Caledonia Mining Corporation Plc ("Caledonia" or the

"Company") (NYSE AMERICAN: CMCL; AIM: CMCL; VFEX: CMCL) announces

its operating and financial results for the quarter and the nine

months ended September 30, 2023 (the "Quarter" and "nine

months" respectively). Further information on the financial

and operating results for the Quarter and nine months can be found

in the management discussion and analysis ("MD&A") and the

unaudited financial statements, which are available on the

Company's website and are being filed on SEDAR.

This Quarter’s results demonstrate a significant

improvement in the production performance of Blanket Mine

(“Blanket”), which reported record quarterly production. This

Quarter was also the last quarter to be affected by the negative

contribution from the Bilboes oxide mine prior to being placed on

care and maintenance from 1 October 2023. This will reduce monthly

costs from approximately $1 million to approximately $200,000 at

Bilboes.

Financial

Highlights

-

Revenues in the Quarter of $41.2 million, a record quarterly

performance for the Group. Nine months’ revenue of $107.7 million

is in line with the prior year performance.

-

Gross profit in the Quarter of $14.1 million and EBITDA1

of $15.5 million, 2.5 per cent lower than the $15.9

million in the third quarter of 2022 (“Q3 2022” or the

“comparative quarter”).

-

Consolidated on-mine cost per ounce for the Quarter of $928 (Q3

2022: $734 per ounce). The increase was mainly due to the

high cost per ounce at the Bilboes oxide mine, which has

subsequently been placed on care and maintenance. On-mine costs at

Blanket were $817 per ounce, an 11.3 per cent increase from the

comparative quarter with the increase being due to higher labour

and electricity costs.

-

All-in sustaining cost ("AISC") at Blanket for the Quarter was

$1,171 per ounce (Q3 2022: $962), the increase being due to the

higher on-mine cost per ounce and higher sustaining capital

expenditure and administrative expenses. The group’s AISC for the

Quarter was higher, at $1,268 per ounce, reflecting the costs of

Bilboes which have now materially reduced having entered care and

maintenance.

-

Basic IFRS earnings per share ("EPS") for the Quarter of 24.1

cents (Q3 2022: 65.4 cents).

-

Adjusted EPS2 for the Quarter of 33.0 cents (Q3

2022: 60.7 cents).

-

Net cash from operating activities in the Quarter of $14.5

million (Q3 2022: $8.9 million).

-

Net debt at the end of the Quarter of $3.2 million (Q3

2022: net cash $6.2 million. Q2 2023: net debt $2.9 million).

Notwithstanding the very strong operating cash flow in the Quarter,

net cash and cash equivalents decreased in the Quarter due to the

negative cash flows at the Bilboes oxides mine and the continued

high level of capital investment at Blanket, principally on a new

tailings storage facility.

-

A dividend of 14 cents per share was paid in July

2023; a further dividend at the same rate of 14 cents per

share was paid in October 2023, being the 40th quarterly

dividend paid by the Company since it began paying dividends in

2013.

________________________1 Adjusted EBITDA excludes asset

impairments, depreciation and net foreign exchange movements. 2

Adjusted EPS excludes net foreign exchange movements (including the

deferred tax effect and the non-controlling interest thereon) and

deferred tax. A reconciliation of IFRS EPS to Adjusted EPS is set

out in section 10.3 of the MD&A.

Operating

Highlights

-

21,772 ounces of gold were produced at Blanket in the Quarter,

three per cent higher than the 21,120 ounces produced in Q3 2022

and a new quarterly production record.

- Gold produced at Blanket in the

nine months was 55,244 ounces.

- Caledonia reiterates its gold

production guidance for 2023 of between 75,000 and 80,000 ounces at

Blanket.

Bilboes gold

project

- Mining and metallurgical processing continued at the Bilboes

oxide mine until the end of September after which the operation

returned to care and maintenance, resulting in a substantial

reduction in monthly costs from approximately $1 million to

approximately $200,000. After taking account of revenues arising

from the sale of gold that will be extracted from the heap leach,

Bilboes is expected to operate on a break-even basis for the

remainder of the year.

- 1,151 ounces of gold were produced from the Bilboes oxide mine

in the Quarter, showing an increase from the 1,076 ounces produced

in the second quarter of 2023. Leaching of material that has

already been deposited on the leach pad will continue for the

remainder of 2023.

- Oxide mining will resume when the stripping of the waste for

the sulphide project commences.

- Work continues on a revised feasibility study for the Bilboes

sulphide project with a focus on capital allocation with a view to

maximising future shareholder value. This may result in a phased

approach to the project to reduce the initial capital requirement.

A phased approach requires a completely new approach to the

feasibility study (rather than an update to the existing

feasibility study); the initial results of the work on the phased

approach are expected in early 2024.

Other

-

On August 7, 2023, an accident took place at Blanket and, as a

result, an employee of GMG Pty Ltd, a company contracted

to Blanket, succumbed to his injuries in hospital. Caledonia

and Blanket express their sincere condolences to the family and

colleagues of the deceased.

-

The ongoing underground drilling program at Blanket targeted

the Eroica ore body and has yielded encouraging results (as

announced on July 10, 2023).

-

Following a tender process, the Company received an offer from a

global solar operator to buy the solar plant. It is proposed that

the new owner exclusively supplies Blanket with electricity from

the current plant, on a take-or-pay basis, and in doing so secures

some of Blanket’s future power supply. Negotiation of contracts and

commercial terms is continuing.

-

The Environmental Impact Assessment at Motapa has been approved as

a precursor to the start of on-the-ground exploration

activities.

Strategy and Outlook: increased focus on growth

opportunities

-

Maintain production at Blanket at the targeted range of 75,000 -

80,000 ounces for 2023 and at a similar level in 2024.

-

Continue deep level drilling at Blanket with the objective of

further upgrading inferred mineral resources, thereby extending the

life of mine.

-

Complete the feasibility study on the Bilboes sulphide project to

determine the best implementation strategy with a view to optimal

capital allocation and to estimate the revised funding

requirements.

-

Commence the first phase of exploration at Motapa.

Commenting on the

announcement, Mark Learmonth, Chief Executive Officer,

said:

“Production at Blanket in the Quarter was

excellent: Blanket is now operating as expected having achieved

record gold production in the Quarter. Management is exploring

initiatives to further improve mining efficiencies and manage

operating costs.

“The Bilboes oxide mine has been a

disappointment and as a result of operating losses incurred at

Bilboes it has been returned to care and maintenance with effect

from 1 October; from October onwards, the monthly holding cost of

Bilboes is expected to be significantly reduced to approximately

$200,000 per month. In due course, the remaining oxide material

will be mined and processed alongside the sulphide ore. This

outcome has no bearing on the viability of the much larger sulphide

project which was the reason for acquiring Bilboes.

“The solar plant which

was commissioned in early 2023 continues to operate well. The solar

plant is owned by Caledonia rather than by Blanket and therefore

the economic benefit arising from the solar plant has been realised

in the consolidated all-in sustaining cost rather than the on-mine

cost. An offer has been received from a global solar operator to

buy the solar plant and the sale process is underway.

“As previously

announced, encouraging results were received during the Quarter

from the ongoing underground drilling program

at Blanket which currently targets the Eroica ore body.

Initial results indicate that the Eroica ore body has better grades

and widths than expected. These results indicate that there is

additional mineralisation that may, in due course, be accessed

using the current infrastructure and which should further extend

the life of mine. Blanket continues to provide a solid foundation

for the Company, providing us with a platform for our other growth

projects in Zimbabwe.

“We continue to work

on a revised feasibility study for the sulphide project at Bilboes

which will consider updated commercial assumptions and

will inform the most judicious way to commercialise the

project with the objective of providing the best returns for

investors. I look forward to providing an update on our progress in

due course.”

Caledonia will host an online

presentation and Q&A session open to all investors on 16

November at 14.00 London Time

The zoom details are set out below:

When: Nov 16, 2023 02:00 PM LondonTopic: Q3 2023 call for

shareholdersRegister in advance for this webinar:

https://caledoniamining.zoom.us/webinar/register/WN_BTWfQYBxSnOrfd2uh623KQ

After registering, you will receive a confirmation email

containing information about joining the webinar.

Enquiries:

|

Caledonia Mining Corporation PlcMark

LearmonthCamilla Horsfall |

Tel: +44 1534 679 800Tel: +44 7817 841 793 |

|

|

|

|

Cavendish Capital Markets Limited (Nomad and Joint

Broker)Adrian Hadden Pearl Kellie |

Tel: +44 207 397 1965Tel: +44 131 220 9775 |

|

|

|

|

Liberum Capital Limited (Joint Broker)Scott

Mathieson/Kane Collings |

Tel: +44 20 3100 2000 |

|

|

|

|

BlytheRay Financial PR (UK)Tim Blythe/Megan

Ray |

Tel: +44 207 138 3204 |

|

|

|

|

3PPB (Financial PR, North America)Patrick

ChidleyPaul Durham |

Tel: +1 917 991 7701Tel: +1 203 940 2538 |

|

|

|

|

Curate Public Relations (Zimbabwe)Debra

Tatenda |

Tel: +263 77802131 |

|

|

|

|

IH Securities (Private) Limited (VFEX Sponsor -

Zimbabwe)Lloyd Mlotshwa |

Tel: +263 (242) 745 119/33/39 |

|

|

|

The information contained within this

announcement is deemed by the Company to constitute inside

information under the Market Abuse Regulation (EU) No.

596/2014 (“MAR”) as it forms part

of UK domestic law by virtue of the European Union (Withdrawal) Act

2018 and is disclosed in accordance with the

Company's obligations under Article 17 of MAR.

Cautionary Note Concerning

Forward-Looking InformationInformation and statements

contained in this news release that are not historical facts are

“forward-looking information” within the meaning of applicable

securities legislation that involve risks and uncertainties

relating, but not limited, to Caledonia’s current expectations,

intentions, plans, and beliefs. Forward-looking information can

often be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “target”, “intend”,

“estimate”, “could”, “should”, “may” and “will” or the negative of

these terms or similar words suggesting future outcomes, or other

expectations, beliefs, plans, objectives, assumptions, intentions

or statements about future events or performance. Examples of

forward-looking information in this news release include:

production guidance, estimates of future/targeted production rates,

the satisfaction of all conditions precedent in connection with the

acquisition of Bilboes, the completion of the acquisition and the

issuance of the acquisition consideration, our plans regarding a

new feasibility study for Bilboes, the restarting of the Bilboes

oxides operation, our plans and timing regarding further

exploration and development and the commissioning of the solar

plant. The forward-looking information contained in this news

release is based, in part, on assumptions and factors that may

change or prove to be incorrect, thus causing actual results,

performance or achievements to be materially different from those

expressed or implied by forward-looking information. Such factors

and assumptions include, but are not limited to: the establishment

of estimated resources and reserves, the grade and recovery of

minerals which are mined varying from estimates, success of future

exploration and drilling programs, reliability of drilling,

sampling and assay data, the representativeness of mineralization

being accurate, success of planned metallurgical test-work, capital

availability and accuracy of estimated operating costs, obtaining

required governmental, environmental or other project approvals,

inflation, changes in exchange rates, fluctuations in commodity

prices, delays in the development of projects and Caledonia’s

experience of project development in Zimbabwe and other

factors.

To the extent any

forward-looking information herein constitutes a financial outlook

or future oriented financial information,any such statement is made

as of the date hereof and included herein to provide prospective

investors with an understanding of the Company's plans and

assumptions. Security holders, potential security holders and

other prospective investors should be aware that these statements

are subject to known and unknown risks, uncertainties and other

factors that could cause actual results to differ materially from

those suggested by the forward-looking statements. Such factors

include, but are not limited to: risks relating to the completion

of the acquisition of Bilboes, risks relating to estimates of

mineral reserves and mineral resources proving to be inaccurate,

fluctuations in gold price, risks and hazards associated with the

business of mineral exploration, development and mining, risks

relating to the credit worthiness or financial condition of

suppliers, refiners and other parties with whom the Company does

business; inadequate insurance, or inability to obtain insurance,

to cover these risks and hazards, employee relations; relationships

with and claims by local communities and indigenous populations;

political risk; risks related to natural disasters, terrorism,

civil unrest, public health concerns (including health epidemics or

outbreaks of communicable diseases such as the coronavirus

(COVID-19)); availability and increasing costs associated with

mining inputs and labour; the speculative nature of mineral

exploration and development, including the risks of obtaining or

maintaining necessary licenses and permits, diminishing quantities

or grades of mineral reserves as mining occurs; global financial

condition, the actual results of current exploration activities,

changes to conclusions of economic evaluations, and changes in

project parameters to deal with unanticipated economic or other

factors, risks of increased capital and operating costs,

environmental, safety or regulatory risks, expropriation, the

Company’s title to properties including ownership thereof,

increased competition in the mining industry for properties,

equipment, qualified personnel and their costs, risks relating to

the uncertainty of timing of events including targeted production

rate increase and currency fluctuations. Security holders,

potential security holders and other prospective investors are

cautioned not to place undue reliance on forward-looking

information. By its nature, forward-looking information involves

numerous assumptions, inherent risks and uncertainties, both

general and specific, that contribute to the possibility that the

predictions, forecasts, projections and various future events will

not occur. Caledonia undertakes no obligation to update publicly or

otherwise revise any forward-looking information whether as a

result of new information, future events or other such factors

which affect this information, except as required by law.

National Instrument 43-101 - Standards of

Disclosure for Mineral Projects (“NI 43-101”) is a rule of the

Canadian Securities Administrators which establishes standards for

all public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Unless otherwise

indicated, all reserves and resource estimates contained in this

press release have been prepared in accordance with NI 43-101 and

the Canadian Institute of Mining, Metallurgy and Petroleum

Classification System. These standards differ from the requirements

of the U.S. Securities and Exchange Commission (the “SEC”), and

reserve and resource information contained in this press release

may not be comparable to similar information disclosed by U.S.

companies. The requirements of NI 43-101 for identification of

reserves and resources are also not the same as those of the SEC,

and any reserves or resources reported in compliance with NI 43-101

may not qualify as “reserves” or “resources” under SEC standards.

Accordingly, the mineral reserve and resource information set forth

herein may not be comparable to information made public by

companies that report in accordance with United States

standards.

This news release is not an offer of the shares

of Caledonia for sale in the United States or elsewhere. This news

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of the shares of

Caledonia, in any province, state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such province, state

or jurisdiction.

|

Condensed Consolidated Statements of profit or loss and

Other comprehensive income (Unaudited) |

|

|

($’000’s) |

|

|

|

|

|

|

|

|

|

|

|

3 months endedSeptember 30 |

9 months endedSeptember 30 |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

Revenue |

41,187 |

|

35,840 |

|

107,653 |

|

107,904 |

|

|

|

Royalty |

(2,207 |

) |

(1,796 |

) |

(5,650 |

) |

(5,408 |

) |

|

|

Production costs |

(20,452 |

) |

(15,802 |

) |

(61,028 |

) |

(44,663 |

) |

|

|

Depreciation |

(4,385 |

) |

(2,670 |

) |

(10,049 |

) |

(7,372 |

) |

|

|

Gross

profit |

14,143 |

|

15,572 |

|

30,926 |

|

50,461 |

|

|

|

Other income |

62 |

|

14 |

|

127 |

|

17 |

|

|

|

Other expenses |

(701 |

) |

(552 |

) |

(2,800 |

) |

(1,835 |

) |

|

|

Administrative expenses |

(2,889 |

) |

(2,789 |

) |

(11,890 |

) |

(8,068 |

) |

|

|

Net foreign exchange (loss)

gain |

(257 |

) |

1,559 |

|

(2,334 |

) |

6,640 |

|

|

|

Cash-settled share-based

expense |

(27 |

) |

(25 |

) |

(298 |

) |

(335 |

) |

|

|

Equity-settled share-based

expense |

(233 |

) |

(94 |

) |

(564 |

) |

(176 |

) |

|

|

Net derivative financial

instrument expenses |

(102 |

) |

537 |

|

(590 |

) |

(1,160 |

) |

|

|

Operating

profit |

9,996 |

|

14,222 |

|

12,577 |

|

45,544 |

|

|

|

Net finance costs |

(508 |

) |

(9 |

) |

(2,332 |

) |

(300 |

) |

|

|

Profit before

tax |

9,488 |

|

14,213 |

|

10,245 |

|

45,244 |

|

|

|

Tax expense |

(3,777 |

) |

(4,018 |

) |

(8,552 |

) |

(14,051 |

) |

|

|

Profit for the

period |

5,711 |

|

10,195 |

|

1,693 |

|

31,193 |

|

|

|

|

|

|

|

|

|

|

Other comprehensive

income |

|

|

|

|

|

|

Items that are or may

be reclassified to profit or loss |

|

|

|

|

|

|

Exchange differences on

translation of foreign operations |

(79 |

) |

(699 |

) |

(778 |

) |

(858 |

) |

|

|

Total comprehensive

income for the period |

5,632 |

|

9,496 |

|

915 |

|

30,335 |

|

|

|

|

|

|

|

|

|

|

Profit (loss)

attributable to: |

|

|

|

|

|

|

Owners of the Company |

4,506 |

|

8,614 |

|

(1,036 |

) |

25,932 |

|

|

|

Non-controlling interests |

1,205 |

|

1,581 |

|

2,729 |

|

5,261 |

|

|

|

Profit for the

period |

5,711 |

|

10,195 |

|

1,693 |

|

31,193 |

|

|

|

|

|

|

|

|

|

|

Total comprehensive

income attributable to: |

|

|

|

|

|

|

Owners of the Company |

4,427 |

|

7,915 |

|

(1,814 |

) |

25,074 |

|

|

|

Non-controlling interests |

1,205 |

|

1,581 |

|

2,729 |

|

5,261 |

|

|

|

Total comprehensive

income for the period |

5,632 |

|

9,496 |

|

915 |

|

30,335 |

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per

share (cents) |

|

|

|

|

|

|

Basic |

24.1 |

|

65.4 |

|

(6.8 |

) |

197.7 |

|

|

|

Diluted |

14.7 |

|

65.4 |

|

(5.5 |

) |

197.7 |

|

|

|

Adjusted earnings per

share (cents) |

|

|

|

|

|

|

Basic |

33.0 |

|

60.7 |

|

15.2 |

|

178.8 |

|

|

|

Dividends paid per share (cents) |

14.0 |

|

14.0 |

|

56.0 |

|

42.0 |

|

|

Summarised Consolidated Statements of Financial Position

(Unaudited) |

|

($’000’s) |

As at |

Sep-30 |

Dec-31 |

|

|

|

|

2023 |

2022 |

|

|

Total non-current assets |

|

265,813 |

196,764 |

|

|

Inventories |

|

18,826 |

18,334 |

|

|

Prepayments |

|

5,093 |

3,693 |

|

|

Trade and other receivables |

|

5,749 |

9,185 |

|

|

Income tax receivable |

|

- |

40 |

|

|

Cash and cash equivalents |

|

10,775 |

6,735 |

|

|

Derivative financial assets |

|

684 |

440 |

|

|

Assets held for sale |

|

13,397 |

- |

|

|

Total assets |

|

320,337 |

235,191 |

|

|

Total non-current liabilities |

|

18,211 |

9,291 |

|

|

Loan notes payable – short term portion |

|

665 |

7,104 |

|

|

Lease liabilities – short term portion |

|

138 |

132 |

|

|

Trade and other payables |

|

17,459 |

17,454 |

|

|

Income tax payable |

|

2,841 |

1,324 |

|

|

Cash-settled share-based payments - short term portion |

|

674 |

1,188 |

|

|

Derivative financial liabilities |

|

22 |

- |

|

|

Overdraft |

|

13,967 |

5,239 |

|

|

Total liabilities |

|

53,977 |

41,732 |

|

|

Total equity |

|

266,360 |

193,459 |

|

|

Total equity and liabilities |

|

320,337 |

235,191 |

|

|

Condensed Consolidated Statements of Cash Flows

(Unaudited) |

|

($’000’s) |

|

|

|

|

|

|

|

|

|

|

3 months ended September 30 |

9 months ended September 30 |

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

Cash inflow from operations |

16,963 |

|

11,717 |

|

17,629 |

|

41,901 |

|

|

Interest received |

21 |

|

7 |

|

30 |

|

10 |

|

|

Finance costs paid |

(331 |

) |

(34 |

) |

(1,762 |

) |

(126 |

) |

|

Tax paid |

(2,158 |

) |

(2,767 |

) |

(4,504 |

) |

(5,993 |

) |

|

Net cash inflow from operating activities |

14,495 |

|

8,923 |

|

11,393 |

|

35,792 |

|

|

|

|

|

|

|

|

Cash flows used in investing activities |

|

|

|

|

|

Acquisition of property, plant and equipment |

(9,573 |

) |

(10,840 |

) |

(20,175 |

) |

(33,585 |

) |

|

Acquisition of exploration and evaluation assets |

(597 |

) |

(311 |

) |

(880 |

) |

(947 |

) |

|

Acquisition of put options |

(1 |

) |

- |

|

(812 |

) |

- |

|

|

Net cash used in investing activities |

(10,171 |

) |

(11,151 |

) |

(21,867 |

) |

(34,532 |

) |

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

Dividends paid |

(2,801 |

) |

(2,709 |

) |

(8,118 |

) |

(7,197 |

) |

|

Payment of lease liabilities |

(36 |

) |

(36 |

) |

(108 |

) |

(115 |

) |

|

Repayments gold loan |

- |

|

- |

|

- |

|

(3,698 |

) |

|

Proceeds from call options |

- |

|

415 |

|

- |

|

239 |

|

|

Shares issued - equity raise (net of transaction cost) |

- |

|

- |

|

15,658 |

|

- |

|

|

Loan note instruments - Motapa payment |

(563 |

) |

- |

|

(7,250 |

) |

- |

|

|

Loan note instruments - Solar bond issue receipts (net of

transaction cost) |

- |

|

- |

|

7,000 |

|

- |

|

|

Net cash from/(used in) financing activities |

(3,400 |

) |

(2,330 |

) |

7,182 |

|

(10,771 |

) |

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

|

|

|

|

Effect of exchange rate fluctuations on cash and cash

equivalents |

(1,209 |

) |

(137 |

) |

(1,396 |

) |

(587 |

) |

|

Net cash and cash equivalents at beginning of the period |

(2,907 |

) |

10,862 |

|

1,496 |

|

16,265 |

|

|

Net cash and cash equivalents at end of the

period |

(3,192 |

) |

6,167 |

|

(3,192 |

) |

6,167 |

|

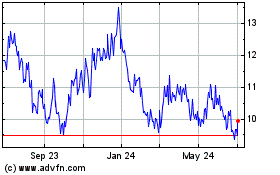

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Oct 2024 to Nov 2024

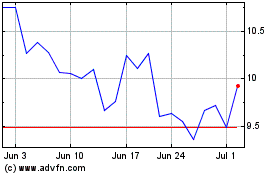

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Nov 2023 to Nov 2024