0001880343

false

true

0001880343

2024-10-07

2024-10-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 7, 2024

Fresh Vine

Wine, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-41147 |

|

87-3905007 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

11500 Wayzata Blvd. #1147

Minnetonka, MN 55305

(Address of Principal Executive Offices) (Zip Code)

(855) 766-9463

(Registrant’s telephone number, including area

code)

Not Applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common stock, par value $0.001 per share |

|

VINE |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth

company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive

Agreement.

Securities Purchase Agreements

- Notes and Warrants

On October 8, 2024, Fresh

Vine Wine, Inc. (the “Company”) entered into Securities Purchase Agreements (the “Securities Purchase Agreements”)

with two accredited investors, pursuant to which the Company agreed to sell up to an aggregate principal amount of $600,000 of secured

convertible promissory notes (“Notes”) that will be convertible into shares of the Company’s common stock, par value

$0.001 per share (the “Common Stock”) and warrants (“Warrants”) to purchase up to 740,000 shares of Common Stock.

The Company intends to use the proceeds for general corporate purposes.

The Securities Purchase

Agreements contain customary representations, warranties and covenants by the Company. The Company agreed not to effect or enter into

any agreement to effect any issuance of Common Stock or Common Stock Equivalents involving a Variable Rate Transaction (as defined in

the Securities Purchase Agreement), for so long as any Note or Warrant is outstanding. The Company granted the investors the right to

participate in certain future issuances of Common Stock or other securities of the Company on a pro rata basis, for so long as any Notes

or Warrants are outstanding. Under the Securities Purchase Agreements, the aggregate of (i) the total number of shares of Common Stock

issuable upon conversion of the Notes and (ii) the total number of shares of Common Stock issuable upon exercise of Warrants may not exceed

19.9% of the Company’s outstanding Common Stock as of the date of the Securities Purchase Agreement unless and until the Company

obtains the approval of its stockholders as required by the applicable rules and regulations of the NYSE American. As part of the Securities

Purchase Agreements, the Company also granted piggy-back registration rights to the investors.

The Notes were issued with

original issuance discount of 20%, resulting in gross proceeds of $500,000 to the Company. The Notes bear no interest unless an event

of default occurs, and mature on April 4, 2025. The Notes may be prepaid. Each Note is convertible into Common Stock at a conversion price

equal to $0.40. A holder of the Note (together with its affiliates) may not convert any portion of the Note to the extent that the holder

would beneficially own more than 9.99% of the outstanding shares of Common Stock immediately after exercise. The conversion price and

number of shares of the Company’s Common Stock issuable upon conversion of the Notes will be subject to adjustment from time to

time for any subdivision or consolidation of shares, dilutive issuances and other events.

Additionally, the Notes

are secured by certain assets of the Company pursuant to a security agreement that was entered into in connection with the issuance of

the Notes (the “Security Agreement”). The obligations under the Notes are guaranteed by a guaranty (the “Guaranty”)

by the Company in favor of the investors.

The Warrants are immediately

exercisable at an initial exercise price equal to $0.40 per share, and will expire on the 5th anniversary of the issuance date. A holder

of the Warrant (together with its affiliates) may not exercise any portion of the Warrants to the extent that the holder would own more

than 9.99% of the outstanding shares of Common Stock immediately after exercise. The exercise price and number of shares of the Company’s

Common Stock issuable upon exercise of the Warrants will be subject to adjustment from time to time for any subdivision or consolidation

of shares, dilutive issuances and other events. The Warrants may not be exercised on a cashless basis.

The foregoing descriptions

of the Securities Purchase Agreement, the Notes, the Warrants, the Security Agreement and the Guaranty are qualified in their entirety

by reference to the full text of such documents, copies of which are filed as Exhibits 10.1, 10.2, 10.3, 10.4, and 10.5 hereto, respectively,

and are incorporated herein by reference.

Securities Purchase Agreement

– Series B Preferred Stock

The Company’s board

of directors has approved the issuance and sale of up to approximately 40,000 shares of Series B Convertible Preferred Stock, par value

$0.001 per share (the “Series B Preferred Stock”), at a purchase price of $100.00 per share in a private placement. As of

October 15, 2024, the Company has received securities purchase agreements (the “Series B SPA”) from accredited investors for

the purchase of a total of 6,980 shares of Series B Preferred Stock for an aggregate purchase price of $698,000. The Company intends to

use the proceeds to cover transaction expenses related to the proposed Merger (defined below) and for general working capital purposes.

Each share of Series B Preferred

Stock has the powers, designations, preferences, and other rights of the shares of such series as are set forth in the Certificate of

Designation of the Series B Preferred Stock filed by the Company with the Secretary of State of the State of Nevada on March 14, 2024.

The description of the terms of the Series B Preferred Stock set forth under Item 5.03 of the Company’s Current Report on Form 8-K

filed with the Securities and Exchange Commission (“SEC”) on March 20, 2024 is incorporated herein by reference.

The Company previously engaged

The Oak Ridge Financial Services Group, Inc. to serve as a financial adviser to the Company in connection with its capital raising activities.

The Company has agreed to pay Oak Ridge a cash fee equal to 8.0% of the gross proceeds received by the Company from the sale of the Series

B Preferred Stock, and to reimburse Oak Ridge for its out-of-pocket expenses.

The foregoing description

of the Series B SPA is qualified in its entirety by the full text of the Series B SPA, which is attached hereto as Exhibits 10.6, and

is incorporated herein by reference.

Secured Promissory Note

The Company and Adifex Holdings

LLC (“Adifex”) entered into that certain promissory note (the “Adifex Note”) effective October 7, 2024, under which

the Company agreed to lend to Adifex the principal sum of up to $3.5 million. The Adifex Note bears interest at 6.00% per annum until

the closing date of the proposed Merger (defined below). If the proposed Merger does not close, the interest rate increases to 12% per

annum from the date that negotiations cease. The unpaid principal plus accrued interest is due and payable on the date that is 9 months

after the date on which the Company or Adifex provides notice to the other that negotiations have ceased if the proposed Merger is not

closed. The Adifex Note is secured by all of the assets of Adifex pursuant to a security agreement (the “Adifex Security Agreement”)

effective as of October 7, 2024.

The foregoing descriptions

of the Adifex Note and the Adifex Security Agreement are qualified in their entirety by reference to the full text of such documents,

copies of which are filed as Exhibits 10.7 and 10.8 hereto, respectively, and are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial

Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant.

The information set forth under “Securities

Purchase Agreements - Notes and Warrants” in Item 1.01 is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity

Securities.

The information set forth in Item 1.01 is incorporated

herein by reference. The Series B Preferred Stock, Notes, Warrants and the shares of Common Stock issuable upon conversion or exercise

of the Notes, Warrants and Series B Preferred Stock, as applicable, were offered and sold in reliance upon exemptions from registration

pursuant to Section 4(a)(2) under the Securities Act of 1933, as amended, and/or Rule 506(b) of Regulation D promulgated thereunder, as

transactions by an issuer not involving any public offering.

Item 7.01 Regulation FD Disclosure

On October 14, 2024, the

Company signed a non-binding letter of intent (the “LOI”) with Adifex and Adifex’s to be acquired subsidiary, Amaze

Software, Inc., for a potential business combination (the “Merger”). Under the terms of the LOI, Fresh Vine would acquire

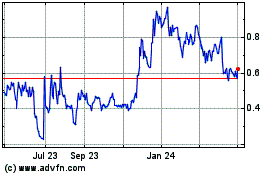

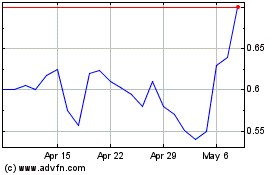

100% of the issued and outstanding membership interests of Adifex in exchange for $140 million of common stock valued at $.80 per share,

via a share exchange transaction, merger transaction or other business combination structure, resulting in the current equity holders

of the Company owning approximately 14% of the combined companies on a fully diluted basis.

The Company expects to announce additional details

regarding the proposed Merger upon the execution of a definitive merger agreement. Completion of the Merger is subject to, among other

matters, the negotiation of a definitive agreement providing for the transaction, various conditions and contingencies, including board

and shareholder approval, regulatory approval, and other customary closing conditions. There can be no assurance that a definitive agreement

will be entered into or that the proposed Merger will be consummated.

The information about the LOI is being furnished

pursuant to Item 7.01 and shall not be deemed “filed” with the SEC for purposes of Section 18 of the Securities Exchange Act

of 1934, or otherwise be subject to the liability of that Section, and shall not be deemed to be incorporated by reference into any filing

under the Securities Act of 1933 or the Securities Exchange Act of 1934.

Item 8.01 Other Events

On October 15, 2024 the Company issued a press

release announcing the LOI. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FRESH VINE WINE, INC. |

| |

|

|

| Date: October 15, 2024 |

By: |

/s/ Michael Pruitt |

| |

|

Michael Pruitt |

| |

|

Chairman and Chief Executive Officer |

Exhibit 10.1

EXECUTION COPY

SECURITIES PURCHASE AGREEMENT

This Securities

Purchase Agreement (this “Agreement”) is dated as of October 8, 2024,

between Fresh Vine Wine, Inc., a Nevada corporation (the “Company” or the “Parent”), and the undersigned

Purchaser (including its successors and assigns, a “Purchaser”).

WHEREAS, subject

to the terms and conditions set forth in this Agreement and a substantially similar Securities Purchase Agreement dated at or about the

date hereof, and pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and/or

Rule 506 promulgated thereunder, the Company desires to issue and sell to the Purchaser, and the Purchaser desire to purchase from the

Company for cash and other valuable consideration, Securities of the Company as defined and described more fully in this Agreement;

NOW, THEREFORE,

in consideration of the representations, warranties and covenants contained in this Agreement, and for other good and valuable consideration,

the receipt and adequacy of which are hereby acknowledged, the Company and each Purchaser agree as follows:

ARTICLE I DEFINITIONS

I.1 Definitions.

In addition to the terms defined elsewhere in this Agreement, the following terms have the meanings set forth in this Section 1.1:

“Affiliate” means each

Person that, directly or indirectly, controls, is controlled by or is under common control with such Person or any Affiliate of such Person.

For purpose of this definition, “control” and related words are used as such terms are used in and construed under Rule 405

of the Securities Act, including, among others, executive officers, directors, large stockholders, subsidiaries, parent entities and sister

companies. Notwithstanding the foregoing, the Purchaser and its Subsidiaries, on the one hand, and the Company Parties and their Subsidiaries,

on the other hand, shall not be considered “Affiliates” of each other.

“AML/CTF Regulation”

has the meaning ascribed to such term in Section 3.1(kk).

“BHCA” has the meaning

ascribed to such term in Section 3.1(gg). “Board of Directors” means the board of directors of the Company.

“Business Day” means

any day except Saturdays, Sundays, any day that is a federal holiday in the United States and any day on which the Federal Reserve Bank

of New York is not open for business.

“Capital Lease” means,

as applied to any Person, any lease of, or other arrangement conveying the right to use, any property (whether real, personal or mixed)

by that Person as lessee that, in conformity with GAAP, is or should be accounted for as a capital lease on the balance sheet of that

Person.

“Capital Stock” means

all shares of capital stock (whether denominated as common stock or preferred stock), equity interests, beneficial, partnership or membership

interests, joint venture interests, participations or other ownership or profit interests in or equivalents (regardless of how designated)

of or in a Person (other than an individual), whether voting or non-voting.

“Closing Date” means

the Trading Day on which, or next following the day on which, all of the Transaction Documents required to be executed or delivered prior

to the Closing have been executed and delivered by the applicable parties thereto and all other conditions precedent to (i) each Purchaser’s

obligations to pay the Subscription Amount and (ii) the Company’s obligations to deliver the Securities, in each case, have been

satisfied or waived.

“Closing” means the

closing of the purchase and sale of the Securities pursuant to Section 2.3.

“Banks” means the Senior

Lender to which the rights and obligations of the parties hereunder are second to and subordinate to, and those banks which may loan money

to the Company subsequent to the Closing Date of this Agreement, under terms which do not include provisions allowing such banks to convert

such loans into the Company’s capital stock to (together with its successors and assigns).

“Commission” means

the United States Securities and Exchange Commission.

“Common Stock” means

the common stock of the Company, par value $0.001 per share, any Capital Stock into which such shares of common stock shall have been

changed, and any share capital resulting from a reclassification of such common stock.

“Common Stock Equivalents”

means any securities of any Company Party which would entitle the holder thereof to acquire at any time Common Stock, including whether

or not presently convertible, exchangeable or exercisable, any debt, preferred stock, right, option, warrant or other instrument that

is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to purchase, subscribe or

otherwise receive, Common Stock.

“Company Party” means

each of the Company and its Subsidiaries.

“Company Covered Person”

has the meaning ascribed to such term in Section 3.1(ll).

“Consents” means any

approval, consent, authorization, notice to, or any other action by, any Person other than any Governmental Authority.

“Contractual Obligation”

means, with respect to any Person, any provision of any security or similar instrument issued

by such Person or of any agreement, undertaking, contract, lease, indenture, mortgage, deed of trust or other instrument (other than a

Transaction Document) to which such Person is a party or by which it or any of its property is bound or to which any of its property is

subject.

“Conversion Price”

has the meaning ascribed to such term in the Notes. “Conversion Shares” has the meaning ascribed to such term in the

Notes.

“Currency Agreement”

means any foreign exchange contract, currency swap agreement, futures contract, option contract, synthetic cap or other similar agreement

or arrangement. For purposes of this definition, cryptocurrencies shall be considered currencies.

“Default Interest”

as defined in the Note, means ten percent (10%) interest, which shall begin accruing upon an Event of Default (as defined in the Note)

retroactive to the Original Issuance Date, and shall continue to accrue until the Note is paid in full, as defined in Section 7(a).

“Derivative” means

any Interest Rate Agreement, Currency Agreement, futures or forward contract, spot transaction, commodity swap, purchase or option agreement,

other commodity price hedging arrangement, cap, floor or collar transaction, any credit default or total return swap, any other derivative

instrument, any other similar speculative transaction and any other similar agreement or arrangement designed to alter the risks of any

Person arising from fluctuations in any underlying variable, including interest rates, currency values, insurance, catastrophic losses,

climatic or geological conditions or the price or value of any other derivative instrument. For the purposes of this definition, “derivative

instrument” means “any derivative instrument” as defined in Statement of Financial Accounting Standards No. 133 (Accounting

for Derivative Instruments and Hedging Activities) of the United States Financial Accounting Standards Board, and any defined with a term

similar effect in any successor statement or any supplement to, or replacement of, any such statement.

“Disqualification Event”

has the meaning ascribed to such term in Section 3.1(ll).

“Dollars” and the sign

“$” each mean the lawful money of the United States of America.

“Evaluation Date” has

the meaning ascribed to such term in Section 3.1(o).

“Event of Default”

shall have the meaning set forth in Section 7(a) of the Note.

“Exchange Transaction”

has the meaning ascribed to such term in Section 4.11(b).

“Exempt Issuance” means

the issuance of (a) shares of Common Stock or options to employees, officers, directors, advisors or consultants of the

Company Parties; provided, that such issuance is approved by a majority of the non-employee and disinterested members of the Board

of Directors of the Company; (b) shares of Common Stock, warrants or options to advisors or independent contractors of

any Company Party for compensatory purposes, (c) securities upon the exercise or exchange of or conversion of any Securities issued hereunder

and/or other securities exercisable or exchangeable for or convertible into shares of Common Stock issued and outstanding on the date

hereof, provided, that such securities have not been amended since the date hereof to increase the number of such securities or

to decrease the exercise price, exchange price or conversion price of such securities, (d) securities issuable pursuant to any contractual

anti-dilution obligations of the Company in effect as of the date hereof, as set forth herein, provided, that such obligations

have not been materially amended since the date of hereof, and (e) securities issued pursuant to any other strategic transactions approved

by a majority of the disinterested members of the Board of Directors; provided, that such other strategic transactions shall not

include a transaction in which the Company is issuing securities primarily for the purpose of raising capital or to an entity whose primary

business is investing in securities and have no registration rights.

“Exercise Price” shall

have the meaning ascribed to such term in the Warrants.

“Federal Reserve” has

the meaning ascribed to such term in Section 3.1(gg).

“GAAP” means United

States generally accepted accounting principles as in effect from time to time, applied consistently throughout the periods referenced

and consistently with (a) the principles and standards set forth in the opinions and pronouncements of the Financial Accounting Standards

Board or any successor entity, (b) to the extent consistent with such principles, generally accepted industry practices and (c) to the

extent consistent with such principles and practices, the past practices of the Company as reflected in its financial statements delivered

to the Purchaser.

“Governmental Authority”

means any nation, sovereign or government, any state, province, territory or other political subdivision thereof, any municipality,

any agency, authority or instrumentality thereof and any entity or authority exercising executive, legislative, taxing, judicial, regulatory

or administrative functions of or pertaining to government, and any corporation or other entity owned or controlled, through stock or

capital ownership or otherwise, by any of the foregoing, including any central bank stock exchange regulatory body arbitrator, public

sector entity, supra- national entity (including the European Union and the European Central Bank) and any self- regulatory organization

(including the National Association of Insurance Commissioners).

“Guaranty” means the

guaranty attached hereto and incorporated herein as Exhibit D.

“Indebtedness” means,

with respect to any Person at any date, without duplication, the following: (a) all indebtedness of such Person for borrowed money, (b)

all obligations of such Person for the deferred purchase price of property or services other than accounts payable and accrued liabilities

incurred in respect of property or services purchased in the ordinary course of business (provided, that such accounts payable

and accrued liabilities are not overdue by more than 180 days), (c) all obligations of such Person evidenced by notes, bonds, debentures

or similar borrowing or securities instruments, (d) all obligations of such Person created or arising under any conditional sale or other

title retention agreement with respect to property acquired by such Person, (e) all obligations of such Person as lessee under Capital

Leases, (f) all reimbursements and all other obligations of such Person with respect to (i) letters of credit, bank guarantees or bankers’

acceptances contingent or otherwise, or (ii) surety, customs, reclamation, performance or other similar bonds, (g) all obligations of

such Person secured by Liens on the assets of such Person, (h) all Guaranty Obligations of such Person, (i) all obligations of such Person

to purchase, redeem, retire, defease or otherwise make any payment in respect of any Capital Stock, Stock Equivalent (valued, in the case

of redeemable preferred stock, at the greater of its voluntary liquidation preference and its involuntary liquidation preference plus

accrued and unpaid dividends) or any warrants, rights or options to acquire such Capital Stock, (j) after taking into account the effect

of any legally-enforceable netting Contractual Obligation of such Person, all payments that would be required to be made in respect of

any Derivative in the event of a termination (including an early termination) on the date of determination and (k) all obligations of

another Person of the type described in clauses (a) through (j) secured by (or for which the holder of such Indebtedness has an existing

right, contingent or otherwise, to be secured by) a Lien on the assets of such Person (whether or not such Person is otherwise liable

for such obligations of such other Person).

“Initial Principal Amount”

means, as to any Purchaser, the principal amount of the Note of such Purchaser set forth on Schedule I.

“Intellectual Property Rights”

means, collectively, all copyrights, patents, trademarks, service marks and trade names all applications for any of the foregoing, together

with: (i) all inventions, processes, production methods, proprietary information, know-how and trade secrets; (ii) all licenses or user

or other agreements granted with respect to any of the foregoing, in each case whether now or hereafter owned or used; (iii) all customer

lists, identification of suppliers, data, plans, blueprints, specifications, designs, drawings, recorded knowledge, surveys, engineering

reports, test reports, manuals, materials standards, processing standards, performance standards, catalogs, computer and automatic machinery

software and programs; (iv) all field repair data, sales data and other information relating to sales or service of products now or hereafter

manufactured; (v) all accounting information and all media in which or on which any information or knowledge or data or records may be

recorded or stored and all computer programs used for the compilation or printout of such information, knowledge, records or data; (vi)

all applications for any of the foregoing and (vii) all causes of action, claims and warranties, in each case, now or hereafter owned

or acquired in respect of any item listed above.

“Interest Rate Agreement”

means any interest rate swap agreement, interest rate cap agreement, interest rate collar agreement, interest rate hedging agreement or

other similar agreement or arrangement.

“Legend Removal Date”

has the meaning ascribed to such term in Section 4.1(c).

“Liabilities” means

all amounts, indebtedness, obligations, liabilities, covenants and duties of every type and description owing by any Company Party from

time to time to any Purchaser or any other Purchaser Party, whether direct or indirect, joint or several, absolute or contingent, due

or to become due, liquidated or unliquidated, secured or unsecured, now existing or hereafter arising and however created, acquired (regardless

of whether acquired by assignment), whether or not evidenced by any note or other instrument or for the payment of money and whether arising

under Contractual Obligations, Regulations or otherwise, including, without duplication, (i) the principal amount due of the Note, (ii)

all other amounts, fees, interest (including any prepayment premium), commissions, charges, costs, expenses, attorneys’ fees and

disbursements, indemnities, reimbursement of amounts paid and other sums chargeable to the Company under the Note, this Agreement or any

other Transaction Document (including attorneys’ fees) or otherwise arising under any Transaction Document and (iii) all interest

on any item otherwise qualifying as a “Liability” hereunder, whether or not accruing after the filing of any petition in bankruptcy,

or the commencement of any insolvency, reorganization or similar proceeding, whether or not a claim for post-filing or post- petition

interest is allowed in such proceeding.

“License Agreement”

has the meaning ascribed to such term in Section 3.1.

“Lien” means any lien

(statutory or other) mortgage, pledge, hypothecation, assignment, security interest, encumbrance, charge, claim, right of first refusal,

preemptive right, restriction on transfer or similar restriction or other security arrangement of any kind or nature whatsoever, including

any conditional sale or other title retention agreement and any capital or financing lease having substantially the same economic effect

as any of the foregoing.

“Losses” means all

liabilities, rights, demands, covenants, duties, obligations (including indebtedness, receivables and other contractual obligations),

claims, damages, Proceedings and causes of actions, settlements, judgments, damages, losses (including reductions in yield), debts, responsibilities,

fines, penalties, sanctions, commissions and interest, disbursements, Taxes, interest, charges, costs, fees and expenses (including fees,

charges, and disbursements of financial, legal and other advisors, consultants and professionals and, if applicable, any value-added and

other taxes and charges thereon), in each case of any kind or nature, whether joint or several, whether now existing or hereafter arising

and however acquired and whether or not known, asserted, direct, contingent, liquidated, due, consequential, actual, punitive or treble.

“Material Adverse Effect”

means material adverse effect on, or change in, (a) the legality, validity or enforceability of any portion of any Transaction Document,

(b) the operations, assets, business, prospects or condition (financial or otherwise) of any Company Party, (c) the ability of any Company

Party to perform on a timely basis its obligations under any Transaction Document for any reason whatsoever, whether foreseen or unforeseen,

including due to pandemic, acts of a Governmental Authority, interruption of transportation systems, strikes, terrorist activities, interruptions

of supply chains or acts of God, or (d) the perfection or priority of any Liens granted to any Purchaser Party under any Transaction Document.

“Maximum Rate” has

the meaning ascribed to such term in Section 5.12.

“Note” means each Secured

Convertible Promissory Note, in the form attached hereto as Exhibit A and otherwise in form and substance satisfactory to the Purchaser

on the Closing Date, issued by the Company to each Purchaser hereunder and as of the Closing Date.

“Notice of Conversion”

has the meaning ascribed to such term in Section 4.5.

“OFAC” has the meaning

ascribed to such term in Section 3.1(ee).

“Original Issuance Discount”

means twenty percent (20%) as detailed in the Note.

“Participation Maximum”

has the meaning ascribed to such term in Section 4.13(a).

“Permit” means, with

respect to any Person, any permit, filing, notice, license, approval, variance, exception, permission, concession, grant, franchise, confirmation,

endorsement, waiver, certification, registration, qualification, clearance or other Contractual Obligation or arrangement with, or authorization

by, to or under the authority of, any Governmental Authority or pursuant to any Regulation, or any other action by any Governmental Authority

in each case whether or not having the force of law and affecting or applicable to or binding upon such Person, its Contractual Obligations

or arrangements or other liabilities or any of its property or to which such Person, its Contractual Obligations or any of its property

is or is purported to be subject.

“Person” means an individual,

sole proprietorship partnership, corporation, incorporated or unincorporated association, limited liability company, limited liability

partnership, joint stock company, land trust, business trust or unincorporated organization, or a government, whether national, city,

federal state, county, city, municipal or otherwise including, without limitation, any instrumentality, division or agency, department

or other subdivision thereof or other entity of any kind.

“Pre-Notice” has the

meaning ascribed to such term in Section 4.13(b).

“Proceeding” against

a Person means an action, suit, litigation, arbitration, investigation, complaint, dispute, contest, hearing, inquiry, inquest, audit,

examination or other proceeding threatened or pending against, affecting or purporting to affect such Person or its property, whether

civil, criminal, administrative, investigative or appellate, in law or equity before any arbitrator or Governmental Authority.

“Pro Rata Portion”

means, with respect to a Purchaser and a group of Purchaser as of a particular date, the ratio of (i) the Subscription Amount of Securities

purchased on or prior to such date by such Purchaser (including, for the avoidance of doubt its predecessors and assignors) that remain

outstanding on such date to (ii) the sum of the aggregate Subscription Amounts of Securities purchased by Purchaser (including, for the

avoidance of doubt, their predecessors and assignors) in such group on or prior to such date that remain outstanding on such date.

“Public Information Failure”

has the meaning ascribed to such term in Section 4.3(b).

“Public Information Failure Payments”

has the meaning ascribed to such term in Section 4.3(b).

“Purchaser Party” has

the meaning ascribed to such term in Section 4.9.

“Redemption” has the

meaning ascribed to such term in Section 6 of the Note.

“Registrable Securities”

means, as of any date of determination, (a) all of the Conversion Shares then issued and issuable upon conversion in full of the Notes

(assuming on such date the Notes are converted in full without regard to any conversion limitations therein), (b) all shares of Common

Stock issued and issuable as interest or principal on the Notes (without giving effect to any limitations on conversion set forth in the

Notes) assuming all interest and principal payments are made in shares of Common Stock and the Notes are held until maturity and one year

thereafter, (c) any additional shares of Common Stock issued and issuable in connection with any anti-dilution provisions in the Notes

(without giving effect to any limitations on conversion set forth in the Notes), (d) all of the Exercise Shares then issued and issuable

upon exercise in full of the Warrants (assuming

on such date the Warrants are exercised in full without regard to any exercise limitations

therein), (e) any additional shares of Common Stock issued and issuable in connection with any anti-dilution provisions in the Warrants

(without giving effect to any limitations on exercise set forth in the Warrants),and (f) any securities issued or then issuable upon any

stock split, dividend or other distribution, recapitalization or similar event with respect to the foregoing.

“Regulation” means,

all international, federal, state, provincial and local laws (whether civil or common law or rule of equity and whether U.S. or non- U.S.),

treaties, constitutions, statutes, codes, tariffs, rules, guidelines, regulations, writs, injunctions, orders, judgments, decrees, ordinances

and administrative or judicial precedents or authorities, including, in each case whether or not having the force of law, the interpretation

or administration thereof by any Governmental Authority, all policies, recommendations or guidance of any Governmental Authority and all

administrative orders, directed duties, directives, requirements, requests.

“Related Parties” of

any Person means such Person, (i) each Affiliate of such Person, (ii) each Person that, directly or indirectly, owns or controls, whether

beneficially, or as a trustee, guardian or other fiduciary, 5% or more of the Capital Stock having ordinary voting power in the election

of directors of such Person or such Affiliate, (iii) each of such Person’s or such

Affiliate’s officers, managers, directors, joint venture partners, partners and employees (and any other Person with a functionally

equivalent role of a Person holding such titles notwithstanding a lack of such title or any other title or classification as a contractor

under employment Regulations), (iv) any lineal descendants, ancestors, spouse or former spouses (as part of a marital dissolution) of

any of the foregoing, (v) any trust or beneficiary of a trust of which any of the foregoing are the sole trustees or for the benefit of

any of the foregoing. Notwithstanding the foregoing, the Purchaser and its Subsidiaries, on the one hand, and the Company Parties and

their Subsidiaries, on the other hand, shall not be considered “Related Parties” of each other.

“Required Filings”

means (a) any filing required pursuant to Section 4.3 or 4.14, (b) the notice and/or application(s) to each applicable Trading

Market for the issuance and sale of the Securities and, if and as applicable, the listing of the Conversion Shares or

Warrant Shares for trading thereon in the time and manner required thereby and (c) such filings as are required to be made under

applicable state securities laws.

“Required Minimum”

means, as of any date, two (2) times the maximum aggregate number of shares of Common Stock then issued or potentially issuable in the

future pursuant to the Transaction Documents, including any (a) Conversion Shares issuable upon conversion of the Notes, ignoring any

conversion limits set forth therein, and assuming that the Conversion Price is at all times on and after the date of determination 100%

of the then Conversion Price and (B) Warrant Shares issuable upon exercise of the Warrants, ignoring any exercise

limits set forth therein, and assuming that the Exercise Price is at all times on and after

the date of determination 100% of the then Exercise Price.

“Restricted Payment” means,

for any Person, (a) any dividend, stock split or other distribution, direct or indirect (including by way of spin off, reclassification,

corporate rearrangement, scheme of arrangement or similar transaction), on account of, or otherwise to the holder or holders of, any shares

of any class of Capital Stock of such Person now or hereafter outstanding, (b) any redemption, retirement, sinking fund or similar payment,

purchase or other for value, direct or indirect, of any shares of any class of Capital Stock of such Person by such Person or any Affiliate

thereof now outstanding and (c) other than the payments made to retire or to obtain the surrender of any Stock Equivalents in an aggregate

amount not to exceed $5,000,000, any payment made to retire, or to obtain the surrender of, any Stock Equivalents now or hereafter outstanding;

provided, that, for the avoidance of doubt, (i) a cashless exercise of an employee stock option in which options are cancelled

to the extent needed such that the “in-the-money” value of the options (i.e. the excess of market price over exercise price)

that are cancelled is utilized to pay the exercise price, and applicable taxes, shall not be a “Restricted Payment”

and (ii) a distribution of rights (including rights to receive assets) or options shall constitute a “Restricted Payment”.

“Rule 144” means Rule

144 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended from time to time, or any similar rule or

regulation hereafter adopted by the Commission having substantially the same effect as such Rule.

“Rule 424” means Rule

424 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted from time to time, or any

similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect as such Rule.

“Sanctioned Jurisdiction”

means, at any time, a country, territory or geographical region that is subject to, the target of, or purported to be subject to, Sanctions

Laws.

“Sanctions Laws” means

all applicable Regulations concerning or relating to economic or financial sanctions, requirements or trade embargoes imposed, administered

or enforced from time to time by OFAC, including the following (together with their implementing regulations, in each case, as amended

from time to time): the International Security and Development Cooperation Act (ISDCA) (22 U.S.C. §23499aa-9 et seq.); the Patriot

Act; and the Trading with the Enemy Act (TWEA) (50 U.S.C. §5 et seq.).

“Sanctioned Person”

means (a) any Person that is listed in the annex to, or otherwise subject to the provisions of, Executive Order 13224 – Blocking

Property and Prohibiting Transactions with Persons Who Commit and Threaten to Commit or Support Terrorism, effective October 24, 2001;

(b) any Person that is named in any Sanctions Laws-related list maintained by OFAC, including the “Specially Designated National

and Blocked Person” list; (c) any Person or individual located, organized or resident or determined to be resident in a Sanctioned

Jurisdiction that is, or whose government is, the target of comprehensive Sanctions Laws; (d) any organization or Person directly or indirectly

owned or controlled by any such Person or Persons described in the foregoing clauses (a) through (c); and (e) any Person that commits,

threatens or conspires to commit or supports “terrorism”," as defined in applicable United States Regulations.

“Securities” means

the Notes, Warrants, the Conversion Shares, and the Warrant Shares.

“Securities Act” means

the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Security Agreement”

means that security agreement attached hereto as Exhibit C.

“Shell Company” means

an entity that fits within the definition of “shell company” under Section 12b-2 of the Exchange Act and Rule 144.

“Short Sales” means

all “short sales” as defined in Rule 200 of Regulation SHO under the Exchange Act.

“Stock Equivalents”

means all securities and/or Indebtedness convertible into or exchangeable for Capital Stock or any other Stock Equivalent and all warrants,

options, scrip rights, calls or commitments of any character whatsoever, and all other rights

or options or other arrangements (including through a conversion or exchange of any other property) to purchase, subscribe for or acquire,

any Capital Stock or any other Stock Equivalent, whether or not presently convertible, exchangeable or exercisable.

“Subscription Amount”

means, as to any Purchaser, the aggregate amount to be paid for the Notes purchased hereunder as specified on Schedule I.

“Subsequent Financing”

has the meaning ascribed to such term in Section 4.13. “Subsequent Financing Notice” has the meaning ascribed

to such term in Section 4.13(b).

“Subsidiary” means

(a) any subsidiary of the Company, and (b) any Person (other than natural persons) the management of which is, directly or indirectly,

controlled by, or of which an aggregate of 50% or more of the outstanding Voting Stock is, at the time, owned or controlled, directly

or indirectly, by such Person or one or more Subsidiaries of such Person.

“Taxes” means any present

or future taxes, levies, imposts, duties, fees, assessments, deductions, withholdings or other charges of whatever nature, including income,

receipts, excise, property, sales, use, transfer, license, payroll, withholding, social security and franchise taxes now or hereafter

imposed or levied by the United States or any other Governmental Authority and all interest, penalties, additions to tax and similar liabilities

with respect thereto, but excluding, in the case of any Purchaser, taxes imposed on or measured by the net income or overall gross receipts

of such Purchaser.

“Third Party Exchange Transfer”

has the meaning ascribed to such term in Section 4.11(b).

“Trading Day” means

a day on which the principal Trading Market for the Common Stock is open for trading.

“Trading Market” means

the NYSE MKT, as referenced in Section 4.6(c).

“Transaction Documents”

means this Agreement, Note (Exhibit A), Warrant (Exhibit B), Security Agreement (Exhibit C), Guaranty (Exhibit

D), and Transfer Agent Instruction Letter (Exhibit E) and any other documents or agreements executed in connection with the

transactions contemplated hereunder., and all financing statements (or comparable documents now or hereafter filed in

accordance with the UCC or other comparable or similar laws, rules or regulations) in favor of the Purchaser as secured parties perfecting

all Liens the Purchaser have on the collateral (which security interests and Liens of the Purchaser shall be senior to all Indebtedness

of the Company), and such other documents, instruments, certificates, supplements, amendments, exhibits and schedules required and/or

attached pursuant to this Agreement and/or any of the above documents, and/or any other document and/or instrument related to the above

agreements, documents and/or instruments, and the transactions hereunder and/or thereunder and/or any other agreement, documents or instruments

required or contemplated hereunder or thereunder, whether now existing or at any time hereafter arising.

“Transfer Agent” means

Computershare and any successor transfer agent for the Company’s Common Stock, which has been agreed to in writing by the Purchaser.

“Transfer Agent Instruction Letter”

means the letter from the Company to the Transfer Agent, duly acknowledged and agreed by the Transfer Agent, which instructs the Transfer

Agent to issue the Conversion Shares or the Warrant Shares pursuant to the Transaction Documents,

in form attached hereto as Exhibit E and otherwise in form and substance satisfactory to the Purchaser on the Closing Date.

“UCC” means the Uniform

Commercial Code as from time to time in effect in the State of New York; provided, that, in the event that, by reason of mandatory

provisions of any applicable Regulation, the attachment, perfection or priority of any security interest in any collateral is governed

by the Uniform Commercial Code of a jurisdiction other than the State of New York, “UCC” shall mean the Uniform Commercial

Code as in effect in such other jurisdiction for purposes of the provisions hereof relating to such attachment, perfection or priority

and for purposes of the definitions related to or otherwise used in such provisions.

“Variable Rate Transaction”

has the meaning ascribed to such term in Section 4.11(a).

“Voting Stock” means

Capital Stock of any Person (i) having ordinary power to vote in the election of any member of the board of directors or any manager,

trustee or other controlling persons of such Person (irrespective of whether, at the time, Capital Stock of any other class or classes

of such entity shall have or might have voting power by reason of the happening of any contingency) and (ii) any Capital Stock of such

Person convertible or exchangeable without restriction at the option of the holder thereof into Capital Stock of such Person described

in clause (i) of this definition.

“Warrants” means the

warrants to purchase up to 740,000 shares of Common Stock in the form attached as Exhibit B to this Agreement.

“Warrant Shares” shall

have the meaning ascribed to such term in the Warrants.

ARTICLE II PURCHASE AND SALE

II.1

Purchase. On the Closing Date, upon the terms and subject to the conditions set forth herein, substantially concurrent

with the execution and delivery of this Agreement by the parties hereto, the Purchasers will purchase an aggregate of (a) $500,000 in

Subscription Amount of Notes, which Subscription Amount shall correspond to an aggregate of $600,000 in Initial Principal Amount of Notes

to reflect an original issuance discount twenty percent (20%) and (b) the Warrants. The purchase will be completed in one or more tranches

as provided herein. The minimum investment per tranche is $50,000.

II.2

Closing. Upon the terms and subject to the conditions set forth herein, the Company agrees to sell, and each

Purchaser agrees, severally and not jointly, to purchase, at the Closing a Note having a principal amount equal to the Initial Principal

Amount applicable to such Purchaser, as set forth on Schedule I and the Warrants as set forth on Schedule I. At the Closing,

such Purchaser shall deliver to the Company, via wire transfer to an account designated by the Company, immediately available Dollars

equal to such Purchaser’s Subscription Amount, and the Company shall deliver to such Purchaser its Notes and Warrants, as set forth

in Section 2.3(a), and the Company and such Purchaser shall deliver to each other the other items set forth in Section 2.3

deliverable at the Closing. Upon satisfaction of the covenants and conditions set forth in Sections 2.3 and 2.4 for Closing,

such Closing shall occur remotely by electronic exchange of Closing documentation. Notwithstanding anything herein to the contrary, if

the Closing Date does not occur within five (5) Business Days of the date hereof, this Agreement shall terminate and be null and void.

It is the parties’

intention that all the transactions described in the preamble to this Agreement close simultaneously; to this end, the parties agree that

their counsel may, among other things, hold documents in escrow pending the closing of the other transactions under the Transaction Documents.

If all of the transactions contemplated by the Transaction Documents do not close as contemplated hereby and thereby on their unamended

and unwaived terms unless approved by each Purchaser then each Purchaser, at its sole option and in its sole discretion, may terminate

this Agreement on notice to the Company with respect to such Purchaser. In such event, the Company shall be obligated to fulfill its covenants

hereunder, including, without limitation, its indemnification obligations and obligation to pay Purchaser’ fees and expenses, which

by their terms survive the termination of this Agreement.

(a)

Deliveries to Purchaser. On or prior to the Closing (except as noted), the Company shall deliver or cause to be delivered

to each Purchaser the following, each dated as of the Closing Date and in form and substance satisfactory to such Purchaser:

(i) this Agreement, duly executed by the Company;

(ii)

a Note for such Purchaser duly executed by the Company with an aggregate Initial Principal Amount equal to the amount set forth

on Schedule I, registered in the name of such Purchaser;

(iii)

the Warrants for such Purchaser duly executed by the Company registered in the name of such Purchaser;

(iv)

the Transfer Agent Instruction Letters, duly executed by the Transfer Agent in addition to the Company;

(v) the Security Agreement and Guaranty;

(vi)

legal opinions of counsel to the Company (including local counsel as may be requested by such Purchaser) in form and substance

acceptable to such Purchaser; an officer’s certificate and compliance certificate from each Company Party, each in form and substance

acceptable to such Purchaser; and

(vii)

a closing statement, in form and substance acceptable to such Purchaser, and such other opinions, statements, agreements and good

standing certificates, and other documents as such Purchaser may require.

(b)

Deliveries to the Company. On or prior to the Closing, each Purchaser shall deliver or cause to be delivered to the Company,

as applicable, the following, each duly executed by such Purchaser and dated as of the Closing Date:

(i)

this Agreement;

(ii) the Transfer

Agent Instruction Letters, duly executed by the Purchaser;

(iii) the Security

Agreement duly executed by the Purchaser; and

(iv) the Purchaser’s Subscription Amount for

the Note and the Warrant being purchased by such Purchaser at the Closing by wire transfer to the account specified in writing by the

Company.

(a)

Conditions to the Company’s Obligations. The obligations of the Company pursuant to Section 2.2 in connection

with the Closing are subject to the satisfaction, or waiver in accordance with this Agreement, of the following conditions on or before

the Closing Date:

(i)

the transactions contemplated by the Transaction Documents have closed in accordance with their respective terms;

(ii)

the representations and warranties of each Purchaser contained herein shall be true and correct as of the Closing Date (unless

expressly made as of an earlier date herein in which case they shall be accurate as of such date);

(iii)

all obligations, covenants and agreements required to be performed by any Purchaser on or prior to the Closing Date (other than

the obligations set forth in Section 2.3 to be performed at the Closing) shall have been performed; and

(iv)

the delivery by each Purchaser of the items such Purchaser is required to deliver prior to the Closing Date pursuant to Section

2.3(b).

(b)

Conditions to each Purchaser’s Obligations. The respective obligations of each Purchaser and pursuant to Section

2.2 in connection with the Closing are subject to the satisfaction, or waiver in accordance with this Agreement, of the following

conditions on or before the Closing Date, both before and after giving effect to the Closing:

(i)

the transactions contemplated by the Transaction Documents have closed in accordance with their respective terms without waiver

or amendment unless approved by each Purchaser;

(ii)

the representations and warranties of each Company Party contained in any Transaction Document shall be true and correct as of

the Closing Date in all respects (without regard to any materiality qualifier) (unless expressly made as of an earlier date herein in

which case they shall be accurate as of such date);

(iii)

all obligations, covenants and agreements required to be performed by any Company Party or any on or prior to the Closing Date

pursuant to any Transaction Document (other than the obligations set forth in Section 2.3 to be performed at the Closing) shall

have been performed;

(iv)

the delivery by each Company Party of the items such Company Party is required to deliver on or prior to the Closing Date pursuant

to Section 2.3(a);

(v)

Purchaser’s due diligence has been completed to its satisfaction;

(vi)

there shall exist no Event of Default (as defined in the Notes) and no event which, with the passage of time or the giving of notice,

would constitute an Event of Default;

(vii)

there shall be no breach of any obligation, covenant or agreement of any Company Party under the Transaction Documents and no existing

event which, with the passage of time or the giving of notice, would constitute such a breach;

(viii)

no Material Adverse Effect shall have occurred from the date hereof through the Closing Date

(ix)

no statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed

by any court or other federal, state, local or other governmental authority of competent jurisdiction that prohibits the consummation

of any of the transactions contemplated by the Transaction; Documents;

(x)

from the date hereof through the Closing Date, trading in the shares of Common Stock shall not have been suspended by the Commission

or the Company’s principal Trading Market and, at any time prior to the Closing Date, trading in securities generally as reported

by Bloomberg L.P. shall not have been suspended or limited, or minimum prices shall not have been established on securities whose trades

are reported by such service, or on any Trading Market, nor shall a banking moratorium have been declared either by the United States

or New York State authorities nor shall there have occurred any material outbreak, including, without limitation, a pandemic, or escalation

of hostilities or other national or international calamity of such magnitude in its effect on, or any material adverse change in, any

financial market which, in each case, in the reasonable judgment of such Purchaser, and without regard to any factors unique to such Purchaser,

makes it impracticable or inadvisable to purchase the Securities at the Closing;

(xi)

the Company meets the current public information requirements under Rule 144 in respect of the Conversion Shares or the Warrant

Shares and or any other Registrable Securities or other shares of Common Stock issuable under the Notes or the Warrants; and

(xii)

any other conditions contained herein or the other Transaction Documents, including delivery of the items that any Company Party

is required to deliver on or prior to the Closing Date pursuant to Section 2.3.

ARTICLE III REPRESENTATIONS AND WARRANTIES

III.1

Representations and Warranties of the Company Parties. The Company hereby makes the following representations and

warranties, (which representations and warranties encompass Subsidiary as a Subsidiary and the Company Party) and include each such representation

and warranty by Subsidiary, in any document or agreement delivered and deliverable by the foregoing in connection with the as if fully

set forth herein, except to the extent modified in this Agreement makes the following representations and warranties as, and to the extent

applicable to, such Company Party) to each Purchaser as of the Closing Date as to each Company Party:

(a)

Subsidiaries. All of the direct and indirect Subsidiaries of the Company if any, are set forth in on Schedule II.

The Company owns, directly or indirectly, all of the Capital Stock and Stock Equivalents of each Subsidiary free and clear of any Liens

and all of the issued and outstanding shares of Capital Stock of each Subsidiary are validly issued and are fully paid, non-assessable

and free of preemptive and similar rights to subscribe for or purchase securities.

(b)

Organization and Qualification. Each Company Party is a Person duly organized, validly existing and in good standing under

the laws of its jurisdiction of organization and is duly qualified or licensed to transact business in its jurisdiction of organization,

the jurisdiction of its principal place of business, any other jurisdiction where such qualification is necessary to conduct its business

or own the property it purports to own, except where the failure to do so would not have a Material Adverse Effect – and no Proceeding

exists or has be instituted or threatened in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail

such power and authority or qualification. Each Company Party has the right, power and authority to enter into and discharge all of its

obligations under each Transaction Document to which it purports to be a party, each of which constitutes a legal, valid and binding obligation

of such Company Party, enforceable against it in accordance with its terms, subject only to bankruptcy and similar Regulations affecting

creditors’ rights generally; and has the power, authority, Permits and Licenses to own its property and to carry on its business

as presently conducted. No Company Party is engaged in the business of extending credit (which shall not include intercompany credit among

the Company Parties) for the purpose of purchasing or carrying margin stock or any cryptocurrency, token or other blockchain asset.

(c)

Authorization; Enforcement. The execution, delivery, performance by each Company Party of its obligations, and exercise

by such Company Party of its rights under the Transaction Documents, including, if applicable, the sale of Notes, Warrants and other securities

under this Agreement, (i) have been duly authorized by all necessary corporate actions of such Company Party, (ii) except for the Required

Filings and the consent of Banks, which shall have been obtained prior to execution of this Agreement, do not require any Consents or

Permits that have not been obtained prior to the date hereof and each such Permit or Consent is in full force and effect and not subject

of any pending or, to the best of any Company Party’s knowledge, threatened, attack or revocation, (iii) are not and will not be

in conflict with or prohibited or prevented by or create a breach under (A) except for those that do not have a Material Adverse Effect,

any Regulation or Permit, (B) any corporate governance document or resolution or (C) except for those that do not have a Material Adverse

Effect, any Contractual Obligation or provision thereof binding on such Company Party or affecting any property of such Company Party

and (iv) will not result in the imposition of any Liens except for the benefit of the Purchaser. Upon execution and delivery thereof,

each Transaction Document to which such Company Party purports to be a party shall constitute the legal, valid and binding obligation

of such Company Party, enforceable against such Company Party in accordance with its terms.

(d)

Issuance of the Securities. The Securities are duly authorized and, when issued and paid for in accordance with the applicable

Transaction Documents, will be duly and validly issued, fully paid and nonassessable, free and clear of all Liens imposed by the Company

other than restrictions on transfer provided for in the Transaction Documents. The Conversion Shares and the Warrant Shares, when issued

in accordance with the terms of the Transaction Documents, will be validly issued, fully paid and nonassessable, free and clear of all

Liens imposed by the Company other than restrictions on transfer provided for in the Transaction Documents. The Company has reserved from

its duly authorized Capital Stock a number of shares of Common Stock for issuance of the Conversion Shares and the Warrant Shares at least

equal to the Required Minimum on the date hereof or as provided for in Section 4.10(a).

(e)

Capitalization. The capitalization of the Company is as set forth in its latest periodic reports, which also includes the

number of shares of Common Stock owned beneficially, and of record, by Affiliates of the Company as of the date hereof. The Company has

not issued any Capital Stock or Stock Equivalent since its most recently filed periodic report under the Exchange Act except, (i) for

the issuance of shares of Common Stock to employees pursuant to the Company’s employee stock purchase plans and (ii) pursuant to

the conversion and/or exercise of Common Stock Equivalents outstanding as of the date of the most recently filed periodic report under

the Exchange. No Person has any right of first refusal, preemptive right, right of participation, or any similar right to participate

in, or triggered by, the transactions contemplated by the Transaction Documents (including the issuance of the Conversion Shares upon

conversion of the Notes and the issuance of the Warrant Shares upon exercise of the Warrants in accordance with their respective terms).

There are no outstanding securities or instruments of the Company or any Subsidiary that contain any redemption or similar provisions,

and there are no contracts, commitments, understandings or arrangements by which the Company or any Subsidiary is or may become bound

to redeem a security of the Company or such Subsidiary. The Company does not have any stock appreciation rights or “phantom stock”

plans or agreements or any similar plan or agreement. There are no outstanding Stock Equivalents with respect to any shares of Common

Stock, and there are no Contractual Obligations by which the Company or any Subsidiary is or may become bound to issue additional shares

of Common Stock or Common Stock Equivalents except as set forth herein. The issuance and sale of the Securities will not obligate the

Company to issue shares of Common Stock or any other securities to any Person (other than to any Purchaser) and will not result in a right

of any holder of securities issued by any Company Party to adjust the exercise, conversion, exchange or reset price under any Stock Equivalent,

except as set forth herein. All of the outstanding shares of Capital Stock of the Company are duly authorized, validly issued, fully paid

and nonassessable, have been issued in compliance with all securities Regulations, and no such outstanding share was issued in violation

of any preemptive right or similar or other right to subscribe for or purchase securities or any other existing Contractual Obligation.

No further approval or authorization of any stockholder or the Board of Directors, and no other Permit or Consent (other than with respect

to Banks, which shall have been obtained prior to the execution of this Agreement) is required

for the issuance and sale of the Securities. There are no stockholders’ agreements, voting agreements or other similar Contractual

Obligations with respect to the Company’s Capital Stock or Stock Equivalents to which the Company is a party or, to the knowledge

of the Company, between or among any of the Company’s stockholders or other equity investors.

(f)

Financial Statements. The Company’s latest 10-K contain the audited consolidated balance sheets, statements

of operations and statements of cash flows (the “Audited Financial Statements”) of certain of the Company and

the Subsidiaries as at and for the annual periods ended December 31, 2023 and 2022. Its latest 10-Q contains the unaudited consolidated

balance sheets, statements of operations and statements of cash flows (the “Unaudited Financial Statements”)

of the Company and the Subsidiaries as at and for the sixi month period ended June 30, 2024. The Audited Financial Statements and the

Unaudited Financial Statements, are hereinafter sometimes collectively referred to as the “Financial Statements.”

The Financial Statements have been prepared from the books and records of the Company and the Subsidiaries and in conformity with GAAP,

consistently applied, except in each case as described in the notes thereto and as set forth on the Sections of Disclosure Schedules set

forth above, In addition, the Financial Statements of the Company comply in all material respects with applicable accounting requirements

and the rules and regulations of the Commission with respect thereto as in effect at the time of preparation and fairly present in all

material respects the financial position of the Company and its consolidated Subsidiaries as of and for the dates thereof and the results

of operations and cash flows for the periods then ended, subject, in the case of unaudited statements, to customary and immaterial year-end

audit adjustments. There is no transaction, arrangement, or other relationship between the Company and an unconsolidated or other off-balance

sheet entity that is required to be disclosed by the Company in its Exchange Act filings and is not so disclosed.

(g) Material

Adverse Effects; Undisclosed Events, Liabilities or Developments. Since the date of the latest audited financial statements

delivered to the Purchaser: (i) there has been no event that has had, or could reasonably be expected to result in, a Material

Adverse Effect, (ii) no Company Party has incurred any Indebtedness or other liability (contingent or otherwise) other than (A)

trade payables and accrued expenses incurred in the ordinary course of business consistent with past practice and (B)

liabilities not required by GAAP to be reflected in the Company’s financial statements and not required to be disclosed in

filings made with the Commission and (C) Indebtedness in favor of Banks; (iii) no Company Party has altered its fiscal year or

accounting methods; (iv) no Company Party has declared or made any Restricted Payment or entered in any Contractual Obligation to do

so, (v) no Company Party has issued any Capital Stock to any officer, director or other Affiliate, and (vi) there has been no event,

prospects, liability, fact, circumstance, occurrence or development has occurred or exists or is reasonably expected to occur or

exist with respect to any Company Party, their Subsidiaries or their respective businesses, properties, operations, assets or

financial condition, that would be required to be disclosed by any Company Party under applicable securities Regulations at the time

this representation is made or deemed made that has not been publicly disclosed at least one (1) Trading Day prior to the date that

this representation is made.

(h)

Litigation. There is no Proceeding against any Company Party or any Subsidiary of any Company Party or any current or former

officer or director of any Company Party or any Subsidiary of any Company Party in its capacity as such which (i) adversely affects or

challenges the legality, validity or enforceability of any of the Transaction Documents or the Securities, (ii) involves the Commission

or otherwise involves violations of securities Regulations or (iii) could, assuming an unfavorable result, have or reasonably be expected

to result in a Material Adverse Effect, and none of the Company Parties, their Subsidiaries, or any director or officer of any of them,

is or has been the subject of any Proceeding involving a claim of violation of or liability under securities Regulations or a claim of

breach of fiduciary duty. The Commission has not issued any stop order or other order suspending the effectiveness of any registration

statement filed by the Company or any Subsidiary under the Exchange Act or the Securities Act.

(i)

Labor Relations. There is no (i) no unfair labor practice at any Company Party and there is no unfair labor practice complaint

pending against any Company Party or any Subsidiary of any Company Party or, to their knowledge of any Company Party, threatened against

any of them before the National Labor Relations Board and no grievance or arbitration proceeding arising out of or under any collective

bargaining agreement that is so pending against any Company Party or any Subsidiary of any Company Party or to their knowledge threatened

against any of them, (ii) no strike, work stoppage or other labor dispute in existence or to their knowledge threatened involving any

Company Party or any Subsidiary of any Company Party, and (iii) no union representation question existing with respect to the employees

of any Company Party or any Subsidiary of any Company Party, as the case may be, and no union organization activity that is taking place,

except (with respect to any matter specified in clause (i), (ii) or (iii) above, either individually or in the aggregate) such as could

not reasonably likely to have a Material Adverse Effect. None of the Company’s or its Subsidiaries’ employees is a member

of a union that relates to such employee’s relationship with the Company or such Subsidiary, and neither the Company nor any of

its Subsidiaries is a party to a collective bargaining agreement. To the knowledge of the Company, the continued service to the Company

of the executive officers of the Company Parties and their Subsidiaries is not, and is not expected to be, in violation of any material

term of any Contractual Obligation in favor of any third party, and does not subject any Company Party or any Subsidiary of any Company

Party to any Loss with respect to any of the foregoing matters.

(j)

Compliance. No Company Party and no Subsidiary thereof, except as could not have or reasonably be expected to result in

a Material Adverse Effect: (i) is in default under or in violation of (and no event has occurred that has not been waived that, with notice

or lapse of time or both, would result in a default by the Company or any Subsidiary under), nor has any Company Party or any Subsidiary

thereof received notice of a claim that it is in default under or that it is in violation of, any Contractual Obligation (whether or not

such default or violation has been waived); (ii) is in violation of any judgment, decree or order of any Governmental Authority; (iii)

is or has been in violation of any Regulation, and to the knowledge of each Company Party, no Person has made or threatened to make any

claim that such a violation exists (including relating to taxes, environmental protection, occupational health and safety, product quality

and safety, employment or labor matters) or (iv) has incurred, or could reasonably be expected to incur Losses relating to compliance

with Regulations (including clean-up costs under environmental Regulations), nor have any such Losses been threatened.

(k)

Permits. Each Company Party and its Subsidiaries possess all Permits, each issued by the appropriate Governmental Authority,

that are necessary to conduct their respective businesses and which failure to possess could reasonably be expected to result in a Material

Adverse Effect and no Company Party nor any Subsidiary thereof has received any notice of proceedings relating to the revocation or

modification of any such Permit.

(ii)

Title to Assets. Each Company Party has good and marketable title in fee simple to all real property owned by it

and good title in fee simple to all personal property owned or purported to be owned by any of them that is material to the business of

any Company Party, in each case free and clear of all Liens except for (i) Liens that do not materially affect the value of any such property

and do not materially interfere with the use made and proposed to be made of such property by the Company Parties, Liens for the payment

of federal, state or other taxes, for which appropriate reserves have been made therefor in accordance with GAAP and, the payment of which

is neither delinquent nor subject to penalties and (iii) Liens in favor of Banks. Any real property and facilities held under lease by

any Company Party (and any personal property if such lease is material to the business of any Company Party) are held by them under valid,

subsisting and enforceable leases with which the Company Parties party thereto are in compliance.

(l) Intellectual

Property. Except where the failure to do so would not have a Material Adverse Effect, each Company Party has, or has rights to

use, all Intellectual Property Rights they purport to have or have rights to use, which, in the aggregate for all such Company

Party, constitute all Intellectual Property Rights necessary or required for use in connection with the businesses of the Company

Parties as presently conducted. No Company Party has received a notice (written or otherwise) that any of the Intellectual Property

Rights has expired, terminated or been abandoned, or is expected to expire or terminate or be abandoned, within two (2) years from

the date of this Agreement, and, to the knowledge of each Company Party no event has occurred that permits, or would permit after

notice or passage of time or both, the revocation, suspension or termination of such rights. No Company Party has received, since

the date of the latest audited financial statements included within the delivered to the Purchaser, a written notice of a claim, nor

has such a claim been threatened or could reasonably be expected to be made, and no Company Party otherwise has any knowledge that