UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

TO

(Amendment No. 1)

Tender Offer Statement under Section

14(d)(1) or Section 13(e)(1)

of the Securities Exchange Act of 1934

GRAN TIERRA ENERGY INC.

(Name of Subject Company and Filing Person

(Issuer) and Name of Filing Person (Offeror))

5.00% Convertible Senior Notes due 2021

(Title of Class of Securities)

38500T AA9

(CUSIP Number of Class of Securities)

Gary S. Guidry

President and Chief Executive Officer

Suite 900, 520 – 3

rd

Avenue SW

Calgary, Alberta, Canada, T2P 0R3

(403) 265-3221

(Name, address and telephone number of

person authorized to receive notices and communications on behalf of filing persons)

with a copy to:

Hillary H. Holmes

Gibson, Dunn & Crutcher LLP

811 Main Street, Suite 3000

Houston, TX 77002

Tel: (346) 718-6600

CALCULATION OF FILING FEE

|

Transaction valuation*

|

|

Amount of filing fee**

|

|

$123,625,000

|

|

$14,983.35

|

|

|

*

|

Calculated solely for the purposes of determining the filing fee based upon a transaction value of $115,000,000. The purchase

price of the 5.00% Convertible Senior Notes due 2021, as described herein is $1,075 per $1,000 principal amount outstanding. The

Company is seeking to purchase from the holders all of the issued and outstanding Convertible Notes resulting in an aggregate maximum

purchase price of $123,625,000.

|

|

|

**

|

The amount of the filing fee equals $121.20 for each $1,000,000 of the value of the transaction.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

Amount Previously Paid:

|

$14,983.35

|

|

Form of Registration No.:

|

Schedule TO

|

|

Filing Party:

|

Gran Tierra Energy Inc.

|

|

Date Filed:

|

June 5, 2019

|

|

☐

|

Check the box if filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions

to which the statement relates:

|

|

☐

|

third-party tender offer subject to Rule 14d-1.

|

|

|

☒

|

issuer tender offer subject to Rule 13e-4.

|

|

|

☐

|

going-private transaction subject to Rule 13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check

the following box if the filing is a final amendment reporting the results of the tender offer:

☒

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

|

|

☐

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

☐

|

issuer tender offer subject to Rule 13e-4 (Cross-Border Third-Party Tender Offer)

|

This Amendment No. 1 (this “

Amendment

”)

amends and supplements the Tender Offer Statement on Schedule TO (the “

Schedule TO

”) previously filed by Gran

Tierra Energy Inc., a Delaware corporation (the “

Company

”), on June 5, 2019.

The Schedule TO relates to the offer (the

“

Offer

”) by the Company to purchase from the holders of 5.00% Convertible Senior Notes due 2021 (the “

Convertible

Notes

”) issued under and pursuant to the provisions of the trust indenture dated April 6, 2016, between the Company

and U.S. Bank National Association, all of the issued and outstanding Convertible Notes (being $115,000,000 aggregate principal

amount), at the purchase price of $1,075 in cash (subject to applicable withholding taxes, if any) per $1,000 principal amount

of Convertible Notes, plus all accrued and unpaid interest outstanding on such Convertible Notes up to, but excluding, the date

on which such Convertible Notes are taken up by the Company, upon the terms and subject to the conditions set forth in the Offer

to Purchase and the accompanying Issuer Bid Circular, each dated June 5, 2019 (collectively, as they may be amended and supplemented

from time to time, the “

Offer and Circular

”) and the related Letter of Transmittal (as it may be amended and

supplemented from time to time, the “

Letter of Transmittal

”), copies of which were attached to the Schedule

TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively. This Amendment should be read in conjunction with the Schedule TO, the Offer

and Circular and the Letter of Transmittal.

Capitalized terms used but not otherwise

defined herein shall have the meanings given to them in the Offer and Circular.

|

|

Item 4.

|

Terms of the Transaction.

|

Item 4 of the Schedule TO is hereby amended

and supplemented by adding the following:

The Offer expired at 2:00 p.m.

(Calgary time) on Friday, July 12, 2019 (the “

Expiration Date

”). On Friday, July 12, 2019, the Company

announced that it took up and accepted for purchase and cancelation all of the issued and outstanding Convertible Notes that

were validly deposited under the Offer and not withdrawn as of the Expiration Date. Based on final information provided to

the Company by Computershare Investor Services Inc., the depositary for the Offer (the “

Depositary

”),

$114,997,000 aggregate principal amount of Convertible Notes, were validly deposited and taken up for purchase and

cancellation, at a purchase price of $1,075 in cash (subject to applicable withholding taxes, if any) per $1,000 principal

amount of Convertible Notes, plus all accrued and unpaid interest outstanding on such Convertible Notes up to, but excluding

the date of purchase. The aggregate consideration will be delivered promptly to the Depositary. After giving effect to the

purchase and cancellation of the Convertible Notes taken up under the Offer, $3,000 aggregate principal amount of Convertible

Notes will remain outstanding.

The full text of the Company’s press

release, dated July 12, 2019, announcing the expiration and results of the Offer is filed as Exhibit (a)(5)(ii) hereto and is incorporated

herein by reference.

|

|

Item 8.

|

Interest in Securities of the Subject Company.

|

Reference is hereby made to the information

set forth under the heading “Issuer Bid Circular—Interest of Directors and Officers and Transactions and Arrangements

Concerning Convertible Notes” of the Offer and Circular, which is incorporated herein by reference. Item 8 of the Schedule

TO is hereby amended and supplemented by adding the following:

On June 19, 2019, Ryan Ellson, Executive

Vice President and Chief Financial Officer of the Company, acquired in an open market transaction 18,400 Shares of Common Stock

at the price of $1.61 per share and Robert Hodgins, a member of the Board of Directors, acquired in an open market transaction

10,000 Shares of Common Stock at the price of $1.61 per share. As of June 19, 2019, Ryan Ellson beneficially owns 284,430 Shares

of Common Stock (30,000 of which are owned by his spouse), and Robert Hodgins beneficially owns 20,000 Shares of Common Stock.

|

Exhibit

Number

|

|

Description

|

|

(a)(1)(A)*

|

|

Offer to Purchase and Issuer Bid Circular, dated June 5, 2019.

|

|

(a)(1)(B)*

|

|

Letter of Transmittal, dated June 5, 2019.

|

|

(a)(5)(A)

|

|

Press Release issued by the Company, dated June 4, 2019 (Incorporated by reference to the pre-commencement communication of the Company on Schedule TO, filed with the SEC on June 4, 2019).

|

|

(a)(5)(B)

|

|

Press Release issued by the Company, dated July 12, 2019.

|

|

(d)(1)

|

|

Indenture related to the Convertible Notes, dated as of April 6, 2016, between the Company and U.S. Bank National Association (Incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K, filed with the SEC on April 6, 2016 (SEC File No. 001-34018)).

|

|

(d)(2)*

|

|

Agreement between the Company and Arceus Partnership, dated as of June 3, 2019, to tender an aggregate of approximately $4,013,000 principal amount of Convertible Notes pursuant to the Offer.

|

|

(d)(3)*

|

|

Agreement between the Company and Citadel Equity Fund Ltd., dated as of June 4, 2019, to tender an aggregate of approximately $15,000,000 principal amount of Convertible Notes pursuant to the Offer.

|

|

(d)(4)*

|

|

Agreement between the Company and Crown Managed Accounts SPC (acting for and on behalf of Crown/Polar Segregated Portfolio), dated as of June 4, 2019, to tender an aggregate of approximately $899,000 principal amount of Convertible Notes pursuant to the Offer.

|

|

(d)(5)*

|

|

Agreement between the Company and MMCAP International Inc. SPC, dated as of June 4, 2019, to tender an aggregate of approximately $6,350,000 principal amount of Convertible Notes pursuant to the Offer.

|

|

(d)(6)*

|

|

Agreement between the Company and Polar Multi-Strategy Master Fund, dated as of June 4, 2019, to tender an aggregate of approximately $14,101,000 principal amount of Convertible Notes pursuant to the Offer.

|

|

(d)(7)*

|

|

Agreement between the Company and Scotia Capital (USA) Inc., dated as of June 4, 2019, to tender an aggregate of approximately $2,035,000 principal amount of Convertible Notes pursuant to the Offer.

|

|

(d)(8)*

|

|

Agreement between the Company and Verition Canada Master Fund Ltd., dated as of June 3, 2019, to tender an aggregate of approximately $18,837,000 principal amount of Convertible Notes pursuant to the Offer.

|

|

(d)(9)

|

|

Details of the Goldstrike Special Voting Share (Incorporated by reference to Exhibit 10.14 to the Annual Report on Form 10-KSB/A for the period ended December 31, 2005, and filed with the SEC on April 21, 2006 (SEC File No. 333-111656)).

|

|

(d)(10)

|

|

Goldstrike Exchangeable Share Provisions (Incorporated by reference to Exhibit 10.15 to the Annual Report on Form 10-KSB/A for the period ended December 31, 2005 and filed with the SEC on April 21, 2006 (SEC File No. 333-111656)).

|

|

(d)(11)

|

|

Provisions Attaching to the GTE–Solana Exchangeable Shares (Incorporated by reference to Annex E to the Proxy Statement on Schedule 14A filed with the SEC on October 14, 2008 (SEC File No. 001-34018)).

|

|

(d)(12)

|

|

Subscription Receipt Agreement, dated July 8, 2016, by and between Gran Tierra Energy Inc. and Computershare Trust Company of Canada (Incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K, filed with the SEC on July 14, 2016 (SEC File No. 001-34018)).

|

|

(d)(13)

|

|

Indenture related to the 6.25% Senior Notes due 2025, dated as of February 15, 2018, between Gran Tierra Energy International Holdings Ltd., the Guarantors named therein and U.S. Bank National Association (Incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed with the SEC on February 16, 2018 (SEC File No. 001-34018)).

|

|

(d)(14)

|

|

Amended and Restated 2007 Equity Incentive Plan (Incorporated by reference to Exhibit 10.6 to the Quarterly Report on Form 10-Q filed with the SEC on August 7, 2012 (SEC File No. 001-34018)).

|

|

(d)(15)

|

|

Executive Employment Agreement effective May 7, 2015, between Gran Tierra Energy Canada ULC, Gran Tierra Energy Inc. and Gary Guidry (Incorporated by reference to Exhibit 10.2 to the Quarterly Report on Form 10-Q, filed with the SEC on November 4, 2015 (SEC File No. 001-34018)).

|

|

(d)(16)

|

|

Executive Employment Agreement effective May 11 2015, between Gran Tierra Energy Canada ULC, Gran Tierra Energy Inc. and Lawrence West (Incorporated by reference to Exhibit 10.5 to the Quarterly Report on Form 10-Q, filed with the SEC on November 4, 2015 (SEC File No. 001-34018)).

|

|

(d)(17)

|

|

Executive Employment Agreement effective May 11, 2015, between Gran Tierra Energy Canada ULC, Gran Tierra Energy Inc. and James Evans (Incorporated by reference to Exhibit 10.6 to the Quarterly Report on Form 10-Q, filed with the SEC on November 4, 2015 (SEC File No. 001-34018)).

|

|

(d)(18)

|

|

Executive Employment Agreement effective May 11 2015, between Gran Tierra Energy Canada ULC, Gran Tierra Energy Inc. and Ryan Ellson (Incorporated by reference to Exhibit 10.5 to the Quarterly Report on Form 10-Q, filed with the SEC on May 4, 2016 (SEC File No. 001-34018)).

|

|

(d)(19)

|

|

Indenture related to the 7.750% Senior Notes due 2027, dated as of May 23, 2019, among Gran Tierra Energy Inc., the guarantors named therein, and U.S. Bank National Association (Incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K, filed with the SEC on May 23, 2019 (SEC File No. 001-34018).

|

|

(g)

|

|

Not applicable.

|

|

(h)

|

|

Not applicable.

|

|

* Previously filed as an exhibit to the Schedule TO filed on June 5, 2019.

|

SIGNATURE

After due inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

GRAN TIERRA ENERGY INC.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Gary S. Guidry

|

|

|

|

|

Name:

|

Gary S. Guidry

|

|

|

|

|

Title:

|

President and Chief Executive Officer

|

|

|

Date: July 12, 2019

|

|

|

|

|

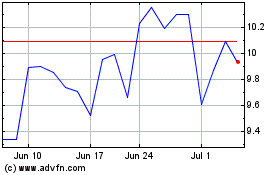

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Apr 2024 to May 2024

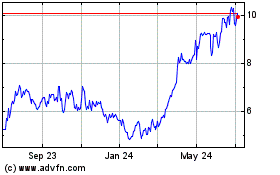

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From May 2023 to May 2024