CORRECT: Imperial Oil, Exxon To Pursue New Routes For Oil-Sands Equipment

August 08 2011 - 5:14PM

Dow Jones News

After encountering legal challenges to their plan to move giant

loads of oil-sands equipment through Idaho and Montana, Imperial

Oil Ltd. (IMO) and Exxon Mobil Corp. (XOM) said Monday they will

break down the loads into smaller pieces and pursue other routes,

at a great expense.

Many of the 205 pieces of large oil-sands equipment built in

South Korea were destined to travel through Idaho and Montana on

two-lane U.S. Highway 12, with Imperial planning to widen the road

in some cases to make room for the giant pieces of equipment on the

scenic highway through Montana's Lolo pass.

Imperial, 70% owned by Exxon Mobil, wanted to use the

low-traffic scenic route to ship oversized loads larger than two

lanes of traffic and several times longer than the average semi

trailer, by moving the modules very slowly at night and pulling

over every few miles to let any traffic pass.

But the company faces legal challenges in both states claiming

that Imperial's plan would potentially damage tourism revenues, the

local highways and environment.

After facing months of permitting delays and legal obstacles,

Calgary-based Imperial Oil now says it will to break up the

equipment into smaller pieces so it can be transported in semi

trucks on interstate highways in Washington State, Idaho and

Montana--or face a delay of the $11 billion Kearl oil-sands

project, which is scheduled to begin operations by the end of next

year.

Each of about 150 oversized modules will cost about $500,000 to

disassemble and reassemble after a roughly 1,300-mile journey from

the port of Vancouver, Wash., to Kearl Lake, Alberta.

It also amounts to about 5,000 to 6,000 hours of skilled labor

by technicians per module, Imperial Oil spokesman Pius Rolheiser

said.

"They were not intended originally to be disassembled into

smaller loads," Rolhieser said, "So it's significant, not only the

cost but as a technical challenge."

However, Rolhieser said the extra cost will not raise the budget

of the project. He said the permitting delays will make meeting the

schedule to begin production next year "more challenging," though

he added the project is still on track to meet that timeline.

The first phase of the Kearl project is expected to produce

110,000 barrels of oil a day from the 4.6-billion-barrel reserve in

northern Alberta. Subsequent phases would bring the project up to

345,000 barrels a day.

Rolhieser said that Imperial is still pursuing permits to allow

it to move the larger pieces of equipment through Montana and

Idaho.

Shares of Imperial Oil closed down 4.6% Monday at $38.35 on the

New York Stock Exchange amid a broader pullback in oil and gas

equities.

-By Edward Welsch, Dow Jones Newswires; 403-229-9095;

edward.welsch@dowjones.com

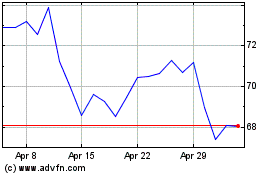

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024