U.S. Futures Dip Ahead of Key Inflation Data and Q1 Earnings Season Kickoff, Oil Prices Decline

April 08 2024 - 7:19AM

IH Market News

U.S. index futures are slightly down in Monday’s pre-market

trading, marking the start of a week that is eagerly awaited due to

the announcement of U.S. inflation data, as well as the beginning

of the first quarter financial results season.

At 06:26 AM, Dow Jones futures (DOWI:DJI) fell 18 points, or

0.05%. S&P 500 futures fell 0.08%, and Nasdaq-100 futures lost

0.02%. The yield on 10-year Treasury bonds was at 4.44%.

In the commodities market, West Texas Intermediate crude oil for

May fell 0.91%, to $86.12 per barrel. Brent crude for June fell

0.90%, near $90.35 per barrel. Iron ore traded on the Dalian

exchange rose 3.19% to $109.41 per metric ton.

On Monday’s economic agenda, the highlight is the monthly

consumer inflation expectation, scheduled for 11:30 AM. At the same

time, there will be a Federal Reserve bond auction with 3 and

6-month maturities, also scheduled for 11:30 AM.

European markets start the week positively, awaiting significant

economic updates and the next European Central Bank meeting on

Thursday, where monetary policy guidelines will be discussed.

Although no immediate changes in interest rates are expected, there

is a growing expectation in the markets of a possible cut in June,

despite recent adjustments in the Federal Reserve’s schedule.

Asian markets closed mostly higher, with Japan standing out,

where the Nikkei advanced 0.91%, driven by the electronics and

automotive sector. The Kospi indices in South Korea (+0.13%), the

Hang Seng in Hong Kong (+0.05%) and the ASX 200 in Australia

(+0.20%) had modest gains. The exception was the mainland China

Shanghai SE index, which performed negatively (-0.72%) after a

two-day holiday.

U.S. Treasury Secretary Janet Yellen expressed openness to

various measures during her visit to Beijing, including tariffs on

China’s green energy exports, aiming to create level playing field

conditions in the sector. She highlighted the need for adjustments

in Chinese policy, especially in reducing local subsidies. Yellen

emphasized the importance of ensuring opportunities for American

companies and workers in future industries, given concerns about

competitiveness hampered by subsidized Chinese products.

On Friday, U.S. stocks recovered considerably, reflecting

renewed market optimism. Major indices, including Dow Jones,

S&P 500, and Nasdaq, recorded gains of 0.80%, 1.11%, and 1.24%,

respectively, erasing some of Thursday’s losses. This movement was

driven both by the search for attractively priced stocks and by a

positive response to a Department of Labor report, which showed job

growth higher than expected for March.

The report also said that the unemployment rate fell to 3.8% in

March, from 3.9% in February, while economists expected the

unemployment rate to remain unchanged. Despite the recovery on the

day, the Dow plummeted 2.3% last week, while the S&P 500 fell

1.0% and the Nasdaq retreated 0.8%.

Ahead of the quarterly reports, the companies that will announce

this week include JPMorgan Chase (NYSE:JPM),

Wells Fargo (NYSE:WFC), Citigroup

(NYSE:C), Delta Air Lines (NYSE:DAL),

BlackRock (NYSE:BLK), Constellation

Brands (NYSE:STZ), CarMax (NYSE:KMX),

State Street (NYSE:STT), Fastenal

(NASDAQ:FAST), Infosys (NYSE:INFY),

WD-40 (NASDAQ:WDFC), and Neogen

(NASDAQ:NEOG).

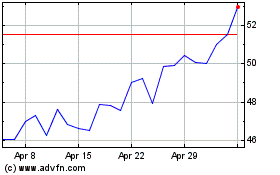

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

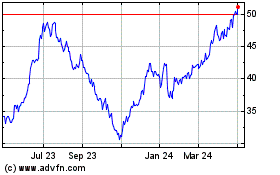

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024