Imperial Oil Continues Existing Share Repurchase Program

June 23 2011 - 1:01PM

PR Newswire (Canada)

CALGARY, June 23, 2011 /CNW/ -- CALGARY, June 23, 2011 /CNW/ -

Imperial Oil Limited today announced it has received final

acceptance from the Toronto Stock Exchange for a new normal course

issuer bid to continue its existing share repurchase program

facility that will expire on June 24, 2011. The new program enables

the company to repurchase up to five percent of its 847,709,258

outstanding common shares as of June 15, 2011, or a maximum of

42,385,463 shares during the next 12 months. That total will be

reduced by the number of shares purchased for the company's

employee savings plan and employee retirement plan. Shares

purchased under the normal course issuer bid are restored to the

status of authorized but unissued shares. Exxon Mobil Corporation,

Imperial's majority shareholder, will also be permitted to sell its

shares to Imperial outside the provisions of, but concurrently

with, the normal course issuer bid in order to maintain its

proportionate share ownership at 69.6%. Exxon Mobil Corporation has

advised Imperial that it intends to participate, as it has in prior

years. The new one year program will begin on June 25, 2011, and

will end when the company has purchased the maximum allowable

number of shares, or it provides earlier notice of termination. All

share purchases will be made through the facilities of the Toronto

Stock Exchange. From time to time Imperial may have cash in excess

of its day-to-day operating and capital investment needs.

Imperial's board of directors has concluded that it would be in the

best interests of its shareholders to have the flexibility to

purchase shares in the market and from Exxon Mobil Corporation. If

required, it is a flexible way of rebalancing Imperial's capital

structure while distributing a portion of its cash reserves to

shareholders who choose to participate by selling their shares.

Exxon Mobil Corporation's concurrent participation with the normal

course issuer bid will permit Exxon Mobil Corporation to maintain

its current percentage ownership level of shares. In addition,

Imperial had a stock option plan in 2002 for selected directors and

key employees. In December 2002, Imperial also introduced a

restricted stock unit plan pursuant to which shares may be issued

upon vesting. Since there could be a dilution in the

percentage ownership levels of shareholders that would result from

the issue of shares on the exercise of stock options and the

vesting of restricted stock units, Imperial considers that it would

be in the best interests of Imperial and its shareholders to

proceed with the purchase of shares in the market and from Exxon

Mobil Corporation to reduce or eliminate such dilution. The company

has no plans to issue stock options in the future. Imperial will

continue to evaluate its share purchase program in the context of

its overall capital activities. Share repurchases under the

existing program were limited to 917,997 shares at a total cost of

about $44.2 million by June 15, 2011, representing an average cost

of $48.14 per share. Imperial's daily trading limit under the

new program will be 211,646 shares, which number is 25% of

Imperial's daily trading volume. To view this news release in HTML

formatting, please use the following URL:

http://www.newswire.ca/en/releases/archive/June2011/23/c8831.html

table border="0" tr td Investor Relations /td td /td

td Media Relations /td /tr tr td Mark Stumpf /td td

/td td (403)237-2710 /td /tr tr td (403)237-4537 /td /tr /table p

/p

Copyright

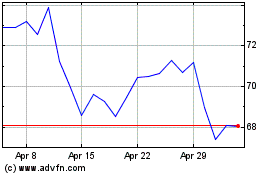

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024