U.S. Index Futures on the Rise, Oil Prices Show Stability

March 26 2024 - 7:21AM

IH Market News

U.S. index futures are showing an uptrend in pre-market trading

this Tuesday, with investors keen on driving a recovery that had

previously lifted stocks to their all-time highs, looking to

reverse the losses seen in the previous session.

At 06:19 AM, Dow Jones futures (DOWI:DJI) rose 103 points, or

0.26%. S&P 500 futures advanced 0.40%, and Nasdaq-100 futures

gained 0.50%. The 10-year Treasury bond yield was at 4.234%.

In the commodities market, West Texas Intermediate crude oil for

May rose 0.02% to $81.97 per barrel. Brent crude for May fell

0.03%, near $86.72 per barrel. Iron ore traded on the Dalian

exchange fell 3.72% to $112.84 per metric ton. The April benchmark

iron ore SZZFJ4 on the Singapore Exchange fell 4.34% to $103.85 a

ton.

On the economic agenda this Tuesday, the highlights include

February’s durable goods orders at 8:30 AM, by the Commerce

Department; the January S&P Case/Shiller index at 09 AM,

reflecting residential property prices; and at 10 AM, the March

consumer confidence index, by the Conference Board.

Asian markets had mixed movements, reflecting varied reactions

to sectoral and economic developments. In China, the Shanghai

Composite index saw a slight increase of +0.17%, driven by optimism

in the real estate sector and positive comments from the PBoC

chairman. In Hong Kong, the Hang Seng index grew +0.88%, benefited

by the performance of developers. In Japan, the Nikkei showed

stability (-0.04%), balancing advances in the semiconductor sector

with declines in banks and railways, highlighting the global

influence of the chip industry. South Korea’s Kospi index

appreciated +0.71%. On the other hand, Australia’s ASX 200 recorded

a drop of -0.41%.

European markets are experiencing uncertain movements as

investors reflect on the recent policy decisions made by central

banks in Europe and the United States last week.

At Monday’s close, the Dow Jones, S&P 500, and Nasdaq fell

0.41%, 0.31%, and 0.27%, respectively, impacted by weakness in the

technology sector, especially after reports on Chinese restrictions

on microprocessors. While Intel (NASDAQ:INTC) and

AMD (NASDAQ:AMD) faced significant declines,

sectors such as aviation and oil services showed positive

performance, contrasting with the overall market trend.

In terms of quarterly results, financial reports are scheduled

to be presented before market open by McCormick

(NYSE:MKC), TD Synnex Corp (NYSE:SNX),

Bragg Gaming Group (NASDAQ:BRAG), Terran

Orbital (NYSE:LLAP), VolitionRX Limited

(AMEX:VNRX), Luna Innovations (NASDAQ:LUNA),

GDS Holdings Ltd (NASDAQ:GDS), Douyu

International Holdings (NASDAQ:DOYU), Elbit

Systems (NASDAQ:ESLT), among others.

After the close, results from GameStop

(NYSE:GME), Noah Holdings (NYSE:NOAH),

Intrusion (NASDAQ:INTZ), Panbela

Therapeutics (NASDAQ:PBLA), Direct Digital

Holdings (NASDAQ:DRCT), Ouster

(NYSE:OUST), Progress Software Corporation

(NASDAQ:PRGS), Concentrix (NASDAQ:CNXC),

nCino Inc (NASDAQ:NCNO), Biora

Therapeutics (NASDAQ:BIOR), and more are awaited.

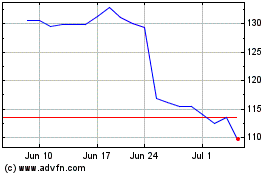

TD SYNNEX (NYSE:SNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

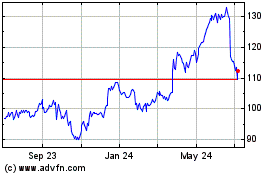

TD SYNNEX (NYSE:SNX)

Historical Stock Chart

From Apr 2023 to Apr 2024