false

0000008504

0000008504

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 7, 2024

AGEAGLE

AERIAL SYSTEMS INC.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

001-36492 |

|

88-0422242 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 8201

E. 34th Cir N, Suite 1307, Wichita, Kansas |

|

67226 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (620) 325-6363

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

UAVS |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

4.02 |

Non-Reliance

on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review |

On

November 7, 2024, the Audit Committee of the Board of Directors and the Board of Directors (the “Board”), in consultation

with management, concluded that the Company’s previously issued (i) audited financial statements contained in its Annual Report

on Form 10-K for the fiscal years ended December 31, 2023 and December 31, 2022 and (ii) unaudited financial statements contained in

its Quarterly Reports on Form 10-Q for each of the quarters ended June 30, 2024, March 31, 2024, September 30, 2023, June 30, 2023 and

March 31, 2023 (collectively, the “Non-Reliance Periods”) should no longer be relied upon. It was determined that the errors

described below require a restatement of the financial statements for each of these prior periods. As a result, the financial statements

for each of the Non-Reliance Periods should no longer be relied on. Similarly, any previously

issued or filed reports, press releases, earnings releases, and investor presentations or other communications describing the Company’s

financial statements and other related financial information covering the Non-Reliance Periods should no longer be relied upon.

During

the preparation of the Company’s consolidated financial statements as of and for the three- and nine-month periods ended September

30, 2024, the Company identified prior period accounting errors resulting from an error in the computation and an overstatement of comprehensive

loss due to the inclusion of dividends and deemed dividends that are not considered to be components of comprehensive income (loss).

The

error in the computation of net loss attributable to common stockholders resulted in an understatement of net loss per common share basic

and diluted as presented on our consolidated statements of operations and comprehensive loss.

The

net loss attributable to common stockholders erroneously excluded accrued cumulative dividends on outstanding Series F preferred stock

and deemed dividends resulting from the triggering of down round features embedded within outstanding equity-linked financial instruments.

Pursuant to ASC 260 - Earnings Per Share income available to common stockholders shall be computed by deducting dividends accumulated

for the period on cumulative preferred stock. Also, the value of the effect of a down round feature shall be recognized in an equity-classified

freestanding financial instrument when the down round feature is triggered. That effect shall be treated as a dividend and as a reduction

of income available to common stockholders in basic earnings per share.

Further,

the accrued cumulative dividends and deemed dividends were included as a component of other comprehensive loss. However, pursuant to

ASC 220 – Income Statement – Reporting Comprehensive Income items required to be reported as direct adjustments to

additional paid-in capital (APIC) and retained earnings are not considered to be components of other comprehensive income (loss).

The

Company will file an amended Form 10-K, as soon as practicable, for the year ended December 31, 2023 which will include a restated consolidated

statement of operations and comprehensive loss for the years ended December 31, 2023 and 2022. The Form 10-K/A will contain in the notes

to the consolidated financial statements condensed quarterly statements of operations and comprehensive loss to correct the quarterly

information for the periods ended September 30, 2023, June 30, 2023 and March 31, 2023. Further, the Company’s Form 10-Q for the

three and nine months ended September 30, 2024 will contain in the notes to the consolidated financial statements condensed quarterly

statements of operations and comprehensive loss to correct the quarterly information for the periods ended June 30, 2024 and March 31,

2024.

The

Company is currently in the process of determining the exact amounts and full effect of the errors in the financial statements for each

of the Non-Reliance Periods. The Company does not currently expect the errors to change the cash position of the Company as of the end

of each Non-Reliance Period.

Management

is assessing the effect of these Restatements on the Company’s internal control over financial reporting and its disclosure controls

and procedures. The Company expects to report at least one material weakness following completion of its analysis of the cause of these

Restatements. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such

that there is a reasonable possibility that a material misstatement of a company’s annual or interim financial statements will

not be prevented or detected on a timely basis. The existence of one or more material weaknesses precludes a conclusion by management

that the Company’s disclosure controls and procedures and internal control over financial reporting are effective. As a result

of the material weakness or material weaknesses, the Company believes that its internal control over financial reporting was not effective,

and its disclosure controls and procedures were not effective for the Non-Reliance Periods.

The

Company’s management and the Board have discussed the matters disclosed in this Current Report on Form 8-K pursuant to this Item

4.02(a) with WithumSmith+Brown, PC, the Company’s independent registered public accounting firm.

On

November 4, 2024, the Company announced that it received a letter on January 3, 2023 from the NYSE American LLC (the “NYSE American”)

stating that it is not in compliance with the continued listing standards set forth in (i) Section 801(h) of the NYSE American Company

Guide (the “Company Guide”) because the Board was not comprised of at least 50% independent directors and (ii) Section 803B(2)(c)

of the Company Guide because the Company’s Audit Committee is not comprised of at least two independent members.

On

November 13, 2024, the Company announced that it had received a letter on November 6, 2024 from the NYSE American, wherein the

NYSE American advised that the Company had regained compliance with its continued listing standard set forth in Section 801(h) and Section

803(B(2)(C) of the Company Guide. The Company was removed from the list of issuers noncompliant with NYSE American corporate governance

listing standards posted on https://www.nyse.com/regulation/noncompliant-issuers and the BC indicator was removed from the profile, data

and news pages of the Company’s security.

A

copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

Forward-Looking

Statements

This

Current Report on Form 8-K contains “forward-looking” statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements, other than statements of historical fact, contained in this Current Report on Form 8-K are forward-looking

statements. Forward-looking statements contained in this Current Report on Form 8-K may be identified by the use of words such as “anticipate,”

“believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,”

“seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“suggest,” “target,” “aim,” “should,” “will,” “would,” or the

negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking

statements are based on the Company’s current expectations and are subject to inherent uncertainties, risks and assumptions that

are difficult to predict, including the Company’s plans related to restatement of the financial statements as of and for each of

the year ended December 31, 2023 and quarterly periods ended March 31, 2024, June 30, 2024, and the Company’s estimates related

to the errors included in the financial statements covering the Non-Reliance Periods. Further, certain forward-looking statements are

based on assumptions as to future events that may not prove to be accurate. For a further discussion of risks and uncertainties that

could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business

of the Company in general, see the risk disclosures in the Annual Report on Form 10-K of the Company for the year ended December 31,

2023, and in subsequent reports on Forms 10-Q and 8-K and other filings made with the Securities and Exchange Commission by the Company.

All such forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise

these statements, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

November 13, 2024 |

AGEAGLE

AERIAL SYSTEMS INC. |

| |

|

|

| |

By: |

/s/

William Irby |

| |

Name: |

William

Irby |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

AgEagle

Aerial Systems Regains Compliance with NYSE American Continued Listing Standards

WICHITA,

Kan., November 13, 2024 – AgEagle Aerial Systems Inc. (the “Company”) (NYSE: UAVS), a leading provider of best-in-class

unmanned aerial systems (UAS), sensors and software solutions for customers worldwide in the commercial and government verticals, announced

today that the Company received a notice from the NYSE American LLC (“NYSE American”) on November 6, 2024, advised that the

Company had regained compliance with its continued listing standard set forth in Section 801(h) and Section 803(B(2)(C) of the NYSE American

Company Guide. Specifically, the Company now has at least 50% board independence and two independent audit committee members.

About

AgEagle Aerial Systems Inc.

Through

its three centers of excellence, AgEagle is actively engaged in designing and delivering best-in-class flight hardware, sensors and software

that solve important problems for its customers. Founded in 2010, AgEagle was originally formed to pioneer proprietary, professional-grade,

fixed-winged drones and aerial imagery-based data collection and analytics solutions for the agriculture industry. Today, AgEagle is

a leading provider of full stack UAS, sensors and software solutions for customers worldwide in the energy, construction, agriculture,

and government verticals. For additional information, please visit our website at www.ageagle.com.

AgEagle

Aerial Systems Contacts

Investor

Relations:

Email:

UAVS@ageagle.com

Media:

Email:

media@ageagle.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

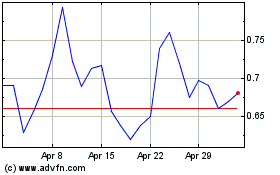

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Nov 2024 to Dec 2024

AgEagle Aerial Systems (AMEX:UAVS)

Historical Stock Chart

From Dec 2023 to Dec 2024