This press release constitutes a "designated

news release" for the purposes of the Company's prospectus

supplement dated May 17, 2021, to its short form base shelf

prospectus dated January 29, 2021.

Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”), a growing North American

precious metals producer, is pleased to provide the Company’s

attributable silver production, silver equivalent production, cost

and capital expenditure guidance for 2023 and production outlook

for 2024.

Highlights

- The Company’s attributable silver equivalent1 production is

expected to increase to a range of 5.5 – 6.0 million ounces in 2023

with further increases anticipated to result in production of

between 6.5 – 7.0 million ounces in 2024. Attributable silver

production forecast for 2023 is between 2.2 – 2.6 million ounces,

with further increases anticipated to result in production of 3.5 -

4.0 million ounces in 2024.

- Year-over-year, attributable silver production is expected to

increase in 2023 by over 80% based on the mid-point of the expected

2023 guidance range, while attributable silver equivalent

production is expected to increase in 2023 by approximately

10%.

- Silver production is expected to increase in 2023 as a result

of: i) a higher portion of production coming from the higher-grade

silver Upper Zone of the San Rafael deposit at the Cosalá

Operations; ii) a full year of production from the 3700 Level at

the Galena Complex which contains higher grade ore as well as the

completion of the Galena Hoist project before H2-2023.

- Sustaining and discretionary growth capital expenditures in

2023 are expected to be roughly in-line with 2022 actuals.

Capitalized exploration costs will be higher as a $1.2 million

drill program is expected to test the Cosalá North prospect in

2023.

- 2022 attributable production was 1.31 million silver ounces and

5.3 million silver equivalent ounces. 2022 attributable cash cost

per silver ounce2 and all-in sustaining cost per silver ounce2 were

approximately $0.77 per silver ounce and $9.63 per silver ounce,

respectively.

“The Company’s 2023 guidance and 2024 production outlook is

expected to continue to deliver solid organic production increases

and substantial silver optionality to our stakeholders over the

next several years,” stated Americas President and CEO Darren

Blasutti. “The Galena Hoist project is nearing completion and is

expected before H2-2023 while the Cosalá Operations are actively

mining the higher-grade silver zones, both of which are expected to

boost attributable silver production by over 80% in 2023.”

Consolidated 2023 Attributable Guidance and 2024 Attributable

Production Outlook*

2022 Actual

2023 Guidance

2024 Outlook

Silver Production (ounces)

1.31 Moz

2.2 – 2.6 Moz

3.5 – 4.0 Moz

Zinc Production (million pounds)

39.3 Mlbs

33.0 – 37.0 Mlbs

23.0 – 27.0 Mlbs

Lead Production (million pounds)

24.6 Mlbs

22.0 – 26.0 Mlbs

18.0 – 22.0 Mlbs

Copper Production (million pounds)

–

–

1.5 – 2.0 Mlbs

Silver Equivalent Production

(ounces)

5.3 Moz

5.5 – 6.0 Moz

6.5 – 7.0 Moz

Cash costs ($ per silver ounce)

$0.77/oz

$8.00 – 9.00/oz

Capital Expenditures ($) – Sustaining

$9.0 M

$9.0 – 10.0 M

–

Discretionary

$4.0 M

$3.0 – 4.0 M

Exploration Drilling ($)

– Discretionary

$2.6 M

$3.0 – 4.0 M

* Guidance for 2023 and production outlook for 2024 include only

the Cosalá Operations and the Galena Complex (60%). Silver

equivalent production throughout this press release was calculated

based on $22.00/oz silver, $1.00/lb lead and $1.45/lb zinc.

2023 Guidance

The Company expects to continue to increase metal production in

2023. Consolidated attributable silver equivalent production for

2023 is anticipated to be between 5.5 – 6.0 million ounces which

compares favourably with 2022 production of 5.3 million silver

equivalent ounces.

Silver production from the Cosalá Operations in 2023 is forecast

to be between 1.2 – 1.4 million ounces, benefitting from more

production from the higher-grade silver areas in the Upper Zone of

the San Rafael mine. Zinc production from the Cosalá Operations is

expected to be approximately 33 – 37 million pounds while lead

production is expected to be 11 – 13 million pounds. The Cosalá

Operations produced 636,000 ounces of silver, 15.3 million pounds

of lead and 39.3 million pounds of zinc in 2022.

Attributable silver production to the Company from the Galena

Complex (60% owned by Americas) in 2023 is expected to be between

1.0 – 1.2 million silver ounces benefitting from a full year of

production from higher grade ore on the 3700 Level. Attributable

lead production is expected to be between 11 – 13 million pounds.

The Galena Complex attributable production for 2022 was 672,000

ounces of silver and 9.3 million pounds of lead.

The Galena Complex is currently impacted by an industry wide

shortage of labour, which is reflected in the Company’s silver

equivalent production guidance for 2023. The Company estimates that

increasing the hourly workforce at the Galena Complex by

approximately 10% would boost silver production at the complex in

2023 by approximately 20%.

First quarter 2023 production will be impacted by a

two-and-a-half-week shutdown in February in order to complete

remedial work on the decant tunnel at the Cosalá Operations

tailings facility. The tunnel is no longer required and

decommissioning of the tunnel is part of the long-term

environmental plan at the operations. This temporary shutdown

allowed the San Rafael Mine to build back significant ore

stockpiles that had been drawn down in 2022 and allowed scheduled

maintenance to be carried out at the Los Braceros mill, setting the

operation up for a strong end to Q1-2023 and rest of 2023.

Consolidated cash cost (net of by-product credits) for 2023 is

expected to range between $8.00 – $9.00 per silver ounce assuming

zinc and lead prices of $1.45/lb and lead of $1.00/lb,

respectively. Expected cash cost per silver ounce in 2023 are

higher than actual 2022 cash cost per silver ounce as realized zinc

and lead prices in 2022 were higher than the budgeted prices the

Company is assuming for 2023.

Anticipated consolidated capital expenditures for the Company in

2023 of $16 – $20 million are related to completion of the Galena

Hoist as well as increased development and sustaining capital at

the Cosalá Operations.

2024 Production Outlook

The Company anticipates consolidated silver equivalent

production to further increase in 2024 benefitting from a full year

of the increased hoisting capacity following the completion of the

Galena Hoist and higher silver contribution from the Cosalá

Operations. Consolidated silver equivalent production for 2024 is

expected to range between 6.5 – 7.0 million ounces.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a growing precious

metals mining company with multiple assets in North America. The

Company owns and operates the Cosalá Operations in Sinaloa, Mexico,

manages the 60%-owned Galena Complex in Idaho, USA, and is

re-evaluating the Relief Canyon mine in Nevada, USA. The Company

also owns the San Felipe development project in Sonora, Mexico. For

further information, please see SEDAR or www.americas-gold.com.

Technical Information and Qualified Persons

The scientific and technical information relating to the

operation of the Company’s material operating mining properties

contained herein has been reviewed and approved by Daren Dell,

P.Eng., Chief Operating Officer of the Company. The Company’s

current Annual Information Form and the NI 43-101 Technical Reports

for its other material mineral properties, all of which are

available on SEDAR at www.sedar.com, and EDGAR at www.sec.gov

contain further details regarding mineral reserve and mineral

resource estimates, classification and reporting parameters, key

assumptions and associated risks for each of the Company’s material

mineral properties, including a breakdown by category.

All mining terms used herein have the meanings set forth in

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”), as required by Canadian securities

regulatory authorities. These standards differ from the

requirements of the SEC that are applicable to domestic United

States reporting companies. Any mineral reserves and mineral

resources reported by the Company in accordance with NI 43-101 may

not qualify as such under SEC standards. Accordingly, information

contained in this news release may not be comparable to similar

information made public by companies subject to the SEC’s reporting

and disclosure requirements.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas Gold and

Silver’s expectations, intentions, plans, assumptions and beliefs

with respect to, among other things, estimated and targeted

production rates and results for gold, silver and other metals, the

expected prices of gold, silver and other metals, as well as the

related costs, expenses and capital expenditures; the expected

timing for completion of the Galena Hoist project at the Galena

Complex, including the expected production levels and potential

additional mineral resources thereat; expectations regarding

addressing impacts of industry wide labour shortage and the

anticipated improvements to production in respect of same. Guidance

and outlook contained in this press release was prepared based on

current mine plan assumptions with respect to production, costs and

capital expenditures, the metal price assumptions disclosed herein,

and assumes no adverse impacts to operations from the COVID 19

pandemic and no further adverse impacts to the Cosalá Operations

from blockades, the Company’s ability to address the impacts of the

industry wide labour shortage and anticipated improvements to

production at the Galena Complex, and is subject to the risks and

uncertainties outlined below. Often, but not always,

forward-looking information can be identified by forward-looking

words such as “anticipate”, “believe”, “expect”, “goal”, “plan”,

“intend”, “potential’, “estimate”, “may”, “assume” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions, or statements

about future events or performance. Forward-looking information is

based on the opinions and estimates of Americas Gold and Silver as

of the date such information is provided and is subject to known

and unknown risks, uncertainties, and other factors that may cause

the actual results, level of activity, performance, or achievements

of Americas Gold and Silver to be materially different from those

expressed or implied by such forward-looking information. With

respect to the business of Americas Gold and Silver, these risks

and uncertainties include risks relating to widespread epidemics or

pandemic outbreak including the COVID-19 pandemic; the impact of

COVID-19 on our workforce, suppliers and other essential resources

and what effect those impacts, if they occur, would have on our

business, including our ability to access goods and supplies, the

ability to transport our products and impacts on employee

productivity, the risks in connection with the operations, cash

flow and results of the Company relating to the unknown duration

and impact of the COVID-19 pandemic; interpretations or

reinterpretations of geologic information; unfavorable exploration

results; inability to obtain permits required for future

exploration, development or production; general economic conditions

and conditions affecting the industries in which the Company

operates; the uncertainty of regulatory requirements and approvals;

fluctuating mineral and commodity prices; the ability to obtain

necessary future financing on acceptable terms or at all; the

ability to operate the Company’s projects; and risks associated

with the mining industry such as economic factors (including future

commodity prices, currency fluctuations and energy prices), ground

conditions, illegal blockades and other factors limiting mine

access or regular operations without interruption, failure of

plant, equipment, processes and transportation services to operate

as anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital and construction expenditures, reclamation activities,

labor relations or disruptions, social and political developments

and other risks of the mining industry. The potential effects of

the COVID-19 pandemic on our business and operations are unknown at

this time, including the Company’s ability to manage challenges and

restrictions arising from COVID-19 in the communities in which the

Company operates and our ability to continue to safely operate and

to safely return our business to normal operations. The impact of

COVID-19 on the Company is dependent on a number of factors outside

of its control and knowledge, including the effectiveness of the

measures taken by public health and governmental authorities to

combat the spread of the disease, global economic uncertainties and

outlook due to the disease, and the evolving restrictions relating

to mining activities and to travel in certain jurisdictions in

which it operates. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated, or intended. Readers are cautioned not to

place undue reliance on such information. Additional information

regarding the factors that may cause actual results to differ

materially from this forward‐looking information is available in

Americas Gold and Silver’s filings with the Canadian Securities

Administrators on SEDAR and with the SEC. Americas Gold and Silver

does not undertake any obligation to update publicly or otherwise

revise any forward-looking information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law. Americas Gold and Silver

does not give any assurance (1) that Americas Gold and Silver will

achieve its expectations, or (2) concerning the result or timing

thereof. All subsequent written and oral forward‐looking

information concerning Americas Gold and Silver are expressly

qualified in their entirety by the cautionary statements above.

Non-GAAP Financial Measures

This press release makes reference to certain non‐GAAP measures,

including certain metrics specific to the industry in which we

operate. Non-GAAP financial measures disclosed herein include

financial measures that depict historical or expected future

financial performance, financial position or cash flow of a

company. These measures are not recognized measures under

International Financial Reporting Standards as issued by the

International Accounting Standards Board (“IFRS”), do not have a

standardized meaning prescribed by IFRS and, therefore, may not be

comparable to similar measures presented by other companies.

Rather, these measures are provided as additional information to

complement those IFRS measures by providing further understanding

of our results of operations from management’s perspective.

Accordingly, these measures are not intended to represent, and

should not be considered as alternatives to [net income] or other

performance measures derived in accordance with IFRS as measures of

operating performance or operating cash flows or as a measure of

liquidity. In addition to our results determined in accordance with

IFRS, we use non‐GAAP measures including historical measures or

expected future guidance for “cash cost per silver ounce”, “all-in

sustaining cost per silver ounce”, “capital expenditures –

sustaining”, “capital expenditures – discretionary” and

“exploration drilling – discretionary”. We believe these non‐GAAP

measures provide useful information to both management and

investors in measuring our financial performance and condition and

highlight trends in our core business that may not otherwise be

apparent when relying solely on IFRS measures.

We do not provide a reconciliation of forward-looking measures

for each of “cash cost per silver ounce”, “all-in sustaining cost

per silver ounce”, “capital expenditures – sustaining”, “capital

expenditures – discretionary” and “exploration drilling –

discretionary” to the most directly comparable financial measures

calculated and presented in accordance with IFRS because a

meaningful or accurate calculation of reconciling items and the

information is not available without unreasonable effort due to

unknown variables, including the timing and amount of certain

reconciling items, and the uncertainty related to future results.

These unknown variables may include unpredictable transactions of

significant value that maybe inherently difficult to determine

without unreasonable efforts. The probable significance of such

unavailable information, which could be material to future results,

cannot be addressed.

________________ 1 Silver equivalent ounces for the 2023

guidance and 2024 production outlook references were calculated

based on $22.00/oz silver, $1.00/lb lead and $1.45/lb zinc

throughout this press release. Silver equivalent ounces for

production in 2022 was calculated based on silver, zinc and lead

realized prices during the period throughout this press

release.

2 This metric is a non-GAAP financial measure or ratio. The

Company uses the financial measures “cash cost per silver ounce”

and “all-in sustaining cost per silver ounce” in accordance with

measures widely reported in the silver mining industry as a

benchmark for performance measurement and because it understands

that, in addition to conventional measures prepared in accordance

with IFRS, certain investors and analysts use this information to

evaluate the Company’s underlying cash costs and total costs of

operations. Cash costs are determined on a mine-by-mine basis and

include mine site operating costs such as mining, processing,

administration, production taxes and royalties which are not based

on sales or taxable income calculations, while all-in sustaining

costs is the cash costs plus all development, capital expenditures,

and exploration spending. A full reconciliation of these non-GAAP

financial measures will be provided when the Company reports its

year-end results on or before March 31, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230222006026/en/

For more information: Stefan Axell VP, Corporate

Development & Communications Americas Gold and Silver

Corporation 416-874-1708

Darren Blasutti President and CEO Americas Gold and Silver

Corporation 416‐848‐9503

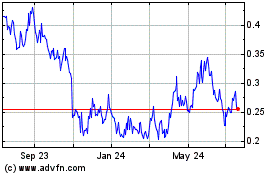

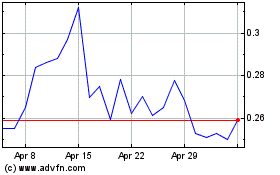

Americas Gold and Silver (AMEX:USAS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Americas Gold and Silver (AMEX:USAS)

Historical Stock Chart

From Feb 2024 to Feb 2025