false

0000887396

0000887396

2024-10-01

2024-10-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_________________

FORM

8-K

_________________

Current

Report

Pursuant

To Section 13 or 15 (d)

of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported):

OCTOBER 1, 2024

_______________________________

EMPIRE

PETROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware |

001-16653 |

73-1238709 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

2200

S. Utica Place, Suite 150,

Tulsa, Oklahoma

74114

(Address of Principal Executive Offices) (Zip

Code)

Registrant’s telephone number, including area

code: (539) 444-8002

(Former name or former address,

if changed since last report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

Common

Stock $.001 par value

|

EP

|

NYSE

American

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On

October 1, 2024, Empire Petroleum Corporation (the “Company”) announced the launch of a $10.0 million registered

rights offering. Under the terms of the rights offering, the Company will grant, at no charge, to each stockholder as of the close of

business on the record date of September 30, 2024, one non-transferable subscription right for each whole share of common stock owned

by that stockholder on the record date. Each subscription right will entitle a rights holder to purchase 0.063 shares of the Company’s

common stock at a subscription price equal to $5.05 per whole share (subject to rounding down to avoid the issuance of fractional shares).

The rights offering will also include an oversubscription privilege, which will entitle stockholders who fully exercise their subscription

rights the right to purchase at the same exercise price additional shares of common stock in the rights offering that other stockholders

do not purchase, subject to availability and pro-rata allocation of shares among rights holders exercising such oversubscription privilege.

No fractional shares of common stock will be issued in the rights offering. The subscription rights will expire if they are not exercised

by 5:00 p.m. Eastern time on October 16, 2024 (unless extended). More details of the rights offering are set forth in a

prospectus supplement dated, and filed with the U.S. Securities and Exchange Commission on October 1, 2024.

Certain

documents related to the rights offering are filed as Exhibits 99.1 through 99.5 hereto. In addition, on

October 1, 2024, the Company issued a press release announcing the commencement of the

rights offering. A copy of the press release is filed as Exhibit 99.6 hereto.

This

Current Report shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any offer,

solicitation or sale of securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state.

| Item

9.01 | Financial

Statements and Exhibits. |

| (d) | | Exhibits. |

| | | |

| The following exhibits

are filed or furnished herewith. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

EMPIRE

PETROLEUM CORPORATION

|

|

| Date:

October 1, 2024 |

By: |

/s/ Michael

R. Morrisett |

|

| |

|

Michael

R. Morrisett

President

and Chief Executive Officer |

|

3

EXHIBIT

5.1

|

|

1000

Main Street, 36th Floor

Houston,

Texas 77002-6341

(713)

226-6000 Main

porterhedges.com

|

October 1, 2024

Empire Petroleum Corporation

2200 S. Utica Place, Suite 150

Tulsa, Oklahoma 74114

Ladies

and Gentlemen:

We

have acted as counsel to Empire Petroleum Corporation, a Delaware corporation (the “Company”), in connection

with the filing by the Company of a prospectus supplement dated October 1, 2024 (the “Prospectus Supplement”)

under the Registration Statement (the “Registration Statement”) on Form S-3 (Registration No. 333-274327) filed

by the Company on September 1, 2023 with the Securities and Exchange Commission (the “Commission”) under the

Securities Act of 1933, as amended (the “Securities Act”), including the prospectus dated September 22, 2023

(together with the Prospectus Supplement, the “Prospectus”), relating to the issuance by the Company to its

stockholders of non-transferable subscription rights (the “Rights”) entitling the holders thereof to purchase

up to 1,980,198 shares of the Company’s common stock, par value $.001 per share (the “Common Stock”).

The Prospectus relates to (i) the Rights and (ii) the shares of Common Stock that may be issued and sold by the Company upon the exercise

of the Rights.

For

purposes of the opinions we express below, we have examined the originals or copies, certified or otherwise identified, of: (i) the Certificate

of Incorporation and Bylaws, each as amended to date, of the Company; (ii) the Registration Statement; (iii) the Prospectus; and (iv)

the corporate records of the Company, including minute books of the Company, certificates of public officials and of representatives

of the Company, statutes and other instruments and documents as we considered appropriate for purposes of the opinions hereafter expressed.

In giving such opinions, we have relied upon certificates of officers of the Company and of public officials with respect to the accuracy

of the material factual matters contained in such certificates. In giving the opinions below, we have assumed that the signatures on

all documents examined by us are genuine, that all documents submitted to us as originals are accurate and complete, that all documents

submitted to us as copies are true and correct copies of the originals thereof and that all information submitted to us was accurate

and complete.

In

making our examination, we have assumed and have not verified (i) that all signatures on documents examined by us are genuine, (ii) the

legal capacity of all natural persons, (iii) the authenticity of all documents submitted to us as originals and (iv) the conformity

to the original documents of all documents submitted to us as copies thereof.

Based

on the foregoing, and subject to the assumptions, exceptions and qualifications set forth herein, we are of the opinion that the

shares of Common Stock issuable upon exercise of the Rights are duly authorized and, when such shares are issued and delivered upon

the exercise of Rights and the receipt of the consideration payable therefor in accordance with their terms as described in the

Registration Statement, the Prospectus and the Prospectus Supplement, such shares will be validly issued, fully paid and

nonassessable.

The

opinions expressed herein are limited to the General Corporation Law of the State of Delaware and the federal securities laws of the

United States of America.

We

hereby consent to the filing of this opinion as Exhibit 5.1 to the Company’s Current Report on Form 8-K. We also consent to the

references to our Firm under the heading “Legal Matters” in the Prospectus Supplement. In giving this consent, we do not

hereby admit we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the

Commission thereunder.

Very

truly yours,

/s/ Porter Hedges LLP

PORTER HEDGES LLP

EXHIBIT

99.1

Rights Certificate Number:_________

Number of Rights: ________

EMPIRE PETROLEUM CORPORATION

SUBSCRIPTION RIGHTS CERTIFICATE

Evidencing Subscription Rights to Purchase

Shares of Common Stock

of Empire Petroleum Corporation

Subscription Price: $5.05 per Share

SUBSCRIPTION RIGHTS WILL EXPIRE IF NOT EXERCISED ON OR BEFORE 5:00 P.M., EASTERN TIME, ON OCTOBER 16, 2024, UNLESS EXTENDED BY THE COMPANY

Dear Stockholder:

As the registered owner

of this Rights Certificate, you are the owner of the number of subscription rights shown above. You have been issued, at no charge, one

subscription right for each share of common stock that you held on September 30, 2024. The subscription rights entitle you to subscribe

for shares of common stock, par value $0.001 per share, of Empire Petroleum Corporation (the “Company”). Each subscription

right will entitle the holder to purchase 0.063 shares of our common stock at the subscription price of $5.05 per share (the “Subscription

Price”). If you subscribe for all of the shares available to you, you are also entitled to subscribe for additional shares (subject

to pro-ration) at the Subscription Price. The Rights Offering is described in the Company’s enclosed Prospectus Supplement, dated

October 1, 2024 (the “Prospectus Supplement”), and its accompanying prospectus, dated September 22, 2023 (the “Base

Prospectus” and collectively, with the Prospectus Supplement, the “Prospectus”).

THESE SUBSCRIPTION RIGHTS ARE NON-TRANSFERABLE.

You have four choices:

| |

1. |

You can subscribe for all of the shares underlying the number of rights listed at the top of this page; |

| |

2. |

You can subscribe for less than all of the shares underlying the number of rights listed above, and allow the rest of your subscription rights to expire; |

| |

3. |

If you have subscribed for all of such shares (exercised your subscription right in full), then you can also subscribe for additional shares of common stock, subject to an allocation process as described in the Prospectus; or |

| |

4. |

If you do not want to purchase any shares, you can disregard this material. |

To subscribe for any number of shares, full

payment of the Subscription Price is required for each share of common stock you are subscribing for (including under the over-subscription

right). You must complete the reverse side of this form to subscribe for new shares.

Date: October 1, 2024

| |

EMPIRE PETROLEUM CORPORATION |

| |

|

| |

By: |

|

| |

|

Name: Michael Morrisett

Title: Chief Executive Officer |

DELIVERY OPTIONS FOR RIGHTS CERTIFICATE

Deliver by mail, hand or overnight courier to:

Securities Transfer Corporation

2901 North Dallas Parkway, Suite 380

Plano, Texas 75093

(469) 633-0101

stc@stctransfer.com

Delivery other than in the manner or to the address

listed above will not constitute valid delivery.

PLEASE PRINT ALL INFORMATION CLEARLY AND LEGIBLY.

If you wish to subscribe for shares pursuant

to your subscription right in full or a portion thereof:

I subscribe for ____________ shares x $5.05= $______________________

(Line 1)

If you subscribed for your subscription right

in full and wish to subscribe for additional shares pursuant to the Over-Subscription Right:

I subscribe for ____________ shares x $5.05= $______________________

(Line 2)

Total amount of payment enclosed (sum of line 1 and line 2): $______________________

If you fully exercise your subscription right

and other stockholders do not fully exercise their subscription rights, you will have an over-subscription right that entitles you to

purchase, at the same subscription price, additional shares of common stock that remain unsubscribed at the expiration date for the Rights

Offering. The available shares of common stock issuable will be distributed proportionately among rights holders who exercise their over-subscription

right, based on the number of shares each rights holder subscribed for under the subscription right until either all shares of common

stock have been allocated or all over-subscription exercises have been fulfilled, whichever occurs earlier.

I acknowledge that I have received the Prospectus

for this Rights Offering and I hereby irrevocably subscribe for the number of shares indicated above on the terms and conditions specified

in the Prospectus.

______________________________________________

Signature(s)

IMPORTANT: The signature(s) must correspond

with the name(s) as printed on the reverse of this Subscription Rights Certificate in every particular, without alteration or enlargement,

or any other change whatsoever.

If you wish to have your shares delivered to

an address other than that shown on front, your signature must be guaranteed by an eligible guarantor institution (bank, stock broker,

savings & loan association or credit union) with membership in an approved signature guarantee medallion program pursuant to Securities

and Exchange Commission Rule 17Ad-15.

Signature Guaranteed: ____________________________________________________________________________________________

(Name of Bank or Firm)

______________________________________________________________________________________________________________

(Signature of Officer)

FOR INSTRUCTIONS ON THE USE OF THE RIGHTS

CERTIFICATES, CONSULT SECURITIES TRANSFER CORPORATION, THE SUBSCRIPTION AGENT, AT THE ADDRESS OR TELEPHONE NUMBER INDICATED ABOVE.

Method of Payment (Check One)

| |

[_] |

Uncertified personal check, payable to “Securities Transfer Corporation, as Subscription Agent.” Please note that funds paid by uncertified personal check may take at least five business days to clear. Accordingly, subscription rights holders who wish to pay the purchase price by means of an uncertified personal check are urged to make payment sufficiently in advance of the expiration date to ensure that such payment is received and clears by the expiration date, and are urged to consider payment by means of a certified or bank check, money order or wire transfer of immediately available funds. |

| |

[_] |

Certified check or bank check drawn on a U.S. bank or money order, payable to “Securities Transfer Corporation, as Subscription Agent.” |

| |

[_] |

Wire transfer of immediately available funds directed to the account maintained by the Subscription Agent, Securities Transfer Corporation, at: |

Bank Name: EagleBank

Bank Address: 7735

Old Georgetown Rd Ste 100, Bethesda, MD 20814

Routing Number: 055003298

Name of Beneficiary:

Securities Transfer Corporation

As Escrow Agent for Empire

Petroleum Rights Offering

2901 Dallas Parkway

Suite 380

Plano, TX 75093

Account Number of Beneficiary: 200429579

| ***Purpose: | Empire Petroleum Rights Offering |

International

Bank Name: EagleBank

Bank Address: 7735

Old Georgetown Rd Ste 100, Bethesda, MD 20814

Name of Beneficiary: Securities

Transfer Corporation

As Escrow Agent for Empire

Petroleum Rights Offering

Account Number of Beneficiary: 200429579

Beneficiary Address: 2901

Dallas Parkway, Suite 380, Plano, TX 75093

*** Purpose: Empire

Petroleum Rights Offering

*** Beneficiary Info

(OBI) MUST be included. If it is not included your wire may be rejected and/or credit to your account may be delayed***

If the amount enclosed

or transmitted is not sufficient to pay the purchase price for all shares of common stock that are subscribed for, or if the number of

shares of common stock being subscribed for is not specified, the number of shares of common stock subscribed for will be assumed to be

the maximum number that could be subscribed for upon payment of such amount. If the amount enclosed or transmitted exceeds the purchase

price for all shares of common stock that the undersigned has subscribed or over-subscribed for, Securities Transfer Corporation shall

return the excess to the subscriber without interest or deduction as soon as practicable after the expiration of the offering.

3

EXHIBIT

99.2

EMPIRE

PETROLEUM CORPORATION

1,980,198 Shares of Common Stock

Offered Pursuant to Rights Distributed to Security Holders

October 1, 2024

Dear

Security Holders:

This

notice is being distributed by Empire Petroleum Corporation (the “Company”) to all holders of record of shares of its common

stock, par value $0.001 per share (the “Common Stock”), at the close of business on September 30, 2024 (the “Record

Date”), in connection with an offering (the “Rights Offering”) of non-transferable subscription rights (the “Subscription

Rights”) to subscribe for and purchase shares of common stock, par value $0.001 per share, of the Company (“Common Stock”).

The Subscription Rights are being distributed to all holders of record of Common Stock (“Record Date Stockholders”) as of

the Record Date. The Rights Offering is described in the Company’s enclosed Prospectus Supplement, dated October 1, 2024 (the

“Prospectus Supplement”), and its accompanying prospectus, dated September 22, 2023 (the “Base Prospectus” and

collectively, with the Prospectus Supplement, the “Prospectus”).

In

the Rights Offering, the Company is offering an aggregate of 1,980,198 shares of Common Stock to be issued upon the exercise of the Subscription

Rights and Over-Subscription Rights (as defined below), which are described further in the Prospectus. The Subscription Rights will expire

if they are not exercised by 5:00 p.m., Eastern Time, on October 16, 2024, unless the Company extends the Rights Offering period as described

in the Prospectus (such date and time, as it may be extended, the “Expiration Date”).

As

described in the Prospectus, stockholders on the Record Date (“Record Date Stockholders”) will receive one Subscription Right

for each share of Common Stock owned as of the Record Date. For every Subscription Right held, Record Date Stockholders will be entitled

to purchase 0.063 new shares of Common Stock. The number of Subscription Rights to be issued to Record Date Stockholders will be rounded

down to the nearest whole number and fractional shares of Common Stock will not be issued upon the exercise of the Subscription Rights.

The subscription price per share of Common Stock was determined by the Company’s board of directors on September 20, 2024. Record

Date Stockholders will be required to pay for Common Stock pursuant to your Subscription Rights at the subscription price of $5.05 per

share of Common Stock (the “Subscription Price”).

Phil

E. Mulacek, Chairman of the Board of the Company (“Mulacek”) owns approximately 20.3% of our common stock outstanding prior

to the rights offering, and Energy Evolution Master Fund, Ltd., a Cayman Islands exempted company and our largest stockholder (“EEF”)

owns approximately 31.4% of our common stock outstanding prior to the rights offering. Mulacek and EEF have indicated their intent to

participate in the rights offering and fully subscribe to the shares of common stock corresponding to their subscription rights, as well

as their intent to fully exercise their over-subscription rights to purchase their proportion of the underlying securities related to

the rights offering that remain unsubscribed at the Expiration Date.

You

should be aware that there will be an over-subscription right associated with the Rights Offering. As described further in the Prospectus,

Record Date Stockholders who fully exercise all Subscription Rights initially issued to them are entitled to an Over-Subscription Right

to buy those shares of Common Stock (“Over-Subscription Shares”) that remain unsubscribed at the Expiration Date at the same

Subscription Price. If enough Over-Subscription Shares are available, all such requests will be honored in full. If the requests for

Over-Subscription Shares exceed the Over-Subscription Shares available, the available Over-Subscription Shares will be allocated pro

rata among the Record Date Stockholders who have fully exercised their Subscription Rights and who have requested to over-subscribe,

based on the number of shares of Common Stock purchased by virtue of their Subscription Rights. See the Prospectus for further details

on the Over-Subscription Rights.

As

noted above, Mulacek and EEF have indicated that they intend to fully exercise their Over-Subscription Rights relating to their portion

of shares of Common Stock that remain unsubscribed at the Expiration Date.

Record

Date Stockholders will be required to submit payment in full for all of the Common Stock they wish to buy pursuant to the exercise of

their Subscription Rights and Over-Subscription Rights to Securities Transfer Corporation, the subscription agent for the Rights Offering,

prior to 5:00 p.m., Eastern Time, on the Expiration Date. Any excess payments made by Record Date Stockholders as a result of the exercise

of their Over-Subscription Rights (if any) will be refunded and will be mailed by Securities Transfer Corporation to such holder as soon

as practicable after the Expiration Date. Record Date Stockholders will have no right to rescind a purchase after Securities Transfer

Corporation has received payment either by means of a notice of guaranteed delivery or a check, except as described in the Prospectus.

The

Subscription Rights will be evidenced by a subscription certificate (the “Subscription Certificate”) registered in the Record

Date Stockholder’s name.

Enclosed

are copies of the following documents:

1. The

Prospectus;

2.

A Subscription Certificate; and

3. A

return envelope addressed to Securities Transfer Corporation.

Your

prompt action is requested. As indicated in the Prospectus, to exercise your Subscription Rights you should deliver to Securities

Transfer Corporation prior to 5:00 p.m., Eastern Time, on the Expiration Date, a properly completed and executed Subscription

Certificate with payment of the estimated Subscription Price in full for each Common Share subscribed for pursuant to the

Subscription Rights and/or Over-Subscription Rights (if applicable). FAILURE TO RETURN THE PROPERLY COMPLETED RIGHTS CERTIFICATE

WITH THE CORRECT PAYMENT WILL RESULT IN YOUR NOT BEING ABLE TO EXERCISE YOUR RIGHTS. A Rights holder cannot revoke the exercise of

its Rights. Rights not exercised prior to the Expiration Date will expire.

Additional

copies of the enclosed materials and assistance or information may be obtained from Securities Transfer Corporation. Their telephone

number is (469) 633-0101 and their e-mail address is stc@stctransfer.com.

Very

truly yours,

EMPIRE PETROLEUM CORPORATION

EXHIBIT

99.3

EMPIRE

PETROLEUM CORPORATION

1,980,198 Shares of Common Stock

Offered Pursuant to Rights Distributed to Security Holders

October 1, 2024

To

Securities Dealers, Commercial Banks, Trust Companies and Other Nominees:

This

letter is being distributed to securities dealers, commercial banks, trust companies and other nominees by Empire Petroleum Corporation

(the “Company”) in connection with an offering (the “Rights Offering”) of non-transferable subscription rights

(the “Subscription Rights”) to subscribe for and purchase shares of common stock, par value $0.001 per share, of the Company

(“Common Stock”). The Subscription Rights are being distributed to all holders of record of Common Stock (“Record Date

Stockholders”) as of the close of business on September 30, 2024 (the “Record Date”). The Rights Offering is described

in the Company’s enclosed Prospectus Supplement, dated October 1, 2024 (the “Prospectus Supplement”), and its accompanying

prospectus, dated September 22, 2023 (the “Base Prospectus” and collectively, with the Prospectus Supplement, the “Prospectus”).

We are requesting that you contact your clients for whom you hold Common Stock, and who are to receive the Subscription Rights distributable

with respect to those shares, regarding the Rights Offering.

In

the Rights Offering, the Company is offering an aggregate of 1,980,198 shares of Common Stock to be issued upon the exercise of the Subscription

Rights and Over-Subscription Rights (as defined below), which are described further in the Prospectus. The Subscription Rights will expire

if they are not exercised by 5:00 p.m., Eastern Time, on October 16, 2024, unless the Company extends the Rights Offering period as described

in the Prospectus (such date and time, as it may be extended, the “Expiration Date”).

As

described in the Prospectus, stockholders on the Record Date (“Record Date Stockholders”) will receive one Subscription Right

for each share of Common Stock owned as of the Record Date. For every Subscription Right held, Record Date Stockholders will be entitled

to purchase 0.063 new shares of Common Stock. The number of Subscription Rights to be issued to Record Date Stockholders will be rounded

down to the nearest whole number and fractional shares of Common Stock will not be issued upon the exercise of the Subscription Rights.

The subscription price per share of Common Stock was determined by the Company’s board of directors on September 20, 2024. Record

Date Stockholders will be required to pay for Common Stock pursuant to your Subscription Rights at the subscription price of $5.05 per

share of Common Stock (the “Subscription Price”).

Phil

E. Mulacek, Chairman of the Board of the Company (“Mulacek”) owns approximately 20.3% of our common stock outstanding prior

to the rights offering, and Energy Evolution Master Fund, Ltd., a Cayman Islands exempted company and our largest stockholder (“EEF”)

owns approximately 31.4% of our common stock outstanding prior to the rights offering. Mulacek and EEF have indicated their intent to

participate in the rights offering and fully subscribe to the shares of common stock corresponding to their subscription rights, as well

as their intent to fully exercise their over-subscription rights to purchase their proportion of the underlying securities related to

the rights offering that remain unsubscribed at the Expiration Date.

You

should be aware that there will be an over-subscription right associated with the Rights Offering. As described further in the Prospectus,

Record Date Stockholders who fully exercise all Subscription Rights initially issued to them are entitled to an Over-Subscription Right

to buy those shares of Common Stock (“Over-Subscription Shares”) that remain unsubscribed at the Expiration Date at the same

Subscription Price. If enough Over-Subscription Shares are available, all such requests will be honored in full. If the requests for

Over-Subscription Shares exceed the Over-Subscription Shares available, the available Over-Subscription Shares will be allocated pro

rata among the Record Date Stockholders who have fully exercised their Subscription Rights and who have requested to over-subscribe,

based on the number of shares of Common Stock purchased by virtue of their Subscription Rights. See the Prospectus for further details

on the Over-Subscription Rights.

As

noted above, Mulacek and EEF have indicated that they intend to fully exercise their Over-Subscription Rights relating to their portion

of shares of Common Stock that remain unsubscribed at the Expiration Date.

Record

Date Stockholders will be required to submit payment in full for all of the Common Stock they wish to buy pursuant to the exercise of

their Subscription Rights and Over-Subscription Rights to Securities Transfer Corporation, the subscription agent for the Rights Offering,

prior to 5:00 p.m., Eastern Time, on the Expiration Date. Any excess payments made by Record Date Stockholders as a result of the exercise

of their Over-Subscription Rights (if any) will be refunded and will be mailed by Securities Transfer Corporation to such holder as soon

as practicable after the Expiration Date. Record Date Stockholders will have no right to rescind a purchase after Securities Transfer

Corporation has received payment either by means of a notice of guaranteed delivery or a check, except as described in the Prospectus.

The

Subscription Rights will be evidenced by a subscription certificate (the “Subscription Certificate”) registered in the Record

Date Stockholder’s name.

We

are asking that you contact your clients for whom you hold shares of Common Stock registered in your name(s) or in the name(s) of your

nominee(s) to obtain instructions with respect to the Subscription Rights. If you hold Subscription Rights for the account of more than

one client, you may aggregate your exercise of Subscription Rights for all your clients, provided that you identify the number of Subscription

Rights you are exercising for each client.

Securities

dealers, commercial banks, trust companies and other nominees will be required to certify to Securities Transfer Corporation, before

any Over-Subscription Rights may be exercised with respect to any particular beneficial owner, as to the aggregate number of Subscription

Rights exercised and the number of shares of Common Stock subscribed for pursuant to any Over-Subscription Rights by such beneficial

owner and that such beneficial owner’s subscription was exercised in full. Nominee holder over-subscription forms and beneficial

owner certification forms will be distributed to banks, broker-dealers, Directors and other nominee holders of rights with the Subscription

Certificates.

All

commissions, fees and other expenses (including brokerage commissions and transfer taxes), other than fees and expenses paid to Securities

Transfer Corporation, incurred in connection with the exercise of the Subscription Rights will be for the account of the holder of the

Subscription Rights, and none of such commissions, fees or expenses will be paid by the Company or Securities Transfer Corporation.

Enclosed

are copies of the following documents:

1. The

Prospectus;

2. A

Subscription Certificate;

3. A

form of letter and Beneficial Owner Election Form, on which you may obtain your clients’ instructions with regard to the Rights

Offering; and

4. A

return envelope addressed to Securities Transfer Corporation.

Your

prompt action is requested. As indicated in the Prospectus, to exercise your Subscription Rights you should deliver to Securities Transfer

Corporation prior to 5:00 p.m., Eastern Time, on the Expiration Date, a properly completed and executed Subscription Certificate with

payment of the estimated Subscription Price in full for each Common Share subscribed for pursuant to the Subscription Rights and/or Over-Subscription

Rights (if applicable).

Additional

copies of the enclosed materials and assistance or information may be obtained from Securities Transfer Corporation. Their telephone

number is (469) 633-0101 and their e-mail address is stc@stctransfer.com.

Very

truly yours,

Empire Petroleum Corporation

___________________________________

Nothing

in the Prospectus Supplement or in the enclosed documents shall constitute you or any person as an agent of Empire Petroleum Corporation,

the Subscription Agent or any other person making or deemed to be making offers of the securities issuable upon valid exercise of the

rights, or authorize you or any other person to make any statements on behalf of any of them with respect to the offering except for

statements made in the Prospectus Supplement.

2

EXHIBIT

99.4

EMPIRE PETROLEUM CORPORATION

1,980,198 Shares of Common Stock

Offered Pursuant to Rights Distributed to Security Holders

October 1, 2024

To

Our Clients:

Enclosed

for your consideration is a prospectus supplement, dated October 1, 2024 (the “Prospectus Supplement”), and its accompanying

prospectus, dated September 22, 2023 (the “Base Prospectus” and collectively, with the Prospectus Supplement, the “Prospectus”)

in connection with an offering (the “Rights Offering”) of non-transferable subscription rights (the “Subscription Rights”)

to subscribe for and purchase shares of common stock, par value $0.001 per share, of the Company (“Common Stock”). The Subscription

Rights are being distributed to all holders of record of Common Stock (“Record Date Stockholders”) as of the close of business

on September 30, 2024 (the “Record Date”).

In

the Rights Offering, the Company is offering an aggregate of 1,980,198 shares of Common Stock to be issued upon the exercise of the Subscription

Rights and Over-Subscription Rights (as defined below), which are described further in the Prospectus. The Subscription Rights will expire

if they are not exercised by 5:00 p.m., Eastern Time, on October 16, 2024, unless the Company extends the Rights Offering period as described

in the Prospectus (such date and time, as it may be extended, the “Expiration Date”).

As

described in the Prospectus, stockholders on the Record Date (“Record Date Stockholders”) will receive one Subscription Right

for each share of Common Stock owned as of the Record Date. For every Subscription Right held, Record Date Stockholders will be entitled

to purchase 0.063 new shares of Common Stock. The number of Subscription Rights to be issued to Record Date Stockholders will be rounded

down to the nearest whole number and fractional shares of Common Stock will not be issued upon the exercise of the Subscription Rights.

The subscription price per share of Common Stock was determined by the Company’s board of directors on September 20, 2024. Record

Date Stockholders will be required to pay for Common Stock pursuant to your Subscription Rights at the subscription price of $5.05 per

share of Common Stock (the “Subscription Price”).

Phil

E. Mulacek, Chairman of the Board of the Company (“Mulacek”) owns approximately 20.3% of our common stock outstanding prior

to the rights offering, and Energy Evolution Master Fund, Ltd., a Cayman Islands exempted company and our largest stockholder (“EEF”)

owns approximately 31.4% of our common stock outstanding prior to the rights offering. Mulacek and EEF have indicated their intent to

participate in the rights offering and fully subscribe to the shares of common stock corresponding to their subscription rights, as well

as their intent to fully exercise their over-subscription rights to purchase their proportion of the underlying securities related to

the rights offering that remain unsubscribed at the Expiration Date.

You

should be aware that there will be an over-subscription right associated with the Rights Offering. As described further in the Prospectus,

Record Date Stockholders who fully exercise all Subscription Rights initially issued to them are entitled to an Over-Subscription Right

to buy those shares of Common Stock (“Over-Subscription Shares”) that remain unsubscribed at the Expiration Date at the same

Subscription Price. If enough Over-Subscription Shares are available, all such requests will be honored in full. If the requests for

Over-Subscription Shares exceed the Over-Subscription Shares available, the available Over-Subscription Shares will be allocated pro

rata among the Record Date Stockholders who have fully exercised their Subscription Rights and who have requested to over-subscribe,

based on the number of shares of Common Stock purchased by virtue of their Subscription Rights. See the Prospectus for further details

on the Over-Subscription Rights.

As

noted above, Mulacek and EEF have indicated that they intend to fully exercise their Over-Subscription Rights relating to their portion

of shares of Common Stock that remain unsubscribed at the Expiration Date.

Record

Date Stockholders will be required to submit payment in full for all of the Common Stock they wish to buy pursuant to the exercise of

their Subscription Rights and Over-Subscription Rights to Securities Transfer Corporation, the subscription agent for the Rights Offering,

prior to 5:00 p.m., Eastern Time, on the Expiration Date. Any excess payments made by Record Date Stockholders as a result of the exercise

of their Over-Subscription Rights (if any) will be refunded and will be mailed by Securities Transfer Corporation to such holder as soon

as practicable after the Expiration Date. Record Date Stockholders will have no right to rescind a purchase after Securities Transfer

Corporation has received payment either by means of a notice of guaranteed delivery or a check, except as described in the Prospectus.

Your

Subscription Rights will be evidenced by a subscription certificate registered in the names of the record holders of the shares of Common

Stock for which the Subscription Rights are being distributed (the “Subscription Certificate”).

THE

MATERIALS ENCLOSED ARE BEING PROVIDED TO YOU AS THE BENEFICIAL OWNER OF COMMON STOCK CARRIED BY US IN YOUR ACCOUNT BUT NOT REGISTERED

IN YOUR NAME. EXERCISES OF SUBSCRIPTION RIGHTS AND OVER-SUBSCRIPTION RIGHTS MAY BE MADE ONLY BY US AS THE RECORD OWNER AND PURSUANT TO

YOUR INSTRUCTIONS.

Accordingly,

we request instructions as to whether you wish us to elect to subscribe for any shares of Common Stock to which you are entitled, pursuant

to the terms and subject to the conditions set forth in the enclosed Prospectus. We urge you to read the Prospectus carefully before

instructing us whether to exercise your Subscription Rights.

Your

instructions to us should be forwarded as promptly as possible in order to permit us to exercise the Subscription Rights on your behalf

in accordance with the provisions of the Rights Offering.

If

you wish to have us, on your behalf, exercise the Subscription Rights and Over-Subscription Rights for any shares of Common Stock to

which you are entitled, please so instruct us by completing, executing and returning to us the enclosed Beneficial Owner Election

Form in the accompanying return envelope. Delivery of the Beneficial Owner Election Form to an address other than as set

forth on the accompanying return envelope does not constitute a valid delivery.

Any

questions or requests for assistance concerning the Rights Offering should be directed to Securities Transfer Corporation, the subscription

and information agent, at (469) 633-0101, stc@stctransfer.com.

2

EXHIBIT

99.5

BENEFICIAL OWNER ELECTION FORM

The undersigned acknowledge(s) receipt of your

letter and the enclosed materials referred to therein relating to the grant of non-transferable subscription rights (the “Subscription

Rights”) to purchase shares of common stock, par value $.001 per share (“Common Stock”), of Empire Petroleum

Corporation (the “Company”) pursuant to a rights offering (the “Rights Offering”) as described further

in the Company’s Prospectus Supplement, dated October 1, 2024 (the “Prospectus Supplement”), and the accompanying

base prospectus, dated September 22, 2023 (the “Base Prospectus” and collectively, with the Prospectus Supplement,

the “Prospectus”), the receipt of which is hereby acknowledged.

You are hereby instructed, on the undersigned’s

behalf, to exercise the Subscription Rights to purchase Common Stock with respect to the shares of Common Stock held by you for the account

of the undersigned, pursuant to the terms and subject to the conditions set forth in the Prospectus and the related “Subscription

Certificate,” as follows:

PLEASE PRINT ALL INFORMATION CLEARLY AND

LEGIBLY

SECTION 1: OFFERING INSTRUCTIONS (check the appropriate box

if you wish to exercise subscription rights)

IF YOU WISH TO EXERCISE ALL OR A PORTION OF YOUR SUBSCRIPTION

RIGHTS:

Please exercise my Subscription Rights for

Common Stock pursuant to the Rights Offering, as set forth below:

| |

|

|

|

|

|

|

|

|

|

1. Subscription

Rights*

(1 Subscription

Right = 0.063

shares of

Common Stock) |

|

Number of

Subscription Rights

to be exercised: |

|

Number of shares of Common

Stock subscribed for under the

Subscription:

|

|

|

|

Payment to be made in

connection with the Common

Stock subscribed for under the

Subscription: |

| |

Subscription Rights |

|

shares of Common

Stock

(Subscription Rights x 0.063) |

|

x $5.05

(price/share) |

|

= $ |

| |

|

|

|

|

2. Over-

Subscription

Rights** |

|

|

|

Number of shares of Common

Stock requested under the

Over-Subscription Rights: |

|

|

|

Payment to be made in

connection with the shares of

Common Stock requested

under the Over-Subscription

Rights: |

| |

|

|

|

|

| |

|

|

|

shares of Common

Stock |

|

x $5.05

(price/share) |

|

= $ |

| 3. Totals |

|

|

|

|

|

|

|

|

| |

|

|

|

Total Number of

Subscription Rights to be Delivered:

Subscription

Rights |

|

Total Number of shares of

Common Stock subscribed for

and/or requested: Shares

of Common Stock |

|

Total Payment:

$

|

| |

|

|

|

| * |

You will receive one Subscription Right for each share of Common Stock owned as of the Record Date. For every Subscription Right held, you will be entitled to purchase 0.063 shares of Common Stock at the Subscription Price of $5.05 per share. The number of Subscription Rights to be issued to you will be |

1

| |

rounded down to the nearest whole number and fractional shares will not be issued upon the exercise of the Subscription Rights. Accordingly, if you held 100 Subscription Rights, your Subscription Rights entitle you to purchase up to 6 shares of Common Stock. The subscription price per share of Common Stock was determined on September 20, 2024. |

| ** |

If you purchase all of the shares available to you pursuant to your Subscription Rights, you may subscribe for additional shares pursuant to your Over-Subscription Rights, if any, using the Subscription Price of $5.05 per share. See the description of the Over-Subscription Rights in the Prospectus. |

IF YOU DO NOT WISH TO EXERCISE YOUR SUBSCRIPTION RIGHT:

Please DO NOT exercise my Subscription Rights

for Common Stock

SECTION 2: PAYMENT

Payment in the amount of $

(the total Subscription Price) by check or wire transfer is enclosed. Please deduct payment from the following account maintained by you

as follows:

Type of Account:

Account Number:

Amount to be deducted: $

(the total Subscription Price)

SECTION 3: SUBSCRIPTION AUTHORIZATION

I acknowledge that I have received the Prospectus for this offering

of Subscription Rights and I hereby exercise such Subscription Rights for the number of shares indicated above on the terms and conditions

specified in the Prospectus. I hereby agree that if I fail to pay in full for the Common Stock for which I have subscribed, the Company

may exercise any of the remedies provided for in the Prospectus.

| |

|

|

| Signature(s) of subscriber(s): |

|

|

| |

|

| |

|

|

| |

|

| Print Name: |

|

Print Name: |

| |

|

| Telephone No.: |

|

Telephone No.: |

| |

|

| Date: |

|

Date: |

2

EXHIBIT

99.6

EMPIRE

PETROLEUM ANNOUNCES COMMENCEMENT OF PREVIOUSLY ANNOUNCED RIGHTS OFFERING

TULSA,

Okla., October 1, 2024 --

(BUSINESS WIRE) -- Empire Petroleum Corporation (NYSE American: EP) ("Empire" or the "Company"), an oil and gas company

with current producing assets in New Mexico, North Dakota, Montana, Texas, and Louisiana, announced today that it has commenced its previously

announced subscription rights offering (“Rights Offering”) pursuant to which it intends to raise gross proceeds of up to

approximately $10.0 million. The Company is distributing at no charge to holders of its common stock, par value $0.001 per share (“Common

Stock”), as of the close of business on September 30, 2024 (the record date for the Rights Offering), one subscription right for

each share of Common Stock held. Each subscription right entitles the holder to purchase 0.063 shares of Common Stock at a subscription

price of $5.05 per share per one whole share of Common Stock. As a result, a stockholder must hold at least 16 shares of Common Stock

to receive subscription rights to purchase at least one share of Common Stock. The subscription rights are non-transferable, and will

not be listed for trading on any stock exchange or market. In addition, holders of subscription rights who fully exercise their subscription

rights are entitled to over-subscribe for additional shares of Common Stock, subject to proration.

The

Rights Offering is expected to expire at 5:00 p.m., Eastern Time, on October 16, 2024 (“Expiration Date”), subject to extension

or earlier termination.

Phil

E. Mulacek, Chairman of the Board of Empire, and Energy Evolution Fund, Ltd., our largest shareholders, have indicated that they intend

to participate in the Rights Offering and fully subscribe to the shares of Common Stock corresponding to their subscription rights. They

have each also indicated that they intend to fully exercise their over-subscription rights to purchase their pro rata share of the underlying

securities related to the Rights Offering that remain unsubscribed at the Expiration Date.

Holders

of subscription rights who hold their shares directly will receive a prospectus, a prospectus supplement, a letter from Empire describing

the Rights Offering, and a subscription rights certificate. Those holders who intend to exercise their subscription rights and over-subscription

rights should review all of these materials, properly complete and execute the subscription rights certificates, and deliver the subscription

rights certificates and full payment to Securities Transfer Corporation, the subscription agent for the Rights Offering, at the address

set forth in the prospectus supplement.

The

Rights Offering is more fully described in the prospectus supplement filed with the Securities and Exchange Commission (“SEC”)

on October 1, 2024. A copy of the prospectus, prospectus supplement or further information with respect to the Rights Offering may

be obtained by contacting Securities Transfer Corporation, the subscription and information agent for the Rights Offering, at (469) 633-0101.

This

news release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any offer,

solicitation or sale of securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state.

About

Empire Petroleum

Empire

Petroleum Corporation is a publicly traded, Tulsa-based oil and gas company with current producing assets in New Mexico, North Dakota,

Montana, Texas, and Louisiana. Management is focused on organic growth and targeted acquisitions of proved developed assets with synergies

with its existing portfolio of wells. More information about Empire can be found at www.empirepetroleumcorp.com.

Safe

Harbor Statement

This

release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Forward-looking statements involve a wide variety of risks and uncertainties, and include, without limitations,

statements with respect to the Company’s estimates, strategy and prospects. Such statements are subject to certain risks and uncertainties

which are disclosed in the Company’s reports filed with the SEC, including its Form 10-K for the fiscal year ended December 31,

2023, and its other filings with the SEC. Readers and investors are cautioned that the Company’s actual results may differ materially

from those described in the forward-looking statements due to a number of factors, including, but not limited to, the Company’s

ability to acquire productive oil and/or gas properties or to successfully drill and complete oil and/or gas wells on such properties,

general economic conditions both domestically and abroad, and other risks and uncertainties related to the conduct of business by the

Company. Other than as required by applicable securities laws, the Company does not assume a duty to update these forward-looking statements,

whether as a result of new information, subsequent events or circumstances, changes in expectations, or otherwise.

Contacts

Empire Petroleum

Corporation:

Mike Morrisett

President and CEO

539-444-8002

info@empirepetrocorp.com

Kali Carter

Communications &

Investor Relations Manager

918-995-5046

IR@empirepetrocorp.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

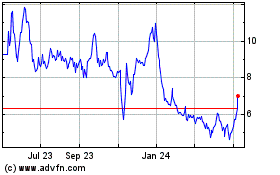

Empire Petroleum (AMEX:EP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Empire Petroleum (AMEX:EP)

Historical Stock Chart

From Dec 2023 to Dec 2024