Caledonia Mining Corporation Plc (“Caledonia” or the “Company”)

(NYSE AMERICAN: CMCL; AIM: CMCL; VFEX: CMCL) is pleased to announce

that it has purchased Motapa Mining Company UK Limited, the parent

company of a Zimbabwe subsidiary which holds a registered mining

lease over the Motapa gold exploration property in Southern

Zimbabwe (“Motapa” or the “Project”). The Company has made the

purchase from Bulawayo Mining Company Limited, a privately owned UK

company. The purchase price is undisclosed but is below the

regulatory disclosure threshold.

Highlights

-

Caledonia considers Motapa to be highly prospective and

strategically important to its growth ambitions in Zimbabwe in

terms of both location and scale.

-

Motapa is a large exploration property which is contiguous to the

Bilboes gold project in respect of which Caledonia announced that

it had entered into a binding sale and purchase agreement in July

2022.

-

The Project was formerly owned and explored by Anglo American

Zimbabwe prior to its exit from the Zimbabwean gold sector in the

late 1990s. The Project is approximately 75km north of Bulawayo

with a mining lease covering approximately 2,200 hectares.

-

The Motapa asset has been mined throughout most of the second half

of the 20th century, Caledonia Mining understands that during this

period the region produced as much as 300,000oz of gold. Whilst

none of the mining infrastructure remains, the evidence of

historical mining will provide guidance to our exploration team in

best understanding the prospectivity of the region.

Commenting on the acquisition, Mark Learmonth, Chief Executive

Officer, said:

“We are pleased to have concluded the purchase

of Motapa. Given its large scale, excellent geological

prospectivity and its strategic location adjacent to Bilboes,

Motapa was a high priority acquisition for Caledonia. We look

forward to developing an exploration program for Motapa as we

target a large-scale gold belt surrounding the Bilboes project.

“With the central shaft at Blanket now fully

operational and production targeting 80,000 ounces of gold per

year1 we anticipate that we will deploy the incremental cash flow

arising from Blanket into our exciting exploration and project

development portfolio in Zimbabwe.

“The acquisition of Motapa following the signing

of a sale and purchase agreement to acquire Bilboes and the

acquisition of Maligreen demonstrates that over the last 12 months

Caledonia has established a pipeline of high-quality exploration

and development projects. This is in addition to the potential for

further growth at Blanket where we are optimistic about its

exploration potential.”

The image below illustrates the location of Motapa in comparison

to the Bilboes project:

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/52fac47f-2ddc-4da1-bf48-8963d107b64c

Note that the Bilboes claim boundary is not limited to the area

highlighted in the image

|

Caledonia Mining Corporation PlcMark

LearmonthCamilla Horsfall |

Tel: +44 1534 679 802Tel: +44 7817 841793 |

|

Cenkos Securities plc (Nomad and Joint

Broker)Adrian HaddenNeil McDonaldPearl Kellie |

Tel: +44 207 397 1965Tel: +44 131

220 9771Tel: +44 131 220 9775 |

| Liberum Capital Limited

(Joint Broker)Scott Mathieson/Kane Collings |

Tel: +44 20 3100 2000 |

| BlytheRay Financial

PRTim Blythe/Megan Ray |

Tel: +44 207 138 3204 |

| 3PPBPatrick

ChidleyPaul Durham |

Tel: +1 917 991 7701Tel: +1 203

940 2538 |

| Curate Public Relations

(Zimbabwe)Debra Tatenda |

Tel: +263 77802131 |

| IH Securities (Private)

Limited (VFEX Sponsor - Zimbabwe)Dzika DhanaLloyd

Mlotshwa |

Tel: +263 (242) 745

119/33/39 |

Note: The information contained within

this announcement is deemed by the Company to constitute inside

information under the Market Abuse Regulation (EU) No.

596/2014 (“MAR”) as it forms part

of UK domestic law by virtue of the European Union (Withdrawal) Act

2018 and is disclosed in accordance with the

Company's obligations under Article 17 of MAR.

Cautionary Note Concerning

Forward-Looking InformationInformation and statements

contained in this news release that are not historical facts are

“forward-looking information” within the meaning of applicable

securities legislation that involve risks and uncertainties

relating, but not limited, to Caledonia’s current expectations,

intentions, plans, and beliefs. Forward-looking information can

often be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “target”, “intend”,

“estimate”, “could”, “should”, “may” and “will” or the negative of

these terms or similar words suggesting future outcomes, or other

expectations, beliefs, plans, objectives, assumptions, intentions

or statements about future events or performance. Examples of

forward-looking information in this news release include:

production guidance, estimates of future/targeted production rates,

the execution of a sale and purchase agreement, the satisfaction of

all conditions precedent in connection with the acquisition, the

completion of the acquisition and the issuance of the acquisition

consideration, our plans regarding a modified development plan with

a phased approach with lower initial production and a lower peak

funding requirement and our plans and timing regarding further

exploration and drilling and development. The forward-looking

information contained in this news release is based, in part, on

assumptions and factors that may change or prove to be incorrect,

thus causing actual results, performance or achievements to be

materially different from those expressed or implied by

forward-looking information. Such factors and assumptions include,

but are not limited to: the establishment of estimated resources

and reserves, the grade and recovery of minerals which are mined

varying from estimates, success of future exploration and drilling

programs, reliability of drilling, sampling and assay data, the

representativeness of mineralization being accurate, success of

planned metallurgical test-work, capital availability and accuracy

of estimated operating costs, obtaining required governmental,

environmental or other project approvals, inflation, changes in

exchange rates, fluctuations in commodity prices, delays in the

development of projects, the assessment of the existing capital

intensity of the Bilboes gold project and Caledonia’s experience of

project development in Zimbabwe and other factors.

Security holders, potential security holders and

other prospective investors should be aware that these statements

are subject to known and unknown risks, uncertainties and other

factors that could cause actual results to differ materially from

those suggested by the forward-looking statements. Such factors

include, but are not limited to: risks relating to the completion

of the acquisition, risks relating to estimates of mineral reserves

and mineral resources proving to be inaccurate, fluctuations in

gold price, risks and hazards associated with the business of

mineral exploration, development and mining, risks relating to the

credit worthiness or financial condition of suppliers, refiners and

other parties with whom the Company does business; inadequate

insurance, or inability to obtain insurance, to cover these risks

and hazards, employee relations; relationships with and claims by

local communities and indigenous populations; political risk; risks

related to natural disasters, terrorism, civil unrest, public

health concerns (including health epidemics or outbreaks of

communicable diseases such as the coronavirus (COVID-19));

availability and increasing costs associated with mining inputs and

labour; the speculative nature of mineral exploration and

development, including the risks of obtaining or maintaining

necessary licenses and permits, diminishing quantities or grades of

mineral reserves as mining occurs; global financial condition, the

actual results of current exploration activities, changes to

conclusions of economic evaluations, and changes in project

parameters to deal with unanticipated economic or other factors,

risks of increased capital and operating costs, environmental,

safety or regulatory risks, expropriation, the Company’s title to

properties including ownership thereof, increased competition in

the mining industry for properties, equipment, qualified personnel

and their costs, risks relating to the uncertainty of timing of

events including targeted production rate increase and currency

fluctuations. Security holders, potential security holders and

other prospective investors are cautioned not to place undue

reliance on forward-looking information. By its nature,

forward-looking information involves numerous assumptions, inherent

risks and uncertainties, both general and specific, that contribute

to the possibility that the predictions, forecasts, projections and

various future events will not occur. Caledonia undertakes no

obligation to update publicly or otherwise revise any

forward-looking information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law.

National Instrument 43-101 - Standards of

Disclosure for Mineral Projects (“NI 43-101”) is a rule of the

Canadian Securities Administrators which establishes standards for

all public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Unless otherwise

indicated, all reserves and resource estimates contained in this

press release have been prepared in accordance with NI 43-101 and

the Canadian Institute of Mining, Metallurgy and Petroleum

Classification System. These standards differ from the requirements

of the U.S. Securities and Exchange Commission (the “SEC”), and

reserve and resource information contained in this press release

may not be comparable to similar information disclosed by U.S.

companies. The requirements of NI 43-101 for identification of

reserves and resources are also not the same as those of the SEC,

and any reserves or resources reported in compliance with NI 43-101

may not qualify as “reserves” or “resources” under SEC standards.

Accordingly, the mineral reserve and resource information set forth

herein may not be comparable to information made public by

companies that report in accordance with United States

standards.

This news release is not an offer of the shares

of Caledonia for sale in the United States or elsewhere. This news

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of the shares of

Caledonia, in any province, state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such province, state

or jurisdiction.

1 Refer to the

technical report entitled "Caledonia Mining Corporation Plc NI

43-101 Technical Report on the Blanket Gold Mine, Zimbabwe" dated

May 17, 2021 prepared by Minxcon (Pty) Ltd and filed by the Company

on SEDAR on May 26, 2021.

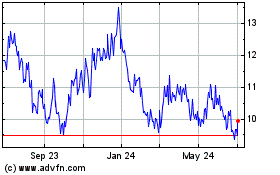

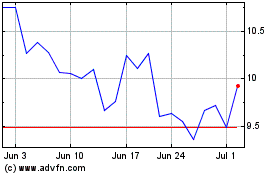

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Apr 2024 to May 2024

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From May 2023 to May 2024