Empire Petroleum Announces Extension of Previously Announced Rights Offering

October 10 2024 - 6:32AM

Business Wire

Empire Petroleum Corporation (NYSE American: EP) ("Empire" or

the "Company"), an oil and gas company with current producing

assets in New Mexico, North Dakota, Montana, Texas, and Louisiana,

announced today that it has extended the expiration date of its

previously announced subscription rights offering (“Rights

Offering”) pursuant to which it intends to raise gross proceeds of

up to approximately $10.0 million. The Company has extended the

Expiration Date in order to allow its stockholders to have more

time to consider their participation and arrange finances for the

Rights Offering. A contributing factor is requests by Company

stockholders as a result of the recent disruption caused by

Hurricane Milton.

The Company has distributed at no charge to holders of its

common stock, par value $0.001 per share (“Common Stock”), as of

the close of business on September 30, 2024 (the record date for

the Rights Offering), one subscription right for each share of

Common Stock held. Each subscription right entitles the holder to

purchase 0.063 shares of Common Stock at a subscription price of

$5.05 per share per one whole share of Common Stock. As a result, a

stockholder must hold at least 16 shares of Common Stock to receive

subscription rights to purchase at least one share of Common Stock.

The subscription rights are non-transferable, and will not be

listed for trading on any stock exchange or market. In addition,

holders of subscription rights who fully exercise their

subscription rights are entitled to over-subscribe for additional

shares of Common Stock, subject to proration.

The Rights Offering is now expected to expire at 5:00 p.m.,

Eastern Time, on October 24, 2024 (“Expiration Date”), subject to

extension or earlier termination.

Phil E. Mulacek, Chairman of the Board of Empire, and Energy

Evolution Fund, Ltd., our largest shareholders, have indicated that

they intend to participate in the Rights Offering and fully

subscribe to the shares of Common Stock corresponding to their

subscription rights. They have each also indicated that they intend

to fully exercise their over-subscription rights to purchase their

pro rata share of the underlying securities related to the Rights

Offering that remain unsubscribed at the Expiration Date.

Holders of subscription rights who hold their shares directly

have received a prospectus, a prospectus supplement, a letter from

Empire describing the Rights Offering, and a subscription rights

certificate. Empire will also be providing an additional prospectus

supplement regarding the updated terms noted in this news release.

Those holders who intend to exercise their subscription rights and

over-subscription rights should review all of these materials,

properly complete and execute the subscription rights certificates,

and deliver the subscription rights certificates and full payment

to Securities Transfer Corporation, the subscription agent for the

Rights Offering, at the address set forth in the prospectus

supplements referenced below.

The Rights Offering is more fully described in the prospectus

supplement filed with the Securities and Exchange Commission

(“SEC”) on September 30, 2024, as supplemented by the prospectus

supplement field with the SEC on October 10, 2024. A copy of the

prospectus, prospectus supplements or further information with

respect to the Rights Offering may be obtained by contacting

Securities Transfer Corporation, the subscription and information

agent for the Rights Offering, at (469) 633-0101.

This news release shall not constitute an offer to sell or

the solicitation of an offer to buy any securities, nor shall there

be any offer, solicitation or sale of securities in any state in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state.

About Empire Petroleum

Empire Petroleum Corporation is a publicly traded, Tulsa-based

oil and gas company with current producing assets in New Mexico,

North Dakota, Montana, Texas, and Louisiana. Management is focused

on organic growth and targeted acquisitions of proved developed

assets with synergies with its existing portfolio of wells. More

information about Empire can be found at

www.empirepetroleumcorp.com.

Safe Harbor Statement

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Forward-looking

statements involve a wide variety of risks and uncertainties, and

include, without limitations, statements with respect to the

Company’s estimates, strategy and prospects. Such statements are

subject to certain risks and uncertainties which are disclosed in

the Company’s reports filed with the SEC, including its Form 10-K

for the fiscal year ended December 31, 2023, and its other filings

with the SEC. Readers and investors are cautioned that the

Company’s actual results may differ materially from those described

in the forward-looking statements due to a number of factors,

including, but not limited to, the Company’s ability to acquire

productive oil and/or gas properties or to successfully drill and

complete oil and/or gas wells on such properties, general economic

conditions both domestically and abroad, and other risks and

uncertainties related to the conduct of business by the Company.

Other than as required by applicable securities laws, the Company

does not assume a duty to update these forward-looking statements,

whether as a result of new information, subsequent events or

circumstances, changes in expectations, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241009883426/en/

Empire Petroleum Corporation: Mike Morrisett President and CEO

539-444-8002 info@empirepetrocorp.com Kali Carter Communications

& Investor Relations Manager 918-995-5046

IR@empirepetrocorp.com

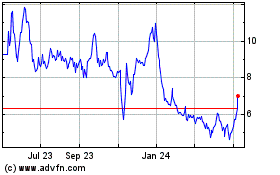

Empire Petroleum (AMEX:EP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Empire Petroleum (AMEX:EP)

Historical Stock Chart

From Dec 2023 to Dec 2024