Genius Group Settles Litigation with Alto Opportunity Master Fund, SPC, Ayrton Capital, LLC and Waqas Khatri

March 29 2023 - 9:45AM

Genius Group Limited (NYSE American: GNS) (“Genius Group” or the

“Company”), a leading entrepreneur edtech and education group,

today announced it reached an amicable settlement with Alto

Opportunity Master Fund, SPC – Segregated Master Portfolio B,

Ayrton Capital, LLC and Waqas Khatri (the "Parties”) and withdrawn

the complaint, with prejudice, filed by the Company on February 27,

2023 in the United States District Court Southern

District of New York (Case Number 1:23-cv-01639).

All parties have worked diligently together to

ensure a mutually beneficial agreement has been reached for the

joint benefit of the Company’s shareholders and the Parties’

limited partners.

The summary terms of settlement include:

- The Company acknowledging that it

does not believe that Ayrton is an unregistered broker-dealer, has

not violated federal securities laws, and has otherwise committed

no wrongdoing under the terms of the previously agreed upon August

24, 2022 convertible note financing agreement between the Company

and the Parties.

- The Company has opted to make the

remainder of monthly payments it owes on the $18 million

convertible note in cash over time, to ensure no further dilution

of shares. As such, the Company will not be subject to any future

installment-related accelerations at a variable price from the

note, unless consented to by the Company.

- The Company will deliver to the

Parties 13 million ordinary shares relating to the redemption of

convertible notes due for the period from January to March

2023.

- The Parties have cancelled

convertible notes conversion relating to 36 million of the 49

million shares included within the complaint.

- The Parties will release the

remaining $6.5 million of the note currently held in deposit to the

Company.

- The Parties will invest in the next

bona-fide subsequent offering conducted by the Company, at a range

of between $3.7 million to $6.2 million based on the Company’s

current share price, the timing of such future raise to be at the

Company’s discretion and the final amount within the range at the

Parties’ discretion.

- The Company also retains the right

to an early redemption of the note, with a 60-day notice period for

any such redemption.

- Various restrictions related to the

Company’s ability to operate its business were removed, which will

enable further flexibility for the Company’s management navigating

its strategic direction.

- The Company and the Parties have

also reaffirmed their commitment to work together in partnership

for the benefit of their respective investors.

Genius Group’s CEO, Roger Hamilton, said, “We

are very pleased to have reached a settlement in this matter. All

parties have worked hard and shown a high degree of goodwill to

find a satisfactory solution for all sides. I look forward to an

ongoing and mutually beneficial partnership with Alto, Ayrton and

Waqas Khatri.”

Alto and Ayrton Capital’s Principal, Waqas

Khatri, said, “We invested in Genius Group as we believed in the

Company’s mission, model and management. We are pleased to resolved

this matter in a manner that is in the best interests for both our

investors and the Company. We look forward to an ongoing

partnership with Genius Group.”

The settlement of this complaint remains

separate from other legal actions that Genius Group is currently

pursuing and will continue to pursue against various parties, which

unrelated to this now settled matter and does not include Alto

Opportunity Master Fund, SPC – Segregated Master Portfolio B,

Ayrton Capital, LLC and/or Waqas Khatri, for the recovery of

damages that the Company believes have occurred due to market

manipulation of its shares.

About Genius Group

Genius Group is a world leading entrepreneur

Edtech and education group, with a mission to disrupt the current

education model with a student-centered, life-long learning

curriculum that prepares students with the leadership,

entrepreneurial and life skills to succeed in today’s market. The

group has a group user base of 4.3 million users in 200 countries,

ranging from ages 0 to 100.

For more information, please visit

https://www.geniusgroup.net/

Investor Notice

Investing in our securities involves a high

degree of risk. Before making an investment decision, you should

carefully consider the risks, uncertainties and forward-looking

statements described in our most recent Annual Report on Form 20-F

for the fiscal year ended December 31, 2021, filed with the SEC on

May 13, 2022. If any of these risks were to occur, our business,

financial condition or results of operations would likely suffer.

In that event, the value of our securities could decline, and you

could lose part or all of your investment. The risks and

uncertainties we describe are not the only ones facing us.

Additional risks not presently known to us or that we currently

deem immaterial may also impair our business operations. In

addition, our past financial performance may not be a reliable

indicator of future performance, and historical trends should not

be used to anticipate results in the future. See “Forward-Looking

Statements” below.

Forward-Looking Statements

Statements made in this press release include

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements can be

identified by the use of words such as “may,” “will,” “plan,”

“should,” “expect,” “anticipate,” “estimate,” “continue,” or

comparable terminology. Such forward-looking statements are

inherently subject to certain risks, trends and uncertainties, many

of which the Company cannot predict with accuracy and some of which

the Company might not even anticipate and involve factors that may

cause actual results to differ materially from those projected or

suggested. Readers are cautioned not to place undue reliance on

these forward-looking statements and are advised to consider the

factors listed above together with the additional factors under the

heading “Risk Factors” in the Company’s Annual Reports on Form

20-F, as may be supplemented or amended by the Company’s Reports of

a Foreign Private Issuer on Form 6-K. The Company assumes no

obligation to update or supplement forward-looking statements that

become untrue because of subsequent events, new information or

otherwise.

Contacts

Investors:Flora Hewitt, Vice President of Investor Relations and

Mergers and AcquisitionsEmail: investor@geniusgroup.net

Media Contacts: Adia PREmail: gns@adiapr.co.uk

US Investors: Dave GentryRedChip Companies

Inc1-800-RED-CHIPGNS@redchip.com

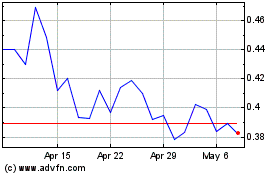

Genius (AMEX:GNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genius (AMEX:GNS)

Historical Stock Chart

From Apr 2023 to Apr 2024