Is Gold losing its shine? - Real Time Insight

January 10 2013 - 10:09AM

Zacks

After a bull-run lasting more than 12 years, gold has shown some

signs of weakness in the last few months.

The minutes of the latest FOMC meeting suggest

that several members want the quantitative easing to end in

2013. Continued easing by the Fed and other major central

banks was one of the reasons for the bullish run in gold in recent

years.

On the other hand, central banks have continued their gold

purchases. The demand in China may also pick up this year as the

economy recovers. The demand in India is holding up well so far,

even though the metal price is near all-time high in Indian Rupee

terms.

In fact the Indian government is considering some tax measures

to make the gold imports more expensive as massive gold imports by

the country are worsening the country’s current account

deficit.

I remain positive on the long-term prospects for gold for

reasons mentioned here. What do you think?

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARS-GOLD TR (IAU): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

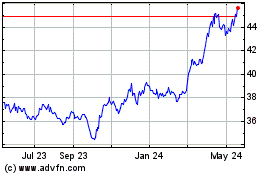

iShares Gold (AMEX:IAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

iShares Gold (AMEX:IAU)

Historical Stock Chart

From Jul 2023 to Jul 2024