MacKenzie Gas Pipeline Approved By Canada's Energy Regulator

December 16 2010 - 5:43PM

Dow Jones News

After a six-year review, Canada's National Energy Board Thursday

approved plans to build a 740-mile pipeline to ship natural gas

from the Arctic to points southward.

The decision removes a major hurdle for the C$16.2 billion

($16.1 billion) MacKenzie Gas Project, which proposes to bring

natural gas from fields in Canada's Northwest Territories bordering

the Arctic Ocean to other pipelines and refineries that serve the

North American market.

Engineering and field work on the project has been frozen since

2007 as the regulatory-review process dragged on. The pipeline--the

farthest along of three proposals to ship natural gas from the far

north--would be able to carry as much as 1.2 billion cubic feet per

day, and would go into service by 2018 at the earliest.

But even as project partners led by Calgary-based Imperial Oil

Ltd. (IMO, IMO.T) proceed to the next stage of development, some

industry watchers worry the project's economics no longer work out

due to a recent glut of natural gas pulled from rocks known as

shale. That glut has pushed natural-gas prices to just over $4 per

million British thermal units--well below the $6 to $7 price range

that project partners estimate they need to make the pipeline

feasible.

Canada's energy regulator approved the project even as it

acknowledged the steep drop in natural-gas prices since it was

first proposed.

"We do not agree with those who say these are reasons to deny

the project," it said in a lengthy report explaining its decision.

"It is up to the companies to decide whether the project makes

economic sense."

It added, however, that construction must begin by

2015--Imperial Oil had asked for a 2016 deadline, and said 2014 is

the earliest it could begin construction.

Imperial Oil spokesman Pius Rolheiser said his company remains

committed to pursuing the project, on the grounds that it believes

demand for natural gas will grow and supply from other sources will

decline.

However, Rolheiser said Imperial Oil won't be able to make an

investment decision until the end of 2013, and needs to work out an

agreement on taxes and royalties with the Canadian government--it

would also need to re-staff the project and file for more than

6,000 required permits. Imperial Oil and its partners have already

spent around C$750 million on preliminary engineering studies and

regulatory matters.

"We've known from the outset that this is a complex project,"

Rolheiser said. "The central challenge has always been and remains

that gas from the Mackenzie Delta needs to be competitive on a

supply-cost basis with other sources of supply."

Gregory Ebel, chief executive of Spectra Energy Corp. (SE), a

Houston, Texas-based company that operates Canadian natural-gas

pipelines in British Columbia, said the Mackenzie project is "a

very, very tough project given how far it is from market."

"The dynamics in the market are now significantly different from

what they once were," said Greg Stringham, vice president for

markets at the Canadian Association of Petroleum Producers. "It's

really a challenging time for all natural gas now."

The MacKenzie Gas Project partners--which also include an

aboriginal peoples' group as well as the Canadian arms of

ConocoPhillips (COP), Royal Dutch Shell PLC (RDSA, RDSA.LN) and

Exxon Mobil Corp. (XOM)--are counting on tightening natural-gas

supplies and rising prices during the next several years to put

their plans back on track.

"It's not the natural-gas price now--it's what it is when these

wells come into service" in 2018, says Bob Reid, president of the

Aboriginal Pipeline Group, which has a one-third stake in the

pipeline and represents the interests of three native groups over

whose land the pipeline will pass. "I'm confident we will make a

decision to construct."

Meanwhile, two other natural-gas pipeline projects are also

competing to bring another source of natural gas south, from

Alaska's North Shore. TransCanada Corp. (TRP, TRP.T) and Exxon

Mobil are asking natural-gas producers to support their project to

ship up to 4.5 billion cubic feet per day over the rival Denali

pipeline project supported by BP PLC (BP, BP.LN) and

ConocoPhillips, and which is expected to be completed by the end of

the decade.

-By Phred Dvorak and Edward Welsch, Dow Jones Newswires;

403-229-9095; edward.welsch@dowjones.com

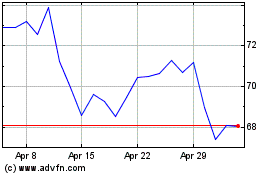

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024