may include, among other things, voting rights (including the right to vote as a series on particular

matters), preferences as to dividends and liquidation, conversion and redemption rights, and sinking fund provisions, any of which could

adversely affect holders of our common stock. Although there are currently no shares of preferred stock outstanding, future holders of

preferred stock may have rights superior to our common stock and such rights could also be used to restrict our ability to merge with

or sell our assets to third parties.

We

are also subject to the “anti-takeover” provisions of Section 203 of the Delaware General Corporation Law, which could prevent

us from engaging in a “business combination” with a 15% or greater stockholder for a period of three years from the date

such person acquired that status unless appropriate board or stockholder approvals are obtained.

In

addition, our By-laws contain advance notice requirements for director nominations and for new business to be brought up at

stockholder meetings. Stockholders wishing to submit director nominations or raise matters to a vote of stockholders must provide

notice to us within specified date windows and in very specific forms in order to have that matter voted on at a stockholders

meeting.

The

aforementioned provisions could deter unsolicited takeovers or delay or prevent changes in our control or management, including transactions

in which stockholders might otherwise receive a premium for their shares over the then current market price. These provisions may also

limit the ability of stockholders to delay, deter or prevent a change of control, or approve transactions that they may deem to be in

their best interests.

Our

stock price may be volatile.

The

market price of our common stock may be highly volatile and could fluctuate widely in price in response to various factors, many of which

are beyond our control, including, but not limited to, the following:

| • | the

outcome of our litigation against Google and YouTube involving certain patents within our

Cox Patent Portfolio; |

| • | our

ability to further develop, license and monetize our M2M/IoT Patent Portfolio; |

| • | our

ability to further develop, license and monetize our HFT Patent Portfolio; |

| • | our

ability to achieve a successful outcome of our investment in ILiAD; |

| • | our

ability to acquire additional intellectual property; |

| • | our

ability to enter into strategic relationships with third parties to license or otherwise

monetize their intellectual property; |

| • | variations

in our quarterly and annual operating results; |

| • | our

ability to continue to pay cash dividends; |

| • | our

ability to raise capital if needed; |

| • | sales

of our common stock; |

| • | legislative,

regulatory and competitive developments; and |

| • | economic

and other external factors. |

In

addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to

the operating performance of particular companies. These market fluctuations may also have a

material and adverse effect on the market price of our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 1C. CYBERSECURITY

Based

on our small size (two employees and two consultants), we rely extensively on information technology systems managed by third party major

service providers to securely process, store and transmit our data to conduct business. Our employees and consultants utilize end point

security tools, such as firewalls and anti-virus protection, to protect our data. We have recently implemented overall risk procedures

which incorporate certain uniform processes. To date, we have not engaged any consultants, auditors or other third parties in connection

with our risk management system or processes.

In

connection with our use of third party services providers, we have certain processes in place to oversee and identify cybersecurity risks

from threats and incidents. To date, we have not been materially impacted by risks from cybersecurity threats or incidents and we are

not aware of cybersecurity threats or incidents that are reasonably likely to materially affect our business. However, there could be

cybersecurity threats or incidents in the future that may adversely affect our business.

Our

Executive Vice President oversees risks of cybersecurity threats and reports quarterly, and as necessary, to the Board of Directors,

including promptly reporting any cybersecurity incidents that may pose a significant risk to us. Our Executive Vice President has over

ten years of experience with developers of access management, network security and data protection solutions.

ITEM 2. PROPERTIES

Our

principal executive offices are located in New Canaan, Connecticut, where we lease approximately 2,000 square feet of office space at

a base rent of $5,500 per month pursuant to a lease amendment, dated May 1, 2022, which term expires on April 30, 2025. On September

29, 2023, we exercised our early termination right under the lease to terminate the lease on December 31, 2023, which has been extended

to March 31, 2024. We believe that our office facility is suitable and appropriate to support our current needs.

ITEM 3. LEGAL PROCEEDINGS

Cox

Patent Portfolio Litigation

On

April 4, 2014 and December 3, 2014, we initiated litigation against Google Inc. (“Google”) and YouTube, LLC (“YouTube”)

in the U.S. District Court for the Southern District of New York for infringement of several of our patents within our Cox Patent Portfolio

which relate to the identification of media content on the Internet. The lawsuit alleges that Google and YouTube have infringed and continue

to infringe certain of our patents

by making, using, selling and offering to sell unlicensed systems and related products and services, which include YouTube’s Content

ID system.

The

litigations against Google and YouTube were subject to court ordered stays which were in effect from July 2, 2015 until January 2, 2019

as a result of proceedings then pending at the Patent Trial and Appeal Board (PTAB) and appeals to the U.S. District Court of Appeals

for the Federal Circuit. Pursuant to a joint stipulation and order, entered on January 2, 2019, the parties agreed, among other things,

that the stays with respect to the litigations were lifted. In January 2019, the two litigations against Google and YouTube were consolidated.

Discovery is complete and the parties have each submitted summary judgment motions which are pending. A trial date has not yet been set.

Mirror

Worlds Patent Portfolio Litigation

Meta

(Facebook) Litigation

On

May 9, 2017, Mirror Worlds Technologies, LLC, our wholly-owned subsidiary, initiated litigation against Facebook, Inc. (“now Meta

Platforms, Inc., “Meta”) in the U.S. District Court for the Southern District of New York, for infringement of U.S. Patent

No. 6,006,227, U.S. Patent No. 7,865,538 and U.S. Patent No. 8,255,439 (among the patents within our Mirror Worlds Patent Portfolio).

The lawsuit alleges that the asserted patents are infringed by Meta’s core technologies that enable Meta’s Newsfeed and Timeline

features. We seek, among other things, monetary damages based upon reasonable royalties.

On

August 11, 2018, the Court issued an order granting Meta’s motion for summary judgment of non-infringement and dismissed the case.

On January 23, 2020, the U.S. Court of Appeals for the Federal Circuit ruled in our favor and reversed the summary judgment finding on

non-infringement of the District Court and remanded the litigation to the Southern District of New York for further proceedings.

On

March 7, 2022, the District Court entered a ruling granting in part and denying in part a motion for summary judgment by Meta. In its

ruling the Court (i) denied Meta’s motion that the asserted patents were invalid by concluding that all asserted claims were patent

eligible under §101 of the Patent Act and (ii) granted summary judgment of non-infringement in favor of Meta and dismissed the

case. We strongly disagree with the decision on non-infringement and on April 4, 2022, we filed an appeal to the U.S. Court of Appeals

for the Federal Circuit. The appeal is pending.

Remote

Power Patent Litigation

October-November

2022 Litigation

In

October and November 2022, we initiated nine separate litigations against ten defendants for infringement of our Remote Power Patent

seeking monetary damages based upon reasonable royalties, as follows: (i) on October 6, 2022, we initiated such litigation against

Arista Networks, Inc., Fortinet, Inc., Honeywell International Inc. and Ubiquiti Inc. in the United States District Court, District

of Delaware; (ii) on October 27, 2022, and November 3, 2022, we initiated such litigation against TP-Link USA Corporation and

Hikvision USA, Inc. in the United States District Court for the Central District of California;(iii) on November 4, 2022, we

initiated such litigation against Panasonic Holdings Corporation and Panasonic Corporation of North America in the United States

District Court for the Eastern District of Texas (Marshall Division); and (iv) on November 8, 2022 and November 16, 2022, we

initiated such litigation against Antaira Technologies, LLC and Dahua Technology USA in the United States District Court for the

Central District of California.

During

the year ended December 31, 2023, we entered into settlement agreements with Arista Networks, Inc., Antaira Technologies, LLC, Dahua

Technology USA, Inc., Fortinet, Inc., Hikvision USA, Inc., Panasonic Holdings Corporation and TP-Link USA Corporation with respect

to the above referenced litigations resulting in aggregate settlement payments to us of $2,601,000 and a conditional payment of $150,000.

Our litigations against Ubiquity Inc and Honeywell International Inc. remain pending.

Netgear

Litigation

On

December 15, 2020, we filed a lawsuit against Netgear in the Supreme Court of the State of New York, County of New York, for breach of

a Settlement and License Agreement, dated May 22, 2009, with us for Netgear’s failure to make royalty payments, and provide corresponding

royalty reports to us based on sales of Netgear’s PoE products. On October 22, 2021, Netgear filed a Demand for Arbitration with

the American Arbitration Association (“AAA”) seeking to arbitrate certain issues raised in the litigation in the Supreme

Court, State of New York, County of New York. We have objected to jurisdiction at the AAA. On April 22, 2022, Netgear filed a counterclaim

in the New York court action alleging that we breached the license agreement by not offering Netgear lower royalties. On September 22,

2022, the arbitration brought by Netgear was dismissed by the AAA on jurisdiction grounds. On August 27, 2023, the Court granted Netgear’s

cross-motion for summary judgment and dismissed our claims and also denied our summary judgment motion with respect to Netgear’s

counterclaim for breach of the license agreement. We appealed the court’s decision. On February 20, 2024, the Appellate Division,

First Department, upheld the lower court decision dismissing our complaint and granted our motion to dismiss Netgear’s counterclaim

that we breached the most favored license provision concerning two licensees, but said there was a triable issue of fact with respect

to one licensee.

ITEM

4. MINE SAFETY DISCLOSURES

None.

PART

II

| ITEM

5. | | MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

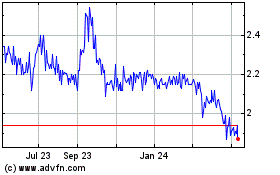

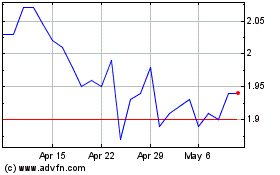

Market

Information. Our common stock is listed for trading on the NYSE American exchange under the symbol “NTIP”. On March 1,

2024, the closing price for our common stock as reported on the NYSE American exchange was $2.15 per share. The number of record

holders of our common stock was 37 as of March 1, 2024. In addition, we believe there were in excess of approximately 1,000 holders

of our common stock in “street name” as of March 1, 2024.

Dividend

Policy. Our dividend policy consists of semi-annual cash dividends of $0.05 per share ($0.10 per share annually) which

have been paid in March and September of each year. On March 3, 2023, our Board of Directors declared a semi-annual cash

dividend of $0.05 per share with a payment date of March 31, 2023 to all common shareholders of record as of March 15, 2023. On September

8, 2023, our Board of Directors declared a semi-annual cash dividend of $0.05 per share with a payment date of September 29, 2023 to

all common shareholders of record as of September 19, 2023. On February 23, 2024, our Board of Directors declared a semi-annual

cash dividend of $0.05 per share with a payment date of March 29, 2024 to all common shareholders of record as of March 15, 2024.

At this time, we anticipate continuing to pay dividends consistent with our policy. However, our dividend policy undergoes a periodic

review by our Board of Directors and is subject to change at any time depending upon our earnings, financial requirements and other factors

existing at the time.

As

of December 31, 2023, we accrued dividends of $99,000 for unvested restricted stock units with dividend equivalent rights.

Recent

Issuances of Unregistered Securities. There were no unregistered sales of equity securities during the quarter ended December 31,

2023.

Stock

Repurchases. On June 14, 2023, our Board of Directors authorized an extension and increase of the share repurchase program (“Share

Repurchase Program”) to repurchase up to $5,000,000 of shares of our common stock over the subsequent 24 month period. The common

stock may be repurchased from time to time in open market transactions or privately negotiated transactions in our discretion. The timing

and amount of the shares repurchased is determined by management based on its evaluation of market conditions and other factors. The

Share Repurchase Program may be increased, suspended or discontinued at any time.

During

the months of October, November and December 2023, we repurchased common stock pursuant to our Share Repurchase Program as indicated

below:

Period |

Total

Number of Shares Purchased |

Average

Price Paid Per Share |

Total

Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum

Number (or Approximate Dollar Value) of Shares) that May Yet Be Purchased Under the Plans or Programs |

October

1, 2023 to

October 31, 2023 |

31,146 |

$2.22 |

31,146 |

$4,561,139

|

November

1, 2023 to

November 30, 2023 |

77,087 |

$2.20 |

77,087 |

$4,391,365 |

December

1, 2023 to

December 31, 2023 |

8,581 |

$2.17 |

8,581 |

$4,372,705 |

| Total |

116,814 |

$2.20 |

116,814 |

|

During

the year ended December 31, 2023, we repurchased an aggregate of 428,132 shares of our common stock pursuant to our Share Repurchase

Program at a cost of $955,182 (exclusive of commissions) or an average price per share of $ 2.23.

Since

inception of our Share Repurchase Program (August 2011) to December 31, 2023, we repurchased an aggregate of 9,523,982 shares of our

common stock at a cost of $18,712,916 (exclusive of commissions) or an average per share price of $1.94.

On

December 29, 2023, we entered into a written trading plan( the “10b5-1 Plan”) under Rule 10b5-1 of the Securities Exchange

Act of 1934 (the” Exchange Act”). Adopting a trading plan that satisfies the conditions of Rule 10b5-1 allows a company to

repurchase its shares at times when it might otherwise be prevented from doing so due to self-imposed trading black-outs or pursuant

to insider trading laws. Purchases under the 10b5-1 Plan may be made during the following periods: (1) beginning on January 9, 2024 until

two trading days after we issue a press release announcing our financial results for the year ended December 31, 2023, and (2) beginning

on April 1, 2024 until two trading days after we issue a press release announcing our financial results for the quarter ended March 31,

2024. Under the 10b5-1 Plan, our third party broker may purchase up to 1,000,000 shares of our common stock, subject to certain price,