CALGARY, July 28, 2011 /CNW/ -- CALGARY, July 28, 2011 /CNW/ -

Second quarter Six months (millions of dollars, 2011 2010 % 2011

2010 % unless noted) Net income (U.S. 726 517 40 1,507 993 52 GAAP)

Net income per common share - assuming dilution 0.85 0.60 40 1.76

1.16 52 (dollars) Capital and 925 881 5 1,784 1,781 - exploration

expenditures Bruce March, chairman, president and chief executive

officer of Imperial Oil, commented: "Imperial's earnings in the

second quarter of 2011 were $726 million, up 40 percent or $209

million from 2010. The Upstream business was the primary

contributor to this increase with strong earnings driven in part by

higher production from our Cold Lake operations, which set another

production record in the quarter. Overall, Upstream results were

very good despite challenges in delivering conventional crude oil

volumes from our Norman Wells operations as a result of third-party

pipeline reliability issues in the quarter. I am especially pleased

at how the organization continues to sustain base business

operating performance while executing a complex portfolio of

projects, including the Kearl oil sands project. Our Downstream

business continued to contribute solid results despite significant

planned refinery maintenance activity, which impacted our second

quarter results by about $95 million. Operations excellence remains

a key focus for our Downstream business. Our Chemical segment

performed very well with strong operations, sales, and margins

contributing to another quarter of good earnings. Imperial's

consistent, long-term and disciplined business approach has allowed

us to continue to advance our growth plans for the company while

sustaining focus and performance in our base business. Capital and

exploration expenditures to the end of June were $1,784 million

mostly directed to the continued development of the Kearl project.

In addition to capital spending for Kearl, we continue to progress

activity at Cold Lake, including the Nabiye project, and the

production pilot at Horn River. Our continued strong business

performance allowed us to finance these investments largely by cash

flow from operations." Imperial Oil is one of Canada's largest

corporations and a leading member of the country's petroleum

industry. The company is a major producer of crude oil and natural

gas, Canada's largest petroleum refiner, a key petrochemical

producer and a leading marketer with a coast-to-coast supply

network that includes about 1,850 retail service stations. Second

quarter items of interest -- Net income was $726 million, compared

with $517 million for the second quarter of 2010, an increase of 40

percent or $209 million. -- Net income per common share was $0.85,

an increase of 40 percent from the second quarter of 2010. -- Cash

generated from operating activities was $656 million which was net

of a $232 million contribution to the company's pension plans. This

was double the $324 million in cash generated in the same period

last year. -- Capital and exploration expenditures were $925

million, up five percent from the second quarter of 2010, as a

result of progressing the Kearl oil sands and other growth

projects. -- Gross oil-equivalent barrels of production averaged

292,000 barrels a day, compared with 300,000 barrels in the same

period last year. Lower production volumes in the second quarter

were primarily due to lower Syncrude volumes, a result of higher

maintenance activities, and lower conventional crude oil

production, a result of third-party pipeline unplanned downtime.

These factors were partially offset by increased Cold Lake bitumen

production. -- Cold Lake achieves another production record - Cold

Lake established a second-quarter production record and averaged

158,000 barrels a day, compared to 140,000 barrels a day in the

second quarter of 2010 and 157,000 barrels a day in the first

quarter of 2011. The increase is due to contributions from new

wells steamed in 2010 and 2011 and the cyclic nature of production

at Cold Lake. -- Kearl oil sands project update - The Kearl initial

development is 68 percent complete and is progressing on schedule

with expected start-up in late 2012. The Kearl development plan was

reconfigured from a three-phase to a two-phase strategy. Production

from the initial development will be at 110,000 barrels of bitumen

a day. A second phase expansion, with debottlenecking of both

phases, will be used to reach the regulatory capacity of 345,000

barrels a day. We are evaluating the recent Montana court decision

barring any permits for transport of modules on Highway 12 and are

encouraged by the Idaho hearing officer's findings in the contested

case proceedings that confirmed preparations for safe module

transport on the Idaho portion of Highway 12. Efforts to reduce the

size of modules in Lewiston, Idaho are near complete and the

company began moving reduced-in-size modules on alternate routes in

mid-July. -- Acreage acquisition - Imperial Oil and ExxonMobil

Canada jointly acquired two exploration licenses totalling 444,000

net acres in the Summit Creek area of the Central Mackenzie Valley

in the Northwest Territories. -- Horn River pilot project update -

This project was sanctioned, and drilling began in April on

Imperial's horizontal multi-well pilot production pad to evaluate

well productivity and cost performance. All surface casings have

been installed and the first production section well has been

drilled and cased. The program is proceeding on schedule with

proposed start up in late 2012. -- Strathcona refinery wins safety

award - Imperial's Strathcona refinery was recognized by the

Alberta Petro-Chemical Safety Council as the Best Performer in 2010

for achieving the lowest worker injury rate amongst its members.

Second quarter 2011 vs. second quarter 2010 The company's net

income for the second quarter of 2011 was $726 million or $0.85 a

share on a diluted basis, compared with $517 million or $0.60 a

share for the same period last year. Earnings in the second quarter

were higher than the same quarter in 2010 primarily due to the

impacts of higher crude oil commodity prices of about $430 million,

stronger industry refining margins of about $80 million and

increased Cold Lake bitumen production of about $70 million. These

factors were partially offset by the unfavourable effects of higher

royalty costs of about $120 million, lower Syncrude volumes of

about $50 million, primarily a result of higher unplanned

maintenance activities, and lower conventional crude oil volumes of

about $45 million due to third-party pipeline reliability issues.

Earnings were also negatively impacted by the foreign exchange

effects of the stronger Canadian dollar of about $70 million and

higher planned refinery maintenance activities of about $40

million. Second quarter 2010 earnings included a gain of about $25

million from the sale of non-operating assets. Upstream net income

in the second quarter was $624 million, $178 million higher than

the same period of 2010. Earnings benefited from higher crude oil

commodity prices of about $430 million and increased Cold Lake

bitumen production of about $70 million. These factors were

partially offset by lower Syncrude volumes of about $50 million,

primarily a result of higher unplanned maintenance activities, and

lower conventional crude oil volumes of about $45 million due to

third-party pipeline reliability issues. Earnings were also

negatively impacted by higher royalty costs due to higher commodity

prices of about $120 million and the foreign exchange effects of

the stronger Canadian dollar of about $55 million. The average

price of Brent crude oil in U.S. dollars, a common benchmark for

Atlantic Basin oil markets, was $117.33 a barrel in the second

quarter of 2011, up about 50 percent from the corresponding period

last year. The average price of West Texas Intermediate (WTI) crude

oil in U.S. dollars, a common benchmark for mid-continent North

American oil markets, was $102.34 a barrel in the second quarter,

up about 31 percent from the corresponding period last year. The

company's average realizations on sales of Canadian conventional

crude oil and synthetic crude oil increased accordingly. The

company's average bitumen realizations in the second quarter were

about 26 percent higher than that in the corresponding period of

2010, more in line with the continuing weakness in WTI crude oil

markets. Gross production of Cold Lake bitumen during the second

quarter averaged 158 thousand barrels a day, a second-quarter

record, up from 140 thousand barrels in the same quarter last year.

Increased volumes were due to contributions from new wells steamed

in 2010 and 2011 and the cyclic nature of production at Cold Lake.

The company's share of Syncrude's gross production in the second

quarter was 70 thousand barrels a day, versus 81 thousand barrels

in the second quarter of 2010. Lower production was primarily the

result of higher unplanned maintenance activities and the negative

impact of wild fires in northern Alberta on the Syncrude

operations. Gross production of conventional crude oil averaged 16

thousand barrels a day in the second quarter, down from 24 thousand

barrels in the second quarter of 2010. Lower volumes were primarily

due to the third-party pipeline unplanned downtime which caused

significantly reduced production at the Norman Wells field. This

pipeline downtime carried forward into the third quarter. Gross

production of natural gas during the second quarter of 2011 was 257

million cubic feet a day, down from 289 million cubic feet in the

same period last year. The lower production volume was primarily a

result of natural reservoir decline. Downstream net income was $64

million in the second quarter of 2011, compared with $68 million in

the same period a year ago. Second quarter earnings in 2010

included a gain of about $25 million from sale of non-operating

assets. Impacting earnings in the second quarter of 2011 when

compared to the prior year's second quarter were higher planned

refinery maintenance activities totalling about $40 million.

Unfavourable effects of the stronger Canadian dollar were about $15

million. Offsetting these negative factors was the favourable

impact of stronger industry refining margins of about $80 million

in the quarter. Planned refinery maintenance activity impacted

second quarter 2011 results by about $95 million. Chemical net

income was $36 million in the second quarter, $14 million higher

than the same quarter last year. Higher polyethylene and

intermediate products sales volumes and lower costs due to lower

planned maintenance activities were the main contributors to the

increase. Net income effects from Corporate and other were $2

million in the second quarter, compared with negative $19 million

in the same period of 2010. Favourable effects were primarily due

to lower share-based compensation charges. Cash flow generated from

operating activities was $656 million during the second quarter of

2011, compared with $324 million in the same period last year.

Higher cash flow was primarily driven by higher earnings and

working capital effects. Investing activities used net cash of $893

million in the second quarter, an increase of $96 million from the

corresponding period in 2010. Additions to property, plant and

equipment were $903 million in the second quarter, compared with

$851 million during the same quarter 2010. Expenditures during the

quarter were primarily directed towards the advancement of the

Kearl oil sands project. Other investments included development

drilling and advancing the Nabiye expansion project at Cold Lake,

environmental and other projects at Syncrude, as well as

exploration drilling and the advancement of the production pilot at

Horn River. In the second quarter, the company increased its

long-term debt level by $320 million by drawing on an existing

facility and issued additional commercial paper which increased

short-term debt by $135 million. The company's cash balance was

$419 million at June 30, 2011, up $152 million from $267 million at

the end of 2010. Six months highlights -- Net income was $1,507

million, up from $993 million in the first six months of 2010. --

Net income per common share increased to $1.76 compared to $1.16 in

the same period of 2010. -- Cash generated from operations was

$1,615 million, versus $1,238 million in the first half of 2010. --

Capital and exploration expenditures were $1,784 million, versus

$1,781 million in the six months of 2010, supporting the Kearl oil

sands and other growth projects. -- Gross oil-equivalent barrels of

production averaged 301,000 barrels a day, compared to 296,000

barrels in the first half of 2010. -- Per-share dividends declared

in the first two quarters of 2011 totalled $0.22, up from $0.21 in

the same period of 2010. -- Continued strong cost management with

production and manufacturing expenses of $2,037 million being flat

with the same six month period of 2010 ($2,042 million). Six months

2011 vs. six months 2010 Net income for the first six months of

2011 was $1,507 million or $1.76 a share on a diluted basis, versus

$993 million or $1.16 a share for the first half of 2010. For the

six months, increased earnings were primarily attributable to

higher crude oil commodity prices of about $460 million, stronger

industry refining margins of about $255 million and increased Cold

Lake bitumen production of about $100 million. These factors were

partially offset by the unfavourable effects of the stronger

Canadian dollar of about $140 million, higher royalty costs of

about $130 million and lower conventional crude oil volumes of

about $45 million due to third party pipeline issues. Upstream net

income for the six months of 2011 was $1,152 million, up $262

million from 2010. Earnings increased primarily due to the impacts

of higher crude oil commodity prices of about $460 million and

increased Cold Lake bitumen production of about $100 million. These

factors were partially offset by the unfavourable effects of higher

royalty costs of about $130 million, the stronger Canadian dollar

of about $105 million and lower conventional crude oil volumes of

about $45 million as a result of the second quarter 2011

third-party pipeline issues. The average price of Brent crude oil

in U.S. dollars, a common benchmark for Atlantic Basin oil markets,

was $111.20 a barrel in the six months of 2011, up about 44 percent

from the corresponding period last year. The average price of West

Texas Intermediate (WTI) crude oil in U.S. dollars, a common

benchmark for mid-continent North American oil markets, was $98.50

a barrel in the six months of 2011, up about 26 percent from the

corresponding period last year. The company's average realizations

on sales of Canadian conventional crude oil and synthetic crude oil

increased accordingly. The company's average bitumen realizations

in the first six months of 2011 were about six percent higher than

that in the corresponding period of 2010. Cold Lake bitumen

realizations were negatively impacted by third-party pipeline

integrity issues carried over from the second half of 2010 into the

first quarter of 2011 and continued weakness in WTI crude oil

markets. Gross production of Cold Lake bitumen for the six months

was 157 thousand barrels a day this year, a first six-month record,

compared with 144 thousand barrels in the same period of 2010.

Increased volumes were due to contributions from new wells steamed

in 2010 and 2011 and the cyclic nature of production at Cold Lake.

The company's share of gross production from Syncrude averaged 75

thousand barrels a day, up slightly from 74 thousand barrels

in 2010. Increased production was due to improved operating

reliability. Gross production of conventional crude oil was 19

thousand barrels a day, compared with 24 thousand barrels in 2010.

Lower volumes were primarily due to third-party pipeline downtime,

which reduced production at the Norman Wells field, and natural

reservoir decline. Gross production of natural gas during the six

months of 2011 was 263 million cubic feet a day, down from 281

million cubic feet in the six months of 2010. The lower production

volume was primarily a result of natural reservoir decline. Six

months Downstream net income was $340 million, an increase of $233

million over 2010. Higher earnings were primarily due to favourable

impacts of stronger industry refining margins of about $255 million

and $40 million associated with improved refinery operations. These

factors were partially offset by the unfavourable impact of the

stronger Canadian dollar of about $35 million. Earnings in 2010

included a gain of about $25 million from sale of non-operating

assets. Chemical net income in the first half of 2011 was $74

million, up $53 million from 2010. Earnings were positively

impacted by improved industry margins across all product channels,

lower costs due to lower planned maintenance activities and higher

polyethylene sales volumes. For the six months of 2011, net income

effects from Corporate and other were negative $59 million, versus

negative $25 million last year. Unfavourable effects were primarily

due to changes in share-based compensation charges. Key financial

and operating data follow. Forward-Looking Statements Statements in

this report relating to future plans, projections, events or

conditions are forward-looking statements. Actual future results,

including project plans, costs, timing and capacities; financing

sources; the resolution of contingencies and uncertain tax

positions; the effect of changes in prices and other market

conditions; and environmental and capital expenditures could differ

materially depending on a number of factors, such as the outcome of

commercial negotiations; changes in the supply of and demand for

crude oil, natural gas, and petroleum and petrochemical products;

political or regulatory events; and other factors discussed in Item

1A of the company's 2010 Form 10K. IMPERIAL OIL LIMITED SECOND

QUARTER 2011 Second Quarter Six Months millions of Canadian

dollars, unless 2011 2010 2011 2010 noted Net Income (U.S. GAAP)

Total revenues and other income 7,774 6,139 14,645 12,305 Total

expenses 6,815 5,457 12,635 10,972 Income before income taxes 959

682 2,010 1,333 Income taxes 233 165 503 340 Net income 726 517

1,507 993 Net income per common share 0.86 0.61 1.78 1.17 (dollars)

Net income per common share - 0.85 0.60 1.76 1.16 assuming dilution

(dollars) Other Financial Data Federal excise tax included in 325

322 640 626 operating revenues Gain/(loss) on asset sales, - 36 4

40 after tax Total assets at June 30 22,966 18,368 Total debt at

June 30 1,209 228 Interest coverage ratio - earnings basis (rolling

4 quarters, times 280.3 355.6 covered) Other long-term obligations

at 2,747 2,427 June 30 Shareholders' equity at June 30 12,364

10,393 Capital employed at June 30 13,602 10,656 Return on average

capital employed (a) (rolling 4 quarters, percent) 22.1 20.8

Dividends on common stock Total 94 93 187 178 Per common share

(dollars) 0.11 0.11 0.22 0.21 Millions of common shares outstanding

At June 30 847.6 847.6 Average - assuming dilution 853.9 854.5

854.0 854.3 Return on capital employed is net income excluding

after-tax cost (a) of financing divided by the average rolling four

quarters' capital employed. IMPERIAL OIL LIMITED SECOND

QUARTER 2011 Second Quarter Six Months millions of Canadian dollars

2011 2010 2011 2010 Total cash and cash equivalents 419 64 419 64

at period end Net income 726 517 1,507 993 Adjustment for non-cash

items: Depreciation and depletion 190 192 378 374 (Gain)/loss on

asset sales - (42) (6) (46) Deferred income taxes and 4 70 (86) 72

other Changes in operating assets and (264) (a) (413) (178) (155)

liabilities Cash flows from (used in) 656 324 1,615 1,238 operating

activities Cash flows from (used in) (893) (797) (1,699) (1,604)

investing activities Proceeds from asset sales 6 54 20 60 Cash

flows from (used in) 355 3 236 (83) financing activities (a) Second

quarter 2011 cash flows from operating activities were negatively

impacted by $232 million funding contributions to the company's

registered pension plans. IMPERIAL OIL LIMITED SECOND QUARTER 2011

Second Quarter Six Months millions of Canadian dollars 2011 2010

2011 2010 Net income (U.S. GAAP) Upstream 624 446 1,152 890

Downstream 64 68 340 107 Chemical 36 22 74 21 Corporate and other 2

(19) (59) (25) Net income 726 517 1,507 993 Revenues and other

income Upstream 2,543 1,984 4,882 4,193 Downstream 6,758 5,312

12,825 10,504 Chemical 445 331 865 684 Eliminations/Other (1,972)

(1,488) (3,927) (3,076) Total 7,774 6,139 14,645 12,305 Purchases

of crude oil and products Upstream 963 653 1,824 1,440 Downstream

5,647 4,237 10,416 8,424 Chemical 329 234 636 510 Eliminations

(1,973) (1,488) (3,930) (3,077) Purchases of crude oil and 4,966

3,636 8,946 7,297 products Production and manufacturing expenses

Upstream 596 573 1,195 1,175 Downstream 415 389 752 759 Chemical 47

50 90 108 Production and 1,058 1,012 2,037 2,042 manufacturing

expenses Capital and exploration expenditures Upstream 884 832

1,702 1,687 Downstream 36 46 72 84 Chemical 1 2 3 8 Corporate and

other 4 1 7 2 Capital and exploration 925 881 1,784 1,781

expenditures Exploration expenses charged to income included 22 30

59 117 above IMPERIAL OIL LIMITED SECOND QUARTER 2011

Operating statistics Second Quarter Six Months 2011 2010 2011 2010

Gross crude oil and Natural Gas Liquids (NGL) production (thousands

of barrels a day) Cold Lake 158 140 157 144 Syncrude 70 81 75 74

Conventional 16 24 19 24 Total crude oil production 244 245 251 242

NGLs available for sale 5 7 6 7 Total crude oil and NGL 249 252 257

249 production Gross natural gas production 257 289 263 281

(millions of cubic feet a day) Gross oil-equivalent production (a)

(thousands of oil-equivalent barrels 292 300 301 296 a day) Net

crude oil and NGL production (thousands of barrels a day) Cold Lake

114 112 117 115 Syncrude 63 74 69 67 Conventional 12 18 14 18 Total

crude oil production 189 204 200 200 NGLs available for sale 4 5 4

5 Total crude oil and NGL 193 209 204 205 production - - Net

natural gas production (millions 227 265 238 251 of cubic feet a

day) Net oil-equivalent production (a) (thousands of oil-equivalent

barrels 231 253 243 247 a day) Cold Lake blend sales (thousands of

206 184 209 192 barrels a day) NGL Sales (thousands of barrels a 17

9 11 11 day) Natural gas sales (millions of cubic 241 263 246 263

feet a day) Average realizations (Canadian dollars) Conventional

crude oil 97.96 69.53 87.36 72.01 realizations (a barrel) NGL

realizations (a barrel) 62.03 43.79 61.08 50.53 Natural gas

realizations (a 3.68 3.79 3.76 4.49 thousand cubic feet) Synthetic

oil realizations (a 111.41 77.98 101.77 79.91 barrel) Bitumen

realizations (a barrel) 68.72 54.46 62.30 58.73 Refinery throughput

(thousands of 397 418 425 428 barrels a day) Refinery capacity

utilization 78 83 84 85 (percent) Petroleum product sales

(thousands of barrels a day) Gasolines (Mogas) 215 214 212 209

Heating, diesel and jet fuels 148 136 157 141 (Distilates) Heavy

fuel oils (HFO) 28 31 27 32 Lube oils and other products 44 47 40

43 (Other) Net petroleum products sales 435 428 436 425

Petrochemical Sales (thousands of 249 236 521 484 tonnes) (a) Gas

converted to oil-equivalent at 6 million cubic feet = 1 thousand

barrels IMPERIAL OIL LIMITED SECOND QUARTER 2011 Net income

Net income (U.S. GAAP) per common share (millions of Canadian

dollars) (dollars) 2007 First Quarter 774 0.82 Second Quarter 712

0.76 Third Quarter 816 0.88 Fourth Quarter 886 0.97 Year 3,188 3.43

2008 First Quarter 681 0.76 Second Quarter 1,148 1.29 Third Quarter

1,389 1.57 Fourth Quarter 660 0.77 Year 3,878 4.39 2009 First

Quarter 289 0.34 Second Quarter 209 0.25 Third Quarter 547 0.64

Fourth Quarter 534 0.63 Year 1,579 1.86 2010 First Quarter 476 0.56

Second Quarter 517 0.61 Third Quarter 418 0.49 Fourth Quarter 799

0.95 Year 2,210 2.61 2011 First Quarter 781 0.92 Second Quarter 726

0.86 To view this news release in HTML formatting,

please use the following URL:

http://www.newswire.ca/en/releases/archive/July2011/28/c8006.html p

403-237-2710 /p

Copyright

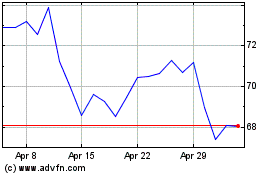

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024