UPDATE: FERC Rules For Enbridge In Clipper Surcharge Dispute

March 31 2010 - 4:44PM

Dow Jones News

U.S. regulators ruled in favor of Canadian pipeline company

Enbridge Inc. (ENB) Wednesday in a dispute with oil producers over

higher tolls for a new pipeline scheduled to begin pumping oil into

the U.S. on Thursday.

The U.S. Federal Energy Regulatory Commission dismissed

arguments made by Calgary-based oil producers Suncor Energy Inc.

(SU) and Imperial Oil Ltd. (IMO) against surcharges to pay for the

Alberta Clipper line, a 1,000-mile, 450,000 barrel-a-day crude oil

expansion line between Hardisty, Alberta, and Superior, Wis. FERC

approved Enbridge's plan to implement the surcharges when the

pipeline begins bringing Canadian crude into the U.S. on

Thursday.

Enbridge will charge $3.89 per barrel of oil transported the

full length of its system from Hardisty to Chicago, about 75 cents

of which is the surcharge to pay for construction of the Alberta

Clipper expansion, according to company spokesman Glenn

Herchak.

Suncor and Imperial argued that economic circumstances had

changed since producers agreed in a 2008 industry settlement to a

surcharge to help pay for Enbridge's Alberta Clipper line. The

agreement was made before the global economic downturn hit, as oil

prices reached record levels in the summer of 2008. Oil demand

dropped steeply afterwards and still hasn't recovered to

pre-recession levels.

Suncor argued that Enbridge "imprudently pursued the Alberta

Clipper even as circumstances changed dramatically," according to a

FERC filing, and asked that producers not be required to pay the

higher surcharges "until the shippers need the expansion

capacity."

FERC dismissed that and other arguments put forward by Suncor

and Imperial, saying it "will not undo a settlement because certain

parties now argue that the deal turned out differently than they

thought."

"We are pleased that the FERC agrees with our decision and to be

able to begin collecting tolls as of April 1, tomorrow," Enbridge's

Herchak said. Representatives of Suncor and Imperial weren't

immediately available to comment.

"It would have been a shock had it gone the other way," said

Carl Kirst, an analyst with BMO Capital Markets. "Companies cannot

do multi-billion investments like this, with the backing of

shippers at the time, only to have the market change on you and

have the rug pulled away. All of a sudden you'd have a fairly large

chilling effect on [pipeline] investment," he said.

It wasn't clear how much extra producers will pay in the

surcharge, but Kirst estimated it was close to an extra 25% per

barrel of oil above the base toll rate.

Enbridge shares closed down 17 cents at $47.75 in New York

Wedesday. Suncor shares closed down 26 cents at $32.54. Imperial

Oil shares closed up 34 cents at $38.87.

-By Edward Welsch, Dow Jones Newswires; 613-237-0669;

edward.welsch@dowjones.com

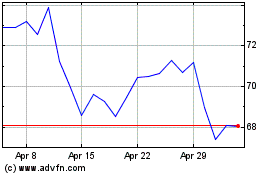

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024