U.S. Futures Rebound Amid Global Market Fluctuations, Oil Prices Decline

April 18 2024 - 7:15AM

IH Market News

U.S. index futures are rising in pre-market trading on Thursday,

following four consecutive days of losses for the S&P 500 and

Nasdaq.

As of 6:27 AM, Dow Jones Industrial Average futures (DOWI:DJI)

were up 68 points, or 0.18%. S&P 500 futures advanced 0.20%,

and Nasdaq-100 futures gained 0.25%. The yield on 10-year Treasury

notes was at 4.573%.

In the commodities market, West Texas Intermediate crude for May

fell 1.00%, to $81.86 per barrel. Brent crude for June dropped

1.04%, near $86.38 per barrel. Iron ore traded on the Dalian

exchange rose 3.07%, to $120.73 per metric ton.

On the U.S. economic calendar for Thursday, the highlight is the

release of unemployment insurance claims for the week ending last

Saturday, scheduled for 8:30 AM by the Department of Labor.

Simultaneously, the April industrial activity index will be

published by the Philadelphia Fed. Later, at 10 AM, the Conference

Board will release the March leading indicators index, followed by

the National Association of Realtors (NAR) releasing sales data for

used residential properties for the same month.

European markets are showing positive performance, driven by a

series of robust corporate results, which are mitigating the

effects of recent declines in electric car sales across the

European Union, which fell more than 11% last month. According to

recent data released by the European Automobile Manufacturers

Association (ACEA), there was a 5.2% reduction in new vehicle

registrations in March, marking the first decline of the year, with

sales approaching one million units.

Asian markets ended positively, overcoming a recent history of

declines, driven by bargain hunting. South Korea’s Kospi led the

gains with a rise of 1.95% in Seoul, after four sessions of losses,

while Japan’s Nikkei grew 0.31% in Tokyo, breaking a three-day

losing streak. Hong Kong’s Hang Seng and Taiwan’s Taiex also posted

increases of 0.82% and 0.43%, respectively, despite Wall Street’s

weak performance the day before.

U.S. stocks had a volatile session on Wednesday, ending lower.

The Nasdaq and the S&P 500 marked the fourth consecutive day of

losses, reaching their lowest closing levels in nearly two months.

Meanwhile, the Dow Jones saw a modest decline. The performance was

impacted by a downturn in the technology sector, especially

following disappointing results from ASML

(NASDAQ:ASML), which pressured semiconductor stocks. Additionally,

concerns about the Federal Reserve’s interest rate policy

contributed to market tension.

On the quarterly earnings front, scheduled to present reports

before trading begins are Taiwan Semiconductor

Manufacturing Company (NYSE:TSM), Nokia

(NYSE:NOK), Blackstone (NYSE:BX),

KeyCorp (NYSE:KEY), Elevance

Health (NYSE:ELV), DR Horton (NYSE:DHI),

Alaska Airlines (NYSE:ALK),

Infosys (NYSE:INFY), Texas Capital

Bank (NASDAQ:TCBI), among others.

After the close, earnings from Netflix

(NASDAQ:NFLX), Intuitive Surgical (NASDAQ:ISRG),

PPG Industries (NYSE:PPG), Western

Alliance (NYSE:WAL), Metropolitan Commercial

Bank (NYSE:MCB), Alpine Income Property

Trust (NYSE:PINE), Banco Latino-Americano de

Exportações (NYSE:BLX), SB Financial

(NASDAQ:SBFG), Provident Financial Group

(NYSE:PFS), and more are awaited.

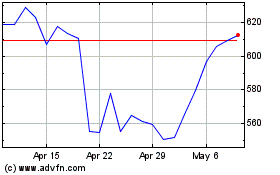

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2024 to May 2024

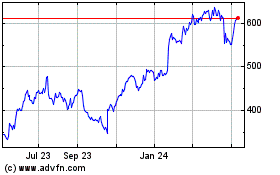

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From May 2023 to May 2024