India Globalization Capital, Inc. (NYSE American: IGC) announces

its financial results for the three months ended September 30,

2021, which is the second quarter of the Company’s 2022 fiscal

year.

The highlights for the quarter are:

- As previously disclosed, on September 7, 2021, the Company

announced the completion of its Phase 1 clinical trial on IGC’s

tetrahydrocannabinol (“THC”) based investigational new drug,

IGC-AD1, intended to alleviate certain symptoms of individuals who

have Alzheimer’s disease. The primary endpoint of this Phase 1

trial was safety and tolerability. Based on this study and subject

to FDA concurrence the cannabis-based investigational drug IGC-AD1

was generally safe and well-tolerated by the Alzheimer’s trial

participants. The trial’s secondary endpoints including

pharmacokinetics, genotyping, Neuropsychiatric Inventory (NPI), and

measurement of suicide severity, have also been completed. We

expect to report this data as it becomes available and after

submission to the FDA.

- The Company is preparing an INDA submission to the FDA for a

Phase 2/3 trial for the use of IGC-AD1 to address symptoms

associated with Alzheimer’s disease. The Company believes that this

may be the first such filing using low doses of a natural

phytocannabinoid, THC, on patients suffering from Alzheimer’s

disease.

- On September 17, 2021, the Company filed a provisional patent

application (IGC-513) with the United States Patent and Trademark

Office (“USPTO”) for addressing Neuropsychiatric Symptoms (NPS)

associated with dementia using a dosing pattern of IGC-AD1 that was

employed in the recently completed Phase 1 trial on patients

suffering from Alzheimer's disease. The patent filing specifically

addresses reducing the overall presence and severity of NPS in

dementia as measured by the NPI, a tool that assesses the presence

of twelve symptoms such as delusion, hallucination,

agitation/aggression, depression, anxiety, elation/euphoria,

apathy, disinhibition, irritability, aberrant motor behavior, sleep

disorder, appetite and eating disorders.

- On October 5, 2021, the Company received a Good Manufacturing

Practice (GMP) certificate for its hemp processing facility in

Vancouver Washington where it manufactures tinctures, lotions,

gummies and other topical and consumable products.

- During the six months ended September 30, 2021, the Company

raised approximately $4.1 million of net proceeds from the issuance

of equity stock. The Company had entered an “at the market” (“ATM”)

offering pursuant to a Sales Agreement entered on January 13, 2021,

with The Benchmark Company, LLC for the issuance and sale of up to

$75,000,000 of the Company’s shares of common stock, par value

$0.0001 per share.

Revenue in the quarters ended September 30, 2021, and September

30, 2020, were primarily derived from our Life Sciences segment,

which involved sales of products such as lotion, gummies, and

alcohol-based hand sanitizers, among others. Revenue was

approximately $56 thousand and $125 thousand for the three months

ended September 30, 2021, and the three months ended September 30,

2020, respectively. Revenue in our Infrastructure segment for the

three months ended September 30, 2021, was $3 thousand and $67

thousand in the three months ended September 30, 2020. The revenue

relates to the execution of a construction contract. Primarily due

to COVID-19, we have limited visibility on when either of our

segments will stabilize, generate significant revenue, and become

predictable. We expect volatility in both segments in the

foreseeable future.

Selling, General and Administrative (SG&A) expenses

increased by approximately $2.6 million to approximately $4.1

million for the three months ended September 30, 2021, from

approximately $1.48 million for the three months ended September

30, 2020. The $2.6 million increase in SG&A is attributable to

the following: approximately $1.7 million to a provision for stolen

inventory at our vendor’s premises, approximately $352 thousand for

previously announced legal settlements and associated legal

expenses, approximately $125 thousand for an IRS tax penalty, and

non-cash increases of $223 thousand and $55 thousand for common

stock-based compensation and depreciation respectively. The

remaining increase of about $ 153 thousand is related to marketing

and other operating expenses.

Research and Development (“R&D”) expenses were attributed to

conducting the Phase 1 trial on patients suffering from Alzheimer’s

disease and product research in our Life Sciences segment. The

R&D expenses for the three months ended September 30, 2021, are

approximately $276 thousand and approximately $219 thousand for the

three months ended September 30, 2020. We expect R&D expenses

to increase with progression in trials on IGC-AD1, subject to FDA

approval.

Net loss for the three months ended September 30, 2021, was

approximately $4.3 million or ($0.08) per share, compared to

approximately $1.65 million or ($0.04) per share for the three

months ended September 30, 2020.

About IGC: IGC operates two lines of business: (i)

infrastructure and (ii) life sciences. The Company is based in

Potomac, Maryland, U.S.A. social media: www.igcinc.us /

www.igcpharma.com

Forward-looking Statements: This press release contains

forward-looking statements. These forward-looking statements are

based largely on IGC’s expectations and are subject to several

risks and uncertainties, certain of which are beyond IGC’s control.

For the next several years, our success is highly correlated

primarily with the successful outcome of our clinical trials and

the recovery of the world and local economies following the

COVID-19 pandemic, and, secondarily, on the sale of our products

and services candidates. IGC may not be able to complete human

trials on our investigational drug candidates, or, once conducted,

the results of human trials testing may not be favorable or as

anticipated. Our projections and investments anticipate stable

pricing, which may not hold out over the next several years, and

certain regulatory changes, specifically in states where medical

cannabis has been, is, or will be legalized and the diseases which

we anticipate our products will target are approved conditions for

treatment or usage with cannabis/cannabinoids. We may not be able

to protect our intellectual property adequately or receive patents.

We may not receive regulatory approval for our products, or trials.

An additional risk factor worth highlighting specifically related

to patent licensing is that the patent applications we have

licensed may not be granted by the USPTO, even if the Company is in

full compliance with USPTO requirements. We may not have adequate

resources including financial resources, to successfully conduct

all requisite clinical trials, to bring a product to market, or to

pay applicable maintenance fees over time. We may not be able to

successfully commercialize our products even if they are successful

and receive regulatory approval. Failure or delay with respect to

any of the factors above could have a material adverse effect on

our business, future results of operations, our stock price, and

our financial condition. Actual results could differ materially

from these forward-looking statements as a result of, the factors

described both herein and in IGC’s SEC filings. IGC incorporates by

reference the Risk Factors identified in its Annual Report on Form

10-K filed with the SEC on June 14, 2021, Quarterly Reports on Form

10-Q filed with the SEC on August 11, 2021 and October 29, 2021, as

if fully incorporated and restated herein. In light of these risks

and uncertainties, there can be no assurance that the

forward-looking information contained in this release will in fact

occur.

< Financial Tables to Follow>

India Globalization Capital,

Inc.

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

data)

September 30,

2021

($)

March 31, 2021

($)

ASSETS

Current assets:

Cash and cash equivalents

14,399

14,548

Accounts receivable, net

138

175

Inventory

5,498

5,478

Non-Marketable securities

-

80

Deposits and advances

1,669

3,236

Total current assets

21,704

23,517

Intangible assets, net

411

407

Property, plant and equipment, net

10,589

10,840

Non-Marketable securities

11

12

Claims and advances

611

603

Operating lease asset

510

488

Total long-term assets

12,132

12,350

Total assets

33,836

35,867

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable

418

476

Accrued liabilities and others

1,594

1,588

Short-term loans

3

304

Total current liabilities

2,015

2,368

Long-term loans

146

276

Other liabilities

15

15

Operating lease liability

404

405

Total non-current liabilities

565

696

Total liabilities

2,580

3,064

Commitments and Contingencies –

See Note 12

Stockholders' equity:

Preferred stock, $0.0001 par value:

authorized 1,000,000 shares, no shares issued or outstanding as of

September 30, 2021 and March 31, 2021.

-

-

Common stock and additional paid-in

capital, $0.0001 par value: 150,000,000 shares authorized;

51,041,017 and 47,827,273 shares issued and outstanding as of

September 30, 2021 and March 31, 2021, respectively.

114,371

109,720

Accumulated other comprehensive loss

(2,840

)

(2,774

)

Accumulated deficit

(80,275

)

(74,143

)

Total stockholders' equity

31,256

32,803

Total liabilities and stockholders'

equity

33,836

35,867

These financial statements should be read in

connection with the accompanying notes on Form 10-Q for the quarter

ended September 30, 2021, filed with the SEC on October 29,

2021.

India Globalization Capital,

Inc.

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except loss per

share and share data)

Three months ended September

30,

2021

($)

2020

($)

Revenue

56

125

Cost of revenue

(18

)

(99

)

Gross Profit

38

26

Selling, general and administrative

expenses

(4,110

)

(1,483

)

Research and development expenses

(276

)

(219

)

Operating loss

(4,348

)

(1,676

)

Impairment of investment

-

-

Other income, net

4

19

Loss before income taxes

(4,344

)

(1,657

)

Net loss attributable to common

stockholders

(4,344

)

(1,657

)

Foreign currency translation

adjustments

20

142

Comprehensive loss

(4,324

)

(1,515

)

Loss per share attributable to common

stockholders:

Basic & diluted

$

(0.09

)

$

(0.04

)

Weighted-average number of shares used in

computing loss per share amounts:

49,948,930

41,244,109

These financial statements should be read in

connection with the accompanying notes on Form 10-Q for the quarter

ended September 30, 2021, filed with the SEC on October 29,

2021.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211029005572/en/

Claudia Grimaldi 301-983-0998

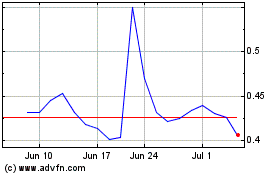

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Oct 2024 to Nov 2024

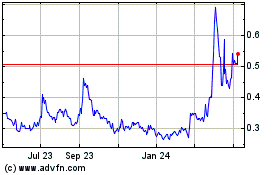

IGC Pharma (AMEX:IGC)

Historical Stock Chart

From Nov 2023 to Nov 2024