Should You Buy Gold Now? - Real Time Insight

June 06 2012 - 10:13AM

Zacks

Gold price reached its one month high this morning, supported by

hopes for additional stimulus by the Federal Reserve, after last

Friday’s weak employment report. The precious metal is now up about

4% year-to-date, after a weak price performance for the last four

months.

According to the World Gold Council, the worldwide demand for

gold was down about 5% during Q1 2012 compared with Q1 2011, mainly

due to import duty in India and higher gold prices.

Demand for the yellow metal in China was up 10% as the country

is now emerging as the largest consumer of gold, leaving India

behind.

In India, the demand for gold fell during the quarter (jewelry

demand down 19% and Investment demand down 46%) due to

imposition of import duty by the government as well as increase in

the price of gold (resulting from sharp decline in the currency).

Gold price in India is now at its all-time high (in rupee

terms).

During the first quarter, the central banks continued to add to

their gold holdings, in order to diversify their reserves. Further,

per data released by IMF, central banks’ gold purchases continued

in April as well. Russia, Mexico, Kazakhstan, Turkey and

Philippines have been the main purchasers this year.

Further, China’s import of gold from Hongkong this year is at

record high levels, leading to speculation that mainland China is

adding to its gold reserves.

There was an interesting article in WSJ a couple days back,

which analyzed gold’s ability to act as “safe haven” using the

short-term correlations with the stock market and bonds.

The article inferred that gold acts as safe haven “when it wants

to be”. Like while it rose two years back over fears over Greece

whereas in the last few weeks, it has moved opposite to the “safe”

bonds which jumped as fears over “Grexit” intensified.

In my view, short-term correlations tend to be volatile since

the investment case for gold does not rest solely on its “safe

haven” status, but many investors especially in India and China

invest in gold due to “store of value” status.

Earlier this year, in addition to the reduced demand from India

(India and China together account for more than 40% of the global

demand), strength in the US dollar also affected the gold

price.

Several studies have shown that over the longer term gold has

the ability to hedge against inflation as also remain uncorrelated

with the stock market returns.

So, there is a strong possibility that the ounce of physical

gold that you buy now (or buy shares in gold ETFs like GLD or IAU)

will preserve its purchasing power in the long-run, whereas other

safe assets like bonds will decline in value in real terms.

Gold has been rising now for the last 11 years in a row and some

analysts say that it may now be heading for its 12th

year of annual gains. And, there are others who think that the

gold’s 11 year bull-run may be over now.

What do you think?

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARS-GOLD TR (IAU): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

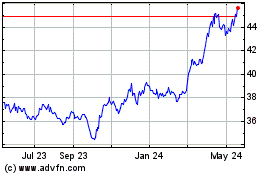

iShares Gold (AMEX:IAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

iShares Gold (AMEX:IAU)

Historical Stock Chart

From Jul 2023 to Jul 2024