Southwest Airlines (NYSE:LUV) – Southwest

Airlines’ shares fell 9.6% in pre-market trading after reporting a

larger first-quarter loss compared to the previous year and warned

of potential delays from Boeing impacting its growth until 2025.

The company plans to increase capacity by 4%, below the planned 6%,

and expects a decline in revenue for the second quarter. In the

first quarter, Southwest Airlines recorded a loss of $231 million,

or 39 cents per share, compared to a loss of $159 million, or 27

cents per share, in the same period last year. Its revenue

increased to $6.33 billion, representing a nearly 11% increase from

the previous year.

AstraZeneca (NASDAQ:AZN) – AstraZeneca’s shares

rose 5.4% in pre-market trading after exceeding market expectations

in the first quarter. AstraZeneca reported a revenue of $12.68

billion in the first quarter, an annual increase of 19%, and basic

earnings per share of $2.06, also up 19%. Oncology was a highlight,

with sales increasing 26%, totaling $5.12 billion. The CEO

emphasized investments in R&D and promising launches.

Merck (NYSE:MRK) – Merck’s shares rose 2% in

pre-market trading after disclosing its first-quarter figures,

exceeding expectations with revenues and adjusted profits boosted

by robust sales of Keytruda, a successful cancer-fighting drug, and

vaccine products. Merck recorded an adjusted earnings per share of

$2.07, compared to the $1.88 forecast by analysts. Additionally,

its revenues reached $15.78 billion, surpassing projections of

$15.20 billion. The company raised its projections for the year,

now forecasting sales between $63.1 billion and $64.3 billion, with

adjusted earnings of $8.53 to $8.65 per share, highlighting

progress in preparation for Keytruda’s patent expiration in

2028.

Sanofi (NASDAQ:SNY) – In the first quarter,

Sanofi’s operating profit fell 14.7%, affected by currency effects

and competition with Aubagio for multiple sclerosis. The adjusted

operating profit, at €2.84 billion ($3.04 billion), slightly

exceeded expectations, while Dupixent sales increased by 25%,

totaling €2.84 billion. Sanofi’s shares rose 5.2% in pre-market

trading.

Meta Platforms (NASDAQ:META) – Meta’s shares

fell 12.7% in pre-market trading, impacted by a conservative

outlook despite strong performance in the first quarter of 2024.

Earnings per share of $4.71 exceeded expectations, as did revenue

of $36.46 billion. However, the outlook for the second quarter,

between $36.5 billion and $39 billion, fell short of analysts’

estimates.

International Business Machines (NYSE:IBM) –

IBM’s shares fell about 8.4% in pre-market trading, reflecting the

disappointing performance of its consulting unit. Despite this, the

company exceeded earnings per share expectations, hitting $1.68,

but its total revenue of $14.46 billion was slightly below the

$14.55 billion estimate. The acquisition of

HashiCorp (NASDAQ:HCP) for $6.4 billion marks a

significant transformation strategy under CEO Arvind Krishna,

towards leadership in high-growth software and services.

Ford Motor (NYSE:F) – Ford Motor’s shares rose

2.6% in pre-market trading after exceeding Wall Street’s

expectations for the first quarter, reporting earnings per share of

49 cents (against the expected 43 cents) and actual revenue of

about $42.8 billion, surpassing projections.

Unilever (NYSE:UL) – Unilever’s shares rose

5.9% in pre-market trading after surpassing first-quarter sales

forecasts, with growth of 4.4%, driven by a recovery of shoppers

opting for cheaper products amid recent global inflation. Volumes

increased by 2.2%, reflecting confidence in the expansion strategy.

The company maintained its annual outlook.

Barclays (NYSE:BCS) – Barclays’ shares rose

4.3% in pre-market trading. Barclays recorded a 12% drop in

first-quarter profit, reaching $2.84 billion, slightly above

forecasts. In the first quarter, Barclays recorded a 7% decline in

total investment bank earnings. The global return on tangible

equity (ROTE) of the unit was 12%, 2.4 percentage points below the

same period in 2023. Fixed income, currencies, and commodities

(FICC) revenues fell 21%. Total investment bank earnings recorded a

7% decline.

Deutsche Bank (NYSE:DB) – Deutsche Bank’s

first-quarter profit increased by 10%, reaching $1.37 billion,

surpassing analysts’ expectations. Investment banking revenues grew

13%, driven by a resurgence in trading. The results were considered

solid, although regulators warn of future challenges, including the

real estate crisis. Shares are down 0.4% in pre-market trading.

STMicroelectronics (NYSE:STM) –

STMicroelectronics’ shares rose 2.75% in pre-market trading after

reporting below-expected results for the first quarter. Its

earnings before interest and taxes (EBIT) were $551 million, a 54%

drop from the previous year. Revenue fell 18% to $3.46 billion,

below analysts’ expectations. The European chip company revised its

annual sales expectations downward, reflecting weak demand from

automakers and reduced orders for laptops and phones. Revenue for

2024 is projected between $14 billion and $15 billion, below

previous expectations. Weakness in automotive and industrial sales

affected the results.

Lam Research (NASDAQ:LRCX) – Lam Research fell

2.4% in pre-market trading despite exceeding third-quarter fiscal

results. Lam Research announced adjusted earnings of $7.79 per

share and revenue of $3.79 billion. Analysts surveyed by LSEG had

predicted earnings of $7.30 per share and revenue of $3.72 billion.

Additionally, the company issued positive projections on adjusted

earnings per share for the current quarter.

ServiceNow (NYSE:NOW) – ServiceNow’s shares

fell 4.9% in pre-market trading despite slightly exceeding

analysts’ revenue expectations for the first quarter. Revenue

totaled $2.6 billion compared to the $2.59 billion forecast by

LSEG. Additionally, adjusted profit increased by 44% to $3.41 per

share compared to the previous year.

Impinj (NASDAQ:PI) – Impinj’s shares rose 10.1%

in pre-market trading after the IoT chip company reported adjusted

earnings and revenue in the first quarter that surpassed Wall

Street expectations. Additionally, the company forecasted revenue

for the second quarter between $96 million and $99 million,

exceeding estimates of $79 million.

Align Technology (NASDAQ:ALGN) – Align

Technology rose 4.9% in pre-market trading after surpassing

analysts’ forecasts for first-quarter performance. Align reported

adjusted earnings of $2.14 per share with revenue of $997.4

million, exceeding analyst expectations, who had anticipated

earnings per share of $1.97 and revenue of $974 million, as

surveyed by LSEG.

Ethan Allen Interiors (NYSE:ETD) – Ethan Allen

Interiors’ shares fell 5.7% in pre-market trading after the home

goods supplier released third-quarter fiscal results. Ethan Allen’s

adjusted earnings were 48 cents per share, a drop compared to 86

cents per share recorded in the same quarter of the previous year.

Additionally, the company’s revenue totaled $146.4 million,

reflecting a 21% decline from the same period in 2023.

Whirlpool (NYSE:WHR) – Whirlpool’s shares rose

1.1% in pre-market trading after announcing adjusted earnings of

$1.78 per share and revenue of $4.49 billion, surpassing consensus

estimates, which were $1.68 per share in earnings and $4.42 billion

in revenue, as reported by LSEG. Whirlpool also announced it would

lay off approximately 1,000 salaried employees globally, following

a first wave of cuts in March. Seeking to reduce costs by up to

$400 million this year, the company expects a second wave of

reductions in early May.

Chipotle Mexican Grill (NYSE:CMG) – Chipotle’s

shares increased by 3.1% after reporting first-quarter earnings of

$13.37 per share, excluding extraordinary items, surpassing the

LSEG estimate of $11.68 per share, due to strong traffic in its

restaurants.

Churchill Downs (NASDAQ:CHDN) – Churchill’s

shares rose 3.7% in pre-market trading. Churchill Downs reported

first-quarter earnings per share of $1.13 on revenue of $590.90

million. This was above the analyst’s estimate for earnings per

share of 83 cents and revenue of $565.42 million.

United Rentals (NYSE:URI) – United Rentals’

stock rose 3.8% in pre-market trading after reporting improved

adjusted earnings and revenue in the first quarter. United Rentals

reported earnings per share of $9.15 on revenue of $3.49 billion.

This was above the analyst’s estimate for earnings per share of

$8.32 and revenue of $3.44 billion.

Equinor (NYSE:EQNR) – In the first quarter,

Equinor recorded a sharp drop in adjusted pre-tax profit, falling

nearly 37% to $7.53 billion, due to falling natural gas prices in

Europe. However, its strong energy trading boosted revenue,

surpassing analysts’ expectations. Shares rose 3.5% in pre-market

trading.

Teck Resources (NYSE:TECK) – Teck Resources

missed first-quarter profit estimates due to weak steelmaking coal

sales volumes and lower zinc prices. Its adjusted earnings were

C$0.75 per share, below the average estimate of C$0.85. Teck

Resources also missed first-quarter revenue estimates. Steelmaking

coal production was impacted by a freezing event. Shares are up

1.5% in pre-market trading.

Honeywell (NASDAQ:HON) – Honeywell exceeded

Wall Street’s first-quarter expectations, driven by its aerospace

segment. With adjusted earnings of $2.25 per share and sales of

$9.1 billion, the performance was robust, led by double-digit

growth in commercial aviation and defense and space. Financial

outlooks for the year remain stable, with expected sales growth of

4% to 6% and earnings per share between $9.80 and $10.10.

Honeywell’s shares rose 0.9% in pre-market trading.

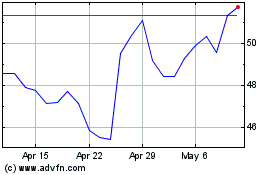

Teck Resources (NYSE:TECK)

Historical Stock Chart

From Apr 2024 to May 2024

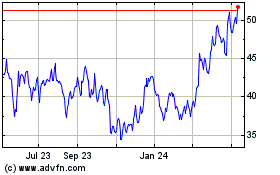

Teck Resources (NYSE:TECK)

Historical Stock Chart

From May 2023 to May 2024