0001026655false00010266552024-05-072024-05-0700010266552023-05-092023-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 5, 2024

Core Molding Technologies, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | 001-12505 | 31-1481870 | |

| (State or other jurisdiction incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

| | | | |

| 800 Manor Park Drive, Columbus, Ohio | | 43228-0183 | |

| (Address of principal executive office) | | (Zip Code) | |

Registrant’s telephone number, including area code: (614) 870-5000

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 | CMT | NYSE American LLC |

| Preferred Stock purchase rights, par value $0.01 | N/A | NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

| | | | | | | | |

| |

| Item 2.02 | Results of Operations and Financial Condition. |

On November 5, 2024, the Company announced financial results for the third quarter ended September 30, 2024. A copy of the press release announcing this event is included in this Form 8-K as Exhibit 99.1.

Item 9.01 Finance Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | CORE MOLDING TECHNOLOGIES, INC. |

| | |

| Date: November 5, 2024 | | By: | | /s/ John P. Zimmer |

| | Name: | | John P. Zimmer |

| | Title: | | Executive Vice President, Treasurer, Secretary and Chief Financial Officer |

FOR IMMEDIATE RELEASE

Core Molding Technologies Reports Fiscal 2024 Third Quarter Results

COLUMBUS, OH, November 5, 2024 – Core Molding Technologies, Inc. (NYSE American: CMT) (“Core Molding”, “Core” or the “Company”), a leading engineered materials company specializing in molded structural products, principally in building products, industrial and utilities, medium and heavy-duty truck and powersports industries across the United States, Canada and Mexico today reports financial and operating results for the fiscal periods ended September 30, 2024.

Third Quarter 2024 Highlights

•Total net sales of $73.0 million decreased 15.8% compared to the prior year third quarter.

•Gross margin of $12.3 million, or 16.9% of net sales, compared to 17.6% of net sales in the prior year third quarter.

•Selling, general, and administrative expenses of $8.7 million, or 12.0% of net sales, compared to $9.4 million, or 10.8% of net sales for the prior year third quarter.

•Operating income of $3.6 million, or 4.9% of net sales, compared to operating income of $5.9 million, or 6.8% of net sales for the prior year third quarter.

•Net income of $3.2 million, or $0.36 per diluted share, compared to net income of $4.4 million, or $0.49 per diluted share for the prior year third quarter.

•Adjusted EBITDA1 of $7.5 million, or 10.3% of net sales, compared to $9.8 million, or 11.3% for the prior year third quarter.

•Labor reduction completed in the quarter that is expected to produce annual cost saving of $2.6 million.

•For the three months ended September 30, 2024, 111,884 shares were purchased under the share repurchase authorization at an average price of $17.62.

Nine Month 2024 Highlights

•Total net sales of $239.9 million decreased 15.5% compared to the prior year nine-month period.

•Gross margin of $43.4 million, or 18.1% of net sales, compared to 18.9% of net sales in the prior year nine-month period.

•Selling, general, and administrative expenses of $27.6 million, or 11.5% of net sales, compared to $29.6 million, or 10.4% of net sales for the prior year nine-month period.

•Operating income of $15.8 million, or 6.6% of net sales, compared to operating income of $24.0 million, or 8.5% of net sales for the prior year nine-month period.

•Net income of $13.3 million, or $1.51 per diluted share, compared to net income of $18.1 million, or $2.08 per diluted share for the prior year nine-month period.

•Adjusted EBITDA1 of $27.8 million, or 11.6% of net sales, compared to $35.8 million, or 12.6% for the prior year nine-month period.

1Adjusted EBITDA is a non-GAAP financial measure as defined and reconciled below.

David Duvall, the Company’s President and Chief Executive Officer, said, “Third quarter performance continues to reflect margin stability, cash flow generation, and the execution of critical Invest for Growth strategies. We won $45 million of product sales in the first nine months of 2024, 55% of which is new versus replacement work. We are especially excited about a new program in the medical industry for hospital bed structures. In addition, we have several large program negotiations with our blue-chip customers, which are significant and demonstrate expanded wallet share with existing customers.

“We recently welcomed our newly appointed Chief Commercial Officer, Alex Bantz, and we continue to be highly focused on sales growth in our Must Win Battle for 2024/2025. Alex is now leading our sales transformation initiatives to streamline sales execution processes, drive our Grow Wallet share initiatives, increase capabilities in our Account Management organization, data-driven market analyses, enhance our lead generation processes and increase trade shows displays and attendance. Elements of our specialized teams now ‘own’ each vertical with active sales engagement and cross-selling initiatives to build an active lead generation funnel.

“Our growing sales opportunity pipeline is currently over $275 million. Core’s quote-to-cash cycle begins 12 to 18 months after a project win due to the design and tooling phases, which will positively impact revenues throughout 2025 and into 2026. Core Molding is known as a trusted, highly engineered provider of single-sourced OEM and wholesale products for customers in diverse, growing end markets, which include powersports (outdoor land/marine vehicles), medium- and heavy-duty trucks, building products, industrial/utility, packaging, construction and agricultural products. Our aggressive multi-industry channel expansion plans target a total addressable market of $10+ billion with a focus on higher value solutions, large complex parts and long-term customer partnerships.”

John Zimmer, the Company’s EVP and Chief Financial Officer, commented, “In the third quarter, sales declined by 15.8% compared to the prior year quarter and gross margins were 16.9% of net sales. Gross margins for the first nine months of 2024 were 18.1% within our targeted range of 17% to 19%. Based on a challenging demand environment in the medium term, we recently implemented a labor reduction that impacted plant and headquarters’ fixed payroll costs, and we expect an annual cost saving of $2.6 million. As a reminder, approximately 70% to 75% of Core’s costs are variable, so we have been actively re-baselining costs to align with current demand. We now expect full year 2024 revenues to be down approximately 17%.

“Our balance sheet is strong and total available liquidity was $92.3 million at the end of the third quarter. We generated $23.1 million of free cash flows1 for the first nine months of 2024, compared to $19.3 million in the same period of 2023. The Company remains in a solid cash-generating position after executing operational improvements and other actions. Consistent with our capital allocation strategy, we repurchased approximately 112 thousand shares during the third quarter at an average stock price of $17.62 under our previously announced share repurchase program.”

1Free Cash Flow is a non-GAAP financial measure as defined and reconciled below.

2024 Capital Expenditures

The Company’s capital expenditures for the first nine months of 2024 were $7.0 million. The Company anticipates spending approximately $11 to $13 million for full year 2024 on property, plant and equipment purchases for all of the Company's operations.

Financial Position at September 30, 2024

The Company’s total liquidity at September 30, 2024 was $92.3 million, with $42.3 million in cash, $25.0 million of undrawn capacity under the Company’s revolving credit facility and $25.0 million of undrawn capacity under the

Company's capex credit facility. The Company’s term debt was $22.0 million at September 30, 2024. The term debt-to-trailing twelve months Adjusted EBITDA1 was less than one times trailing twelve months Adjusted EBITDA1 as of September 30, 2024. The Company had a trailing twelve months return on capital employed1 of 10.8% as of September 30, 2024. Excluding accumulated cash available for future investment, return on capital employed1 was 14.4% for the trailing twelve months ending September 30, 2024.

1 Adjusted EBITDA and return on capital employed are non-GAAP financial measures as defined and reconciled below.

Conference Call

The Company will conduct a conference call today at 10:00 a.m. Eastern Time to discuss financial and operating results for the periods ended September 30, 2024. To access the call live by phone, dial (844) 881-0134 and ask for the Core Molding Technologies call at least 10 minutes prior to the start time. A telephonic replay will be available through November 12, 2024, by calling (877) 344-7529 and using passcode ID: 5291745#. A webcast of the call will also be available live and for later replay on the Company’s Investor Relations website at www.coremt.com/investor-relations/events-presentations/.

About Core Molding Technologies, Inc.

Core Molding Technologies is a leading engineered materials company specializing in molded structural products, principally in building products, utilities, transportation and powersports industries across North America. The Company operates in one operating segment as a molder of thermoplastic and thermoset structural products. The Company’s operating segment consists of one reporting unit, Core Molding Technologies. The Company offers customers a wide range of manufacturing processes to fit various program volume and investment requirements. These processes include compression molding of sheet molding compound (“SMC”), resin transfer molding (“RTM”), liquid molding of dicyclopentadiene (“DCPD”), spray-up and hand-lay-up, direct long-fiber thermoplastics (“DLFT”) and structural foam and structural web injection molding (“SIM”). Core Molding Technologies serves a wide variety of markets, including the medium and heavy-duty truck, marine, automotive, agriculture, construction, and other commercial products. The demand for Core Molding Technologies’ products is affected by economic conditions in the United States, Mexico, and Canada. Core Molding Technologies’ operations may change proportionately more than revenues from operations.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws that are subject to risks and uncertainties. These statements often include words such as “believe”, “anticipate”, “plan”, “expect”, “intend”, “will”, “should”, “could”, “would”, “project”, “continue”, “likely”, and similar expressions. In particular, this press release may contain forward-looking statements about the Company’s expectations for future periods with respect to its plans to improve financial results, the future of the Company’s end markets. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: dependence on certain major customers, and potential loss of any major customer due to completion of existing production programs or otherwise; general macroeconomic, social, regulatory and political conditions, including uncertainties surrounding volatility in financial markets; changes in the plastics, transportation, marine and commercial product industries (including changes in demand for production), efforts of the Company to expand its customer base and develop new products to diversify markets, materials and processes and increase operational enhancements; the Company’s initiatives to quote and execute manufacturing processes for new business, acquire raw materials, address inflationary pressures, regulatory matters and labor relations; the Company’s financial position or other financial information; and other risks and uncertainties described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and our subsequent quarterly reports, all of which are available on the SEC and Company website. These statements are based on certain assumptions that the Company has made in light of its experience as well as its perspective on historical trends, current conditions, expected future developments and other factors it believes are appropriate under the

circumstances. Actual results may differ materially from the anticipated results because of certain risks and uncertainties, including those included in the Company’s filings with the SEC. There can be no assurance that statements made in this press release relating to future events will be achieved. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on behalf of the Company are expressly qualified in their entirety by such cautionary statements.

Company Contact:

Core Molding Technologies, Inc.

John Zimmer

Executive Vice President & Chief Financial Officer

jzimmer@coremt.com

Investor Relations Contact:

Three Part Advisors, LLC

Sandy Martin or Steven Hooser

214-616-2207

- Financial Statements Follow –

Core Molding Technologies, Inc.

Consolidated Statements of Operations

(unaudited, in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| | | | | | | | | | | |

| Net sales: | | | | | | | | | | | |

| Products | $ | 71,258 | | | $ | 80,896 | | | $ | 231,045 | | | $ | 274,933 | | | | | |

| Tooling | 1,734 | | | 5,832 | | | 8,835 | | | 9,028 | | | | | |

| Total net sales | 72,992 | | | 86,728 | | | 239,880 | | | 283,961 | | | | | |

| | | | | | | | | | | |

| Total cost of sales | 60,647 | | | 71,450 | | | 196,505 | | | 230,380 | | | | | |

| | | | | | | | | | | |

| Gross margin | 12,345 | | | 15,278 | | | 43,375 | | | 53,581 | | | | | |

| | | | | | | | | | | |

| Selling, general and administrative expense | 8,740 | | | 9,403 | | | 27,550 | | | 29,562 | | | | | |

| | | | | | | | | | | |

| Operating income | 3,605 | | | 5,875 | | | 15,825 | | | 24,019 | | | | | |

| | | | | | | | | | | |

| Other income and expense | | | | | | | | | | | |

| | | | | | | | | | | |

| Net interest expense | (144) | | | 187 | | | (99) | | | 836 | | | | | |

| Net periodic post-retirement benefit | (138) | | | (52) | | | (414) | | | (157) | | | | | |

| Total other (income) and expense | (282) | | | 135 | | | (513) | | | 679 | | | | | |

| | | | | | | | | | | |

| Income before income taxes | 3,887 | | | 5,740 | | | 16,338 | | | 23,340 | | | | | |

| | | | | | | | | | | |

| Income tax expense | 727 | | | 1,386 | | | 3,000 | | | 5,198 | | | | | |

| | | | | | | | | | | |

| Net income | $ | 3,160 | | | $ | 4,354 | | | $ | 13,338 | | | $ | 18,142 | | | | | |

| | | | | | | | | | | |

| Net income per common share: | | | | | | | | | | | |

| Basic | $ | 0.36 | | | $ | 0.50 | | | $ | 1.53 | | | $ | 2.13 | | | | | |

| Diluted | $ | 0.36 | | | $ | 0.49 | | | $ | 1.51 | | | $ | 2.08 | | | | | |

Core Molding Technologies, Inc.

Product Sales by Market

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Medium and heavy-duty truck | $ | 41,324 | | | $ | 46,413 | | | $ | 129,674 | | | $ | 140,104 | |

| Power sports | 16,464 | | | 18,524 | | | 56,225 | | | 59,619 | |

| Building products | 2,348 | | | 4,595 | | | 14,322 | | | 27,301 | |

| Industrial and utilities | 4,961 | | | 6,154 | | | 12,482 | | | 17,525 | |

| All other | 6,161 | | | 5,210 | | | 18,342 | | | 30,384 | |

| Net product revenue | $ | 71,258 | | | $ | 80,896 | | | $ | 231,045 | | | $ | 274,933 | |

Core Molding Technologies, Inc.

Consolidated Balance Sheets

(in thousands)

| | | | | | | | | | | |

| As of | | |

| September 30, | | As of |

| 2024 | | December 31, |

| (unaudited) | | 2023 |

| Assets: | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 42,348 | | | $ | 24,104 | |

| Accounts receivable, net | 36,777 | | | 41,711 | |

| Inventories, net | 20,687 | | | 22,063 | |

| Prepaid expenses and other current assets | 15,686 | | | 15,001 | |

| Total current assets | 115,498 | | | 102,879 | |

| | | |

| Right of use asset | 2,314 | | | 3,802 | |

| Property, plant and equipment, net | 79,171 | | | 81,185 | |

| Goodwill | 17,376 | | | 17,376 | |

| Intangibles, net | 4,827 | | | 6,017 | |

| Other non-current assets | 1,465 | | | 2,118 | |

| Total Assets | $ | 220,651 | | | $ | 213,377 | |

| | | |

| Liabilities and Stockholders' Equity: | | | |

| Liabilities: | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 1,814 | | | $ | 1,468 | |

| | | |

| Accounts payable | 25,011 | | | 23,958 | |

| Contract liabilities | 4,695 | | | 5,204 | |

| Compensation and related benefits | 7,779 | | | 10,498 | |

| Accrued other liabilities | 8,582 | | | 5,058 | |

| Total current liabilities | 47,881 | | | 46,186 | |

| | | |

| Other non-current liabilities | 2,191 | | | 3,759 | |

| Long-term debt | 20,164 | | | 21,519 | |

| Post retirement benefits liability | 2,575 | | | 2,960 | |

| Total Liabilities | 72,811 | | | 74,424 | |

| | | |

| Stockholders' Equity: | | | |

| Common stock | 87 | | | 86 | |

| Paid in capital | 45,332 | | | 43,265 | |

| Accumulated other comprehensive income, net of income taxes | 2,583 | | | 5,301 | |

| Treasury stock | (35,569) | | | (31,768) | |

| Retained earnings | 135,407 | | | 122,069 | |

| Total Stockholders' Equity | 147,840 | | | 138,953 | |

| Total Liabilities and Stockholders' Equity | $ | 220,651 | | | $ | 213,377 | |

Core Molding Technologies, Inc.

Consolidated Statements of Cash Flows

(unaudited, in thousands)

| | | | | | | | | | | |

| Nine months ended September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 13,338 | | | $ | 18,142 | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | |

| Depreciation and amortization | 10,018 | | | 9,575 | |

| Loss on disposal of property, plant and equipment | 241 | | | 80 | |

| | | |

| Share-based compensation | 2,067 | | | 2,223 | |

| | | |

| Losses (gain) on foreign currency | 1,306 | | | 202 | |

| Change in operating assets and liabilities: | | | |

| Accounts receivable | 4,934 | | | (1,677) | |

| Inventories | 1,376 | | | (1,117) | |

| Prepaid and other assets | (2,037) | | | (4,474) | |

| Accounts payable | (270) | | | (414) | |

| Accrued and other liabilities | 56 | | | 4,340 | |

| Post retirement benefits liability | (867) | | | (731) | |

| Net cash provided by operating activities | 30,162 | | | 26,149 | |

| Cash flows from investing activities: | | | |

| Purchase of property, plant and equipment | (7,045) | | | (6,803) | |

| Net cash used in investing activities | (7,045) | | | (6,803) | |

| Cash flows from financing activities: | | | |

| Gross borrowings on revolving loans | — | | | (38,962) | |

| Gross repayment on revolving loans | — | | | 37,098 | |

| Payments for taxes related to net share settlement of equity awards | (1,439) | | | (2,669) | |

| Purchase of treasury shares | (2,364) | | | — | |

| Payment on principal on term loans | (1,071) | | | (961) | |

| Net cash used in financing activities | (4,874) | | | (5,494) | |

| Net change in cash and cash equivalents | 18,243 | | | 13,852 | |

| Cash and cash equivalents at beginning of period | 24,104 | | | 4,183 | |

| Cash and cash equivalents at end of period | $ | 42,347 | | | $ | 18,035 | |

| Cash paid for: | | | |

| Interest | $ | 788 | | | $ | 939 | |

| Income taxes | $ | 1,633 | | | $ | 4,518 | |

| Non cash investing activities: | | | |

| Fixed asset purchases in accounts payable | $ | 245 | | | $ | 848 | |

| | | |

| | | |

Non-GAAP Financial Measures

This press release contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Core Molding management uses non-GAAP measures in its analysis of the Company's performance. Investors are encouraged to review the reconciliation of non-GAAP financial measures to the comparable GAAP results available in the accompanying tables.

Reconciliation of Non-GAAP Financial Measures

Adjusted EBITDA represents net income before, as applicable from time to time, (i) interest expense, net, (ii) provision (benefit) for income taxes, (iii) depreciation and amortization of long-lived assets, (iv) share based compensation expense, (v) plant closure costs, and (vi) nonrecurring legal settlement costs and associated legal expenses unrelated to the Company's core operations. Debt-to-trailing twelve months Adjusted EBITDA represents total outstanding debt divided by trailing twelve months Adjusted EBITDA. Free Cash Flow represents net cash (used in) provided by operating activities less purchase of property, plant and equipment. Trailing twelve months return on capital employed represents the trailing twelve months earnings before (i) interest expense, net and (ii) provision (benefit) for income taxes divided by (i) stockholders' equity and (ii) current and long-term debt. Trailing twelve months return on capital employed excluding cash represents the trailing twelve months earnings before (i) interest expense, net and (ii) provision (benefit) for income taxes divided by (i) stockholders' equity and (ii) current and long-term debt less (iii) cash on hand.

We present Adjusted EBITDA, Adjusted EBITDA as a percent of net sales, debt-to-trailing twelve months Adjusted EBITDA, Free Cash Flow and trailing twelve months Return on Capital Employed because management uses these measures as key performance indicators, and we believe that securities analysts, investors and others use these measures to evaluate companies in our industry. These measures have limitations as analytical tools and should not be considered in isolation or as an alternative to performance measure derived in accordance with GAAP as an indicator of our operating performance. Our calculation of these measures may not be comparable to similarly named measures reported by other companies. The following tables present reconciliations of net income to Adjusted EBITDA, and Cash Flow from Operating Activities to Free Cash Flow, the most directly comparable GAAP measures, and Debt to trailing twelve months Adjusted EBITDA and trailing twelve months Return on Capital Employed, for the periods presented:

Core Molding Technologies, Inc.

Net Income to Adjusted EBITDA Reconciliation

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net income | $ | 3,160 | | | $ | 4,354 | | | $ | 13,338 | | | $ | 18,142 | | | | | |

| Provision for income taxes | 727 | | | 1,386 | | | 3,000 | | | 5,198 | | | | | |

Total other expenses(1) | (282) | | | 135 | | | (513) | | | 679 | | | | | |

| Depreciation and amortization | 3,376 | | | 3,208 | | | 9,956 | | | 9,516 | | | | | |

| Share-based compensation | 562 | | | 736 | | | 2,067 | | | 2,223 | | | | | |

| Adjusted EBITDA | $ | 7,543 | | | $ | 9,819 | | | $ | 27,848 | | | $ | 35,758 | | | | | |

| | | | | | | | | | | |

| Adjusted EBITDA as a percent of net sales | 10.3 | % | | 11.3 | % | | 11.6 | % | | 12.6 | % | | | | |

| | | | | | | | | | | |

(1)Includes net interest expense and non-cash periodic post-retirement benefit cost. |

Core Molding Technologies, Inc.

Computation of Debt to Trailing Twelve Months Adjusted EBITDA

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Q4 2023 | | Q1 2024 | | Q2 2024 | | Q3 2024 | | Trailing Twelve Months |

| Net income | | | $ | 2,182 | | | $ | 3,759 | | | $ | 6,419 | | | $ | 3,160 | | | $ | 15,520 | |

| Provision for income taxes | | | 223 | | | 1,029 | | | 1,246 | | | 727 | | | 3,225 | |

Total other expenses(1) | | | 112 | | | (56) | | | (176) | | | (282) | | | (402) | |

| Depreciation and amortization | | | 3,315 | | | 3,272 | | | 3,308 | | | 3,376 | | | 13,271 | |

| Share-based compensation | | | 700 | | | 739 | | | 766 | | | 562 | | | 2,767 | |

| Adjusted EBITDA | | | $ | 6,532 | | | $ | 8,743 | | | $ | 11,563 | | | $ | 7,543 | | | $ | 34,381 | |

| | | | | | | | | | | |

| Total Outstanding Term Debt as of September 30, 2024 | | | | $ | 21,978 | |

| | | | | | | | | | | |

Debt to Trailing Twelve Months Adjusted EBITDA | | | | 0.64 | |

| | | | | | | | | | | |

(1)Includes net interest expense and non-cash periodic post-retirement benefit cost. |

Core Molding Technologies, Inc.

Computation of Trailing Twelve Months Return on Capital Employed

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Q4 2023 | | Q1 2024 | | Q2 2024 | | Q3 2024 | | Trailing Twelve Months |

| Operating Income | | | $ | 2,517 | | | $ | 4,732 | | | $ | 7,489 | | | $ | 3,605 | | | $ | 18,343 | |

| | | | | | | | | | | |

| Equity | | | | $ | 147,840 | |

| Structured Debt | | | | $ | 21,978 | |

Total Capital Employed | | | | $ | 169,818 | |

| | | | | | | | | | | |

| Return on Capital Employed | | | | 10.8 | % |

Core Molding Technologies, Inc.

Computation of Trailing Twelve Months Return on Capital Employed Excluding Cash

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Q4 2023 | | Q1 2024 | | Q2 2024 | | Q3 2024 | | Trailing Twelve Months |

| Operating Income | | | $ | 2,517 | | | $ | 4,732 | | | $ | 7,489 | | | $ | 3,605 | | | $ | 18,343 | |

| | | | | | | | | | | |

| Equity | | | | $ | 147,840 | |

| Structured Debt | | | | $ | 21,978 | |

| Less Cash | | | | $ | (42,348) | |

Total Capital Employed, Excluding Cash | | | | $ | 127,470 | |

| | | | | | | | | | | |

| Return on Capital Employed, Excluding Cash | | | | 14.4 | % |

Core Molding Technologies, Inc.

Free Cash Flow

Nine Months Ended September 30, 2024 and 2023

(unaudited, in thousands)

| | | | | | | | | | | |

| 2024 | | 2023 |

| Cash flow provided by operations | $ | 30,162 | | | $ | 26,149 | |

| Purchase of property, plant and equipment | (7,045) | | | (6,803) | |

| Free cash flow | $ | 23,117 | | | $ | 19,346 | |

Cover Page

|

May 07, 2024 |

May 09, 2023 |

| Cover [Abstract] |

|

|

| Document Type |

8-K

|

|

| Document Period End Date |

Nov. 05, 2024

|

|

| Entity Registrant Name |

Core Molding Technologies, Inc.

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity File Number |

001-12505

|

|

| Entity Tax Identification Number |

31-1481870

|

|

| Entity Address, Address Line One |

800 Manor Park Drive

|

|

| Entity Address, City or Town |

Columbus

|

|

| Entity Address, State or Province |

OH

|

|

| Entity Address, Postal Zip Code |

43228-0183

|

|

| City Area Code |

614

|

|

| Local Phone Number |

870-5000

|

|

| Written Communications |

false

|

|

| Soliciting Material |

false

|

|

| Pre-commencement Tender Offer |

false

|

|

| Pre-commencement Issuer Tender Offer |

false

|

|

| Title of 12(b) Security |

|

Common Stock, par value $0.01

|

| Trading Symbol |

|

CMT

|

| Security Exchange Name |

|

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

|

| Document Information [Line Items] |

|

|

| Document Period End Date |

Nov. 05, 2024

|

|

| Entity Registrant Name |

Core Molding Technologies, Inc.

|

|

| Entity Central Index Key |

0001026655

|

|

| Amendment Flag |

false

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

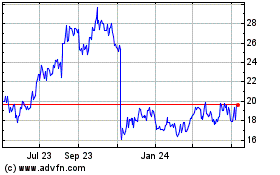

Core Molding Technologies (AMEX:CMT)

Historical Stock Chart

From Feb 2025 to Mar 2025

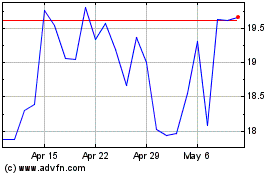

Core Molding Technologies (AMEX:CMT)

Historical Stock Chart

From Mar 2024 to Mar 2025